UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2015

PANGAEA LOGISTICS SOLUTIONS LTD.

(Exact Name of Registrant as Specified in Charter)

|

| | |

Bermuda | 001-36139 | N/A |

(State or Other Jurisdiction | (Commission | (IRS Employer |

of Incorporation) | File Number) | Identification No.) |

109 Long Wharf, Newport, Rhode Island 02840

(Address of Principal Executive Offices) (Zip Code)

(401) 846-7790

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

| ¬ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| ¬ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| ¬ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| ¬ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

|

| |

Item 2.01 | Results of Operations and Financial Condition. |

On November 12, 2015, Registrant issued a press release announcing financial results for the three months ended September 30, 2015. The full text of this press release is included as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933.

|

| |

Item 7.01 | Regulation FD Disclosure. |

The slide presentation contains summary information regarding the Company and includes financial results for the three months ended September 30, 2015 and 2014, and for the year ended December 31, 2014. The presentation, which may be distributed to potential shareholders, is attached as Exhibit 99.2 to this Current Report on Form 8-K. Statements in this Current Report on Form 8-K, may contain certain statements about the Company and its consolidated subsidiaries that do not directly or exclusively relate to historical facts. The statements are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are necessarily estimates reflecting the best judgment and current expectations, plans, assumptions and beliefs about future events (in each case subject to change) of the Company’s senior management and management of its subsidiaries and involve a number of risks, uncertainties and other factors, some of which may be beyond the Company’s control that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets,” “plans,” “believes,” “expects,” “intends,” “will,” “likely,” “may,” “anticipates,” “estimates,” “projects,” “should,” “would,” “expect,” “positioned,” “strategy,” “future,” “potential,” “plan,” “forecast,” or words, phrases or terms of similar substance or the negative thereof, are forward-looking statements. Factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements are discussed under the heading “Risk Factors” and “Forward-Looking Statements” in the company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), as they may be updated in any future reports filed with the SEC. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, the Company’s actual results, performance, or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements included herein are made as of the date hereof, and the Company undertakes no obligation to update publicly such statements to reflect subsequent events or circumstances. The information in this Current Report, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933.

|

| |

Item 9.01 | Financial Statements, Pro Forma Financial Information and Exhibits. |

| |

99.1 | Press Release of Pangaea Logistics Solutions Ltd. dated November 12, 2015 announcing financial results for the three months ended September 30, 2015 and 2014. |

| |

99.2 | Investor Presentation of Pangaea Logistics Solutions Ltd. dated November 12, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 12, 2015

|

| | |

| PANGAEA LOGISTICS SOLUTIONS LTD. |

| |

| By: | /s/ Anthony Laura |

| | Name: Anthony Laura Title: Chief Financial Officer |

Pangaea Logistics Solutions Ltd. Reports Financial Results for the Three Months Ended September 30, 2015

Adjusted EBITDA increases nearly six-fold backed by strong margins and cash flow

NEWPORT, RI – November 12, 2015 – Pangaea Logistics Solutions Ltd. (“Pangaea” or the “Company”) (NASDAQ: PANL), a global provider of comprehensive maritime logistics solutions, announced today its results for the quarter ended September 30, 2015.

Third Quarter Highlights

| |

• | Net income attributable to Pangaea Logistics Solutions Ltd. was $3.0 million in the third quarter of 2015, compared to a net loss of $2.9 million in the third quarter of 2014 |

| |

• | Pro forma adjusted earnings per common share1 of $0.08 in the third quarter of 2015, compared to a pro forma adjusted loss per common share of $0.08 in the third quarter of 2014 |

| |

• | Adjusted EBITDA2 increased to $8.1 million in the third quarter of 2015, compared with $1.2 million in the third quarter of 2014 |

| |

• | Cash flow from operations was $18.0 million for the nine months ended September 30, 2015, compared with $12.5 million for the same period in 2014 |

| |

• | At the end of the quarter, Pangaea had $34.2 million in cash and cash equivalents |

| |

• | Acquired the remaining non-controlling interest in Nordic Bulk Carriers AS ("NBC"), making NBC a wholly-owned subsidiary of Pangaea |

Edward Coll, Chairman and Chief Executive Officer of Pangaea Logistics Solutions, said, “This quarter’s performance exemplifies our ability to continue to deliver profitable results in a challenging dry bulk sector. Our focus on efficiency and our disciplined approach to generating revenues coupled with a commitment to delivering unmatched service to our global clients, who rely on us to solve their most difficult logistical challenges, remain the foundation of our Company. We are confident that our unique business model and best-in-class execution will continue to serve us well.”

