UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 11-K

(Mark One)

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission File

Number 113928

| A. |

Full title of the plan and the address of the plan, if different from that of the issuer named below: |

RBC U.S.A. Retirement and Savings Plan

60 South Sixth Street, RBC Plaza, Minneapolis, MN 55402

| B. |

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

Royal Bank of Canada

(Exact name of Registrant as specified in its charter)

Toronto, Ontario

Canada

(State or other jurisdiction of) Identification No.)

200 Bay Street, Royal Bank of Plaza, Toronto, Ontario Canada M5J2J5

(Address of principal executive offices) (Zip Code)

REQUIRED INFORMATION

In lieu of the requirements of Items 1-3 of Form 11-K, and as permitted by Item 4 of Form 11-K, plan financial statements and schedules are being

filed in accordance with the financial reporting requirements of ERISA.

The following are furnished for the plan and are included in Appendix

A:

RBC U.S.A. Retirement

and Savings Plan

Employer ID No.: 20-0563684

Plan Number: 003

Financial Statements as of

December 31, 2014 and

2013, and for the Year Ended December 31, 2014,

Supplemental Schedule as of and for the Year Ended

December 31, 2014, and Report of

Independent

Registered Public Accounting Firm

RBC U.S.A. RETIREMENT AND SAVINGS PLAN

TABLE OF CONTENTS

|

|

|

|

|

| |

|

Page |

|

|

|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

|

1 |

|

|

|

| FINANCIAL STATEMENTS: |

|

|

|

|

|

|

| Statements of Net Assets Available for Plan Benefits as of December 31, 2014 and

2013 |

|

|

2 |

|

|

|

| Statement of Changes in Net Assets Available for Plan Benefits for the Year Ended December 31,

2014 |

|

|

3 |

|

|

|

| Notes to Financial Statements as of December 31, 2014 and 2013, and for the Year Ended December

31, 2014 |

|

|

4–15 |

|

|

|

| SUPPLEMENTAL SCHEDULES FURNISHED PURSUANT TO THE REQUIREMENTS OF FORM 5500 AS OF DECEMBER

31, 2014: |

|

|

16 |

|

|

|

| Form 5500, Schedule H, Line 4i

— Schedule of Assets (Held at End of Year) as of December 2014 |

|

|

17 |

|

|

|

| Form 5500, Schedule H, Part IV, Question 4a

— Schedule of Delinquent Participant Contributions for the Year Ended December 31, 2014 |

|

|

18 |

|

| NOTE: |

All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee

Retirement Income Security Act of 1974 have been omitted because they are not applicable. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Trustees and Participants of

RBC U.S.A Retirement and Savings Plan

Minneapolis, Minnesota

We have audited the accompanying statements of net assets available for benefits of the RBC U.S.A Retirement and Savings Plan (the “Plan”) as

of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our

responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with

standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a

test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We

believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material

respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014, in conformity with accounting principles generally

accepted in the United States of America.

The supplemental schedule of assets (held at end of year) as of December 31, 2014 has been

subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the

supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In

forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including the form and content, is presented in compliance with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under

the Employee Retirement Income Security Act of 1974. In our opinion, such schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Deloitte & Touche LLP

New York, New York

June 25, 2015

RBC U.S.A. RETIREMENT AND SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR PLAN BENEFITS

AS OF DECEMBER 31, 2014 AND 2013

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| ASSETS: |

|

|

|

|

|

|

|

|

| Investments — at fair value — |

|

|

|

|

|

|

|

|

| Total participant directed investments |

|

$ |

1,941,984,184 |

|

|

$ |

1,842,180,873 |

|

|

|

|

|

|

|

|

|

|

| Receivables: |

|

|

|

|

|

|

|

|

| Notes receivable from participants |

|

|

19,559,878 |

|

|

|

18,582,708 |

|

| Employer matching fixed contribution |

|

|

3,829,347 |

|

|

|

3,324,923 |

|

|

|

|

|

|

|

|

|

|

| Total receivables |

|

|

23,389,225 |

|

|

|

21,907,631 |

|

|

|

|

|

|

|

|

|

|

| NET ASSETS REFLECTING ALL INVESTMENTS AT FAIR VALUE |

|

|

1,965,373,409 |

|

|

|

1,864,088,504 |

|

| ADJUSTMENT FROM FAIR VALUE TO CONTRACT VALUE FOR INDIRECT |

|

|

|

|

|

|

|

|

| FULLY BENEFIT-RESPONSIVE INVESTMENT CONTRACTS |

|

|

(2,654,559 |

) |

|

|

(2,689,452 |

) |

|

|

|

|

|

|

|

|

|

| NET ASSETS AVAILABLE FOR PLAN BENEFITS |

|

$ |

1,962,718,850 |

|

|

$ |

1,861,399,052 |

|

|

|

|

|

|

|

|

|

|

| See notes to financial statements. |

|

|

|

|

|

|

|

|

- 2 -

RBC U.S.A. RETIREMENT AND SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR PLAN BENEFITS

