TIDMIDE

RNS Number : 7030N

IDE Group Holdings PLC

26 September 2019

IDE Group Holdings Plc

("IDE", the "Group" or the "Company")

Unaudited Interim Results

IDE Group Holdings plc, the mid-market network, cloud and IT

managed services provider, today announces its unaudited results

for the six months ended 30 June 2019.

Summary

-- Revenue of GBP14.7 million (H1 2018*: GBP21.8 million)

-- Adjusted EBITDA** profit of GBP1.2 million (H1 2018*: loss of

GBP7.6 million), including IFRS 16 adjustment of GBP0.57

million

-- The loss after tax for the period was reduced to GBP2.9

million (H1 2018 - continuing operations: loss of GBP35.5

million).

-- Net debt*** as at 30 June 2019 of GBP12.3 million (31

December 2018: GBP9.9 million), following GBP10.0 million loan note

issue in first quarter and repayment of Group bank debt

-- Loan notes subscribed for by existing shareholders, Company

now has no external debt other than with key shareholders

-- Significant customer multi-year contract renewals, including

a 3-year contract for cloud and hosting with a total value of GBP1

million

-- New partnership with a global IT services company, first

project started post-period end in August

* from continuing operations, excluding the results relating to

365 ITMS Limited and the PACT business which were sold in October

2018

** before net finance costs, tax, depreciation, impairment

charges, amortisation, exceptional items and share based payment

charges

*** excluding IFRS 16 liabilities

IDE Group Holdings Plc Tel: +44 (0)344

Andy Parker, Executive Chairman 874 1000

finnCap Limited Tel: +44 (0)20 7220

Nominated Adviser and Broker 0500

Corporate finance: Jonny Franklin-Adams/

Hannah Boros

ECM: Tim Redfern/ Richard Chambers

Executive Chairman's Statement

The first six months of the year has been a period of

stabilisation following the upheaval of the restructuring which

took place during 2018. As a result of the actions taken during

2018, we started 2019 in a much improved position with a strong

leadership team, an appropriate cost base as well as a clear focus

on operational execution and customer service to drive increased

profitability and cash generation. To that end, it is pleasing to

report an Adjusted EBITDA* of GBP1.2 million (including a GBP0.57

million IFRS adjustment as explained in the financial review) for

the period compared to the GBP7.6 million loss in the corresponding

last year, which reflected the significant challenges the business

faced last year.

Refinancing

In January 2019 we announced a proposed fundraising of GBP10.0

million by the way of the issue of secured loan notes in order to

fully repay the Group's bank facilities and provide additional

working capital. The first tranche of loan notes was issued in

January with the remaining loan notes issued in February and March

following which the Group's bank facilities were fully repaid. We

saw this as a very positive step as the Group now has secure, long

term funding and no external debt as the loan notes are held solely

by shareholders of the Company, predominantly the three largest,

two of whom are also represented on the Board. Further details of

the loan notes can be found in the financial review below.

Trading

Towards the end of 2018, several of the Group's material

customers renewed their contracts with IDE, some on a multi-year

basis and I am pleased to say that during the period under review,

the Group secured several other significant renewals including a 3

year contract for cloud and hosting services with a total contract

value of over GBP1 million.

The restructuring last year meant that we entered this year with

an appropriate cost base and the refinancing in the first quarter

has given us a stable platform from which to grow. To that end, in

May this year we recruited a new Head of Sales to drive sales

growth. Already our level of engagement with our key customers,

including a large international outsourcer, has immeasurably

improved. In addition, we are being awarded extensions to other

contracts and have commenced new projects which we expect to grow

over the coming months.

Furthermore, we were very pleased to enter into a new

partnership with another global IT services company during the

period, and the first project under this new partnership commenced

post-period end in August. We believe there is significant

potential for growth with this partner and look forward to updating

shareholders in this respect.