1 Earnings per share represents total earnings allocated to common stock divided by the weighted average number of common shares outstanding. Pro Forma adjusted earnings per share represents adjusted total earnings allocated to common stock divided by the weighted average number of shares giving effect to the mergers as if they had been consummated as of January 1, 2014. See Reconciliation of Adjusted EBITDA and Pro Forma Adjusted Earnings Per Share.

2 Adjusted EBITDA is a non-GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, and other non-operating income and/or expense, if any. See Reconciliation of Adjusted EBITDA and Pro Forma Adjusted Earnings Per Share.

Results for the Quarter Ended September 30, 2015

The Company reported net income of $3.0 million, or $0.08 per common share, for the third quarter of 2015, compared to a net loss of $2.9 million, or $0.08 per common share on a pro forma basis, in the third quarter of 2014. Adjusted EBITDA rose to $8.1 million from $1.2 million. This improvement was primarily attributable to Pangaea's improved operating margin, which rose to 6.8% from negative 2.1% as the Company continued to focus on profitable voyage revenue from contracts of affreightment and benefited from declining bunker and charter-in costs during the period.

Total revenue of $71.2 million for the quarter ended September 30, 2015 decreased 22% from the $91.2 million generated in the same quarter in 2014 and comprised $64.6 million in voyage revenue and $6.6 million in charter revenue, year-over-year decreases of 20% and 38%, respectively.

Specifically, the decline in total revenue was primarily attributable to a 16% decrease in the Company’s total shipping days from 4,099 days in the third quarter of 2014 to 3,443 days in the third quarter of 2015. Total shipping days are the sum of voyage days, which are tied to COAs and decreased 11% year-over-year, and charter days, which are subject to market rates and decreased 34% year-over-year. The Company strategically limited its exposure to declining rates by chartering in vessels only to meet the demands of specific voyage contracts in order to maximize profitability and reduce risk. Voyage and charter expenses declined more than revenue, with year-over-year decreases of 35% and 40% respectively, leading to the aforementioned improvement in operating margin.

Coll noted, “During the third quarter we continued to execute on the strategy that has enabled us to deliver profits for shareholders during a challenging 2015: focusing on profitable trades tied to COAs, leveraging our expertise in backhaul and vessel positioning to minimize idle time, limiting our exposure to uncovered long vessel positions, controlling costs, improving efficiencies, and working to selectively add attractive pieces of business from new and existing clients.”

Markets

Mr. Coll commented about the dry bulk shipping market in general, “The limited growth in commodities shipping activity and the ongoing delivery of newbuildings to the global dry bulk fleet leads us to believe that the rate environment will continue to be challenged for some time. We believe Pangaea, with its ‘cargo-first’ emphasis and flexible ‘asset-right’ strategy, is better positioned to weather the storm of too many ships chasing too few cargoes than many of our competitors whose strategies are asset heavy and burdened with large fixed costs. Our nimbleness allows us to optimize our activities to meet changing conditions and positions us to continue to outperform the industry in a variety of rate environments, including the currently muted one.”

Business Updates

In October, 2015, Pangaea acquired the remaining non-controlling interest in Nordic Bulk Carriers AS (“NBC”), making NBC a wholly-owned subsidiary of Pangaea.

Cash Flows

Cash and cash equivalents were $34.2 million as of September 30, 2015, compared with $29.8 million on December 31, 2014.

