TIDMZYT

RNS Number : 0133Z

Zytronic PLC

12 December 2017

12 December 2017

Zytronic plc

("Zytronic" or the "Group")

Preliminary Results for the year ended 30 September 2017

(audited)

Zytronic plc, a leading specialist manufacturer of touch

sensors, announces its preliminary results for the year ended 30

September 2017.

Overview

-- Significant improvement in Group trading profits to GBP5.4m

(2016: GBP4.3m)

-- Strong cash generation from operating activities of GBP4.7m

(2016: GBP5.6m)

-- Final dividend increased by 39% to 15.2p (2016: 10.96p),

bringing total dividends for the year to 19.0p (2016: 14.41p), up

32% year-on-year and the fourth successive year of double-digit

dividend growth

-- Touch sensor units sold increased to 138,000 units (2016:

130,000 units) with large sensors > 30" increasing to 18,000

units (2016: 14,000)

-- Basic earnings per share increased to 29.0p (2016: 26.6p)

Commenting on the outlook, Chairman, Tudor Davies said:

"The current year has started with orders, revenues and trading

along similar levels to that of the prior year which together with

our strong balance sheet and cash generation provides a sound base

for further growth in dividends and shareholder value."

It is intended that the AGM will take place at the Company's

offices at Whiteley Road, Blaydon-on-Tyne, Tyne and Wear, NE21 5NJ

on Thursday 22 February 2018 at 9.30am. Notice of the AGM will be

sent to shareholders with the annual report and accounts in due

course.

Enquiries:

Zytronic plc (Today: 020 7496 3000;

Mark Cambridge, Chief Thereafter 0191 414 5511)

Executive

Claire Smith, Group

Finance Director

N+1 Singer (020 7496 3000)

(Nominated Advisor &

Broker)

Aubrey Powell

Liz Yong

Notes to Editors

Zytronic is a world renowned developer and manufacturer of a

unique range of internationally award winning optically transparent

interactive touch sensor overlay products for use with electronic

displays in industrial, self-service and public access

equipment.

Zytronic's products employ a sensing solution that is readily

configurable and is embedded in a laminate core which offers

significant durability, environmental stability and optical

enhancement benefits to system designers specific requirements.

Zytronic has continually developed process and technological

know-how and IP since the late 1990's around two sensing

methodologies; the first being single touch self-capacitive which

Zytronic markets as PCT(TM) ("Projected Capacitive Technology") and

the second being multi-touch, multi-user mutual-capacitive which

Zytronic markets as MPCT(TM) ("Mutual Projected Capacitive

Technology"), in which Zytronic holds five granted patents.

Operating from a single site near Newcastle-upon-Tyne in the

United Kingdom, Zytronic is relatively unique in the touch

eco-system as it offers a complete one-stop solution from

processing internally the form and factor of the glass substrates,

assembles their touch overlay products to customers specific

requirements, in environmentally controlled cleanrooms and develops

the bespoke firmware, software and electronic hardware to link the

interactive overlays to customer's integrated systems and

products.

Chairman's statement

We are pleased to announce the results for the year ended 30

September 2017, which show continuing growth in revenues, profits

and cash generation and a 39% increase (2016: 24%) in the final

dividend, resulting in an overall dividend increase of 32% (2016:

20%) for the year.

Results

Revenues for the year ended 30 September 2017 increased 9% to

GBP22.9m (2016: GBP21.1m), profit before tax increased 27% to

GBP5.4m (2016: GBP4.3m), with profit after tax increasing to

GBP4.6m (2016: GBP4.1m) and basic earnings per share increasing to

29.0p (2016: 26.6p).

The growth in revenues during the year has primarily arisen from

an increase in further projects for the gaming market, with the

growth driven by large format touch sensors. A fuller explanation

of the strategic sales and marketing initiatives and opportunities

are covered in the CEO's Operational review later in this

report.