Group revenue in the period was impacted by certain projects and

contracts coming to an end and a general level of churn in the

business, in particular with respect to our cloud and networks

divisions. In order to address this going forward, we continue to

enhance our cloud platform and offering and are developing a joint

value proposition with Equinix, Inc. a multi-national data centre

and co-location provider. Furthermore, we continue to close down

legacy networks in order to improve service and profitability.

In summary, the first half of the year has shown a significant

turnaround from the upheaval of the previous year. We have been

successful in renewing significant customer contracts and in

progressing new relationships. We continue to explore further areas

where costs can be saved whilst investing in areas that will help

drive growth. We are confident in the outlook for the Group and

remain ambitious in securing and improving margins and cash

generation.

Andy Parker

Executive Chairman

Financial Review

Results for the six months to 30 June 2019

Revenue for the six months to 30 June 2019 was GBP14.7 million

(H1 2018 - continuing operations: GBP21.8 million). The decrease in

revenue can be primarily attributed to a fall in lifecycle revenues

included within managed services and reductions in project revenues

due to certain significant projects coming to an end last year and

during the period under review. Furthermore, as referred to in the

Chairman's statement, there has been a general level of churn

across the business, in particular within the cloud and networks

divisions.

Gross profit for the six months to 30 June 2019 was GBP3.6

million (including a GBP0.1 million IFRS 16 adjustment) (H1 2018 -

continuing operations: GBP0.3 million), representing an overall

gross margin of 24%, a significant improvement to the prior period.

The low level of gross profit in the six months to 30 June 2018 was

due predominantly to the inclusion within cost of sales of a

provision of GBP2.2 million in relation to an onerous supply

contract.

At an Adjusted EBITDA* level the Group generated a profit of

GBP1.2 million (including an IFRS 16 adjustment of GBP0.57 million

as detailed above) from continuing operations as compared to a loss

of GBP7.6 million from continuing operations in the first half of

2018. The results six months to 30 June 2018 included GBP5.7

million of provisions in relation to onerous contracts and empty

properties which were a major contributor to the loss at Adjusted

EBITDA* level in that period.

Exceptional costs amounted to GBP0.4 million (H1 2018 -

continuing operations: GBP0.9 million) and related predominantly to

legacy redundancy costs as a result of the reduction in headcount

in the previous financial year. Going forward, we expect

exceptional costs to continue to decrease.

Depreciation increased to GBP1.5 million for the six months to

30 June 2019 compared to GBP1.2 million for H1 2018 as a result of

a GBP0.5 million adjustment in relation to IFRS 16.

There were no impairment charges for the six months to 30 June

2019, whereas for the six months to 30 June 2018 impairment charges

totalling GBP27.5 million were recognised in relation to goodwill

and intangible assets resulting from the acquisition of IDE Group

Manage (formerly Selection Services), although at the time of the

final results for the year to 31 December 2018, GBP13.7 million of

these charges were reversed.

Net financial costs have increased to GBP1.0 million (H1 2018 -

continuing operations: GBP0.3 million), which include GBP0.7

million of interest on the loan notes issued in the first half of

the year which is payable at the end of their term. In addition the

costs include GBP0.1 million of notional interest in relation to

the convertible loan notes issued last year and an additional

GBP0.1 million of interest expense relating to the IFRS 16

adjustment.

The loss after tax for the period was GBP2.9 million (H1 2018 -

continuing operations: loss of GBP35.5 million).

Loss per share was 0.73p (H1 2018 - continuing operations:

17.86p).

Cashflow and Net Debt

The Group's cash outflow from operating activities in the period

was GBP0.5 million (H1 2018: GBP1.6 million). A number of onerous

contracts have been provided for and hence do not impact the

Group's Adjusted EBITDA*, but continue to affect the Group's

cashflow, however continued efforts are being made in identifying

further areas where costs can be rationalised in order to improve

both profitability and cash flow.