FOR THE YEAR ENDED DECEMBER 31, 2014

|

|

|

|

|

| INVESTMENT INCOME: |

|

|

|

|

| Dividends and interest |

|

$ |

71,462,036 |

|

| Net appreciation(depreciation) in fair value of investments (Note 3) |

|

|

42,050,569 |

|

|

|

|

|

|

|

|

| Net investment income |

|

|

113,512,605 |

|

|

|

|

|

|

|

|

| INTEREST INCOME — Notes receivable |

|

|

816,788 |

|

|

|

| CONTRIBUTIONS: |

|

|

|

|

| Participant |

|

|

84,157,930 |

|

| Participant rollover |

|

|

12,700,131 |

|

| Employer — fixed matching — net of forfeitures of $1,894,400 |

|

|

38,153,366 |

|

|

|

|

|

|

|

|

| Total contributions |

|

|

135,011,427 |

|

|

|

|

|

|

|

|

| DEDUCTIONS: |

|

|

|

|

| Benefits paid to participants |

|

|

(147,530,859 |

) |

| Administrative expenses |

|

|

(490,163 |

) |

|

|

|

|

|

|

|

| Total deductions |

|

|

(148,021,022 |

) |

|

|

|

|

|

|

|

| INCREASE IN NET ASSETS AVAILABLE FOR PLAN BENEFITS |

|

|

101,319,798 |

|

|

|

| NET ASSETS AVAILABLE FOR PLAN BENEFITS — Beginning of year |

|

|

1,861,399,052 |

|

|

|

|

|

|

|

|

| NET ASSETS AVAILABLE FOR PLAN BENEFITS — End of year |

|

$ |

1,962,718,850 |

|

|

|

|

|

|

See notes to financial statements.

- 3 -

RBC U.S.A. RETIREMENT AND SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF

DECEMBER 31, 2014 AND 2013, AND FOR THE YEAR ENDED DECEMBER 31, 2014

| 1. |

DESCRIPTION OF THE PLAN |

The following description of the RBC U.S.A. Retirement and Savings Plan (the “Plan”) is provided for general information

purposes only. Participants should refer to the plan document for complete information regarding the Plan’s definitions, benefits, eligibility, and other matters.

General — The Plan is a defined contribution plan covering all eligible employees for RBC Wealth Management, RBC Capital Markets, the U.S. office of Royal Bank of Canada, RBC Real

Estate Finance Inc., and RBC Bank (Georgia) (the “RBC Companies” or “Plan Sponsor” or “the Company”) in the United States. The Plan is subject to the provisions of the Employee Retirement Income Security Act of

1974 (ERISA) and the Internal Revenue Code (the “Code”). Fidelity Investments Institutional Operations Company, Inc. is the Plan’s “Administrator” and Fidelity Management Trust Company is the Plan’s

“Trustee”.

Eligibility — Employees may make pretax and after-tax contributions to the Plan upon

hire. Eligible employees receive employer matching contributions beginning the first of the month following one year of service consisting of at least 1,000 hours.

Contributions — Employees may contribute up to 50% of their compensation to the Plan on a pretax basis or on an after-tax basis to their Roth 401(k) account. In addition,

employees may also contribute up to 5% of their compensation to the Plan on an after-tax basis. Participant contributions are subject to maximum amounts as described in the Code. Employees who have attained age 50 before the end of the plan

year may also elect to make pretax and/or Roth 401(k) catch-up contributions up to 25% of compensation. Catch-up contributions were subject to an annual limit of $5,500 under Internal Revenue Service (IRS) regulations during 2014. Catch-up

contributions are not subject to RBC Companies’ matching contributions. Employees may also contribute to the Plan by making rollover contributions, which represent distributions from other qualified plans.

A fixed matching contribution is paid by the RBC Companies throughout the year as eligible employees make deferrals that are equal to one

dollar for every dollar of a participant’s pretax contribution or after-tax Roth 401(k) contribution, up to a maximum of 6% of participant compensation. All matching contributions are invested in accordance with participant investment

elections.

Employees who have not enrolled in the Plan by the time they become eligible for company match are automatically

enrolled for a 3% pretax contribution. If no investment elections are in place, the contribution is allocated to the appropriate JPMorgan SmartRetirement fund based on a normal age 65 retirement. Employees may opt out of this automatic

enrollment. Additionally, employees may request a refund of an automatically enrolled amount if they make that request within 90 days of the initial contribution and the related company match would be forfeited.

Employee and employer contributions are limited to the extent necessary to comply with the applicable sections of the Code. Starting

February 1, 2009, RBC Wealth Management financial advisors, branch directors, and complex directors are not eligible for fixed matching contributions. Starting March 1, 2009, RBC Wealth Management divisional directors are not eligible for

fixed matching contributions. After-tax contributions (excluding Roth 401(k)) and catch-up contributions are not eligible for fixed matching contributions.

- 4 -

The Employee Stock Ownership Plan (ESOP) was funded solely with contributions made by the

RBC Companies. The RBC Companies had the sole and exclusive discretion as to the amounts contributed, if any. As of January 1, 2010, the ESOP feature of the Plan has been frozen.

Participant Accounts — Individual accounts are maintained for each Plan participant. Each participant account is credited

with the participant’s voluntary pretax and after-tax contributions, Roth 401(k) after-tax contributions, the RBC Companies’ fixed matching contributions, and fund earnings, and charged with withdrawals and an allocation of fund

losses. Fund earnings and losses are allocated based on participant balances in each fund.

Investments —

Participants may direct and redirect the balance of their account and contributions into any of the Plan’s 27 investment options, including the Fidelity BrokerageLink investment option. The Fidelity BrokerageLink investment is a

self-directed mutual fund brokerage account, which participants may choose to invest in a variety of eligible mutual funds. Investment elections may be changed by the participant daily.

Participants may change the investment of accounts or portions of accounts, including the RBC Common Stock dividends, from the RBC Stock

Fund (the Company’s unitized common stock fund which invests in RBC shares) into one or more other investment funds.

The

various investment options available to the participants include the RBC Stock Fund, mutual funds including lifestyle funds, common collective trusts and Fidelity BrokerageLink.

Vesting — Participants are immediately vested in their pretax contributions, Roth 401(k) contributions, after-tax

contributions, and rollover contributions, plus earnings thereon. Participants are 25% vested in the fixed employer matching contributions after two years of service and vest in 25% increments per year thereafter. All participants are fully vested

after five years of service. In addition, all participants become fully vested upon death or disability, attaining retirement age, or if the Plan is terminated.