Cash generation from operating activities for the year ended 30

September 2017 is GBP4.7m (2016: GBP5.6m), from which we invested

GBP1.1m (2016: GBP0.8m) in research and development and capital

expenditure. The Group also received GBP1.2m (2016: GBP0.2m) from

the proceeds of share options and made a final payment of GBP1.1m

(2016: GBP0.2m) on its property loan before the dividend payments

of GBP2.4m (2016: GBP1.9m), resulting in a net increase in year-end

cash balances of GBP1.3m to GBP14.1m (2016: GBP2.9m to

GBP12.8m).

Dividend

The Directors are pleased to propose a final dividend of 15.2p

(2016: 10.96p), payable on 9 March 2018 to shareholders on the

register on 23 February 2018, which increases the total dividend

for the year by 32% to 19.0p (2016: 14.41p) and brings the dividend

increase over the last five years to 124%.

Outlook

The current year has started with orders, revenues and trading

along similar levels to that of the prior year, which, together

with our strong balance sheet and cash generation, provides a sound

base for further growth in dividends and shareholder value. The

focus on growth this year will be from expansion in local sales

representation in the USA and the Far East, and we shall keep

shareholders updated on the progress, and any material

developments, over the course of the year.

Tudor Davies

Chairman

11 December 2017

Operational review

The following provides insights into the sales and marketing

initiatives and the strategic programmes undertaken by Zytronic's

research and development department during the year and the

consequential sales output profile.

Strategic sales and marketing initiatives

We continued to sell our products to customers around the world

in two ways: directly, sometimes with the assistance of

commissioned manufacturers' representatives and agents; and

indirectly, via franchised distributors and value-added resellers

("VARs"). Collectively, we refer to these agents, distributors and

VARs as our sales channel partners.

In 2017, we made several changes to our global network of sales

channel partners whilst increasing regionally our direct sales

function. At the end of the fiscal period we had 13 regional

agreements covering North, Central and South America ("AMERICAS"),

twelve across Asia Pacific ("APAC") and 13 spanning various

European, Middle Eastern and African countries ("EMEA").

Additionally, we had two global distribution agreements, with

Future Electronics and the Quixant group respectively.

-- In the AMERICAS, we terminated three underperforming agents

and appointed a new representative in the Southeastern USA. In

addition, to strengthen the direct sales presence of Zytronic Inc.,

we completed the recruitment of an industry and market experienced

US national, based in Austin, TX, to the position of director of

sales for the region.

-- In the APAC region, we appointed two further distributors in

Japan and increased our direct presence in the country, retaining a

Tokyo-based full-time business development manager under contract.

We also expanded the responsibility of our Taipei-based business

development manager, to include countries in Southeast Asia.

-- In the EMEA region, we appointed a new distributor for Switzerland and Austria.

Entering the new fiscal year, we have commenced a review on the

recruitment of a sales support engineer for the APAC region, most

likely to be based in Japan. We are also working to increase our

sales channel partner network in Western Europe and the USA, with

new agent and VAR appointments expected. Additionally, we are

presently planning to increase our direct sales team in the USA in

the second half of the year.

Our 2017 marketing strategy in support of sales activities

focused on increasing our profile in European, American and Asian

trade publications and key vertical markets. In addition, we have

expanded our digital and social media presence, releasing online a

new "factory tour" video to highlight our unique capabilities in

the touch ecosystem and the competitive benefits we bring to

customers. We also participated in several application specific

global trade events, including Electronica (the large German

electronics fair in November 2016), C-Touch in Shenzhen, China, in

the same month, the Integrated Systems Europe ("ISE") expo in

February 2017 in Amsterdam and the USA-focused Digital Signage Expo

("DSE") in March 2017. Indirectly, products were also well

represented at a number of tradeshows by distributors and

customers, such as the ICE Totally Gaming Expo in London during

January 2017, the Society of Information Displays ("SID") Display

Week and the Infocomm Expo during June 2017 in the USA.

Strategic research and development

The primary emphasis of the research and development team

throughout 2017 was the continued development of our MPCT(TM)

capabilities and the requirements of the developing Zytronic

Application Specific Integrated Chip ("ASIC"). Initial approval

samples of the designed ASIC were received in late January 2017,

followed by several months of in-house approval and compliance

testing. In May 2017, we provided approval and the order to build

and supply an initial 24,000 ASICs. Supply of production chips is

expected around December 2017. A new family of controllers

incorporating the ASICs has been designed along with new bespoke

firmware which will be released under the controller family

designation series ZXY500 early in the new calendar year.