As at the beginning of the period the Group's facilities with

National Westminster Bank plc ("Natwest") comprised a five-year,

fully drawn GBP4.75 million Revolving Credit Facility ("RCF") and a

GBP3.5 million overdraft facility (the "Facilities"). Interest was

payable on the utilised RCF at 2% above LIBOR.

In January 2019 the Company issued GBP5.3 million of secured

loan notes with a six-year term and a 12% coupon which is

compounded, rolled up and payable at the end of the term ("Secured

LNs"). The proceeds of the Secured LNs were used to repay GBP4.125

million to Natwest and the RCF was reduced to GBP625k. In February

and March 2019, a further GBP4.7 million in total of Secured LNs

were issued to repay the remaining Facilities, which were then

cancelled, and provide additional working capital. The Secured LNs

carry an arrangement fee of 2.5 per cent., payable at the end of

the term, and an exit fee of 2.5 per cent., also payable at the end

of the term.

The net debt balance (excluding IFRS 16 liabilities) at 30 June

2019 was GBP12.3 million (31 December 2018: GBP9.9 million), which

comprised the Secured LNs held at amortised cost using the

effective interest rate method resulting in a liability as at 30

June 2019 of GBP10.7 million (note 5), plus the convertible loan

notes of GBP1.7 million issued in August 2018 (note 6) and finance

lease liabilities of GBP0.6 million, net of cash of GBP0.7

million.

New IFRS implementation

The Company has adopted IFRS 16 - Leases for the financial year

ending 31 December 2019, and it has chosen to use the modified

retrospective approach to adoption which means there are no

restatements to the prior year figures.

IFRS 16 introduces a single lessee accounting model, whereby the

Group now recognises a lease liability and a right of use asset at

1 January 2019 for leases previously classified as operating

leases. Within the income statement, operating lease charges, which

previously sat in both cost of sales and administrative expenses,

have been replaced by depreciation and interest expenses.

The adoption of IFRS 16 resulted in a right of use asset of

GBP2.0 million, with a corresponding liability of GBP2.0 million,

being recognised as at 1 January 2019 which was depreciated to a

value of GBP1.5 million as at 30 June 2019.

In order to see how the impact of IFRS 16 has affected gross

profit and Adjusted EBITDA*, a reconciliation is presented

below:

6 months ended 6 months ended

30 June 2019 30 June 2018

(continuing

operations)

GBP000 GBP000

Gross profit - consistent with 2018

presentation and accounting policy 3,495 346

Changes due to new accounting policy 93 -

- IFRS 16

Gross profit - consistent with 2019

presentation and accounting policy 3,588 346

Adjusted EBITDA* - consistent with

2018 presentation and accounting

policy 651 (7,649)

Changes due to new accounting policy 567 -

- IFRS 16

Adjusted EBITDA* - consistent with

2019 presentation and accounting

policy 1,218 (7,649)

* before net finance costs, tax, depreciation, impairment

charges, amortisation, exceptional items and share based payment

charges.

Consolidated Statement of Comprehensive Income

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

Note GBP000 GBP000 GBP000

----------------------------------------------- -------------- ------------ -------------

Continuing Operations

Revenue 2 14,713 21,781 41,137

Cost of sales (11,125) (21,435) (34,521)

---------------------------------------- ------ -------------- ------------ -------------

Gross profit 3,588 346 6,616

Administrative expenses excluding

impairment (5,704) (12,162) (19,247)

Impairment charge on goodwill - (23,722) (17,528)

Operating loss (2,116) (35,538) (30,159)

---------------------------------------- ------ -------------- ------------ -------------

Analysed as:

Adjusted EBITDA* 1,218 (7,649) (3,886)

Exceptional items 3 (410) (846) (2,368)

Depreciation of property,

plant and equipment (1,491) (1,151) (2,848)

Amortisation of intangible

assets (1,433) (1,949) (3,290)

Impairment of goodwill & intangibles - (23,722) (17,528)