Forfeitures — After a participant’s termination of employment, the unvested portion of the participant’s account, if any, is forfeited at the time the participant takes a

distribution from the Plan. Forfeited amounts are retained in the Plan and used to reduce future RBC Companies’ contributions or to pay administrative expenses of the Plan. Forfeitures of $1,894,400 were used to reduce RBC Companies’

contributions for the Plan year ended December 31, 2014. Forfeiture account balances were $3,609,041 and $3,708,115 as of December 31, 2014 and 2013, respectively.

If a participant is rehired by the RBC Companies or by an affiliate within five years after termination, the participant shall receive a full restoration of the amount previously forfeited.

Notes Receivable from Participants — Participants may borrow from their vested account balance an amount not to exceed

the lesser of 50% of their vested account balance or $50,000 reduced by the highest outstanding loan balance within the past year. Additionally, the minimum loan amount is $1,000. The normal maximum loan repayment period is five years. If the

purpose of the loan is to acquire a principal residence, then the loan repayment period shall not exceed 15 years. In general, participants are limited to one loan from their vested account balance. A second loan is permitted if used for the

acquisition of a principal residence. Interest on participant loans is fixed and is based on the prime rate, plus 1% at the time of the loan. Current interest on loans ranges from 4.25% to 10.5%. Loans are due at various dates through 2029. Loans

are generally repaid through regular payroll deductions and are secured by the balance in the participant’s account.

- 5 -

Payment of Benefits — Upon termination of employment, participants may

generally request a lump-sum distribution of the employee pretax, Roth 401(k) and after-tax contributions account balances. Each participant who has terminated employment and whose vested account balance is less than $1,000 will automatically

receive a lump-sum payment. If a participant’s account balance is greater than $1,000 but less than $5,000, it is automatically rolled to a Fidelity Individual Retirement Account unless elected otherwise. Participants may also request

in-service distributions, which are limited to the employee pretax and after-tax contributions (including Roth 401(k)) account balance, for financial hardship purposes as defined by the Plan. In addition, eligible participants between

ages 50 and 59 1/2 may request special distribution of certain amounts from the Plan, subject to minimum service requirements. Participants may withdraw vested matching amounts that have been in their account for at least 24 months.

Distributions from the Plan are generally made in cash, except for the RBC Stock Fund where participants can choose to have their value paid in cash or RBC common shares.

Dividend Reinvestment — Participants can elect to have quarterly dividends paid on RBC stock in the RBC Stock Fund to be either reinvested or paid out in cash. Reinvested dividends have

no current tax consequence to the Plan or participants. Dividends that are paid out in cash are considered taxable income in the year that they are paid. Total amount of dividends paid out for the year ended December 31, 2014, and included in

benefits paid to participants, was $1,187,272.

| 2. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Basis of Accounting — The Plan’s financial statements and supplemental schedule have been prepared in accordance with accounting principles generally accepted in the United States of

America (GAAP).

Contributions — Participant and RBC Companies’ fixed matching contributions are recorded

in the period the employer makes the payroll deductions. Employer match true-up contributions are recorded as a receivable for the period to which they are related. Participant accounts are credited with the true-up contribution in the following

year. In the event of a delinquent participant contribution, appropriate lost earnings are determined and recorded in the effected participant’s account to make the participant whole.

Benefits Paid to Participants — Benefit payments to participants are recorded upon distribution. There were no

participants, who elected to withdraw from the Plan, but had not yet been paid as of December 31, 2014.

Investment

Valuation and Income Recognition — The Plan’s investments are stated at fair value. Shares of mutual funds are valued at quoted market prices, which represent the net asset value (NAV) of shares held by the Plan at year-end.

Common collective trust funds are stated at fair value as determined by the issuer of the common/collective trust funds based on the fair market value of the underlying investments, including underlying investments in investment contracts. The RBC

Stock Fund is valued based on the underlying assets as shown in Note 3. The Plan presents in the statement of changes in net assets available for plan benefits the net appreciation (depreciation) in the fair value of its investments, which

consists of the realized gains or losses and the unrealized appreciation or depreciation on those investments.

- 6 -

The Managed Income Portfolio II (the “Portfolio”) is a stable value fund that

is a commingled pool of Fidelity Group Trust for Employee Benefit Plans. The Portfolio may invest in fixed interest insurance investment contracts, money market funds, corporate and government bonds, mortgage-backed securities, bond funds, and other

fixed-income securities. Fair value of the Portfolio is the NAV of its holdings at year-end. Underlying securities for which quotations are readily available are valued at their most recent bid prices or are valued on the basis of information

provided by a pricing service. Fair value of the underlying investment contracts is estimated using a discounted cash flow model. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract

value.

In accordance with GAAP, the Portfolio is included at fair value in participant-directed investments in the statements

of net assets available for benefits, and an additional line item is presented representing the adjustment from fair value to contract value. Contract value represents contributions made to the Portfolio, plus earnings, less participant withdrawals.

The statement of changes in net assets available for benefits is presented on a contract-value basis.

Purchases and sales of

investments are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold

as well as held during the year.

Management fees and operating expenses charged to the Plan for investments in the mutual

funds are deducted from income earned on a daily basis and are not separately reflected. Consequently, management fees and operating expenses are reflected as a reduction of investment return for such investments.

Notes Receivable from Participants — Notes receivable from participants are measured at their unpaid principal balance

plus any accrued but unpaid interest. Delinquent participant loans are recorded as distributions based on the terms of the Plan document.

Administrative Expenses — Administrative expenses are paid by the Plan Sponsor as provided in the second amendment to the Trust Agreement between Trustee and the Plan Sponsor.

Additionally, certain transaction costs for loans and investment redemptions are paid by the participants via reduction of participant account balances.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of net assets

available for plan benefits at the date of the financial statements and the changes in net assets available for plan benefits during the reporting period and disclosure of contingent assets and liabilities. Actual results could differ from those

estimates.