Other significant development work undertaken during the year

has been around new material considerations as an alternative to

the micro-fine sensing wires generally employed in Zytronic PCT(TM)

and MPCT(TM) sensors including, but not limited to, the

collaboration work undertaken on the Hi-Response European-funded

H2020 project.

Further GB patent applications were initiated in the period on

Zytronic's shape recognition technology and our ability to put

physical holes in and through the active sensing area of our glass

sensors without functional detriment to the sensing and

interactivity around the physical hole, both being reliant on the

unique capabilities of our patented MPCT(TM) sensing.

Sales

The business showed an improved trading performance over that of

the previous year, with total revenues of GBP22.9m (2016:

GBP21.1m). Total export revenues as measured by Zytronic, being the

location of the companies where we invoice products, were GBP19.9m

(2016: GBP20.0m), with the slight reduction a consequence of the as

expected drop in legacy display product revenues.

The revenues of legacy display products, were GBP2.3m (2016:

GBP2.9m). Although a number of factors contributed to the decrease,

by far the two most significant were the GBP0.2m of non-recurring

revenues from the completion in 2016 of the curved gaming display

unit project in Korea and a further GBP0.2m reduction in global ATM

display revenues to GBP1.4m (2016: GBP1.6m).

Revenues generated by sales of our touch products were GBP2.4m

higher than the prior year at GBP20.6m (2016: GBP18.2m). The

significant growth in revenues came from invoiced UK sales for the

Gaming market, where product is almost immediately shipped by our

customer to other international locations for integration with

displays and gaming machines. Exported touch product revenues

showed growth to GBP18.0m from GBP17.6m, with EMEA and the AMERICAS

regions each growing by GBP0.3m to GBP7.0m and GBP0.2m to GBP3.8m

respectively, whilst APAC reduced by GBP0.1m to GBP7.2m.

Touch revenues are inherently linked, not only to the number of

touch sensors produced, but more substantially to the mix of the

sensor sizes, as large format units carry an obvious higher price

premium. The total number of sensor units supplied increased to

138,000 (2016: 130,000) and the table below illustrates the split

of sensor sizes and their relative movement from the prior

year.

2017 2016 Variance

Sensor size Units % Units % Units % change

('000) total ('000) total ('000)

----------------------------- --------- ------ --------- ------ ----------- ------------

Small - ( <= 14.9") 33 24 39 30 (6) (16)

Medium - ( >= 15.0 <= 29.9") 87 63 77 59 10 13

Large - ( >= 30.0") 18 13 14 11 4 26

----------------------------- --------- ------ --------- ------ ----------- ------------

Total 138 100 130 100 8 6

----------------------------- --------- ------ --------- ------ ----------- ------------

In large format sensors, the contributory volume of curved units

remained steady at 9,000 units year on year, with the growth coming

from flat units for new gaming projects. With the release in the

latter half of 2016 of the newer ZXY150 series of MPCT(TM)

controllers in support of medium sizes, we saw growth in the total

number of MPCT(TM) products supplied to 12,000 units (2016: 11,000

units).

Touch application markets

For the first time, Financial was not our top revenue-generating

touch application market, with Gaming taking the top spot. Gaming

continued to show considerable strength and growth in both units

produced at 20,000 (2016: 13,000) and revenues generated,

contributing GBP7.7m (2016: GBP5.9m), as new UK (predominantly) and

Asian invoiced PCT(TM) and MPCT(TM) projects moved into production.

Financial, with total unit volumes reducing by 4,000 to 50,000, as

the continued effects of supplier consolidation and reported

saturation of mature geographic markets were observed, moved into

second place contributing GBP6.3m (2016: GBP6.4m).

Vending, although our second highest market in terms of unit

volumes produced at 35,000 units (2016: 24,000 units), remained our

third market in terms of revenue at GBP3.3m (2016: GBP2.6m), with

benefits coming from drinks, fuel and parking management systems in

the USA, Korea and Germany respectively. However with the expected

redesign of the next generation Freestyle(R) drinks dispenser in

2018, resulting in a less durable and functional touch solution

requirement, we expect the requirements of the existing design to

reduce as the project moves towards end-of-life ("EOL").