Loss on disposal of fixed

assets - (164) (441)

Charges for share based

payments - (57) 202

Net financial costs (1,007) (277) (389)

Loss before taxation (3,123) (35,815) (30,548)

Income tax 200 303 1,089

---------------------------------------- ------ -------------- ------------ -------------

Loss for the period from continuing

operations attributable to

owners of the parent company (2,923) (35,512) (29,459)

Discontinued operations

Loss after tax for the year

from discontinued operations - (3,597) (3,165)

---------------------------------------- ------ -------------- ------------ -------------

Loss for the period after

taxation (2,923) (39,109) (32,624)

---------------------------------------- ------ -------------- ------------ -------------

Other comprehensive income:

Items that are or may be classified

subsequently to profit or

loss:

Foreign exchange translation

differences - equity accounted

investments 6 (2) (23)

---------------------------------------- ------ -------------- ------------ -------------

Loss for the period and total

comprehensive income attributable

to equity holders of the parent (2,917) (39,111) (32,647)

---------------------------------------- ------ -------------- ------------ -------------

Basic and diluted loss per

share - continuing operations 4

Basic (pence per share) (0.73) (17.69) (11.97)

Diluted (pence per share) (0.73) (17.69) (11.97)

---------------------------------------- ------ -------------- ------------ -------------

* Earnings from continuing operations before net finance costs,

tax, depreciation, amortisation, impairment charges, share based

payments and exceptional costs

Consolidated Statement of Financial Position

Unaudited Unaudited Audited

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

------------------------------- --- ---------- ------------------- ----------------

Non-current assets

Intangible assets 20,267 10,309 21,464

Goodwill 5,931 14,997 5,931

Property, plant and equipment 10,493 11,470 9,836

Financial and other assets - 63 -

------------------------------- --- ---------- ------------------- ----------------

36,691 36,839 37,231

------------------------------- --- ---------- ------------------- ----------------

Current assets

Trade and other receivables 7,970 12,000 8,893

Stock - 354 -

Cash and cash equivalents 690 3,833 -

8,660 16,187 8,893

------------------------------- --- ---------- ------------------- ----------------

Total assets 45,351 53,026 46,124

------------------------------- --- ---------- ------------------- ----------------

Current liabilities

Borrowings 5 - 4,850 7,586

Trade and other payables 6,578 13,770 7,670

Deferred income 2,190 6,571 2,962

Taxation 342 10 -

Finance lease obligations 613 234 214

Provisions 770 2,510 1,514

10,493 27,945 19,946

------------------------------- --- ---------- ------------------- ----------------

Non-current liabilities

Deferred income 13 - 13

Borrowings 5 10,676 9,500 -

Convertible loan notes 6 1,750 - 1,654

Finance lease obligations 1,526 594 494

Deferred tax liabilities 3,698 4,812 3,899

Provisions 1,705 3,936 1,705

19,368 18,842 7,765

------------------------------- --- ---------- ------------------- ----------------

Total liabilities 29,861 46,787 27,711

------------------------------- --- ---------- ------------------- ----------------

Net assets 15,490 6,239 18,413

------------------------------- --- ---------- ------------------- ----------------

Equity attributable to equity

holders of the parent

Called up share capital 10,020 5,018 10,020

Share premium account 35,439 35,439 35,439

Other reserves 811 (125) 817

Retained earnings (30,780) (34,092) (27,863)

------------------------------- --- ---------- ------------------- ----------------

Total equity 15,490 6,239 18,413

------------------------------- --- ---------- ------------------- ----------------

Consolidated Statement of Changes in Equity

Share Share Equity Retained Foreign

capital premium Reserve earnings currency Total

(a) (b) (c) (d) translation

reserve

(e)

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------- --------- --------- --------- ---------- ------------- ---------

At 1 January 2018 5,018 35,439 - 4,963 (127) 45,293

Total comprehensive

income for the period

Loss for the period - - - (39,109) - (39,109)