For the nine months ended September 30, 2015, the Company’s net cash provided by operating activities was $18.0 million, compared to $12.5 million for the year to date ended September 30, 2014.

For the nine months ended September 30, 2015 and 2014, net cash used in investing activities was $41.0 million and $26.2 million, respectively. Net cash provided by financing activities was $27.3 million and $14.9 million for the nine months ended September 30, 2015 and 2014, respectively. These increases reflect the Company’s purchase of new ice-class ships, including the m/v Nordic Olympic and m/v Nordic Odin, partially offset by the sale of the m/v Bulk Cajun and the m/v Bulk Discovery. The Company also used cash available from operating earnings to pay off its corporate credit line of $3 million.

Conference Call Details

The Company’s management team will host a conference call to discuss the Company’s financial results tomorrow, November 13, 2015 at 8:00 a.m., Eastern Time (ET). Following a recorded discussion of the quarterly results, Edward Coll, Chairman and Chief Executive Officer, and Anthony Laura, Chief Financial Officer, will be available to answer questions from attending participants. To access the conference call, please dial (888) 895-3561 (domestic) or (904) 685-6494 (international) approximately ten minutes before the scheduled start time and reference ID# 75101707.

A supplemental slide presentation will accompany this quarter’s conference call and can be found attached to the Current Report on Form 8-K that the Company filed concurrently with this press release. This document will be available at http://www.pangaeals.com/company-filings or at sec.gov.

A recording of the call will also be available for one week and can be accessed by calling (800) 585-8367 (domestic) or (404) 537-3406 (international) and referencing ID# 97471493.

Pangaea Logistics Solutions Ltd.

Consolidated Statements of Income (Unaudited)

|

| | | | | | | |

| Three Months Ended September 30, |

| 2015 | | 2014 |

| | | |

Revenues: | |

| | |

|

Voyage revenue | $ | 64,599,552 |

| | $ | 80,604,263 |

|

Charter revenue | 6,588,613 |

| | 10,600,956 |

|

| 71,188,165 |

| | 91,205,219 |

|

Expenses: | |

| | |

|

Voyage expense | 30,392,418 |

| | 46,598,184 |

|

Charter hire expense | 20,601,908 |

| | 34,315,719 |

|

Vessel operating expense | 8,462,370 |

| | 7,935,565 |

|

General and administrative | 3,595,398 |

| | 2,790,350 |

|

Depreciation and amortization | 3,195,437 |

| | 3,118,973 |

|

Loss (gain) on sale of vessels | 71,882 |

| | (1,661,368 | ) |

Total expense | 66,319,413 |

| | 93,097,423 |

|

| | | |

Income (loss) from operations | 4,868,752 |

| | (1,892,204 | ) |

| | | |

Other income (expense): | |

| | |

|

Interest expense, net | (1,493,536 | ) | | (1,348,252 | ) |

Interest expense related party debt | (110,764 | ) | | (108,422 | ) |

Imputed interest on related party long-term debt | — |

| | — |

|

Unrealized (loss) gain on derivative instruments | (513,678 | ) | | (551,354 | ) |

Other income | 30,000 |

| | 83,803 |

|

Total other expense, net | (2,087,978 | ) | | (1,924,225 | ) |

| | | |

Net income (loss) | 2,780,774 |

| | (3,816,429 | ) |

Loss (income) attributable to noncontrolling interests | 221,895 |

| | 906,822 |

|

Net income (loss) attributable to Pangaea Logistics Solutions Ltd. | $ | 3,002,669 |

| | $ | (2,909,607 | ) |

| | | |

Earnings (loss) per common share: | |

| | |

|

Basic | $ | 0.08 |

| | $ | (0.42 | ) |

Diluted | $ | 0.08 |

| | $ | (0.42 | ) |

| | | |

Weighted average shares used to compute earnings | |

| | |

|

per common share | |

| | |

|

Basic and diluted | 35,490,097 |

| | 13,421,955 |

|

Pangaea Logistics Solutions Ltd.

