TIDMSYS

RNS Number : 2651P

SysGroup PLC

06 February 2019

6 FEBRUARY 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES

(INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES OR THE DISTRICT OF COLUMBIA), AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF IRELAND, THE REPUBLIC OF SOUTH AFRICA, SINGAPORE OR ANY

OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL ("RESTRICTED JURISDICTIONS"). THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT ITSELF

CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY SECURITIES IN

THE COMPANY. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF SYSGROUP PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED UNDER

THE MARKET ABUSE REGULATION (EU) NO. 596/2014.

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

SysGroup Plc

("SysGroup" or the "Company" or, together with its subsidiaries,

the "Group")

Acquisition of Certus IT Limited ("Certus"),

Placing of 26,315,792 new ordinary shares to raise approximately

GBP10.0 million,

new GBP5.0 million banking facilities,

related party transaction

and

Notice of General Meeting

SysGroup, the award winning managed IT services and cloud

hosting provider, is pleased to announce that it has conditionally

agreed to acquire Certus IT Limited, a growing, profitable and

cash-generative managed IT services and cloud hosting provider

based in Newport, South Wales, for an initial cash consideration of

GBP8.0 million on a debt free cash free and normalised working

capital basis, increasing to a maximum cash consideration of GBP9.0

million dependent on the performance of Certus in the 12 month

period following completion (the "Acquisition"). The Company also

announces that it has conditionally raised GBP10.0 million, before

expenses through the placing of 26,315,792 new ordinary shares of 1

pence each ("Ordinary Shares") in the capital of the Company (the

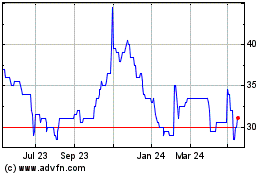

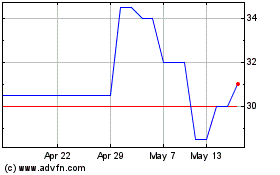

"Placing Shares") at a price of 38 pence each to fund the

acquisition (the "Placing").

The Acquisition is in line with the Group's stated strategy of

augmenting its organic growth with select acquisitions. Certus is

an established and growing managed services provider which has a

complementary service offering, geographical reach and customer

base to SysGroup. Certus will help to bolster the Group's existing

managed service offerings, by expanding the Enlarged Group's

current IaaS customers base, significantly adding to its managed

connectivity portfolio and further strengthening the existing

relationship with Dell EMC by upgrading the Group to gold partner

status. In addition, the Group's consultative led sales approach

and security focus will assist with generating cross-selling

opportunities into the Certus customer base.

Strategic rationale for the Acquisition

Acceleration of the Group's growth and opportunity for value

creation

-- provides the Enlarged Group with critical mass in the managed

IT services market and strengthens the Group's core service

offering;

-- broadens the Enlarged Group's penetration into new vertical

markets, including into the Professional Services and Manufacturing

sectors;

-- provides cross-selling opportunities to offer Certus'

customers the access to the capabilities and services of the

Enlarged Group;

-- enhances the Group's newly structured sales & marketing team;

-- expands the Group's geographical coverage into South Wales and the M4 corridor; and

-- brings Dell EMC Gold Partner status to the Enlarged Group,

complementing SysGroup's portfolio of senior vendor

partnerships.

Operational benefits

-- provide the potential for economies of scale for the Enlarged

Group by way of greater buying power;

-- dilution of central costs;

-- reduce the cost of the Group's existing footprint with the addition of Certus' datacentre;

-- provides complimentary technical ability to support larger managed services projects; and

-- further dilutes the Group's already low customer revenue concentration.

New Banking Facilities

The Company has also conditionally re-financed its existing term

loan facility as a GBP1.75 million term loan over five years and

arranged a new GBP3.25 million acquisition revolving credit

facility with Santander to provide additional financial flexibility

for the Group. The Banking Facilities have terms of five years with

covenants that will be tested quarterly on a 12 month rolling basis

relating to interest cover, net debt to Adjusted EBITDA leverage

and debt service cover.

Commenting on the Transaction, Adam Binks, CEO of SysGroup,

said:

"I am delighted to have completed the Placing and we are very

pleased with the significant support we have received from both new

and existing shareholders. The funds raised coupled with the new

bank facilities will ensure the Group is well positioned to

continue to invest in opportunities for growth. Further, I am

excited to be welcoming both the Certus team and its customers to

the SysGroup family. The addition of Certus to the Group represents

a step-change in terms of the scale of the business, and we believe

the enlarged Group will be better positioned to penetrate our

target market and drive further growth. This acquisition fits

within our strategy of growing the business organically and through

strategic acquisitions, and we are excited by the prospects that

lie ahead."

Information on Certus

Certus is a mid-sized end-to-end managed IT services provider

based in Newport, South Wales. Certus was founded in 2000 and

currently provides services to approximately 130 customers who

typically have 50-250 users. Customers include Admiral,

Confused.com, gocompare.com, Hugh James and London Executive

Offices. Certus has contracted future income of approximately

GBP8.7 million for the three years ending 31 December 2021, of

which GBP4.4 million is contracted for the year to 31 December

2019.

Certus manages its own data centre footprint within the 250,000

sq ft Next Generation Data facility in Newport. Certus is well

invested with 80 racks under management enabling the provision of

contracted managed services and cloud services.

The existing executive management team of Certus will remain

with the Enlarged Group after completion of the Acquisition, which

the Board believes will assist with the integration of Certus

within the Group.

Certus is a Gold Partner of Dell EMC and a Microsoft Gold

Certified Partner; it was named Dell EMC's 'cloud partner of the

year' in 2015 and now employs more than 40 members of staff.

Further details of the Acquisition and Placing

The Company has conditionally agreed to acquire Certus for an

initial cash consideration of GBP8.0 million on a debt-free,

cash-free and normalised working capital basis. Further contingent

consideration of up to a maximum of GBP1.0 million may be payable

subject to the achievement of financial performance criteria, based

upon the financial performance of Certus (the "Earn-out

Consideration") for the 12-month period following the completion of

the Acquisition (the "Earn-out Period"). The Earn-out Consideration

is structured such that for each GBP1 of EBITDA (subject to not

less than 70 per cent. of gross profit being derived from recurring

revenue) over GBP1.2 million that Certus generates during the

Earn-out Period, SysGroup will pay GBP2.50 to the Vendors, capped

at total Earn-out Consideration of GBP1.0 million. Completion of

the Acquisition is conditional, amongst other things, on the

receipt of the subscription monies relating to the Placing

Shares.

The Acquisition will be funded through the conditional placing

of GBP10.0 million (before expenses) through the proposed issue of

26,315,792 new Ordinary Shares (the "Placing Shares") at a price of

38 pence per Placing Share. The Placing is conditional upon, inter

alia, the approval of shareholders at a general meeting to be held

at the offices of Hill Dickinson LLP at 50 Fountain Street,

Manchester, M2 2AS on 22 February 2019 at 10.00 a.m (the "General

Meeting"). A shareholder circular and a notice convening the

General Meeting will be sent to shareholders later today.