Exchange rate differences - - - - (2) (2)

Transactions with

owners recorded directly

in equity

Share based payments - - - 57 - 57

At 30 June 2018 5,018 35,439 - (34,089) (129) 6,239

Total comprehensive

income for the period

Profit for the period - - - 6,485 - 6,485

Exchange rate differences - - - - (21) (21)

Transactions with

owners recorded directly

in equity

Share based payments - - - (259) - (259)

Share issues 5,002 - - - - 5,002

Convertible loan notes - - 967 - - 967

At 31 December 2018 10,020 35,439 967 (27,863) (150) 18,413

Total comprehensive

income for the period

Loss for the period - - - (2,917) - (2,917)

Exchange rate differences - - - - (6) (6)

At 30 June 2019 10,020 35,439 967 (30,780) (156) 15,490

---------------------------- --------- --------- --------- ---------- ------------- ---------

(a) Share capital represents the nominal value of equity shares

(b) Share premium represents the excess over nominal value of

the fair value of consideration received for equity shares; net of

expenses of the share issue;

(c) The equity reserve consists of the equity component of

convertible loan notes that were issued as part of the fundraising

in August 2018 less the equity component of instruments converted

or settled.

The fair value of the equity component of convertible loan notes

issued is the residual value after deduction of the fair value of

the debt component of the instrument from the face value of the

loan note.

(d) Retained earnings represents retained profits and accumulated losses

(e) On consolidation, the balance sheets of the Group's foreign

subsidiaries are translated into sterling at the rates of exchange

ruling at the balance sheet date. Exchange gains or losses arising

from the consolidation of these foreign subsidiaries are recognised

in the foreign currency translation reserve.

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

----------------------------------------- ---- ------------ ------------------- -------------

Loss for the period (2,917) (39,109) (32,624)

Adjustments for:

Depreciation of property, plant

and equipment 1,491 1,278 3,033

Amortisation of intangible assets 1,433 2,121 3,549

Impairment Charge - 27,525 21,505

Net financial costs 1,007 287 390

Equity settled share-based payment

expenses - 57 (202)

Taxation (200) (303) (1,216)

Loss on disposal of fixed assets - 155 425

Other (6) (1) -

Profit on disposal of subsidiary - - (680)

----------------------------------------------- ------------ ------------------- -------------

808 (7,990) (5,820)

Decrease in trade and other receivables 923 2,730 6,284

Decrease in trade and other payables (1,521) (1,655) (11,320)

Decrease in inventory - - 366

(Decrease)/ increase in provisions (745) 5,209 1,485

(535) (1,500) (9,005)

Net corporation tax recovered/ - 103 -

(paid)

Net cash used in operating activities (535) (1,603) (9,005)

----------------------------------------------- ------------ ------------------- -------------

Cash flow from investing activities:

Proceeds from sale of subsidiary

and PACT business, net of overdraft

repaid - - 3,611

Acquisition of property, plant

and equipment (131) - (272)

Realisation of non-current financial

assets - 470 89

Proceeds from sale of fixed assets - 9 23

----------------------------------------------- ------------ ------------------- -------------

Net cash (used in)/ from investing

activities (131) 479 3,451

----------------------------------------------- ------------ ------------------- -------------

Cash flows from financing activities:

Share issue, net of share issue

costs - - 3,752

Proceeds from borrowings, net

of expenses 9,810 2,000 3,800

Repayment of loans and other

borrowings (4,750) - (2,750)

Repayment of finance lease obligations (613) (109) (335)

Net interest paid (186) (286) (320)

Net cash from financing activities 4,261 1,605 4,147

----------------------------------------------- ------------ ------------------- -------------

Net increase/ (decrease) in cash

and cash equivalents 3,595 481 (1,407)

Cash and cash equivalents at

beginning of period (2,905) (1,498) (1,498)

Cash and cash equivalents at

end of period 690 (1,017) (2,905)

----------------------------------------------- ------------ ------------------- -------------

Being:

Cash and cash equivalents 690 3,833 -

Bank overdraft - (4,850) (2,905)

----------------------------------------------- ------------ ------------------- -------------

690 (1,017) (2,905)

---------------------------------------------- ------------ ------------------- -------------

Notes to the half-yearly financial information

1. Basis of preparation

The condensed consolidated interim financial information for the

six-month period ended 30 June 2019 and 30 June 2018 is unaudited.

