TIDMVAST

Vast Resources plc / Ticker: VAST / Index: AIM / Sector: Mining

1 February 2018

Vast Resources plc

("Vast" or the "Company")

Quarterly Production Summary & Operations Update

Vast Resources plc, the AIM listed mining company with operations in

Romania and Zimbabwe, presents its operational update and production

summary for the three months ended 31 December 2017 ('Q4 2017').

To view a presentation, which presents the Q4 2017 results together with

previous quarters, please visit the Company's website:

www.vastresourcesplc.com.

Production Overview:

Q4 2017 was a record quarter for the Pickstone-Peerless Gold Mine

("Pickstone-Pickstone") in Zimbabwe. Outperformance over any previous

quarter in terms of tonnes mined, tonnes milled, and gold produced was

achieved. Operations at the Manaila Polymetallic Mine ("Manaila") in

Romania were affected by a planned plant shut down in December in

anticipation of finalising off-take finance, as further explained below.

This had a dramatic impact on production figures for Q4 2017 but lays

the foundation for improved performance for the remainder of 2018.

Pickstone-Peerless Production Summary

(commissioned on 20 August 2015, Vast ownership 25%):

Ore mined and milled at Pickstone-Peerless rose in the quarter to their

highest recorded levels. A high level of pre-stripping was undertaken

in the quarter, which assisted in paving the way for access to the

deeper lying sulphide bearing ores. The new milling and crushing

circuits for the sulphide plant were commissioned in Q4 2017. Although

the Company is not yet mining the sulphide ore, the plant has increased

crushing, milling and leaching capacity to in excess of 30,000 tonnes

per month, and despite initial teething problems in October and November,

a significant increase in ore tonnage mined was achieved.

-- 27% increase in tonnes of ore mined from Q4 2017 to 90,874 tonnes (Q3

2017: 71,533 tonnes)

-- 26% increase in tonnes of ore milled from Q4 2017 to 86,097 tonnes (Q3

2017: 68,431 tonnes)

-- 28% increase in gold production from Q4 2017 to 6,057 ounces (Q3 2017:

4,738 ounces)

-- 2% increase in milled gold grade from Q4 2017 to 2.46g/t (Q3 2017:

2.41g/t)

Manaila Production Summary

(commissioned on 14 August 2015, Vast Ownership 100%.):

The focus of activity at Manaila towards the end of the quarter was to

increase pre-stripping in order to ensure the sustainable supply of ore

for the recently announced conditional offtake agreement and funding

offer from global energy and commodity trading company Mercuria Energy

Group. This necessitated a temporary cessation of mining and processing

activities given the reduced recovery encountered, which impacted on

total production during the period. Historically Romanian mines close

for the December and January months for general repairs and maintenance

and the Company has readopted this philosophy and will continue to do so

until the new metallurgical plant, that is properly insulated and heated,

is constructed. Normal mining operations have now recommenced.

-- 42% decrease in tonnes of ore mined from Q4 2017 to 23,622 dry tonnes (Q3

2017: 40,462 dry tonnes)

-- 34% decrease in tonnes of ore milled from Q4 2017 to 25,654 dry tonnes

(Q3 2017: 39,135 dry tonnes)

-- 42% increase in the stripping ratio of waste versus ore from Q4 2017 to

4.2 (Q3 2017: 2.9 x)

-- 48% decrease in copper concentrate produced from Q4 2017 to 562 dry

tonnes (Q3 2017: 1,082 dry tonnes)

-- 9% decrease in copper concentrate grade from Q4 2017 to 16.3% (Q3

2017:17.9%)

-- 19% decrease in zinc concentrate produced from Q4 2017 to 96 dry tonnes

(Q3 2017: 157 dry tonnes)

-- 12% decrease in zinc concentrate grade from Q4 2017 to 37.1% (Q3 2017:

42.3%)

-- 20% decrease in pyrite concentrate (containing gold and silver credits)

from Q4 2017 to 6 dry tonnes (Q3 2017: 7 dry tonnes)

-- 174% increase in pyrite concentrate (containing gold and silver credits)

grade from Q4 2017 to 86g/t (Q3 2017: 31.4g/t)

Andrew Prelea, Chief Executive (non Board) of Vast, commented:

"The two principal developments which marked Q4 2017 as a notable period

were the commissioning of the crushing, milling and leaching circuits of

the sulphide plant in Zimbabwe and the increase in production capacity

achieved thereby, and the temporary cessation of primary mining and

processing at Manaila in order to establish a more rigorous mine plan

and processing route for 2018. The first development directly resulted

in a record quarter for Pickstone-Peerless, a tremendous result for the

team and I am confident that this step change in output will continue

over the coming months. Looking now to Manaila, the developments there,

whilst negatively impacting the result for the quarter, should provide a

stable footing through which reliable and sustainable production

henceforth is ensured to satisfy our conditional offtake agreement offer

with Mercuria Energy Group.