Shore Capital Stockbrokers Limited is acting as sole broker and

bookrunner ("Bookrunner") in relation to the Placing.

The Company has conditionally re-financed its existing term loan

facility as a GBP1.75 million term loan over five years and

arranged a new GBP3.25 million acquisition revolving credit

facility with Santander to provide additional financial flexibility

for the Group.

Related party transactions

Gresham House Asset Management Limited and Canaccord Genuity

Group Inc each hold an interest in more than 10 per cent. of the

Company's Existing Ordinary Shares and are therefore considered

related parties of the Company under the AIM Rules. Gresham House

Asset Management Limited and Canaccord Genuity Group Inc have

unconditionally agreed to subscribe for 5,620,386 Placing Shares

and 3,421,053 Placing Shares respectively.

Michael Edelson, Chairman of the Company, has unconditionally

agreed to subscribe for 131,579 Placing Shares and Praetura Group

Limited, in which Michael Fletcher, a Non-Executive Director of the

Company, has a controlling interest, has also unconditionally

agreed to subscribe for 1,710,526 Placing Shares.

The participations in the Placing by Gresham House Asset

Management Limited and Canaccord Genuity Group Inc are related

party transactions under Rule 13 of the AIM Rules. The Directors

consider, having consulted with the Company's Nominated Adviser,

Shore Capital, that the terms of the related party transactions are

fair and reasonable insofar as Shareholders are concerned.

The participations in the Placing by Michael Edelson and

Praetura Group Limited are also related party transactions under

Rule 13 of the AIM Rules. The independent Directors of the Company

consider, having consulted with the Company's Nominated Adviser,

Shore Capital, that the terms of the related party transactions are

fair and reasonable insofar as Shareholders are concerned. The

independent Directors of the Company comprise Adam Binks, Martin

Audcent and Mark Quartermaine.

Extracts from the circular to be sent today to shareholders (the

"Circular") providing further details of the Acquisition and

Placing are set out below in Appendix I.

All defined terms used in this Announcement not otherwise

defined have the meanings set out in the Circular.

For further information, please contact:

SysGroup plc

Adam Binks, CEO

Martin Audcent, CFO +44 (0)151 559 1777

Shore Capital (Nomad & Sole Broker)

Edward Mansfield

Anita Ghanekar

Daniel Bush +44 (0)20 7408 4090

Alma PR (Financial PR Adviser)

Josh Royston

Helena Bogle

Hilary Buchanan + 44 (0)20 3405 0206

About SysGroup

SysGroup is a leading provider of Managed IT Services, Cloud

Hosting, and expert IT Consultancy. The Group delivers solutions

that enable clients to understand and benefit from industry leading

technologies and advanced hosting capabilities. SysGroup focuses on

a customer's strategic and operational requirements - enabling

clients to free up resources, grow their core business and avoid

the distractions and complexity of delivering IT services.

The Group has offices in Liverpool, Coventry, London and

Telford.

IMPORTANT NOTICE

Cautionary statement regarding forward-looking statements

Certain statements in this Announcement are forward-looking

statements which are based on the Company's current expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "intend", "plan",

"estimate", "expect", and words of similar meaning or the negative

thereof, include all matters that are not historical facts and

reflect the directors' beliefs and expectations and involve a

number of risks, assumptions and uncertainties that could cause

actual results and performance to differ materially from any

expected future results or performance expressed or implied by the

forward-looking statements. These statements are not guarantees of

future performance and are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. Statements contained in this

Announcement regarding past trends or activities should not be

taken as a representation that such trends or activities will

continue in the future.

Given these risks and uncertainties, prospective investors are

cautioned not to place undue reliance on forward-looking

statements. Except as required by applicable law, neither the

Company nor the Bookrunner assumes any responsibility or obligation

to update or revise publicly or review any of the forward-looking

statements contained herein, whether as a result of new

information, future events or otherwise. You should not place undue

reliance on any forward-looking statements, which speak only as of

the date of this Announcement.

Information for distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that the Placing Shares are: (i) compatible

with an end target market of retail investors and investors who

meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment").

Notwithstanding the Target Market Assessment, Distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; Placing

Shares offer no guaranteed income and no capital protection; and an

investment in Placing Shares is compatible only with investors who

do not need a guaranteed income or capital protection, who (either

alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any

losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, the Bookrunner will only procure investors who meet the

criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to Placing Shares. Each

distributor is responsible for undertaking its own target market

assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Notice to EEA investors

This Announcement (which is for information purposes only) is

directed only at persons in member states of the European Economic

Area (the "EEA") who are qualified investors within the meaning of

article 2(1)(e) of Directive 2003/71/EC, as amended from time to

time, including by Directive 2010/73/EU to the extent implemented

in the relevant member state and includes any relevant implementing

directive measure in any member state (the "Prospectus Directive")

("Qualified Investors").

Notice to United Kingdom investors

In the United Kingdom, this Announcement is directed only at

Qualified Investors who are persons who (i) have professional

experience in matters relating to investments falling within

article 19(1) of The Financial Services and Markets Act (Financial

Promotion) Order 2005, as amended ("FPO") and who fall within the

definition of "investment professionals" in article 19(5) of the

FPO or fall within the definition of "high net worth companies,

unincorporated associations etc" in article 49(2)(a) to (d) of the

FPO and (ii) are "qualified investors" as defined in section 86 of

The Financial Services and Markets Act 2000, as amended ("FSMA");

or (c) persons to whom it may otherwise lawfully be communicated

(all such persons together being referred to as "Relevant

Persons").

Your attention is drawn to the detailed terms and conditions of

the Placing set out in Appendix II to this Announcement (which

forms part of this Announcement).

Appendix II to this Announcement contains the detailed terms and

conditions of the Placing and the basis on which investors agreed

to participate in the Placing. The Placing has not been

underwritten by Shore Capital Stockbrokers Limited. Placees are

deemed to have read and understood this Announcement in its

entirety, including Appendix II, and to have made their offer on

the terms and subject to the conditions contained herein and to

have given the representations, warranties, undertakings and

acknowledgements contained in Appendix II to this Announcement.

The Placing Shares will be issued credited as fully paid and

will rank pari passu with the existing Ordinary Shares, including

the right to receive all dividends and other distributions (if any)

declared, made or paid on or in respect of such shares after the

date of their issue.

Basis on which information is presented

In this document, references to "pounds sterling", "GBP",

"pence" and "p" are to the lawful currency of the United Kingdom.

All times referred to in this document are, unless otherwise

stated, references to London time.