Consolidated Balance Sheets

|

| | | | | | | |

| September 30, 2015 | | December 31, 2014 |

| (unaudited) | | |

Assets | | | |

Current assets | |

| | |

|

Cash and cash equivalents | $ | 34,201,299 |

| | $ | 29,817,507 |

|

Restricted cash | 1,000,000 |

| | 1,000,000 |

|

Accounts receivable (net of allowance of $4,483,089 at | |

| | |

|

September 30, 2015 and $4,029,669 at December 31, 2014) | 24,471,012 |

| | 27,362,216 |

|

Bunker inventory | 10,014,506 |

| | 15,601,659 |

|

Advance hire, prepaid expenses and other current assets | 3,525,542 |

| | 6,568,234 |

|

Vessels held for sale, net | — |

| | 4,523,804 |

|

Total current assets | 73,212,359 |

| | 84,873,420 |

|

| | | |

Fixed assets, net | 263,117,007 |

| | 207,667,613 |

|

Investments in newbuildings in-process | 18,766,477 |

| | 38,471,430 |

|

Other noncurrent assets | 836,112 |

| | 1,450,802 |

|

Total assets | $ | 355,931,955 |

| | $ | 332,463,265 |

|

| | | |

Liabilities and stockholders' equity | |

| | |

|

Current liabilities | | | |

Accounts payable, accrued expenses and other current liabilities | $ | 23,436,236 |

| | $ | 40,201,794 |

|

Related party debt | 62,902,322 |

| | 59,102,077 |

|

Deferred revenue | 5,469,664 |

| | 11,748,926 |

|

Current portion long-term debt | 18,136,172 |

| | 17,807,674 |

|

Line of credit | — |

| | 3,000,000 |

|

Dividend payable | 12,724,825 |

| | 12,824,825 |

|

Total current liabilities | 122,669,219 |

| | 144,685,296 |

|

| | | |

Secured long-term debt, net | 115,220,158 |

| | 87,430,416 |

|

| | | |

Commitments and contingencies | — |

| | — |

|

| | | |

Stockholders' equity: | |

| | |

|

Preferred stock, $0.0001 par value, 1,000,000 shares authorized and no shares issued or outstanding | — |

| | — |

|

Common stock, $0.0001 par value, 100,000,000 shares authorized 35,537,169 and 34,756,980 shares issued and outstanding at September 30, 2015 and December 31, 2014, respectively | 3,574 |

| | 3,476 |

|

Additional paid-in capital | 134,327,959 |

| | 133,955,445 |

|

Accumulated deficit | (21,526,300 | ) | | (36,142,727 | ) |

Total Pangaea Logistics Solutions Ltd. equity | 112,805,233 |

| | 97,816,194 |

|

Non-controlling interests | 5,237,345 |

| | 2,531,359 |

|

Total stockholders' equity | 118,042,578 |

| | 100,347,553 |

|

Total liabilities and stockholders' equity | $ | 355,931,955 |

| | $ | 332,463,265 |

|

Pangaea Logistics Solutions Ltd.

Consolidated Statements of Cash Flows (Unaudited)

|

| | | | | | | |

| Nine Months Ended September 30, |

| 2015 | | 2014 |

Operating activities | |

| | |

|

Net income | $ | 18,140,297 |

| | $ | 4,579,040 |

|

Adjustments to reconcile net income to net cash provided by operations: | |

| | |

|

Depreciation and amortization expense | 9,457,269 |

| | 8,415,174 |

|

Amortization of deferred financing costs | 591,444 |

| | 627,961 |

|

Unrealized (gain) loss on derivative instruments | (672,873 | ) | | 2,123,246 |

|

Gain from equity method investee | (61,357 | ) | | — |

|

Provision for doubtful accounts | 453,421 |

| | (385,010 | ) |

Loss (gain) on sales of vessels | 638,638 |

| | (3,947,600 | ) |

Write off unamortized financing costs of repaid debt | 25,557 |

| | 241,522 |

|

Amortization of discount on related party long-term debt | — |

| | 322,947 |

|

Share-based compensation | 372,595 |

| | — |

|

Change in operating assets and liabilities: | |

| | |

|

Accounts receivable | 2,437,783 |

| | 14,456,533 |

|

Bunker inventory | 5,587,153 |

| | 22,183 |

|

Advance hire, prepaid expenses and other current assets | 3,006,412 |

| | 1,770,164 |

|

Other non-current assets | — |

| | (236,223 | ) |

Accounts payable, accrued expenses and other current liabilities | (15,671,505 | ) | | (5,228,037 | ) |