The Industrial market, which saw a 3,000-unit reduction in small

sensors sold (2016: 12,000 units), but a 1,000-unit increase in

medium and larger sensors (2016: 7,000 units), showed an increase

in the revenues generated to GBP1.8m (2016: GBP1.4m), predominantly

through new opportunities generated by our Italian channel partner.

This was countered by a decline in the Signage market to GBP0.8m

(2016: GBP1.0m), in which we experienced a 1,000-unit reduction in

large sensors sold (2016: 2,000 units) from our channel partners in

Korea and Germany. However, this is still a market which although

continues to be lower in project unit volumes offers the advantages

of numerous bespoke and value-add opportunities.

The other markets, which predominantly are in the small and

medium-size ranges and are therefore open to much greater

alternative supplier competitive pressures, particularly from spare

capacity from consumer solution providers, being Home Automation,

Healthcare and Telematics, in total decreased to GBP0.7m (2016:

GBP0.9m), as we saw 1,000-unit declines in units supplied to both

Home (2016: 10,000 units) and Health (2016: 4,000 units). Similar

to that mentioned in Vending, we believe that the volumes of our

touch solution for the high-end Bosch cooktop models will continue

to reduce as the models move to EOL over 2018 and beyond.

Opportunities analysis

Our customer relationship management ("CRM") software continues

to be integral in managing and monitoring global sales

opportunities. Incoming leads from all sources (websites,

tradeshows, channel partners, sales management, etc.) are fed into

the CRM system; once validated, those opportunities are then

categorised according to vertical market (application), annual

quantity, touch sensor type, project duration, estimated unit price

and production start date. As the opportunity progresses, it is

dynamically assigned with an estimated probability of success. Only

those opportunities at the point in time when they are assigned

with a high probability are classified as a "Project" and only

those designated as a "Project" at the time of our quarterly sales

review are added into our dynamic forecast model.

As the CRM information is constantly being updated by the sales

team to account for changes to opportunities, which may be because

they are re-classified as dead, lost to a competitor, moved into

production or have changed success probability, the number of

opportunities, and the value of active 'Projects', varies

significantly day to day. At 30 September 2017, there were a total

of 551 live opportunities in the system, with 60 opportunities

classified on that day as "Projects", with those "Projects" having

an unsensitised lifetime revenue contribution of GBP8.2m, over a

projected five years.

Finally, on behalf of the Board of Directors, I would like to

thank all Zytronic employees for their valued contribution to the

performance of the business over the reporting period.

Mark Cambridge

Chief Executive Officer

11 December 2017

Financial review

Group revenue

Group revenue for the year increased by GBP1.8m to GBP22.9m

(2016: GBP21.1m) as a result of increased orders of touch products

totalling GBP20.6m (2016: GBP18.2m), particularly through the

Gaming market from one of the UK-based customers. Touch product

revenue now accounts for 90% of total revenue (2016: 86%).

Gross margin

Gross margin declined slightly in the year to 41.1% (2016:

42.8%), despite the increase in volume of larger format sensors

sold, mainly as a result of the following factors:

-- increased costs of raw materials due to supplier price rises

and purchasing more pre-prepared glass;

-- additional costs of wage rises and increased numbers of

personnel in production(146 employees compared to 129 in 2016);

and

-- increases in commissions payable as more revenue arose from

channel partners over the year.

Group trading profit

Group trading profit increased to GBP5.4m (2016: GBP4.3m). On a

year-on-year basis, excluding the impact of FX movements of

GBP1.0m, administration costs have increased only slightly in 2017

through higher costs of professional fees, marketing and

travel.

Taxation

The Group's taxation charge for the year ended 30 September 2017

of GBP0.8m represents an effective tax rate of 15%. In the year,

the Group continued to claim relief under the Patent Box regime and

the utilisation of R&D tax credits (GBP0.2m). The differences

in tax rates enacted and the fair value movement on the Group's FX

contracts have also impacted the tax charge in the year.