APPIX I

CIRCULAR EXTRACTS

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2019

Announcement of the Proposals and publication 6 February

of this document

Latest time and date for receipt of Forms of 10.00 a.m. on 20

Proxy for the General Meeting February

General Meeting 10.00 a.m. on 22

February

Admission, completion of the Placing and commencement 25 February

of dealings in the Placing Shares

CREST accounts credited 25 February

Completion of the Acquisition By 26 February

Dispatch of share certificates in respect of By 18 March

Placing Shares

STATISTICS RELATING TO THE ACQUISITION AND PLACING

Number of Existing Ordinary Shares as at

the date of this document 23,103,898

Number of Placing Shares 26,315,792

Enlarged Share Capital on Admission 49,419,690

Placing Shares expressed as a percentage

of the Enlarged Share Capital 53.2%

Placing Price 38p

Gross proceeds of the Placing cGBP10million

Market capitalisation at the Placing Price GBP18.8 million

on Admission

1. Introduction

The Company today announced that it has entered into a

conditional agreement with the Vendors to acquire the entire issued

share capital of Certus for GBP8.0 million in cash, on a debt free

cash free and normalised working capital basis. Further deferred

consideration of up to GBP1.0 million may become payable in cash,

subject to the financial performance of Certus in the 12 months

following completion of the Acquisition. The Company is proposing

to raise GBP10 million (before expenses) through a conditional

placing of 26,315,792 Placing Shares at the Placing Price in order

to finance the Acquisition, and provide working capital for the

Enlarged Group. The Group has also conditionally re-financed its

existing term loan facility as a GBP1.75 million term loan over

five years and arranged a new acquisition revolving credit facility

of GBP3.25 million over a five year term.

Certus is a growing, profitable and cash-generative managed IT

services and cloud hosting provider based in Newport, South Wales,

with a presence in South Wales and along the M4 corridor. In 2017

it generated annual revenues of GBP6.4 million - of which

approximately 52 per cent. were recurring in nature.

The Board believes that the Acquisition is highly complementary

to the Group and that it will provide the Company with an enhanced

service offering, broader customer base and geographical reach, and

the potential to deliver sales synergies, by cross selling services

between the Group's and Certus's customer bases. The Board also

believes that there is the potential for operating cost benefits

through the addition of Certus's datacentre facility which could

reduce the cost of the Group's existing footprint. The existing

executive management of Certus will remain with the Group after the

completion of the Acquisition.

Further details of the terms of the Acquisition and the Placing

are set out below under the headings "Principal terms of the

Acquisition" and "Details of the Placing and use of proceeds". The

Placing Shares are being placed conditionally, amongst other

things, on the passing of the Placing Resolutions at the General

Meeting and Admission. Completion of the Acquisition is

conditional, amongst other matters, on the receipt of the

subscription monies relating to the Placing Shares. The Placing has

not been underwritten.

2. Information on SysGroup

2.1. Introduction

SysGroup is an established managed services provider. Founded in

2007, SysGroup transformed itself from a mass-market web hosting

provider to an IT services and cloud hosting provider in 2016,

growing through both organic means and by acquisition. The Group

now provides a range of cloud hosting, managed IT services and

security solutions to its clients operating in different market

verticals including insurance, retail, financial services, not for

profit and education.

The Group has offices in Liverpool, London, Coventry and Telford

and employs more than 80 people. SysGroup was awarded the 'Security

Vendor of the Year - SME' award at the Computing Excellence

Security Awards 2018 and has customers that include Home Bargains,

the Royal Albert Hall, Sega and North Wales Police.

2.2. SysGroup's strategy

In 2016 SysGroup commenced a transition to focus on becoming a

provider of managed IT services and cloud hosting. This transition

was principally executed through the acquisitions of System

Professional Ltd ("Sys-Pro") in 2016 and Rockford IT Ltd in 2017,

as well as the disposal of the Group's SME mass market business in

2016.

SysGroup's focus is to expand its position as a provider of

managed IT services to clients in the UK, typically with 50-500

users. The Board believes that a business focused on the provision

of managed IT services offers a significant growth opportunity and

the potential for increased margins and longer-term contracts,

thereby providing greater revenue visibility. The strategy has

resulted in the Company's growing revenue from GBP4.76 million in

FY2016 to GBP10.45 million representing a CAGR of 48%. The Group

has delivered year on year Adjusted EBITDA growth with Adjusted

EBITDA progressing from GBP0.54 million in FY2016 to GBP1.00

million in FY2018 representing a CAGR of 36%. Managed services have

grown to represent 68% of revenue in the last financial year,

increasing from 53% in FY2016. In pursuit of this strategy, the

Group has positioned itself as an extension of a customer's

existing IT department, with an emphasis on consultative-led sales

focusing on solutions rather than products to guide customers

through the complexities and developments in the market. The

process is supplemented by customer service and support. The Group

invests in R&D to ensure its clients take advantage of the

latest and best solutions available to them, with a vendor/cloud

agnostic approach.

As set out in the Company's half yearly results, published on 26

November 2018, the Group's strategy includes continuing to

supplement organic growth with carefully considered acquisitions

that can add both value, through breadth of service offering and

additional sector specialisms, and scale to the existing operations

of the Group.

2.3. The Group's services

The Group provides a range of managed IT and cloud hosting

services to customers including: Public Cloud, Private Cloud and

Hybrid Cloud; managed infrastructure; virtualisation; IT support;

DRaaS and BaaS; IT security and penetration testing; enterprise

grade and SLA backed connectivity; and cloud and technology

consultancy services. Cloud hosting and managed services revenues

represented 68 per cent of the Group's turnover in the year to 31

March 2018, growing by 32 per cent on the year to 31 March

2017.

The Group also acts as a reseller of products and services to

customers. Value added reselling revenues represented 32 per cent

of the Group's revenues in the year to 31 March 2018.

3. Current trading and prospects

On 26 November 2018 the Company announced its half-yearly report

for the six months to 30 September 2018. The results demonstrated

revenue growth of 47.3% to GBP5.8m with Adjusted EBITDA growth of

300% to GBP0.56m, with recurring managed IT Services growing to

77.8% of total revenue. The Board has continued to focus on

delivering higher value managed services contracts which coupled

with management of the Group's overhead base provides the Board

with confidence of delivering its full year results to 31 March

2019 in line with market expectations.

4. Information on Certus

4.1. Overview of Certus

Certus is a mid-sized end-to-end managed IT services provider

based in Newport, South Wales. Certus was founded in 2000 and

currently provides services to approximately 130 customers who

typically have 50-250 users. Customers include Admiral,

Confused.com, gocompare.com, Hugh James and London Executive

Offices. Certus had 134 on-going customers at 31 December 2017, the

top ten customers represented 46 per cent. of invoiced revenue in

the year ended 31 December 2017. The Company has contracted future

income of approximately GBP8.7 million for the three year ends

ending 31 December 2021, of which GBP4.4 million is contracted for

the year to 31 December 2019.