Risks and Uncertainties — The Plan provides for various investment options in shares of registered

investment companies, common collective trusts, and RBC Stock Fund. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain

investment securities, it is reasonably possible that changes in the value of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets available for plan

benefits.

New Accounting Standards — In May 2015, the Financial Accounting Standards Board (FASB) issued

Accounting Standards Update 2015-07, Disclosures for Investments in Certain Entities that Calculate Net Asset Value Per Share (or its Equivalent), (ASU 2015-07). ASU 2015-07 removes the

- 7 -

requirement to categorize within the fair value hierarchy investments for which fair values are estimated using the net asset value practical expedient provided by Accounting Standards

Codification 820, Fair Value Measurement. Disclosures about investments in certain entities that calculate net asset value per share are limited under ASU 2015-07 to those investments for which the entity has elected to estimate the fair value using

the net asset value practical expedient. ASU 2015-07 is effective for entities (other than public business entities) for fiscal years beginning after December 15, 2016, with retrospective application to all periods presented. Early application

is permitted. Management did not early adopt and is reviewing this new guidance and is currently evaluating the impact to its financial statements

Investments

that represent 5% or more of the Plan’s net assets available for plan benefits at fair value, as of December 31, 2014 and 2013, are as follows:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Royal Bank of Canada Common Stock Fund* |

|

$ |

359,758,966 |

|

|

$ |

367,258,746 |

|

| T. Rowe Price Growth Stock Trust |

|

|

196,918,162 |

|

|

|

184,477,806 |

|

| Fidelity Managed Income Portfolio II* |

|

|

184,440,471 |

|

|

|

191,061,085 |

|

| Fidelity US Equity Index Commingled Pool* |

|

|

162,611,081 |

|

|

|

133,405,710 |

|

| American Funds American Balanced Fund |

|

|

155,031,673 |

|

|

|

142,436,190 |

|

| American Funds EuroPacific Growth Fund |

|

|

128,573,010 |

|

|

|

133,710,353 |

|

| Invesco Comstock Fund** |

|

|

126,251,583 |

|

|

|

** |

|

|

|

|

| * Known to be a party-in-interest (see Note 4) |

|

|

|

|

|

|

|

|

| ** This investment did not represent 5% or more of the Plan’s net assets available for benefits at the end of the Plan year

2013. |

|

|

|

|

|

|

|

|

During the year ended December 31, 2014, the Plan’s investments (including gains and losses on

investments bought and sold, as well as held during the year), appreciated in value by $42,050,569 as follows:

|

|

|

|

|

| Mutual funds |

|

$ |

(5,276,465 |

) |

| Fidelity BrokerageLink |

|

|

1,501,464 |

|

| Common collective trusts |

|

|

35,861,031 |

|

| Employer stock funds |

|

|

9,964,539 |

|

|

|

|

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

42,050,569 |

|

|

|

|

|

|

The following summarizes the components of the employer stock funds, at December 31, 2014 and 2013:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Royal Bank of Canada Common Stock Fund: |

|

|

|

|

|

|

|

|

| Royal Bank of Canada common stock |

|

$ |

359,758,966 |

|

|

$ |

359,198,686 |

|

| Fidelity institutional cash money market funds |

|

|

9,328,552 |

|

|

|

8,380,731 |

|

| Net payables |

|

|

— |

|

|

|

(320,671 |

) |

| Net receivables |

|

|

163,121 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

369,250,639 |

|

|

$ |

367,258,746 |

|

|

|

|

|

|

|

|

|

|

- 8 -

| 4. |

PARTY-IN-INTEREST TRANSACTIONS |

Certain Plan investments are shares of mutual funds managed by Fidelity Management Trust Company. Fidelity is the Trustee as defined by the Plan. Additionally certain plan investments are shares of mutual

funds managed by RBC. RBC is the Plan Sponsor. These transactions qualify as exempt party-in-interest transactions, as defined by ERISA. Fees paid by the Plan for investment management services were included as a reduction of the return earned on

each fund.

At December 31, 2014 and 2013, the Plan held 5,208,191 and 5,343,097 shares, respectively, of common stock of

RBC, with a cost basis of $201,168,614 and $190,159,846 respectively. During the year ended December 31, 2014, the Plan recorded dividend income of $13,584,887 from the RBC Common Stock Fund. These transactions qualify as exempt

party-in-interest transactions. During 2014 and 2013, the Plan’s stock fund had the following transactions related to the Plan sponsor’s common stock:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Number of common shares purchased |

|

|

58,300 |

|

|

|

— |

|

| Cost of common shares purchased |

|

$ |

3,634,101 |

|

|

$ |

— |

|

| Number of common shares sold |

|

|

193,206 |

|

|

|

446,875 |

|

| Market value of common shares sold |

|

$ |

13,040,693 |

|

|

$ |

28,472,052 |

|

| Cost of common shares sold |

|

$ |

4,542,355 |

|

|

$ |

10,325,667 |

|

The Company remitted participant contributions of $1,543 to the trustee on various dates in 2014 and 2013

which were later than required by Department of Labor (DOL) Regulation 2510.3 102. The Company filed Form 5330 with the IRS and paid the required excise tax on the transaction. In addition, participant accounts were credited with the

amount of investment income that would have been earned had the participant contribution been remitted on a timely basis.

Although it has not expressed any intent to do so, the RBC Companies have the right under the Plan to discontinue contributions at any

time and to amend or terminate the Plan subject to the provisions set forth in ERISA. In the event of Plan termination, participants will become fully vested in their account balances.

| 6. |

FAIR VALUE MEASUREMENTS |

ASC 820 Fair Value Measurements established a single authoritative definition of fair value, set a framework for measuring

fair value, and requires additional disclosures about fair value measurements. In accordance with ASC 820, the Plan classifies its investments into Level 1, which refers to securities valued using quoted prices from active markets for

identical assets; Level 2, which refers to securities not traded in an active market but for which observable market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs.