Deferred revenue | (6,279,262 | ) | | (10,292,538 | ) |

Net cash provided by operating activities | 18,025,572 |

| | 12,469,362 |

|

| | | |

Investing activities | |

| | |

|

Purchase of vessels | (44,795,804 | ) | | (38,288,452 | ) |

Proceeds from sales of vessels | 8,265,179 |

| | 23,279,387 |

|

Deposits on newbuildings in-process | (3,470,000 | ) | | (6,960,499 | ) |

Drydocking costs | (643,000 | ) | | (3,639,677 | ) |

Purchase of building and equipment | (59,380 | ) | | (558,376 | ) |

Purchase of non-controlling interest | (250,000 | ) | | — |

|

Net cash used in investing activities | (40,953,005 | ) | | (26,167,617 | ) |

| | | |

Financing activities | |

| | |

|

Proceeds of related party debt | 4,680,001 |

| | 4,750,000 |

|

Payments on related party debt | (1,216,250 | ) | | (54,507 | ) |

Proceeds from long-term debt | 46,000,000 |

| | 35,500,000 |

|

Payments of financing and issuance costs | (928,201 | ) | | (366,800 | ) |

Payments on long-term debt | (17,602,405 | ) | | (24,800,657 | ) |

Payments on line of credit | (3,000,000 | ) | | — |

|

Common stock dividends paid | (100,000 | ) | | (100,000 | ) |

Distribution to non-controlling interest | (521,920 | ) | | — |

|

Net cash provided by financing activities | 27,311,225 |

| | 14,928,036 |

|

| | | |

Net increase in cash and cash equivalents | 4,383,792 |

| | 1,229,781 |

|

Cash and cash equivalents at beginning of period | 29,817,507 |

| | 18,927,927 |

|

Cash and cash equivalents at end of period | $ | 34,201,299 |

| | $ | 20,157,708 |

|

| | | |

Disclosure of noncash items | |

| | |

|

Dividends declared, not paid | $ | — |

| | $ | 6,303,622 |

|

Modification of shareholder loan to on demand | $ | — |

| | $ | 16,433,108 |

|

Imputed interest on related party long-term debt | $ | — |

| | $ | 322,947 |

|

Cash paid for interest | $ | 3,882,603 |

| | $ | 3,660,117 |

|

Pangaea Logistics Solutions Ltd.

Reconciliation of Adjusted EBITDA and Pro Forma Adjusted Earnings Per Share

|

| | | | | | | |

(In thousands of U.S. Dollars except for share and per share data) | Three Months Ended September 30, |

| 2015 | | 2014 |

Adjusted EBITDA | (unaudited) | | (unaudited) |

| | | |

Income from operations | $ | 4,869 |

| | $ | (1,892 | ) |

Depreciation and amortization | 3,195 |

| | 3,119 |

|

Adjusted EBITDA | $ | 8,064 |

| | $ | 1,227 |

|

| | | |

Earnings Per Common Share | | | |

Net Income attributable to Pangaea Logistics Solutions Ltd. | 3,003 |

| | — |

|

Net Income attributable to Bulk Partners (Bermuda) Ltd. | — |

| | (2,910 | ) |

less adjustments related to pre-merger capital structure | — |

| | (2,739 | ) |

Total earnings allocated to common stock | $ | 3,003 |

| | $ | (5,649 | ) |

Weighted average number of common shares outstanding | 35,490,097 |

| | 13,421,955 |

|

Earnings per common share | $ | 0.08 |

| | $ | (0.42 | ) |

| | | |

Pro Forma Adjusted EPS | | | |

Total Income allocated to common stock | 3,003 |

| | (5,649 | ) |

Non-GAAP | | | |

plus adjustments related to pre-merger capital structure | — |

| | 2,739 |

|

Non-GAAP Pro forma adjusted total earnings allocated to common stock | $ | 3,003 |