The company manages its own data centre within the 250,000 sq ft

Next Generation Data facility in Newport. Certus is well invested

with 80 racks under management enabling the provision of contracted

managed services and cloud services.

Certus is a Gold Partner of Dell EMC and a Microsoft Gold

Certified Partner; it was named Dell EMC's 'cloud partner of the

year' in 2015. Certus now employs more than 40 members of

staff.

4.2. Services

Certus, as with SysGroup, provides end-to-end managed IT

services to clients across the UK. The company has an emphasis, in

revenue terms, on the following services:

o Managed services - Certus provides managed service contracts

to customers, including: 24/7 outsourced IT service desk, IaaS,

DRaaS and security solutions. The Certus service desk provides

remote systems monitoring, back-up, software and licence updates

and asset management services for customers and also offers remote

and on-site end-user support. Managed IT service contracts with

clients are typically for a three-year term.

o Consultancy - Certus works with its customers who require both

cloud hosted and on-premise solutions. Through its consulting

services division, Certus is able to support its clients on their

transitional journey to the cloud by engaging in both short and

long term projects on behalf of its customers. Solutions include

migrations from on-premise infrastructure to cloud hosted

infrastructure and refreshes of existing on-premise

infrastructure.

o Value added resale - Certus provides complete vendor

management services to its customers supported by its relationships

with suppliers such as Dell EMC and Arrow ECS. Complimentary to the

managed services offering customers can rely on Certus for the

supply, provision and deployment of their on-premise hardware

requirements which is in support of the end-to-end solutions

provided.

4.3. Summary financial results of Certus

Set out below are the audited financial results of Certus for

the years ending 31 December 2016 and 31 December 2017, prepared

under FRS 102:

Profit and loss

GBP'000 2016(1) 2017(1)

Revenue 5,369 6,397

Gross Profit 2,630 2,994

EBITDA(2) 428 535

EBITDA margin

(%) 8.0% 8.4%

Profit after

tax 23 172

Balance sheet

GBP'000 2016 2017

Gross assets 3,777 3,017

Net assets 1,294 566

Note:

1. Source: audited statutory accounts of Certus

2. Before restructuring costs

5. Background and reasons for the Acquisition

The Acquisition is in line with the Group's stated strategy of

augmenting its organic growth with select acquisitions. Certus is

an established and growing managed services provider which has a

complementary service offering, geographical reach and customer

base to SysGroup. Certus will help to bolster the Group's existing

managed service offerings, by expanding the Enlarged Group's

current IaaS customers base, significantly adding to its managed

connectivity portfolio and further strengthening the existing

relationship with Dell EMC by upgrading the Group to gold partner

status. In addition, the Group's consultative led sales approach

and security focus will assist with generating cross-selling

opportunities into the Certus customer base.

Certus grew revenue by 19 per cent and EBITDA 25 per cent in the

year to 31 December 2017. 52 per cent of its 2017 revenue was

recurring in nature. The Board believes that the Acquisition will

add scale to the Enlarged Group, broaden its geographical reach and

customer base, enhance its service offering, and provide scale

benefits, as described further below.

The existing executive management team of Certus will remain

with the Enlarged Group after the completion of the Acquisition,

which the Board believes will assist with the integration of Certus

into the Group.

5.1. Acceleration of the Group's growth and opportunity for value creation

The Board believe that the Acquisition provides the following

benefits to the Group:

-- provides the Enlarged Group with critical mass in the managed

IT services market and strengthens the Group's core service

offering;

-- broadens the Enlarged Group's penetration into new vertical

markets, including into the Professional Services and Manufacturing

sectors;

-- provides cross-selling opportunities to offer Certus'

customers the access to the capabilities and services of the

Enlarged Group;

-- enhances the Group's newly structured Sales & Marketing team;

-- expands the Group's geographical coverage into South Wales and the M4 corridor; and

-- brings Dell EMC Gold Partner status to the Enlarged Group,

complementing SysGroup's portfolio of senior vendor

partnerships.

5.2. Operational benefits

The Board believes that Certus will also bring operational

benefits to the Enlarged Group:

-- provide the potential for economies of scale for the Enlarged

Group by way of greater buying power

-- dilution of central costs;

-- reduce the cost of the Group's existing footprint with the addition of Certus' datacentre;

-- provides complimentary technical ability which could support

larger managed services projects; and

-- further dilutes the Group's already low customer revenue concentration.

6. Principal terms of the Acquisition

6.1. Acquisition Agreement

Under the terms of the Acquisition Agreement, the Company has

conditionally agreed to acquire Certus from the Vendors for an

Initial Consideration of GBP8.0 million to be satisfied in cash

(the "Initial Consideration") on a debt-free, cash-free and

normalised working capital basis.

The Acquisition Agreement contains warranties and indemnities in

favour of SysGroup customary for a transaction of this nature. The

warranties relating to the Vendors' title to the shares being sold

and their capacity to sell such shares were given on signing of the

Acquisition Agreement and will be repeated prior to completion of

the Acquisition ("Completion"). The remaining warranties relating

to the business of Certus were also given on signing of the

Acquisition Agreement and will be repeated prior to Completion and

SysGroup has, amongst other things, a right to terminate in the

event the Placing Agreement is terminated or there is a material

breach of any of the warranties. Completion of the Acquisition is

conditional, amongst other things, on the receipt of the

subscription monies relating to the Placing Shares.

6.2. Earn out consideration

Under the Acquisition Agreement, further contingent

consideration of up to a maximum of GBP1.0 million may be payable

subject to the achievement of financial performance criteria (the

"Earn-out Consideration"). Payment of the Earn-out Consideration is

based upon the financial performance of Certus for the 12 month

period following the completion of the Acquisition ("Completion"),

(the "Earn-out Period"). The Earn-out Consideration is structured

such that for each GBP1 of EBITDA (subject to not less than 70 per

cent. of gross profit being derived from recurring revenue) over

GBP1.2 million that Certus generates during the Earn-out Period,

SysGroup will pay GBP2.50 to the Vendors, capped at total Earn-out

Consideration of GBP1.0 million.

7. Details of Placing and use of proceeds

The Company has conditionally raised approximately GBP10 million

(before commissions and expenses) through the conditional placing

of the Placing Shares at the Placing Price.

The Placing Shares, when issued, will represent approximately

53.2 per cent. of the Company's Enlarged Share Capital immediately

following Admission. The Placing Shares will rank in full for all

dividends with a record date on or after the date of Admission and

otherwise equally with the Ordinary Shares in issue from the date

of Admission. It is expected that the Placing Shares will be

admitted to trading on AIM on 25 February 2019.