This statement has not been reviewed by the Company's auditor. This

condensed consolidated interim financial information was approved

by the Board of Directors and authorised for issue on 26 September

2019. A copy of this half-yearly financial report is available on

the Company's website at www.idegroup.com.

The Company is a public limited liability company incorporated

and domiciled in Scotland. The address of its registered office is

24 Dublin Street, Edinburgh EH1 3PP. The Company is listed on the

AIM market of the London Stock Exchange.

IDE and its subsidiaries have not applied IAS 34, 'Interim

Financial Reporting' as adopted by the European Union, which is not

mandatory for UK AIM listed companies, in the preparation of this

half-yearly financial report.

This condensed consolidated interim financial information for

the six-month period ended 30 June 2019 therefore does not comply

with all the requirements of IAS 34, 'Interim Financial Reporting'

as adopted by the European Union. The consolidated interim

financial information should be read in conjunction with the annual

financial statements of the Company as at and for the year ended 31

December 2018, which were prepared in accordance with IFRS as

adopted by the European Union.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2018 were approved by the Board of Directors on 24 July

2019 and delivered to the Registrar of Companies. The report of the

auditor was unqualified, did not contain an emphasis of matter

paragraph and did not contain a statement under section 498 (2) or

(3) of the Companies Act 2006.

Accounting policies

The accounting policies used in the preparation of the condensed

consolidated interim financial information for the six months ended

30 June 2019 are in accordance with the recognition and measurement

criteria of International Financial Reporting Standards ("IFRS") as

adopted by the European Union and are consistent with those that

will be adopted in the annual statutory financial statements for

the year ended 31 December 2019.

While the financial information included has been prepared in

accordance with the recognition and measurement criteria of IFRS,

as adopted by the European Union, these financial statements do not

contain sufficient information to comply with IFRSs. The accounting

policies applied by the Group in this financial information reflect

the adoption of IFRS 16 Leases which is effective as of 1 January

2019. The adoption of this standard has not resulted in a

restatement of the prior year figures.

Other than the adoption of IFRS 16 - Leases, the accounting

policies adopted in the interim financial statements are consistent

with those adopted in the financial statements for the year ended

31 December 2018.

IFRS 16 - Leases

The Group has adopted IFRS 16 on a modified retrospective basis.

As disclosed in the Financial Review, upon transition, a lease

liability has been recognised based on future lease payments

discounted at an appropriate borrowing rate. Additionally, a right

of use asset has been recognised along with a related lease

liability. Within the income statement, the operating lease charge

has been replaced by depreciation and interest expense. This has

resulted in a decrease in operating expenses and an increase in

finance costs.

Exceptional items and other non-recurring items

Items which are material because of their size or nature and

which are non-recurring are highlighted separately on the face of

the income statement. The separate reporting of exceptional items

helps provide a better picture of the Company's underlying

performance. Items which may be included within the exceptional

category include:

-- spend on major restructuring programmes;

-- significant goodwill or other asset impairments; and

-- other particularly significant or unusual items.

Exceptional items are excluded from the headline profit measures

used by the Group and are highlighted separately in the income

statement as management believe that they need to be considered

separately to gain an understanding the underlying profitability of

the trading businesses.

For further details, please refer to note 3.

Going concern

The condensed consolidated interim financial information has

been prepared on a going concern basis.

