VietNam Holding Limited Monthly Investor Report (8531M)

January 11 2019 - 2:00AM

UK Regulatory

TIDMVNH

RNS Number : 8531M

VietNam Holding Limited

11 January 2019

VietNam Holding Limited ("VNH" or the "Company")

Monthly Investor Report

A report detailing the activities of the Company for the month

December 2018 has been issued by Dynam Capital Management Limited,

the investment manager of the Company. Electronic copies of the

report have been made available to shareholders on the Company's

website at

http://www.vietnamholding.com/publications/investor-reports and a

summary of the report is included below.

Investor Report Summary

Christmas decorations were abundant in Vietnam, and local

investors also hoped-for a Santa Rally in December which failed to

materialise. The broadest equity index in Vietnam (VNAS) decreased

by 3.5% in the month, and year-to-date by 13.8%. The Fund's NAV

fell by 2.1% in December, delivering a disappointing YTD return of

-12.8%. This is despite an attractive macro picture with modest

inflation (CPI 3% y-o-y), strong FDI (USD 19.1 bn disbursed YTD), a

growing trade surplus (USD 7.2 bn YTD) and more than 7% in GDP

growth.

Vietnamese equities are reasonably priced, at 13x PER, after

stripping out some outliers, in-line with corporate growth

forecasts of 14%. The Fund's portfolio is on an estimated weighted

trailing PER of 12x and a forward PER of 9.7x, and the weighted EPS

growth forecast of our portfolio is 22.5%.

Domestically we are seeing some weakness in the banking and

real-estate sectors, the former from a combination of deliberately

controlled credit growth and higher provisioning for NPLs, and the

latter from delays in licensing and delays in associated

infrastructure (favouring developers with inventory to sell).

We anticipate continued volatility in the global economy, with a

multitude of worries related to geo-political dislocations

(China-US, UK-Europe, China-Taiwan?). As Vietnam is an increasingly

open economy - exporting and importing about 100% of GDP - any

potential slowdown in the global economy will have an impact. As a

result, much of the nervousness in the equity market is imported.

With elections planned for Thailand and Indonesia in 2019, Vietnam

has one of the more stable political environments in ASEAN for 2019

and we remain optimistic for the outlook of the Fund in 2019.

Following the splitting of the portfolio into a Continuing Pool

and a Tender Pool after the EGM on 31st October 2018, and the

successful liquidation of the Tender Pool, we are now working on a

rebalancing strategy for 2019.

In December we made a second and final distribution of USD 1.22

per share from the Tender Pool, taking the total to USD 2.72 per

share. This was achieved in a period of falling equity prices, and

low liquidity.

We wish you all a safe and prosperous 2019.

For more information please contact:

Dynam Capital Limited

Craig Martin Tel: +84 28 3827 7590

info@dynamcapital.com |www.dynamcapital.com

www.vietnamholding.com

finnCap

Nominated Adviser and Corporate Broker Tel: +44 20 7220 0500

William Marle / Giles Rolls

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DOCSFESDFFUSEDF

(END) Dow Jones Newswires

January 11, 2019 02:00 ET (07:00 GMT)

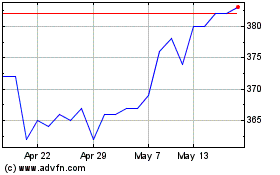

Vietnam (LSE:VNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vietnam (LSE:VNH)

Historical Stock Chart

From Apr 2023 to Apr 2024