The Placing (which is not being underwritten) is conditional,

amongst other things, upon:

(a) the Placing Agreement becoming unconditional in all respects

(save for Admission) and not having been terminated in accordance

with its terms prior to Admission;

(b) the Placing Resolutions set out in the Notice of General

Meeting being approved by Shareholders; and

(c) Admission of the Placing Shares becoming effective on or

before 8.00 am on 25 February 2019 or such later date as the

Company and Shore Capital may agree, being no later than 8.00 am on

31 March 2019.

The Placing is not conditional on the Acquisition completing and

therefore there is a risk, albeit the Directors consider it

unlikely, that the Placing will complete and the Acquisition will

not complete. The Directors believe that if Admission occurs and

therefore the Placing completes, it is unlikely that the

Acquisition will not complete. Consequently, given the nature of

the risk, the Directors have not considered it necessary to

consider alternative uses for the net proceeds from the Placing if

the Acquisition does not complete, apart from that the Company

would use the net proceeds in a way which is in the best interests

of the Shareholders as a whole, including to provide additional

working capital for the Enlarged Group.

7.1. Settlement and dealings

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that Admission will become effective and that dealings in the

Placing Shares will commence on 25 February 2019, subject to the

passing of the Placing Resolutions at the General Meeting.

The Placing Shares being issued pursuant to the Placing will, on

Admission, rank in full for all dividends and other distributions

declared, made or paid on the Ordinary Shares after Admission and

will otherwise rank pari passu in all respects with the issued

Ordinary Shares.

7.2. Use of proceeds

The Company intends to use the net proceeds of the Placing to

finance the Acquisition and to provide additional working capital

for the Enlarged Group.

8. New Banking Facilities

The Company has conditionally re-financed its existing term loan

facility as a GBP1.75 million term loan over five years and

arranged a new GBP3.25 million acquisition revolving credit

facility with Santander to provide additional financial flexibility

for the Group. The Banking Facilities have terms of five years with

covenants that will be tested quarterly on a 12 month rolling basis

relating to interest cover, net debt to Adjusted EBITDA leverage

and debt service cover.

9. Working Capital

The Directors are of the opinion, having made due and careful

enquiry, that, taking into account the net proceeds of the Placing,

the new Banking Facilities and the existing cash resources

available to the Enlarged Group, the Enlarged Group has sufficient

working capital for its present requirements, that is for at least

12 months from the date of Admission.

10. Related party transactions

Gresham House Asset Management Limited and Canaccord Genuity

Group Inc each hold an interest in more than 10 per cent. of the

Company's Existing Ordinary Shares and are therefore considered

related parties of the Company under the AIM Rules. Gresham House

Asset Management Limited and Canaccord Genuity Group Inc have

unconditionally agreed to subscribe for 5,620,386 Placing Shares

and 3,421,053 Placing Shares respectively.

Michael Edelson, Chairman of the Company, has unconditionally

agreed to subscribe for 131,579 Placing Shares and Praetura Group

Limited, in which Michael Fletcher, a Non-Executive Director of the

Company, has a controlling interest, has also unconditionally

agreed to subscribe for 1,710,526 Placing Shares.

The participations in the Placing by Gresham House Asset

Management Limited and Canaccord Genuity Group Inc are related

party transactions under Rule 13 of the AIM Rules. The Directors

consider, having consulted with the Company's Nominated Adviser,

Shore Capital, that the terms of the related party transactions are

fair and reasonable insofar as Shareholders are concerned.

The participations in the Placing by Michael Edelson and

Praetura Group Limited are also related party transactions under

Rule 13 of the AIM Rules. The independent Directors of the Company

consider, having consulted with the Company's Nominated Adviser,

Shore Capital, that the terms of the related party transactions are

fair and reasonable insofar as Shareholders are concerned. The

independent Directors of the Company comprise Adam Binks, Martin

Audcent and Mark Quartermaine.

Following Admission, the interests in the Company of Gresham

House Asset Management Limited, Canaccord Genuity Group Inc,

Michael Edelson and Praetura Group Limited will be as follows:

Shareholder Number of Existing Percentage of Number of New Percentage of

Ordinary Shares(1) existing share Ordinary Shares Enlarged Share

capital(1) Capital

Gresham House Asset

Management Limited 4,603,700 19.93 10,224,086 20.7

Canaccord Genuity

Group Inc 3,153,976 13.65 6,575,029 13.3

Michael Edelson 726,600 3.14 858,179 1.74

Praetura Group

Limited(2) Nil Nil 1,710,526 3.46

(1) As at 3 December 2018

(2) Michael Fletcher, a Non-Executive Director of the Company,

has a controlling interest in Praetura Group Limited

11. Irrevocable undertakings

The Company has received irrevocable undertakings to vote in

favour of the Resolutions from Directors who hold, or are

interested in, an aggregate of 872,642 Existing Ordinary Shares,

representing 3.78 per cent. of the Company's current issued share

capital.

APPIX II

TERMS AND CONDITIONS OF THE PLACING

IMPORTANT INFORMATION ON THE PLACING FOR INVITED PLACEES ONLY.

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE PLACING.

THIS ANNOUNCEMENT DOES NOT ITSELF CONSTITUTE AN OFFER FOR THE SALE

OR SUBSCRIPTION OF ANY SECURITIES IN THE COMPANY.

THIS ANNOUNCEMENT (INCLUDING THIS APPIX) (THE "ANNOUNCEMENT") IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND THE

REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH

PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance and persons needing advice should consult an

independent financial adviser.

Capitalised terms not otherwise defined in this appendix are as

defined in the Circular relating to the Placing of which this

appendix forms a part. References in these Terms and Conditions to

Shore Capital refer to Shore Capital Stockbrokers Limited and/or

Shore Capital and Corporate Limited as the context admits.

References to Bookrunner refer to Shore Capital Stockbrokers

Limited.

These Terms and Conditions do not constitute an offer or

invitation to acquire, underwrite or dispose of, or any

solicitation of any offer or invitation to acquire, underwrite or

dispose of, any Placing Shares or other securities of the Company

to any person in any jurisdiction to whom it is unlawful to make

such offer, invitation or solicitation in such jurisdiction.

Persons who seek to participate in the Placing ("Placees") must

inform themselves about and observe any such restrictions and must

be persons who are able to lawfully receive this Announcement in

their jurisdiction. In particular, these Terms and Conditions do

not constitute an offer or invitation (or a solicitation of any

offer or invitation) to acquire, underwrite or dispose of or

otherwise deal in any Placing Shares or other securities of the

Company in the United States of America, its territories and

possessions ("United States"), Canada, Australia, Japan, Republic

of Ireland or the Republic of South Africa or in any other

jurisdiction in which any such offer, invitation or solicitation is

or would be unlawful ("Restricted Jurisdiction").

The Placing Shares have not been, and will not be, registered

under the United States Securities Act of 1933, as amended (the

"Securities Act") or under the securities laws or with any

securities regulatory authority of any state or other jurisdiction

of the United States and may not be offered, sold, taken up,

renounced, delivered or transferred, directly or indirectly, in the

United States or to or by a person resident in or for the account

of any person in the United States absent registration under the

Securities Act or pursuant to an available exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States.