| | $ | (2,910 | ) |

Non-GAAP Pro forma weighted average number of common shares outstanding | 35,490,097 |

| | 34,696,997 |

|

Non-GAAP Pro forma Adjusted EPS | $ | 0.08 |

| | $ | (0.08 | ) |

INFORMATION ABOUT NON-GAAP FINANCIAL MEASURES. As used herein, “GAAP” refers to accounting principles generally accepted in the United States of America. To supplement our consolidated financial statements prepared and presented in accordance with GAAP, this earnings release discusses non-GAAP financial measures, including (1) non-GAAP adjusted EBITDA and (2) non-GAAP pro forma adjusted earnings per share (“EPS”). These are considered non-GAAP financial measures as defined in Rule 101 of Regulation G promulgated by the Securities and Exchange Commission. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for internal financial and operational decision making purposes and as a means to evaluate period-to-period comparisons of the performance and results of operations of our core business. Our management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the performance of our core business by excluding non-cash losses on impairment of vessels and non-recurring charges that may not be indicative of our recurring core business operating results. These non-GAAP financial measures also facilitate management's internal planning and

comparisons to our historical performance and liquidity. We believe these non-GAAP financial measures are useful to investors as they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making and are used by our institutional investors and the analyst community to help them analyze the performance and operational results of our core business.

Non-GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd., Adjusted EBITDA, and pro forma adjusted EPS. Adjusted net income attributable to Pangaea Logistics Solutions Ltd. represents net income attributable to Pangaea Logistics Solutions Ltd. calculated in accordance with GAAP, plus non-cash losses on impairment of vessels and non-recurring charges. Adjusted EBITDA represents operating earnings before interest expense, income taxes, depreciation, amortization and loss on impairment of vessels. Earnings per share represents total earnings allocated to common stock divided by the weighted average number of common shares outstanding. Pro forma adjusted earnings per share represents adjusted total earnings allocated to common stock divided by the weighted average number of shares giving effect to the mergers as if they had been consummated as of January 1, 2014.

There are limitations related to the use of non-GAAP adjusted net income attributable to Pangaea Logistics Solutions Ltd., adjusted EBITDA, and pro forma adjusted EPS versus net income, income from operations, and EPS calculated in accordance with GAAP. In particular, Pangaea’s definition of adjusted net income attributable to Pangaea Logistics Solutions Ltd., adjusted EBITDA, and pro forma adjusted EPS used here is not comparable to net income, EBITDA, and EPS. Management provides specific information in order to reconcile the GAAP or non-GAAP measure to adjusted net income attributable to Pangaea Logistics Solutions Ltd., adjusted EBITDA, and pro forma adjusted EPS.

The table set forth above provides a reconciliation of the non-GAAP financial measures presented to the most directly comparable financial measures prepared in accordance with GAAP.

About Pangaea Logistics Solutions Ltd.

Pangaea Logistics Solutions Ltd. (NASDAQ: PANL) provides logistics services to a broad base of industrial customers who require the transportation of a wide variety of dry bulk cargoes, including grains, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone. The Company addresses the transportation needs of its customers with a comprehensive set of services and activities, including cargo loading, cargo discharge, vessel chartering, and voyage planning. Learn more at www.pangaeals.com.

Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are based on our current expectations and beliefs and are subject to a number of risk factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The Company disclaims any obligation to publicly update or revise these statements whether as a result of new information, future events or otherwise, except as required by law. Such risks and uncertainties include, without limitation, the strength

of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand for dry bulk shipping capacity, changes in our operating expenses, including bunker prices, dry-docking and insurance costs, the market for our vessels, availability of financing and refinancing, charter counterparty performance, ability to obtain financing and comply with covenants in such financing arrangements, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of shipping routes due to accidents or political events, vessels breakdowns and instances of off-hires and other factors, as well as other risks that have been included in filings with the Securities and Exchange Commission, all of which are available at www.sec.gov.