Assets are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

- 9 -

The following tables set forth by level within the fair value hierarchy a summary of the

Plan’s investments measured at fair value on a recurring basis at December 31, 2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

| |

|

Quoted Prices in

Active Markets

for Identical

Assets (Level 1) |

|

|

Significant

Other

Observable

Inputs (Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Common stock — financial services |

|

$ |

369,250,639 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

369,250,639 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total common stocks |

|

|

369,250,639 |

|

|

|

— |

|

|

|

— |

|

|

|

369,250,639 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Registered investment companies: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap value |

|

|

126,251,583 |

|

|

|

— |

|

|

|

— |

|

|

|

126,251,583 |

|

| Large-cap growth |

|

|

128,573,010 |

|

|

|

— |

|

|

|

— |

|

|

|

128,573,010 |

|

| Fixed-income funds |

|

|

72,498,674 |

|

|

|

— |

|

|

|

— |

|

|

|

72,498,674 |

|

| Large-cap blend |

|

|

187,823,734 |

|

|

|

— |

|

|

|

— |

|

|

|

187,823,734 |

|

| Mid-cap growth |

|

|

97,121,679 |

|

|

|

— |

|

|

|

— |

|

|

|

97,121,679 |

|

| Mid-cap value |

|

|

70,458,689 |

|

|

|

— |

|

|

|

— |

|

|

|

70,458,689 |

|

| Small-cap growth |

|

|

73,078,772 |

|

|

|

— |

|

|

|

— |

|

|

|

73,078,772 |

|

| Small-cap value |

|

|

67,874,192 |

|

|

|

— |

|

|

|

— |

|

|

|

67,874,192 |

|

| Other mutual funds |

|

|

13,682,828 |

|

|

|

138,270,843 |

|

|

|

— |

|

|

|

151,953,671 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total registered investment companies |

|

|

837,363,161 |

|

|

|

138,270,843 |

|

|

|

— |

|

|

|

975,634,004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personal directed brokerage accounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap value |

|

|

3,010,209 |

|

|

|

— |

|

|

|

— |

|

|

|

3,010,209 |

|

| Large-cap growth |

|

|

3,482,914 |

|

|

|

— |

|

|

|

— |

|

|

|

3,482,914 |

|

| Fixed-income funds |

|

|

9,201,752 |

|

|

|

— |

|

|

|

— |

|

|

|

9,201,752 |

|

| Large-cap blend |

|

|

5,613,127 |

|

|

|

— |

|

|

|

— |

|

|

|

5,613,127 |

|

| Small-cap growth |

|

|

648,809 |

|

|

|

— |

|

|

|

— |

|

|

|

648,809 |

|

| Small-cap value |

|

|

209,103 |

|

|

|

— |

|

|

|

— |

|

|

|

209,103 |

|

| Money Market |

|

|

10,067,469 |

|

|

|

|

|

|

|

|

|

|

|

10,067,469 |

|

| Other mutual funds |

|

|

20,896,444 |

|

|

|

— |

|

|

|

— |

|

|

|

20,896,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total registered investment companies |

|

|

53,129,827 |

|

|

|

— |

|

|

|

— |

|

|

|

53,129,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common collective trusts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap equity index |

|

|

— |

|

|

|

162,611,081 |

|

|

|

— |

|

|

|

162,611,081 |

|

| Large-cap growth |

|

|

— |

|

|

|

196,918,162 |

|

|

|

— |

|

|

|

196,918,162 |

|

| Stable value fund |

|

|

— |

|

|

|

184,440,471 |

|

|

|

— |

|

|

|

184,440,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total common collective trusts |

|

|

— |

|

|

|

543,969,714 |

|

|

|

— |

|

|

|

543,969,714 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

1,259,743,627 |

|

|

$ |

682,240,557 |

|

|

$ |

— |

|

|

$ |

1,941,984,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 10 -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2013 |

|

| |

|

Quoted Prices in

Active Markets

for Identical

Assets (Level 1) |

|

|

Significant

Other

Observable

Inputs (Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Common stock — financial services |

|

$ |

367,258,746 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

367,258,746 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total common stocks |

|

|

367,258,746 |

|

|

|

— |

|

|

|

— |

|

|

|

367,258,746 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mutual funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap value |

|

|

120,851,074 |

|

|

|

— |

|

|

|

— |

|

|

|

120,851,074 |

|

| Large-cap growth |

|

|

133,710,353 |

|

|

|

— |

|

|

|

— |

|

|

|

133,710,353 |

|

| Fixed-income funds |

|

|

68,672,843 |

|

|

|

— |

|

|

|

— |

|

|

|

68,672,843 |

|

| Large-cap blend |

|

|

173,053,650 |

|

|

|

— |

|

|

|

— |

|

|

|

173,053,650 |

|

| Mid-cap growth |

|

|

85,446,641 |

|

|

|

— |

|

|

|

— |

|

|

|

85,446,641 |

|

| Mid-cap value |

|

|

74,008,430 |

|

|

|

— |

|

|

|

— |

|

|

|

74,008,430 |

|

| Small-cap growth |

|

|

77,168,006 |

|

|

|

— |

|

|

|

— |

|

|

|

77,168,006 |

|

| Small-cap value |

|

|

66,171,597 |

|

|

|

— |

|

|

|

— |

|

|

|

66,171,597 |

|

| Other mutual funds |

|

|

117,129,130 |

|

|

|

— |

|

|

|

— |

|

|

|

117,129,130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total mutual funds |

|

|

916,211,724 |

|

|

|

— |

|

|

|

— |

|

|

|

916,211,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personal directed brokerage accounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap value |