Taking into account the support of certain of the Company's

significant shareholders, of which two are represented on the

Board, as demonstrated by the refinancing at the beginning of the

year, the Directors have a reasonable expectation that the Group

has adequate resources to continue in operational existence for the

foreseeable future. For this reason, the Directors consider that

the adoption of the going concern basis is appropriate.

2. Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting to the Chief Operating Decision Maker ("CODM").

The CODM has been identified as the Board of Directors.

The operating segments are defined by distinctly separate

product offerings or markets. The CODM assesses the performance of

the operating segments based on a measure of revenue and gross

profit.

The following table presents revenue and gross profit in respect

of the Group's operating segment for the six months ended 30 June

2019:

Unaudited for the six-month period ended 30 June 2019

Managed Services Cloud Hosting Networks Projects Central Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Revenue 5,777 4,204 3,014 1,718 - 14,713

Cost of Sales (4,015) (3,500) (2,545) (1,065) - (11,125)

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Gross profit 1,762 704 469 653 - 3,588

Administrative expenses - - - - (5,704) (5,704)

Operating profit/ (loss) 1,762 704 469 653 (5,704) (2,116)

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Analysed as:

Adjusted EBITDA* 1,762 704 469 653 (2,370) 1,218

Depreciation - - - - (1,491) (1,491)

Amortisation of intangible assets - - - - (1,433) (1,433)

Exceptional costs - - - - (410) (410)

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Net financial costs - - - - (1,007) (1,007)

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Profit/(loss) before taxation 1,762 704 469 53 (6,711) (3,123)

Tax on loss on ordinary activities - - - - 200 200

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Profit/(loss) for the period after

taxation 1,762 704 469 53 (6,511) (2,923)

---------------------------------------- ----------------- -------------- --------- --------- -------- ---------

Unaudited for the six-month period ended 30 June 2018

Continuing Operations Managed Services Cloud Hosting Networks Projects Central Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

Revenue 8,115 5,324 4,051 4,291 - 21,781

Cost of Sales (9,091) (5,271) (4,026) (3,047) - (21,435)

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

Gross loss/ (profit) (976) 53 25 1,244 - 346

Administrative expenses (12,162) (12,162)

Impairment of goodwill & intangibles (23,722) (23,722)

Operating (loss)/ profit (976) 53 25 1,244 (35,884) (35,538)

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

Analysed as:

Adjusted EBITDA* (976) 53 25 1,244 (7,995) (7,649)

Equity settled share-based payments - - - - (57) (57)

Depreciation - - - - (1,151) (1,151)

Amortisation of intangible assets - - - - (1,949) (1,949)

Impairment of goodwill & intangibles - - - - (23,722) (23,722)

(Loss) / profit on Disposal - - - - (164) (164)

Exceptional costs - - - - (846) (846)

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

Net financial costs (277) (277)

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

(Loss)/ profit before taxation (976) 53 25 1,244 (36,161) (35,815)

Tax on loss on ordinary activities - - - - 303 303

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

Profit/(loss) for the period after

taxation (976) 53 25 1,244 (35,858) (35,512)

--------------------------------------- ----------------- -------------- --------- --------- --------- ---------

* Earnings from continuing operations before net finance costs,

tax, depreciation, amortisation, goodwill impairment, share based

payments and exceptional costs

Administrative expenses are not allocated against operating

segments in the Group's internal reporting. The statement of

financial position is not allocated between the operating segments

in the Group's internal reporting.