Earnings per share

The issued share capital is 16,044,041 ordinary shares of 1.0p

each and the resultant weighted EPS for the year is 29.0p, which

represents growth of 9% from that reported last year (2016:

26.6p).

Dividend

During the year the Group paid a final dividend for 2016 of

10.96p per share and a 2017 interim dividend of 3.80p per share

totalling GBP2.4m of cash (2016: GBP1.9m). The Directors recommend

the payment of a final dividend of 15.20p per share for the year

ended 30 September 2017 giving a total dividend for the year of

19.0p per share (2016: 14.41p) and an increase of 32% over last

year. Subject to approval by shareholders, the dividend will be

paid on Friday 9 March 2018 to shareholders on the register as at

the close of business on Friday 23 February 2018. The dividend is

covered 1.5 times by underlying earnings.

Capital expenditure

The Group additions to capital expenditure totalled GBP1.1m and

were weighted more to intangible assets with GBP0.5m of spend

occurring on the continuing development of the MPCT(TM) ASIC

project. This project is on target for completion during early

2018. A further GBP0.1m was spent on the Fibre Laser Table and

investment of GBP0.1m was made into a new CNC Edge Profiling

machine. Additional sensor manufacturing equipment has also been

added over the year to meet production requirements. Depreciation

and amortisation for the year increased slightly to GBP1.2m (2016:

GBP1.1m).

Cash and debt

The Group continues to be cash generative and has recorded an

increase in cash and cash equivalents of GBP1.3m (2016: GBP2.9m) at

the year end. Cash generated from operating activities was GBP4.7m

offsetting the cash outflow from investing and financing

activities. This growth in cash enables the Group to continue its

policy to invest in internal R&D and capital refurbishments and

maintain its progressive dividend policy.

The Group maintains an overdraft facility of GBP1.0m, which is

available for use in any of its currencies and falls for review in

November 2018. The Group also has an FX policy in place at the year

end whereby it is hedged in both US Dollars and Euros for a period

of four months ahead in line with its working capital policies to

try to better manage its net GBP inflows from its surplus currency

requirements.

The Group repaid its property mortgage with Barclays Bank plc

during the year utilising GBP1.1m of its cash. Following this, the

Group is now debt free and had cash balances of GBP14.1m at 30

September 2017.

Revenue reserve

On 22 March 2017, the Group carried out a capital reduction

exercise whereby GBP8.9m of the Group's undistributable profits

(within the retained earnings reserve) were capitalised by way of a

bonus issue of newly created capital reduction shares. These shares

were subsequently cancelled and the GBP8.9m credited to the

retained earnings reserve as distributable profits.

Claire Smith

Group Finance Director

11 December 2017

Consolidated statement of comprehensive income

For the year ended 30 September 2017

2017 2016

Notes GBP'000 GBP'000

------------------------- ------ --------- ---------

Group revenue 22,892 21,087

Cost of sales (13,481) (12,071)

Gross profit 9,411 9,016

Distribution costs (393) (378)

Administration expenses (3,591) (4,365)

------------------------- ------ --------- ---------

Group trading profit 5,427 4,273

Finance costs (24) (23)

Finance revenue 10 20

------------------------- ------ --------- ---------

Profit before tax 5,413 4,270

Tax expense 3 (825) (183)

------------------------- ------ --------- ---------

Profit for the year 4,588 4,087

------------------------- ------ --------- ---------

Earnings per share

Basic 5 29.0p 26.6p

Diluted 5 28.8p 26.1p

------------------------- ------ --------- ---------

All profits are from continuing operations.