"As Vast moves away from equity raising to debt financing, ensuring

long-term sustainability and reliability of production, and hence cash

flow, is paramount. This knowledge was foremost in our minds when we

made the decision to limit activities at Manaila in favour of

reconsolidation work in December and January - deemed as the most

suitable time as a result of historical winter conditions causing losses

to the Company and effectively losing good ore with low recoveries at a

high cost. I am pleased to report that pre-stripping work to access the

high-grade massive sulphide orebody is progressing well and normal

mining activities have recommenced. Together, this work will ensure a

steady feed grade to the plant allowing the Company to maximise value

from our resource.

"The outlook for 2018 remains very positive for Vast, most visibly

illustrated by the recently announced pre-payment finance term sheet and

off-take agreement offer with Mercuria, which I believe underpins the

operational robustness of both our Manaila and Baita Plai Polymetallic

Mines, in addition to our ability to unlock each mine's strategic value.

Combined with an ever-improving production profile at our

Pickstone-Peerless Gold Mine and ameliorating economic and political

environment in Zimbabwe, we are well positioned to deliver more value

throughout the coming months."

Review of Operations & Development Initiatives

Pickstone-Peerless Gold Mine

The upgraded crushing, milling and leaching sections of the

metallurgical plant are performing as expected and the coming months

will see the achievement of the nameplate capacity of 33,000 tonnes per

month processed. The sulphide flotation cells are installed but, as yet,

not commissioned. The ultra-fine grind mills for the flotation

concentrate are not yet on site. A shortage of steel in Zimbabwe has

hampered the final construction phases of the flotation and ultra-fine

grind milling sections.

Testwork is being undertaken on samples from the ore exposed on the

lowermost benches in addition to grade control drilling to determine the

extent of the sulphide content in the ore and the impact on the

metallurgical process. To date there has been no significant indication

of a reduction in metallurgical recovery.

Further updates regarding commissioning of the flotation cells will be

made in due course.

Manaila Polymetallic Mine

Due to inadequate historic capital expenditure on mine development,

Manaila was suffering from a decrease in overburden stripping from a

required Tonne: BCM 5.0 average to 2.3:1 from September 2016 to November

2017, creating a bottleneck in the pit which resulted in a lower grade

ore being processed. The fundraising activities in December 2017 enabled

the Company to commence an intense stripping programme designed to

create a larger working footprint in the open pit and to expose the

higher-grade ore across the full open pit floor. The remedial stripping

programme will be concluded during Q2 2018 and will not interfere with

the normal mining operations which have recommenced.

The pre-stripping activities at Manaila are intended to ensure the

supply of the required tonnage and grade going forward in order to

satisfy the conditional off-take agreement offer with Mercuria Energy

Group. Additional equipment has been brought to site to assist with the

stripping activities. This entails a blasthole drilling rig enabling

management to plan and schedule the removal of overburden in a

controlled manner together with improved fragmentation on the higher

grade massive sulphide ore body.

The historical consequences of this issue are illustrated by a

comparison between the monthly production figures in October and

November 2017 with those of 2016 as shown below.

Comparable Monthly Production Figures (2017 vs. 2016)

2017 2017 2016 2016

Oct Nov Total Oct Nov Total vs 2016

% of

Ore mined 11,356 11,687 23,043 8,693 9,151 17,844 129.1%

Waste mined 40,537 32,609 73,146 19,243 11,042 30,285 241.5%

Stripping ratio 4 3 5 5

Milled in plant 12,094 10,918 23,012 8,094 9,396 17,490 131.6%

Concentrate

produced Copper 284 250 534 252 331 583 91.5%

Concentrate

produced zinc 39 45 84 56 51 107 78.5%

Production Statistics

December 2017 Quarterly Production Summary

Operational data:

Dec'17 Sep'17 June'17 Mar'17 Dec'16

Pickstone-Peerless Units Quarter Quarter Quarter Quarter Quarter

Ore mined Tonnes 90,874 71,533 68,659 51,660 70,930

Waste and low-grade

ore mined Tonnes 1,311,329 1,039,570 1,035,785 546,126 435,083

Stripping ratio Times 14.4 14.5 15.1 10.6 6.1

Ore milled Tonnes 86,097 68,431 58,923 51,102 61,356

Grams

per

Milled Grade tonne 2.46 2.41 2.35 2.06 2.41

Gold produced Ounces 6,057 4,738 4,037 2,974 4,352

Gold sold Ounces 5,729 4,711 3,992 2,873 4,706

Gold in stock at

period end Ounces 1,110 782 755 710 609

Operational

data:

Dec'17 Sep'17 June'17 Mar'17 Dec'16

Manaila Units Quarter Quarter Quarter Quarter Quarter

Ore mined Tonnes 23,622 40,462 27707 19,711(1) 23,905(2)