No public offering of the Placing Shares is being made in the

United Kingdom or elsewhere. Members of the public are not eligible

to take part in the placing and no public offering of Placing

Shares is being or will be made. This Announcement and the terms

and conditions set out and referred to in it are directed only at

persons selected by Shore Capital who are (a) persons in member

states of the European Economic Area (other than the United

Kingdom) who are "qualified investors" falling within the meaning

of article 2(1)(e) (as amended) of the EU Prospectus Directive

(which means directive 2003/71/EC (as amended) and includes any

relevant implementing directive measure in any member state) (the

"Prospectus Directive"); (b) if in the United Kingdom, to persons

who (i) have professional experience in matters relating to

investments falling within article 19(1) of The Financial Services

and Markets Act (Financial Promotion) Order 2005, as amended

("FPO") and who fall within the definition of "investment

professionals" in article 19(5) of the FPO or fall within the

definition of "high net worth companies, unincorporated

associations etc" in article 49(2)(a) to (d) of the FPO and (ii)

are "qualified investors" as defined in section 86 of The Financial

Services and Markets Act 2000, as amended ("FSMA"); or (c) persons

to whom it may otherwise lawfully be communicated (all such persons

together being referred to as "Relevant Persons").

No action has been taken by the Company, Shore Capital, or any

of their respective directors, officers, partners, agents,

employees or affiliates that would permit an offer of the Placing

Shares or possession or distribution of this Announcement or any

other publicity material relating to such Placing Shares in any

jurisdiction where action for that purpose is required. Persons

receiving this Announcement are required to inform themselves about

and to observe any restrictions contained in this Announcement.

This Announcement does not itself constitute an offer for sale

or subscription of any securities in the Company. This Announcement

and the terms and conditions set out herein must not be acted on or

relied on by persons who are not Relevant Persons. Any investment

or investment activity to which this Announcement relates is

available only to Relevant Persons and will be engaged in only with

Relevant Persons. Distribution of this Announcement in certain

jurisdictions may be restricted or prohibited by law. Persons

distributing this announcement must satisfy themselves that it is

lawful to do so.

These Terms and Conditions apply to Placees, each of whom

confirms his or its agreement, whether by telephone or otherwise,

with Shore Capital to subscribe and pay for Placing Shares in the

Placing, and hereby agrees with the Bookrunner and the Company to

be legally and irrevocably bound by these Terms and Conditions

which will be the Terms and Conditions on which the Placing Shares

will be acquired in the Placing and each such Placee is deemed to

have read and understood this Announcement in its entirety

(including this appendix) and to be providing the representations,

warranties, undertakings, agreements and acknowledgements contained

in this appendix.

These Terms and Conditions must not be acted on or relied on by

persons who are not Relevant Persons. Any investment or investment

activity to which the Terms and Conditions set out herein relates

is available only to Relevant Persons and will be engaged in only

with Relevant Persons. A Placee may not assign, transfer, or in any

manner, deal with its rights or obligations under the agreement

arising from the acceptance of the Placing, without the prior

written agreement of the Bookrunner or in accordance with all

relevant requirements.

All times and dates in this appendix are references to times and

dates in London (United Kingdom).

Any indication in this Announcement of the price at which the

Company's shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Company.

Shore Capital and Corporate Limited, which is authorised and

regulated by the FCA, acts as nominated adviser to the Company for

the purposes of the AIM Rules. Shore Capital Stockbrokers Limited

is a member of the London Stock Exchange and is authorised and

regulated by the FCA. Shore Capital and Corporate Limited and Shore

Capital Stockbrokers Limited are acting exclusively for the Company

and for no one else in connection with the Placing and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of Shore Capital or for providing

advice in relation to the Placing, or any other matters referred to

in this Announcement.

Save for the responsibilities and liabilities, if any, of Shore

Capital under FSMA or the regulatory regime established thereunder

or in respect of fraudulent misrepresentation, no representation or

warranty, express or implied, is or will be made as to, or in

relation to, and no responsibility or liability is or will be

accepted by or on behalf of Shore Capital or by its affiliates,

agents, directors, officers and employees as to, or in relation to,

the accuracy or completeness of this Announcement or any other

written or oral information made available to or publicly available

to any interested party or its advisers, and any liability therefor

is expressly disclaimed.

EACH PLACEE SHOULD CONSULT WITH ITS OWN ADVISERS AS TO LEGAL,

REGULATORY, TAX, BUSINESS AND RELATED ASPECTS OF AN ACQUISITION OF

PLACING SHARES.

Persons who are invited to and who choose to participate in the

Placing, by making an oral or written offer to acquire Placing

Shares, including any individuals, funds or others on whose behalf

a commitment to acquire Placing Shares is given, will be deemed to

have read and understood this Announcement in its entirety and to

be making such offer on the Terms and Conditions, and to be

providing the representations, warranties, acknowledgements and

undertakings, contained in this appendix. In particular each such

Placee represents, warrants and acknowledges that:

i. it is a Relevant Person (as defined above) and undertakes

that it will acquire, hold, manage or dispose of any Placing Shares

that are allocated to it for the purposes of its business;

ii. it is acquiring the Placing Shares for its own account or

for an account with respect to which it exercises sole investment

discretion; and

iii. if it is in a member state of the EEA and/or if it is a

financial intermediary, as that term is used in Article 3(2) of the

Prospectus Directive, that any Placing Shares acquired by it in the

Placing will not be acquired on a non-discretionary basis on behalf

of, nor will they be acquired with a view to their offer or resale

to, persons in any member state of the EEA in circumstances which

may give rise to an offer of securities to the public other than an

offer or resale in a member state of the EEA which has implemented

the Prospectus Directive to Qualified Investors, or in

circumstances in which the prior consent of the Bookrunner has been

given to each such proposed offer or resale.

The Bookrunner makes no representation to any Placees regarding

an investment in the Placing Shares.

Terms of the Placing

The Bookrunner has, prior to the notification of this

Announcement to a regulatory information service, entered into the

Placing Agreement with the Company under which the Bookrunner has

undertaken, on the terms and subject to the conditions set out

therein, to use its reasonable endeavours as agent of the Company

to procure Placees for the Placing Shares. This appendix gives

details of the terms and conditions of, and the mechanics for

participation in, the Placing.