Consolidated statement of changes in equity

For the year ended 30 September 2017

Called

up share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- -------- --------- --------

At 1 October 2015 153 7,552 12,986 20,691

Profit for the year - - 4,087 4,087

Tax recognised directly

in equity - - 72 72

Exercise of share options 1 214 - 215

Share-based payments - - 71 71

Dividends - - (1,900) (1,900)

--------- -------- --------- --------

At 1 October 2016 154 7,766 15,316 23,236

Profit for the year - - 4,588 4,588

Tax recognised directly

in equity - - 72 72

Exercise of share options 6 1,228 - 1,234

Issue of capital reduction

shares* 8,919 - (8,919) -

Cancellation of capital

reduction shares* (8,919) - 8,919 -

Share-based payments - - - -

Dividends - - (2,354) (2,354)

---------------------------- --------- -------- --------- --------

At 30 September 2017 160 8,994 17,622 26,776

---------------------------- --------- -------- --------- --------

(*Refer to note 6)

Consolidated balance sheet

At 30 September 2017

2017 2016

Notes GBP'000 GBP'000

---------------------------------- ------- -------- --------

Assets

Non-current assets

Intangible assets 1,633 1,457

Property, plant and equipment 7,030 7,389

8,663 8,846

------------------------------------------ -------- --------

Current assets

Inventories 2,996 2,760

Trade and other receivables 3,506 3,745

Derivative financial assets 54 -

Cash and short term deposits 14,099 12,763

------------------------------------------- -------- --------

20,655 19,268

------------------------------------------ -------- --------

Total assets 29,318 28,114

------------------------------------------- -------- --------

Equity and liabilities

Current liabilities

Trade and other payables 1,042 1,302

Financial liabilities - 1,148

Derivative financial liabilities - 959

Provisions - 205

Accruals 862 834

Tax liabilities 3 122

1,907 4,570

------------------------------------------ -------- --------

Non-current liabilities

Government grants 25 48

Deferred tax liabilities (net) 610 260

635 308

------------------------------------------ -------- --------

Total liabilities 2,542 4,878

------------------------------------------- -------- --------

Net assets 26,776 23,236

------------------------------------------- -------- --------

Capital and reserves

Equity share capital 160 154

Share premium 8,994 7,766

Revenue reserve 17,622 15,316

------------------------------------------- -------- --------

Total equity 26,776 23,236

------------------------------------------- -------- --------

Consolidated cashflow statement

For the year ended 30 September 2017

2017 2016

GBP'000 GBP'000

---------------------------------------- -------- --------

Operating activities

Profit before tax 5,413 4,270

Net finance costs 14 3

Depreciation and impairment of

property, plant and equipment 749 766

Amortisation and impairment of

intangible assets 424 355

Amortisation of government grant (42) (11)

Share-based payments - 71

Fair value movement on foreign

exchange forward contracts (1,013) 870

Working capital adjustments

(Increase)/decrease in inventories (236) 454

Decrease/(increase) in trade and

other receivables 239 (690)

(Decrease)/increase in trade and

other payables and provisions (356) 76

---------------------------------------- -------- --------

Cash generated from operations 5,192 6,164

Tax paid (521) (576)

---------------------------------------- -------- --------

Net cashflow from operating activities 4,671 5,588

---------------------------------------- -------- --------

Investing activities

Interest received 10 20

Receipt of government grant 19 ---

Payments to acquire property,

plant and equipment (472) (387)

Payments to acquire intangible

assets (600) (385)

---------------------------------------- -------- --------

Net cashflow from investing activities (1,043) (752)

---------------------------------------- -------- --------

Financing activities

Interest paid (24) (21)

Dividends paid to equity shareholders

of the Parent (2,354) (1,900)

Proceeds from share issues relating

to options 1,234 215

Repayment of borrowings (1,148) (200)

Net cashflow used in financing

activities (2,292) (1,906)

---------------------------------------- -------- --------

Increase in cash and cash equivalents 1,336 2,930

---------------------------------------- -------- --------

Cash and cash equivalents at the

beginning of the year 12,763 9,833

---------------------------------------- -------- --------

Cash and cash equivalents at the

year end 14,099 12,763

---------------------------------------- -------- --------

Notes to the consolidated financial statement

1. Basis of preparation

The preliminary results for the year ended 30 September 2017

have been prepared in accordance with the recognition and

measurement requirements of International Financial Reporting

Standards ("IFRS") as endorsed by the European Union regulations as

they apply to the financial statements of the Group for the year

ended 30 September 2017. Whilst the financial information included

in this preliminary announcement has been computed in accordance

with the recognition and measurement requirements of IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS. The accounting policies adopted are consistent

with those of the previous year.