Third Quarter 2015 Results November 2015

2 Safe Harbor This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Pangaea’s and managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Pangaea’s business. These risks, uncertainties and contingencies include: business conditions; weather and natural disasters; changing interpretations of GAAP; outcomes of government reviews; inquiries and investigations and related litigation; continued compliance with government regulations; legislation or regulatory environments; requirements or changes adversely affecting the business in which Pangaea is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other providers of logistics and shipping services; general economic conditions; geopolitical events and regulatory changes; and other factors set forth in Pangaea’s filings with the Securities and Exchange Commission and the filings of its predecessors. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that certain of Pangaea’s financial results are unaudited and do not conform to SEC Regulation S-X and as a result such information may fluctuate materially depending on many factors. Accordingly, Pangaea’s financial results in any particular period may not be indicative of future results. Pangaea is not under any obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

3 Third Quarter 2015 Highlights • Net income attributable to Pangaea Logistics Solutions Ltd. was $3.0 million in the third quarter of 2015, compared to a net loss of $2.9 million in the third quarter of 2014 • Pro forma adjusted earnings per common share1 of $0.08 in the third quarter of 2015, compared to a pro forma adjusted loss per common share of $0.08 in the third quarter of 2014 • Adjusted EBITDA2 increased to $8.1 million in the third quarter of 2015, compared with $1.2 million in the third quarter of 2014 • Cash flow from operations was $18.0 million for the nine months ended September 30, 2015, compared with $12.5 million for the same period in 2014 • At the end of the quarter, Pangaea had $34.2 million in cash and cash equivalents • Acquired the remaining non-controlling interest in Nordic Bulk Carriers AS (“NBC”), making NBC a wholly-owned subsidiary of Pangaea 1 Earnings per share represents total earnings allocated to common stock divided by the weighted average number of common shares outstanding. Pro Forma adjusted earnings per share represents adjusted total earnings allocated to common stock divided by the weighted average number of shares giving effect to the mergers as if they had been consummated as of January 1, 2014. See Reconciliation of Adjusted EBITDA and Pro Forma Adjusted Earnings Per Share. 2 Adjusted EBITDA is a non-GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, and other non-operating income and/or expense, if any.

4 Financial Performance Third Quarter 2014 - Third Quarter 2015 $(15,000,000) $(10,000,000) $(5,000,000) $- $5,000,000 $10,000,000 $15,000,000 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Adjusted EBITDA(1) Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 $(20,000,000) $(15,000,000) $(10,000,000) $(5,000,000) $- $5,000,000 $10,000,000 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Net Income Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 $9,500 $10,000 $10,500 $11,000 $11,500 $12,000 $12,500 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 TCE(2) Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 1) Adjusted EBITDA is a non-GAAP measure and represents operating earnings before interest expense, income taxes, depreciation and amortization, and other non-operating income and/or expense, if any. 2) TCE is defined as total revenues less voyage expenses divided by the number of shipping days, which is consistent with industry standards. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per-day amounts while charter hire rates for vessels on time charters generally are expressed in per-day amounts.

5 Drivers of Third Quarter 2015 Performance • Operating margin improved dramatically to 6.8% from negative 2.1%. This reflected an increased share of revenues coming from COAs tied to rates above current market rates, as opposed to market rate charter business, and decreased expenses, specifically: - Voyage revenue per day rose 13% compared to the third quarter of 2014 to $12,112 per day, despite continued industry headwinds, demonstrating the benefit of COAs in generating sustainable revenues - Voyage expense decreased 35% to $30.4 million for the 3rd quarter of 2015 from $46.6 million in the 3rd quarter of 2014, thanks in part to decreased bunker costs - Charter hire expense decreased 40% to $20.6 million from $34.3 million - Vessel operating expense dropped to $6,808 per day from $7,130 per day • Total shipping days decreased by 16% to 3,443 from 4,099 as Pangaea limited its exposure to the weak spot market