Each Placee's commitment to subscribe for Placing Shares under

the Placing will be agreed (orally or otherwise) with the

Bookrunner and such agreement will constitute a binding irrevocable

commitment by a Placee, subject to the Terms and Conditions set out

in this appendix, to subscribe for and pay for Placing Shares

("Placing Participation") at the price per Placing Share notified

to Placees ("Placing Price"). Such commitment is not capable of

variation, termination or rescission by the Placee in any

circumstances except fraud. Upon making this oral offer, each

Placee has an immediate, separate, irrevocable and binding

obligation owed to the Bookrunner, as agent for the Company, to pay

the Bookrunner (or as it may direct) in cleared funds an amount

equal to the product of the Placing Price and the total number of

Placing Shares such Placee has agreed to subscribe for in the

Placing. All such obligations are entered into by the Placee with

the Bookrunner acting in its capacity as agent of the Company and

are therefore directly enforceable by the Company.

Each Placee's allocation of Placing Shares has been agreed

between the Bookrunner and the Company and will be confirmed orally

to each Placee by the Bookrunner (as agent for the Company). A

contract note confirming this allocation, the aggregate amount owed

by such Placee to the Bookrunner and settlement instructions

("Contract Note") will be despatched shortly. The oral confirmation

to such Placee by the Bookrunner (as agent for the Company)

constitutes an irrevocable legally binding commitment upon that

person (who will at that point become a Placee) in favour of the

Bookrunner and the Company to subscribe for the number of Placing

Shares allocated to it at the Placing Price on the terms and

conditions set out in this Appendix and in accordance with the

Company's articles of association. All obligations under the

Placing will be subject to fulfilment of the conditions referred to

below under "Conditions of the Placing" and to the Placing not

being terminated on the basis referred to below under "Right to

terminate the Placing Agreement". By participating in Placing, each

Placee agrees that its rights and obligations in respect of the

Placing will terminate only in the circumstances described below

and will not be capable of rescission or termination by the

Placee.

The Bookrunner and its respective affiliates are entitled to

enter bids as principal in the Placing.

Irrespective of the time at which a Placee's allocation pursuant

to the Placing is confirmed, settlement for all Placing Shares to

be subscribed for pursuant to the Placing will be required to be

made at the same time, on the basis explained below under

"Registration and Settlement".

The Company confirms that the Placing Shares will when issued,

subject to the constitution of the Company, rank pari passu in all

respects and form one class with the existing Ordinary Shares of

the Company in issue on Admission, including the right to receive

dividends or other distributions after the date of issue of the

Placing Shares, if any. The Placing Shares are or will be issued

free of any encumbrance, lien or other security interest.

Application for Admission

Application will be made to the London Stock Exchange ("LSE")

for Admission of the Placing Shares to trading on the AIM Market

operated by the LSE ("AIM"). Subject to the resolutions being

passed at the general meeting of shareholders, the details of which

are set out in the Circular, it is anticipated that Admission of

the Placing Shares to trading on AIM will become effective at

8.00am on 25 February 2019 and that dealings in the Placing Shares

will commence at that time and date for normal account

settlement.

Scaling back

Shore Capital (after consulting with the Company) reserves the

right to scale back the number of Placing Shares to be subscribed

by any Placee or the number of Placing Shares to be subscribed for

by all Placees in aggregate. Shore Capital also reserves the right

not to offer allocations of Placing Shares to any person and not to

accept offers to subscribe for Placing Shares or to accept such

offers in part rather than in whole. Shore Capital shall be

entitled to effect the Placing by such method as it shall in its

sole discretion lawfully determine in the exercise of its

appointment and the powers, authority and discretion conferred on

it as Bookrunner.

To the fullest extent permissible by law, Shore Capital nor any

holding company thereof, nor any subsidiary, branch or affiliate of

Shore Capital (each an "Affiliate") nor any person acting on behalf

of any of the foregoing shall have any liability to Placees (or to

any other person whether acting on behalf of a Placee or

otherwise). In particular, neither Shore Capital, nor any of its

Affiliates nor any person acting on behalf of any such person shall

have any liability to Placees in respect of its conduct of the

Placing.

Placing Agreement

Pursuant to the Placing Agreement, Shore Capital has agreed on

behalf of and as agent of the Company to use its reasonable

endeavours to procure persons to subscribe for the Placing Shares

at the Placing Price, subject to these Terms and Conditions. The

Placing will not be underwritten.

Conditions of the Placing

The obligations of Shore Capital under the Placing Agreement are

conditional, inter alia, on:

-- the Acquisition Agreement:

a) not having lapsed or been terminated;

b) not having been amended, altered or revised without Shore

Capital's prior written approval or consent; and

c) having become unconditional in all respects (subject only to

(a) Admission, (b) any conditions relating to the Placing Agreement

having become unconditional or not having terminated prior to

Admission and (c) payment of the consideration due on completion

thereof) and having been completed in accordance with its terms and

with the Directors not being aware of any breach under the

Acquisition Agreement;

-- the passing of the resolutions set out in the notice of

general meeting set out at the end of the Circular;

-- none of the warranties in the Placing Agreement being untrue

or inaccurate or misleading at the date of the agreement and at the

date of Admission and no fact or circumstance having arisen which

would render any of the warranties untrue or inaccurate or

misleading when repeated at Admission;

-- Admission taking place not later than 8.00am on 25 February

2019 or such later time or date as the Company and Shore Capital

may otherwise agree (but not being later than 8.00am on the Long

Stop Date).

The Placing Agreement will contain, inter alia, certain

warranties and indemnities from the Company for the benefit of

Shore Capital.

If any of the conditions contained in the Placing Agreement

("Conditions") are not fulfilled (or, where appropriate, waived in

whole or part by Shore Capital) by the times and dates stated (or

such later dates as Shore Capital and the Company may agree, being

not later than 31 March 2019, or where no such dates are specified,

31 March 2019) the Placing Agreement shall cease and determine and

no party to the Placing Agreement will have any claim against any

other party for costs, damages, charges, compensation or otherwise

except that, amongst other things, Shore Capital shall return to

prospective Placees, in accordance with the Terms and Conditions,

any monies received from them.

The Bookrunner may, in their absolute discretion and upon such

terms as it thinks fit, waive or extend the time for fulfilment of

all or any part of any of the Conditions which are capable of

waiver or extension by them but provided that the latest time for

fulfilment of any Condition shall not be later than 8.00 am on 25

February 2019. Any such waiver or extension will not affect

Placees' commitments as set out in this Announcement.

Right to terminate the Placing Agreement

Shore Capital may, in its absolute discretion, terminate the

Placing Agreement (inter alia) if: (i) it becomes aware of any

circumstance resulting in a material breach of the warranties given

to them in the Placing Agreement at the date of the agreement or

when repeated on Admission; (ii) the Company is in material breach

of any provision of the Placing Agreement or the Acquisition

Agreement; (iii) an event or other matter (including, without

limitation, any change or development in economic, financial,

political, diplomatic or other market conditions or any change in

applicable law or regulation) has occurred or is reasonably likely

to occur which, in the opinion of Shore Capital, is (or will if it

occurs be) reasonably likely to materially and adversely affect the

assets, financial position or the business or prospects of the

Company and which Shore Capital considers to be material in the

context of the Placing or to the Acquisition and/or Admission or

otherwise makes it impractical or inadvisable for Shore Capital to

perform its obligations under the Placing Agreement; (iv) an event

or omission which would materially and adversely affect the

financial position and/or prospects of the Group taken as a whole,

the Target or the Enlarged Group (as defined therein) or which in

the reasonable opinion of Shore, in good faith, is or will be or

may be materially prejudicial to the Company or to the Acquisition

and/or Admission or to the Placing or to the acquisition of the

Placing Shares by Placees.