The financial information set out in this announcement does not

constitute the statutory accounts for the Group within the meaning

of Section 435 of the Companies Act 2006. The statutory accounts

for the year ended 30 September 2016 have been filed with the

Registrar of Companies. The statutory accounts for the year ended

30 September 2017 will be filed in due course. The auditors' report

on these accounts was not qualified or modified and did not contain

any statement under sections 498(2) or (3) of the Companies Act

2006 or any preceding legislation.

Each of the Directors confirms that, to the best of their

knowledge, the financial statements, prepared in accordance with

IFRS as adopted by EU standards, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Group and the undertakings included in the consolidation taken as a

whole; and the Group results, Operational review and Financial

review includes a fair review of the development and performance of

the business and the position of the Group and the undertakings

included in the consolidation taken as a whole, together with a

description of the principal risks and uncertainties that they

face

2. Basis of consolidation and goodwill

The Group results comprise the financial statements of Zytronic

plc and its subsidiaries as at 30 September each year. They are

presented in Sterling and all values are rounded to the nearest

thousand pounds (GBP'000) except where otherwise indicated.

3. Tax

30 September 30 September

2017 2016

GBP'000 GBP'000

--------------------------------------- ------------- -------------

Current tax

UK corporation tax 576 732

Corporation tax over-provided

in prior years - (289)

--------------------------------------- ------------- -------------

Total current tax charge 576 443

--------------------------------------- ------------- -------------

Deferred tax

Effect of change in tax rates - (103)

Origination and reversal of temporary

differences 249 (157)

--------------------------------------- ------------- -------------

Total deferred tax charge/(credit) 249 (260)

--------------------------------------- ------------- -------------

Tax charge in the income statement 825 183

--------------------------------------- ------------- -------------

Tax relating to items debited to equity

30 September 30 September

2017 2016

GBP'000 GBP'000

-------------------------------- ------------- -------------

Deferred tax

Tax on share-based payments (72) (72)

-------------------------------- ------------- -------------

Total deferred tax debit (72) (72)

-------------------------------- ------------- -------------

Tax charge in the statement of

changes in equity (72) (72)

-------------------------------- ------------- -------------

Reconciliation of the total tax charge

The effective tax rate of the tax expense in the income

statement for the year is 15% (2016: 4%) compared with the average

rate of corporation tax in the UK of 19.5% (2016: 20%). The

differences are reconciled below:

30 September 30 September

2017 2016

GBP'000 GBP'000

------------------------------------------- ------------- -------------

Accounting profit before tax 5,413 4,270

------------------------------------------- ------------- -------------

Accounting profit multiplied by

the average UK rate of corporation

tax of 19.5% (2016: 20%) 1,056 854

Effects of:

Expenses not deductible for tax

purposes 32 16

"Gain" on exercise of share options

allowable for tax purposes but

not reflected in the income statement - (42)

Depreciation in respect of non-qualifying

items 33 38

Enhanced tax reliefs - R&D (229) (187)

Enhanced tax reliefs - Patent

Box (31) (127)

Effect of deferred tax rate reduction

and difference in tax rates (36) (80)

Tax over-provided in prior years - (289)

------------------------------------------- ------------- -------------

Total tax expense reported in

the income statement 825 183

------------------------------------------- ------------- -------------

Factors that may affect future tax charges

Under current tax legislation, some of the amortisation of

licences will continue to be non-deductible for tax purposes.

The "gain" on the exercise of share options, being the

difference between the grant/exercise price and the market value at

the time of exercise, is allowable as a tax deduction from

profits.

There are no tax losses to carry forward at 30 September 2017

(2016: GBPNil).

The main rate of corporation tax in the UK reduced to 19% with

effect from 1 April 2017. The rate will be reduced to 17% from 1

April 2020. Both of these lower rates have been substantively

enacted by the balance sheet date. As the majority of the temporary

differences will reverse when the rate is 17%, this rate has been

applied to the deferred tax assets and liabilities arising at the

balance sheet date.