6 Defensible Pillars of Profitability • Execution specialization: - Material cost savings & enhanced profit through granular operating knowledge & risk sensitive approach - Secured & defended by 200+ years of expertise & embedded relationships; key managers average 20 years in the industry • Backhaul specialization: - Generating profit from a cost center - Secured & defended by reputation, long-term contracts & repeat customers - Minimal ballast time • Ice-class specialization: - Capturing profit from limited supply of tonnage & lower costs - Secured & defended by expertise & ownership of specialized fleet - Own & operate a significant portion of the world’s 1A ice-class dry tonnage • Broader logistics solutions: - Design & implement loading & discharge efficiencies in critical ports - Expand markets & improve business terms for customers

7 Selected Income Statement Data Three months ended September 30, 2015 2014 (unaudited) (unaudited) Revenues: Voyage revenue $64,599,552 $80,604,263 Charter revenue 6,588,613 10,600,956 71,188,165 91,205,219 Expenses: Voyage expense 30,392,418 46,598,184 Charter hire expense 20,601,908 34,315,719 Vessel operating expense 8,462,370 7,935,565 General and administrative 3,595,398 2,790,350 Depreciation and amortization 3,195,437 3,118,973 Loss (gain) on sale of vessels 71,882 (1,661,368) Total expenses 66,319,413 93,097,423 Income from operations 4,868,752 (1,892,204) Other income (expense): Interest expense, net (1,493,536) (1,348,252) Interest expense related party debt (110,764) (108,422) Imputed interest on related party long-term debt 0 0 Unrealized gain (loss) gain on derivative instruments (513,678) (551,354) Other income 30,000 83,803 Total other expense, net (2,087,978) (1,924,225) Net income 2,780,774 (3,816,429) (Loss) income attributable to noncontrolling interests 221,895 906,822 Net income attributable to Pangaea Logistics Solutions Ltd. $3,002,669 $(2,909,607)

8 Selected Balance Sheet and Cash Flow Data Balance Sheet Data September 30, 2015 December 30, 2014 Assets (unaudited) Current Assets Cash and cash equivalents $34,201,299 $29,817,507 Accounts receivable 24,471,012 27,362,216 Other current assets 14,540,048 23,169,893 Total current assets 73,212,359 84,873,420 Fixed assets, net 263,117,007 207,667,613 Investment in newbuildings in-process 18,766,477 38,471,430 Other noncurrent assets 836,112 1,450,802 Total Assets $355,931,955 $332,463,265 Liabilities and stockholders' equity Current liabilities Accounts payable, accrued expenses and other current liabilities $23,436,236 $40,201,794 Related party debt 62,902,322 59,102,077 Current portion long-term debt 18,136,172 17,807,674 Other current liabilities 18,194,489 27,573,751 Total current liabilities 122,669,219 144,685,296 Secured long-term debt, net 115,220,158 87,430,416 Total Pangaea Logistics Solutions Ltd. equity 112,805,233 97,816,194 Non-controlling interests 5,237,345 2,531,359 Total stockholders' equity 118,042,578 100,347,553 Total liabilities and stockholders' equity $355,931,955 $332,463,265 Statements of Cash Flows Data Nine months ended September 30, 2015 2014 Net cash provided by operating activities 18,025,572 12,469,362 Net cash used in investing activities (40,953,004) (26,167,617) Net cash provided by financing activities 27,311,225 14,928,036

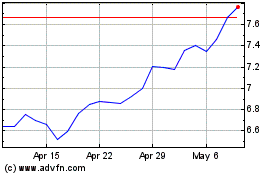

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Aug 2024 to Sep 2024

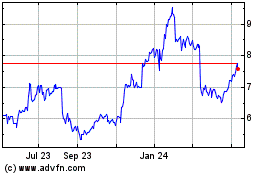

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Sep 2023 to Sep 2024