3. Exceptional costs

In accordance with the Group's policy in respect of exceptional

costs, the following charges were incurred in relation to

continuing operations:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

---------------------------------- ------------ ------------ -------------

Restructuring and reorganisation

costs 410 994 2,368

----------------------------------- ------------ ------------ -------------

4. Earnings per share from continuing operations

The calculation of basic and diluted loss per share is based on

results from continuing operations attributable to ordinary

shareholders divided by the weighted average number of ordinary

shares in issue during the year. The weighted average number of

shares for the purpose of calculating the basic and diluted

measures in the reporting periods is the same. This is because the

outstanding options would have the effect of reducing the loss per

ordinary share and therefore would be anti-dilutive under the terms

of IAS 33. Basic and diluted unaudited loss per share from

continuing operations are calculated as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

GBP000 GBP000 GBP000

----------------------------------- -------------- ------------ -------------

Loss attributable to shareholders (2,923) (35,512) (29,459)

Weighted average number of

shares 400,802,032 200,729,121 246,067,004

Diluted weighted average number

of shares 420,931,989 211,784,158 259,333,840

------------------------------------ -------------- ------------ -------------

Basic loss per share (pence) (0.73) (17.69) (11.97)

Diluted loss per share (pence) (0.73) (17.69) (11.97)

5. Borrowings

As at the beginning of the period the Group's facilities with

National Westminster Bank plc ("Natwest") comprised a five-year,

fully drawn GBP4.75 million Revolving Credit Facility ("RCF") and a

GBP3.5 million overdraft facility (the "Facilities"). Interest was

payable on the utilised RCF at 2% above LIBOR.

In January 2019 the Company issued GBP5.3 million of secured

loan notes with a six-year term and a 12% coupon which is

compounded, rolled up and payable at the end of the term ("Loan

Notes"). The proceeds of the Loan Notes were used to repay GBP4.125

million to Natwest and the RCF was reduced to GBP625,000. In

February and March 2019, a further GBP4.7 million in total of Loan

Notes were issued to repay the remaining Facilities, which were

then cancelled, and provide additional working capital. The Loan

Notes carry an arrangement fee of 2.5 per cent., payable at the end

of the term, and an exit fee of 2.5 per cent., also payable at the

end of the term.

The Loan Notes are held at amortised cost using the effective

interest rate method. The effective interest rate for the Loan

Notes has been calculated to be 18%.

Unaudited Audited

Six months Unaudited Year

ended Six months ended

30 June ended 31 December

2019 30 June 2018

GBP000 2018 GBP000

GBP000

------------------------------ -------------- ------------- -------------

Non-Current

Loan Notes 10,676 - -

Bank Loan - 9,500 -

Total 10,676 9,500 -

------------------------------- -------------- ------------- -------------

Current

Bank Loan - - 4,750

Unamortised loan arrangement

fee - - (69)

Bank overdraft - 4,850 2,905

Total - 4,850 7,586

------------------------------- -------------- ------------- -------------

6. Convertible Loan Notes

On 21 August 2018, as part of a wider fundraising, the Company

issued GBP2.55 million of unsecured loan notes, which have a term

of 5 years and a zero per cent. coupon ("CLNs"). The CLNs can be

converted into new ordinary shares in the capital of IDE at a price

of 2.5 pence per share. Conversion is at the option of the holder

at any time during the 5-year term. At the end of the term, if the

holder has not chosen to convert the CLNs, the CLNs will be settled

with a cash repayment. At issue, the CLNs had a fair value of

GBP2.54 million, split into an equity component (GBP0.96 million)

and a debt component (GBP1.58 million).

Unaudited Audited

Six months Unaudited Year

ended Six months ended

30 June ended 31 December

2019 30 June 2018

GBP000 2018 GBP000

GBP000

-------------------------------- ---- -------------- ------------- -------------

Balance at beginning of period 1,654 - -

Additions - - 1,583

Interest unwound 96 - 71

Total 1,750 - 1,654

-------------------------------------- -------------- ------------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFSTAVIEFIA

(END) Dow Jones Newswires

September 26, 2019 02:01 ET (06:01 GMT)

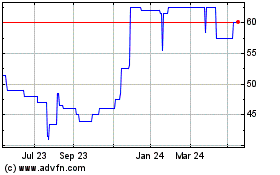

Tialis Essential It (LSE:TIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tialis Essential It (LSE:TIA)

Historical Stock Chart

From Apr 2023 to Apr 2024