The Patent Box regime allows companies to apply a rate of

corporation tax of 10% to profits earned from patented inventions

and similar intellectual property. Zytronic generates such profits

from the sale of products incorporating patented components. The

Group has determined that all relevant criteria has been satisfied

for bringing income within the regime. Consequently, Patent Box

claims have been made for 2014, 2015 and 2016 accounting periods,

and the 2017 benefit has been estimated.

4. Dividends

The Directors propose the payment of a final dividend of 15.2p

per share (2016: 10.96p), payable on 9 March 2018 to shareholders

on the Register of Members on 23 February 2018. This dividend has

not been accrued in these financial statements. The dividend

payment will amount to some GBP2.4m.

30 September 30 September

2017 2016

GBP'000 GBP'000

--------------------------------------- ------------- -------------

Ordinary dividends on equity shares

Final dividend of 8.87p per ordinary

share paid on 11 March 2016 - 1,368

Interim dividend of 3.45p per

ordinary share paid on 22 July

2016 - 532

Final dividend of 10.96p per ordinary 1,744 -

share paid on 3 March 2017

Interim dividend of 3.80p per 610 -

ordinary share paid on 21 July

2017

--------------------------------------- ------------- -------------

2,354 1,900

--------------------------------------- ------------- -------------

5. Earnings per share

Basic EPS is calculated by dividing the profit attributable to

ordinary equity holders of the Company by the weighted average

number of ordinary shares in issue during the year. All activities

are continuing operations and therefore there is no difference

between EPS arising from total operations and EPS arising from

continuing operations.

Weighted Weighted

average average

number number

Earnings of shares EPS Earnings of shares EPS

30 September 30 September 30 September 30 September 30 September 30 September

2017 2017 2017 2016 2016 2016

GBP'000 Thousands Pence GBP'000 Thousands Pence

-------------- ------------- ------------- ------------- ------------- ------------- -------------

Profit

on ordinary

activities

after

tax 4,588 15,819 29.0 4,087 15,346 26.6

-------------- ------------- ------------- ------------- ------------- ------------- -------------

Basic

EPS 4,588 15,819 29.0 4,087 15,346 26.6

-------------- ------------- ------------- ------------- ------------- ------------- -------------

The weighted average number of shares for diluted EPS is

calculated by including the weighted average number of potentially

dilutive shares under option.

Weighted Weighted

average average

number number

Earnings of shares EPS Earnings of shares EPS

30 September 30 September 30 September 30 September 30 September 30 September

2017 2017 2017 2016 2016 2016

GBP'000 Thousands Pence GBP'000 Thousands Pence

--------------- ------------- ------------- ------------- ------------- ------------- -------------

Profit

on ordinary

activities

after tax 4,588 15,819 29.0 4,087 15,346 26.6

Weighted

average

number

of shares

under option - 131 (0.2) - 299 (0.5)

--------------- ------------- ------------- ------------- ------------- ------------- -------------

Diluted

EPS 4,588 15,950 28.8 4,087 15,645 26.1

--------------- ------------- ------------- ------------- ------------- ------------- -------------

6. Revenue reserve

On 22 March 2017, the Group carried out a capital reduction

exercise whereby GBP8.9m of the Group's undistributable profits

(within the retained earnings reserve) were capitalised by way of a

bonus issue of newly created capital reduction shares. These shares

were subsequently cancelled and the GBP8.9m credited to the

retained earnings reserve as distributable profits.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UARBRBAAUAAA

(END) Dow Jones Newswires

December 12, 2017 02:00 ET (07:00 GMT)

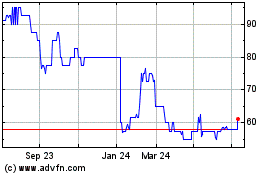

Zytronic (LSE:ZYT)

Historical Stock Chart

From Mar 2024 to Apr 2024

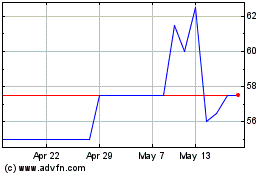

Zytronic (LSE:ZYT)

Historical Stock Chart

From Apr 2023 to Apr 2024