|

|

2,756,828 |

|

|

|

— |

|

|

|

— |

|

|

|

2,756,828 |

|

| Large-cap growth |

|

|

2,821,792 |

|

|

|

— |

|

|

|

— |

|

|

|

2,821,792 |

|

| Fixed-income funds |

|

|

9,447,436 |

|

|

|

— |

|

|

|

— |

|

|

|

9,447,436 |

|

| Large-cap blend |

|

|

5,157,916 |

|

|

|

— |

|

|

|

— |

|

|

|

5,157,916 |

|

| Small-cap growth |

|

|

395,430 |

|

|

|

— |

|

|

|

— |

|

|

|

395,430 |

|

| Small-cap value |

|

|

251,118 |

|

|

|

— |

|

|

|

— |

|

|

|

251,118 |

|

| Money Market |

|

|

9,073,951 |

|

|

|

— |

|

|

|

— |

|

|

|

9,073,951 |

|

| Other mutual funds |

|

|

19,861,332 |

|

|

|

— |

|

|

|

— |

|

|

|

19,861,332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total registered investment companies |

|

|

49,765,803 |

|

|

|

— |

|

|

|

— |

|

|

|

40,691,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common collective trusts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap equity index |

|

|

— |

|

|

|

133,405,710 |

|

|

|

— |

|

|

|

133,405,710 |

|

| Large-cap growth |

|

|

— |

|

|

|

184,477,806 |

|

|

|

— |

|

|

|

184,477,806 |

|

| Stable value fund |

|

|

— |

|

|

|

191,061,085 |

|

|

|

— |

|

|

|

191,061,085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total common collective trusts |

|

|

|

|

|

|

508,944,601 |

|

|

|

|

|

|

|

508,944,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

1,333,236,272 |

|

|

$ |

508,944,601 |

|

|

$ |

|

|

|

$ |

1,842,180,873 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfers Between Levels — The availability of observable market data is monitored to

assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to

another. In such instances, the transfer is reported at the beginning of the reporting period.

- 11 -

We evaluate the significance of transfers between levels based upon the nature of the

financial instrument and size of the transfer relative to total net assets available for benefits. For the years ended, December 21, 2014 and 2013, there were no transfers between levels. The mutual funds listed in 2014 under level 2 are funds

that were offered beginning in 2014.

Asset Valuation Techniques — Valuation technologies maximize the use of

relevant observable inputs and minimize the use of unobservable inputs. The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used as of

December 31, 2014 and 2013.

Common Stocks — Valued at the closing price reported on the active market on

which the individual securities are traded.

Mutual Funds — Valued at the daily closing price as reported by the

fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held by

the Plan are deemed to be actively traded.

Common Collective Trust Fund — Valued at the net asset value of units

of a bank collective trust. The net asset value as provided by the trustee, is used as a practical expedient to estimate fair value. The net asset value is based on the fair value of the underlying investments held by the fund less its liabilities.

This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported net asset value. Participant transactions (purchased and sales) may occur daily. Were the Plan

to initiate a full redemption of the collective trust, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

Stable Value Fund — Valued at the net asset value of units of a bank collective trust. The net asset value as

provided by the trustee, is used as a practical expedient to estimate fair value. The net asset value is based on the fair value of the underlying investments held by the fund less its liabilities.

Participants ordinarily may direct the withdrawal or transfer of all or a portion of their investment at contract value. Contract value

represents contributions made to the Portfolio, plus earnings, less participant withdrawals and administrative expenses. The Portfolio imposes certain restrictions on the Plan, and the Portfolio itself may be subject to circumstances that affect its

ability to transact at contract value as described in the following paragraphs. Plan management believes that the occurrence of events that would cause the Portfolio to transact at less than contract value is not probable.

Limitations on the Ability of the Portfolio to Transact at Contract Value

Restrictions on the Plan — Participant-initiated transactions are those transactions allowed by the Plan, including

withdrawals for benefits, loans, or transfers to noncompeting funds within a plan, but excluding withdrawals that are deemed to be caused by the actions of the Plan Sponsor. The following employer-initiated events may limit the ability of the

Portfolio to transact at contract value:

| |

• |

|

A failure of the Plan or its trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA

|

- 12 -

| |

• |

|

Any communication given to Plan participants designed to influence a participant not to invest in the Portfolio or to transfer assets out of the

Portfolio |

| |

• |

|

Any transfer of assets from the Portfolio directly into a competing investment option |

| |

• |

|

The establishment of a defined contribution plan that competes with the Plan for employee contributions |

| |

• |

|

Complete or partial termination of the Plan or its merger with another plan. |

Circumstances That Affect the Portfolio — The Portfolio invests in assets, typically fixed income securities or bond

funds, and enters into “wrapper” contracts issued by third parties. A wrap contract is an agreement by another party, such as a bank or insurance company to make payments to the Portfolio in certain circumstances. Wrap contracts are

designed to allow a stable value fund to maintain a constant NAV and protect the fund in extreme circumstances. In a typical wrap contract, the wrap issuer agrees to pay the fund the difference between the contract value and the market value of the

underlying assets once the market value has been totally exhausted.

The wrap contracts generally contain provisions that

limit the ability of the Portfolio to transact at contract value upon the occurrence of certain events. These events include:

| |

• |

|

Any substantive modification of the Portfolio or the administration of the Portfolio that is not consented to by the wrap issuer

|

| |

• |

|

Any change in law, regulation, or administrative ruling applicable to a plan that could have a material adverse effect on the Portfolio’s cash

flow |

| |

• |

|

Employer-initiated transactions by participating plans as described above |

In the event that wrap contracts fail to perform as intended, the Portfolio’s NAV may decline if the market value of its assets

declines. The Portfolio’s ability to receive amounts due pursuant to these wrap contracts is dependent on the third-party issuer’s ability to meet their financial obligations. The wrap issuer’s ability to meet its contractual

obligations under the wrap contracts may be affected by future economic and regulatory developments.