Waste mined Cubic Metre 98,933 119,003 53,267 45,143 38,538

Stripping

ratio Times 4.2 2.9 1.9 2.3 1.6

Ore milled Tonnes 25,654 39,135 28082 18,262(1) 26,786(2)

Milled Grade

- Cu Percentage 0.56% 0.70% 0.73% 0.79% 0.91%

Milled Grade

- Zn Percentage 0.58% 0.70% 0.74% 0.76% 0.88%

Concentrate

produced -

Cu Dry tonnes 562 1082 828 526 889

Percentage 16.3% 17.9% 18.2% 18.8% 19.5%

Concentrate

produced -

Zn Dry tonnes 96 118 157 132 165

Percentage 37.1% 42.3% 39.8% 26.3% 30.0%

Concentrate

produced -

Au Dry tonnes 6 7

Grammes per tonne 86.0 31.4

Concentrate

sold - Cu Dry tonnes 590 1079 995 321 889

Concentrate

sold - Zn Dry tonnes 100 92 252 0 200

Concentrate

in stock at

period end

Cu Dry tonnes 12 41 38 206 0

Concentrate

in stock at

period end

Zn Dry tonnes 59 63 37 132 0

Notes:

1. March 2017 Quarter: Tonnes mined and milled have been converted to dry

tonnes. Previously reported: wet tonnes mined of 21,901 and wet tonnes

milled of 20,291

2. December 2016 Quarter: Tonnes mined and milled have been converted to dry

tonnes. Previously reported: wet tonnes mined of 25,245 and wet tonnes

milled of 29,776

Quarterly Conference Call

Andrew Prelea, Chief Executive of Vast, will host a conference call for

shareholders at 11.00 a.m. on 1 February 2018.

To participate in this conference call, please dial 0808 109 0701, or

+44 (0) 20 3003 2701 if you are calling from outside of the UK, and

enter participant code 8653798# when prompted to do so. Please note

that all lines will be muted except for Vast's management, however the

Company invites shareholders to submit questions to its public relations

adviser, St Brides Partners Ltd, ahead of the call via email to

shareholderenquiries@stbridespartners.co.uk or through the online chat

function.

To access the online chat function, please use the link below and log in

as a participant using the event number 959 152 384 followed by the

password, 'Vast':

https://sbmf.webex.com/sbmf/onstage/g.php?MTID=eba1a1f55f88152e6c6c26073260bd8c0

On the right-hand side of the screen you will find an option to submit

questions during the call. The Q&A function will only be made live once

the call has commenced.

The management team will strive to answer as many questions as possible

during the call. A recording of the call will also be made available on

the Company's website.

If you have any problems accessing the call, please contact St Brides

Partners Ltd on shareholderenquiries@stbridespartners.co.uk or call +44

(0) 20 7236 1177.

A copy of the presentation will also be uploaded to the Research, Media

& Presentations page of the website at www.vastresourcesplc.com shortly

before the call commences.

Competent Person's Review:

This announcement has been reviewed by Mr Craig Harvey, Chief Operating

Officer at Vast, and a member of the Geological Society of South Africa

and the Australian Institute of Geoscientists. Mr Harvey meets the

definition of a "qualified person" as defined in the AIM Note for Mining,

Oil and Gas Companies.

* In the previous Quarterly Production Summary, this figure was reported

as wet tonnes however from April 2017 all tonnage measurement are

reported as dry tonnes

** Calculated as an average grade over the previous four quarters

-ENDS-

For further information visit www.vastresourcesplc.com or please

contact:

Vast Resources plc www.vastresourcesplc.com

Andrew Prelea (Chief Executive Officer) +44 (0) 20 7236 1177

Beaumont Cornish - Financial & Nominated Adviser www.beaumontcornish.com

Roland Cornish +44 (0) 020 7628 3396

James Biddle

Brandon Hill Capital Ltd - Joint Broker www.brandonhillcapital.com

Jonathan Evans +44 (0)20 3463 5016

SVS Securities Plc - Joint Broker www.svssecurities.com

Tom Curran +44 (0) 20 3700 0100

Ben Tadd

St Brides Partners Ltd www.stbridespartners.co.uk

Susie Geliher +44 (0) 20 7236 1177

Charlotte Page

The information contained within this announcement is deemed by the

Company to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 ("MAR").

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Vast Resources plc via Globenewswire

http://www.acrplc.com/

(END) Dow Jones Newswires

February 01, 2018 02:00 ET (07:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

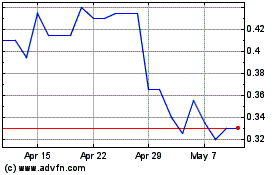

Vast Resources (LSE:VAST)

Historical Stock Chart

From Mar 2024 to Apr 2024

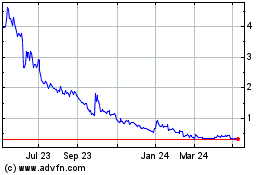

Vast Resources (LSE:VAST)

Historical Stock Chart

From Apr 2023 to Apr 2024