The Portfolio is unlikely

to maintain a stable NAV if, for any reason, it cannot obtain or maintain wrap contracts covering all of its underlying assets. This could result from the Portfolio’s inability to promptly find a replacement wrap contract following termination

of a wrap contract. Wrap contracts are not transferable and have no trading market. There are a limited number of wrap issuers. The Portfolio may lose the benefit of wrap contracts on any portion of its assets in default in excess of a certain

percentage of portfolio assets.

The methods described above may produce a fair value calculation that may not be indicative of

net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the

fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

- 13 -

7. NAV PER SHARE

The following tables set forth a summary of the Plan’s investments with a reported NAV as of December 31,

2014 and 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fair Value Estimated Using Net Asset Value Per Share |

| |

|

December 31, 2014 |

| Investment |

|

Fair Value* |

|

|

Unfunded

Commitment |

|

|

Redemption

Frequency |

|

Other

Redemption

Restrictions |

|

Redemption

Notice

Period |

| Managed Income Portfolio II Class 3 (1) |

|

$ |

184,440,471 |

|

|

$ |

— |

|

|

Immediate |

|

None |

|

None |

| T. Rowe Price Growth Stock Trust (2) |

|

|

196,918,162 |

|

|

|

|

|

|

Immediate |

|

None |

|

None |

| Fidelity U.S. Equity Index Commingled Pool (3) |

|

|

162,611,081 |

|

|

|

|

|

|

Immediate |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

543,969,714 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The fair value of the investments have been estimated using the net asset value of the

investments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fair Value Estimated Using Net Asset Value Per Share |

| |

|

December 31, 2013 |

| Investment |

|

Fair Value* |

|

|

Unfunded

Commitment |

|

|

Redemption

Frequency |

|

Other

Redemption

Restrictions |

|

Redemption

Notice

Period |

| Managed Income Portfolio II Class 3 (1) |

|

$ |

191,061,085 |

|

|

$ |

— |

|

|

Immediate |

|

None |

|

None |

| T. Rowe Price Growth Stock Trust (2) |

|

|

184,477,806 |

|

|

|

|

|

|

Immediate |

|

None |

|

None |

| Fidelity U.S. Equity Index Commingled Pool (3) |

|

|

133,405,710 |

|

|

|

|

|

|

Immediate |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

508,944,601 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The fair value of the investments have been estimated using the net asset value of the investments’ underlying

assets. |

| |

(1) |

The Fidelity Managed Income Portfolio II stable value fund invests in investment contracts (wrap contracts) issued by insurance companies and other financial

institutions, fixed-income securities, such as U.S. Treasury and agency bonds, corporate bonds, mortgage-backed securities, and money market funds to provide daily liquidity. The objective of the stable value fund is to preserve capital and

achieve a competitive level of income over time. |

| |

(2) |

The T. Rowe Price Growth Stock Trust seeks long-term growth of capital and, secondarily, increasing dividend income by investing primarily in common stocks of

well-established growth companies. |

| |

(3) |

The Fidelity US Equity Index Commingled Pool seeks to invest at least 90% of its assets in common stocks included in the S&P 500 index. |

| 8. |

FEDERAL INCOME TAX STATUS |

The IRS has determined and informed the RBC Companies by a letter dated January 30, 2014, that the Plan was designed in accordance

with the applicable regulations of the Code requirements. The RBC Companies and the plan administrator believe that the Plan is currently designed and operated in compliance with the applicable requirements of the Code and the Plan and related trust

continue to be tax-exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken

an uncertain position that more likely than not would not be

- 14 -

sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014 and 2013, there are no

uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no

audits for any tax periods in progress. The Plan administrator believes it is no longer subject to income tax examinations for years prior to 2011.

| 9. |

RECONCILIATION TO FORM 5500 |

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 as of December 31, 2014:

|

|

|

|

|

| Net assets available for plan benefits per financial statements |

|

$ |

1,962,718,850 |

|

| Add adjustment from contract value to fair value for indirect fully benefit-responsive investment contracts |

|

|

2,654,559 |

|

| Adjustment for deemed distributed participant loans |

|

|

— |

|

|

|

|

|

|

|

|

| Net assets available for benefits per Form 5500 |

|

$ |

1,965,373,409 |

|

|

|

|

|

|

The following is a reconciliation of the decrease in net assets per the financial statements to net

income per the Form 5500 for the year ended December 31, 2014:

|

|

|

|

|

| Increase in net assets available for plan benefits per financial statements |

|

$ |

101,319,798 |

|

| Add change in difference between contract value and fair value for indirect fully benefit-responsive investment

contracts |

|

|

(34,893 |

) |

| Add change in deemed distributed participant loans |

|

|

— |

|

|

|

|

|

|

|

|

| Net income per Form 5500 |

|

$ |

101,284,905 |

|

|

|

|

|

|

******

- 15 -

SUPPLEMENTAL SCHEDULES

FURNISHED PURSUANT TO THE REQUIREMENTS OF FORM 5500

- 16 -

RBC-U.S.A. RETIREMENT AND SAVINGS PLAN

(EIN: 20-0563684) (Plan No. 003)

SCHEDULE H, LINE 4i —

SCHEDULE OF ASSETS (Held At End of Year)

DECEMBER 31, 2014

|

|

|

|

|

|

|

|

|

| Identity of Issues,

Borrower, Lessor, or Similar

Party |

|

Description of Investment |

|

Cost

** |

|

Current Value |

|

|

|

|

|

| Royal Bank of Canada* |

|

Royal Bank of Canada Stock Fund: |

|

|

|

|

|

|

|

|

Royal Bank of Canada Common Stock (cost $201,168,614) |

|

|

|

$ |

359,758,966 |

|

|

|

Fidelity Institutional Cash Money Market Fund |

|

|

|

|

9,491,673 |

|

| Fidelity Management Trust Co.* |

|

Fidelity Managed Income Portfolio II |

|

|

|

|

184,440,471 |

|

| T. Rowe Price Associates, Inc. |

|

T. Rowe Price Growth Stock Trust Class B |

|

|

|

|

196,918,162 |

|

| Invesco Advisers, Inc. |

|

Invesco Comstock Fund |

|

|

|

|

126,251,583 |

|

| Fidelity Management Trust Co.* |

|

Spartan Extended Market Index Fund |

|

|

|

|

8,981,952 |

|

| Fidelity Management Trust Co.* |

|

Spartan Global ex U.S. Index Fund |

|

|

|

|

4,700,876 |

|

| Capital Research & Management Company |

|

American Funds American Balanced Fund |

|

|

|

|

155,031,673 |

|

| Fidelity Management Trust Co.* |

|

Fidelity US Equity Index Commingled Pool |

|

|

|

|

162,611,081 |

|

| T. Rowe Price Associates, Inc. |

|

T. Rowe Price Institutional Mid-Cap Equity Growth Fund |

|

|

|

|

71,539,948 |

|

| Fidelity Management Trust Co.* |

|

Spartan US Bond Index Fund |

|

|

|

|

72,498,675 |

|

| Invesco Advisers, Inc. |

|

Invesco Small Cap Discovery |

|

|

|

|

73,078,772 |

|

| Capital Research & Management Company |

|

American Funds EuroPacific Growth Fund |

|

|

|

|

128,573,010 |

|

| RBC Global Asset Management (U.S.) Inc.* |

|

RBC SMID Cap Growth I |

|

|

|

|

25,581,731 |

|

| Artisan Partners Limited Partnership |

|

Artisan Mid Cap Value Fund |

|

|

|

|

70,458,689 |

|

| American Beacon Advisors, Inc. |

|

American Beacon Small Cap Value |

|

|

|

|

67,874,192 |

|

| BlackRock Advisors LLC |

|

BlackRock Global Allocation |

|

|

|

|

32,792,061 |

|

| JP Morgan Asset Management |

|

JPMCB SmartRetirement Passive Blend Income Fund C |

|

|

|

|

6,828,045 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2015 C |

|

|

|

|

7,525,541 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2020 C |

|

|

|

|

19,344,665 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2025 C |

|

|

|

|

15,915,163 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2030 C |

|

|

|

|

20,217,300 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2035 C |

|

|

|

|

20,079,317 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2040 C |

|

|

|

|

19,580,385 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2045 C |

|

|

|

|

13,741,796 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2050 C |

|

|

|

|

11,016,328 |

|

| JP Morgan Asset Management |

|

JPMCB SR PB 2055 C |

|

|

|

|

4,022,303 |

|

| Fidelity Management Trust Co.* |

|

Fidelity BrokerageLink |

|

|

|

|

53,067,525 |

|

| Participant loans* |

|

Interest rates of 4.25% to 10.5% due at various dates through 2029 |

|

|

|

|

19,559,878 |

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

|

|

|

|

$ |

1,961,481,761 |

|

|

|

|

|

|

|

|

|

|

| * |

Known to be a party-in-interest |

| ** |

Cost information is not required for participant directed investments and therefore, is not included. |

- 17 -

RBC-U.S.A. RETIREMENT AND SAVINGS PLAN

EIN: 20-0563684 Plan No: 003

FORM 5500, SCHEDULE H, PART IV,

QUESTION 4a—

SCHEDULE OF DELINQUENT PARTICIPANT CONTRIBUTIONS

FOR THE YEAR ENDED DECEMBER 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total that Constitute Nonexempt

Prohibited Transactions |

|

|

Total Fully

Corrected

Under VFCP and

PTE 2002-51 |

|

| |

|

December 31, 2014 |

|

|

| |

|

Contributions

Not Corrected |

|

|

Contributions

Corrected

Outside VFCP |

|

|

Contributions

Pending

Correction in VFCP |

|

|

| Participant Contributions Transferred Late to Plan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Certain July 2014 participant contributions deposited 14 days late |

|

$ |

— |

|

|

$ |

45 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

| Certain August 2014 participant contributions deposited 28 days late |

|

|

— |

|

|

|

1,409 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total that Constitute Nonexempt

Prohibited Transactions |

|

|

Total Fully

Corrected

Under VFCP and

PTE 2002-51 |

|

| |

|

December 31, 2013 |

|

|

| |

|

Contributions

Not Corrected |

|

|

Contributions

Corrected

Outside VFCP |

|

|

Contributions

Pending

Correction in VFCP |

|

|

| Participant Contributions Transferred Late to Plan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Certain December 2013 participant contributions deposited 16 days late |

|

$ |

— |

|

|

$ |

89 |

|

|

$ |

— |

|

|

$ |

— |

|

- 18 -

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| RBC U.S.A. Retirement and Savings Plan |

|

|

|

|

| (Name of Plan) |

|

|

|

|

|

|

|

| Royal Bank of Canada |

|

|

|

Date: June 25, 2015 |

| (Registrant/Issuer) |

|

|

|

|

|

|

|

| /s/ Steven Decicco |

|

|

|

|

| Steven Decicco |

|

|

|

|

| Chief Financial Officer |

|

|

|

|

|

|

|

| /s/ Ndikum Chi |

|

|

|

|

| Ndikum Chi |

|

|

|

|

| Plan Administrator |

|

|

|

|

APPENDIX A

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-13112 on Form S-8 of our report dated June 25, 2015, relating to

the financial statements and financial statement schedules of RBC U.S.A. Retirement and Savings Plan appearing in this Annual Report on Form 11-K for the year ended December 31, 2014.

Minneapolis, MN

June 25, 2015

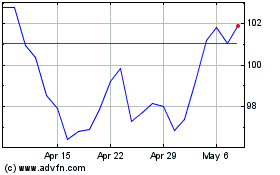

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Sep 2023 to Sep 2024