The exercise by Shore Capital of a right of termination (or any

right of waiver exercisable by Shore Capital) contained in the

Placing Agreement or the exercise of any discretion under the Terms

and Conditions set out herein is within the absolute discretion of

Shore Capital and Shore Capital will not have any liability to

Placees whatsoever in connection with any decision to exercise or

not exercise any such rights.

By accepting the Placing Shares referred to in the Announcement

to which this appendix is annexed, each Placee agrees that, without

having any liability to such Placee, Shore Capital may exercise the

right: (i) to extend the time for fulfilment of any of the

conditions in the Placing Agreement (provided that Placees'

commitments are not extended beyond the Long Stop Date); (ii) to,

in its absolute discretion, waive, in whole or in part, fulfilment

of certain of the conditions (but not including Admission); or

(iii) to terminate the Placing Agreement, in each case without

consulting Placees (or any of them).

If any of the conditions in the Placing Agreement are not

satisfied (or, where relevant, waived), the Placing Agreement is

terminated or the Placing Agreement does not otherwise become

unconditional in all respects, the Placing will not proceed and all

funds delivered by Placees to Shore Capital pursuant to the Placing

and this appendix will be returned to Placees at their risk without

interest, and Placees' rights and obligations under the Placing

shall cease and determine at such time and no claim shall be made

by Placees in respect thereof.

Registration and settlement

Irrespective of the time at which the Placee's allocation(s)

pursuant to the Placing is/are confirmed, settlement for all

Placing Shares to be acquired pursuant to the Placing will be

required to be made on the basis explained below.

Settlement of transactions in the Placing Shares following

Admission will take place on a delivery versus payment basis in

accordance with the instructions set out in the trade confirmation

within the CREST system ("CREST") (subject to certain exceptions).

Shore Capital reserves the right to require settlement for, and

delivery of, the Placing Shares (or a portion thereof) to Placees

by such other means that it may deem necessary if delivery or

settlement is not possible or practicable within CREST within the

timetable set out in the Announcement or would not be consistent

with the regulatory requirements in the jurisdiction of any

Placee.

Subject to the resolutions being passed at the general meeting

of shareholders, the details of which are set out in the Circular,

it is expected that settlement will take place at 8.00 am on 25

February 2019 unless otherwise notified by the Bookrunner.

Interest is chargeable daily on payments not received from

Placees on the due date in accordance with the arrangements set out

above at the rate of 2 percentage points above LIBOR, with interest

compounded on a daily basis.

Each Placee is deemed to agree that, if it does not comply with

these obligations, Shore Capital may sell any or all of the Placing

Shares allocated to that Placee on such Placee's behalf and retain

from the proceeds, for its account and benefit (as agent for the

Company), an amount equal to the aggregate amount owed by the

Placee plus any interest due. The relevant Placee will, however,

remain liable for any shortfall below the aggregate amount owed by

it and may be required to bear any stamp duty or stamp duty reserve

tax or securities transfer tax (together with any interest or

penalties) which may arise in any jurisdiction upon the sale of

such Placing Shares on such Placee's behalf. By communicating a bid

for Placing Shares, each Placee confers on Shore Capital all such

authorities and powers necessary or desirable to carry out any such

sale and agrees to ratify and confirm all actions which Shore

Capital lawfully takes in pursuance of such sale.

If Placing Shares are to be delivered to a custodian or

settlement agent, Placees should ensure that the Contract Note is

copied and delivered immediately to the relevant person within that

organisation.

The Company confirms that, insofar as Placing Shares are

registered in a Placee's name or that of its nominee or in the name

of any person for whom a Placee is contracting as agent or that of

a nominee for such person, such Placing Shares should, subject as

provided below, be so registered free from any liability to UK

stamp duty or stamp duty reserve tax or securities transfer

tax.

Placees will not be entitled to receive any fee or commission in

connection with the Placing.

Further Terms, Confirmations and Warranties

By participating in the Placing, each Placee (and any person

acting on such Placee's behalf) irrevocably makes the following

confirmations, acknowledgements, representations, warranties and/or

undertakings (as the case may be) to Shore Capital (in its capacity

as Bookrunner and agent of the Company) and the Company and their

respective directors, agents and advisers, in each case as a

fundamental term of its offer to acquire and subscribe for Placing

Shares:

1 each Placee confirms, represents and warrants that it has read

and understood the Announcement (including this appendix) in its

entirety and acknowledges that its Placing Participation will be

governed by the terms, conditions, representations, warranties,

acknowledgements, agreements and undertakings in this appendix;

2 each Placee acknowledges and agrees that its Placing

Participation on the Terms and Conditions set out in this appendix

is legally binding, irrevocable and is not capable of termination

or rescission by such Placee in any circumstances and that it has

the funds available to pay the Placing Price in respect of the

Placing Shares for which it has given a commitment under the

Placing;

3 each Placee confirms, represents and warrants that it has not

relied on, received or requested nor does it have any need to

receive, any prospectus, offering memorandum, listing particulars

or any other document (other than the Announcement), any

information given or any representations, warranties, agreements or

undertakings (express or implied), written or oral, or statements

made at any time by the Company or Shore Capital or by any

subsidiary, holding company, branch or associate of the Company or

Shore Capital or any of their respective officers, directors,

agents, employees or advisers, or any other person in connection

with the Placing, the Company and its subsidiaries or the Placing

Shares and that in making its application under the Placing it is

relying solely on the information contained in the Announcement and

this appendix and it will not be relying on any agreements by the

Company and its subsidiaries or Shore Capital, or any director,

employee or agent of the Company or Shore Capital other than as

expressly set out in this appendix, for which neither Shore Capital

nor any of its directors and/or employees and/or person(s) acting

on its behalf shall to the maximum extent permitted

under law have any liability except in the case of fraud;

4 each Placee acknowledges that the content of this Announcement

and any information publicly announced to a Regulatory Information

Service by or on behalf of the Company on or prior to the date of

this Announcement is exclusively the responsibility of the Company

and that none of the Bookrunner, any of its Affiliates, directors,

officers, employees or agents, or any person acting on behalf of

any of them has or shall have any responsibility or liability for

any information, representation or statement contained in this

Announcement or any information previously or subsequently

published by or on behalf of the Company and will not be liable for

any Placee's decision to participate in the Placing based on any

information, representation or statement contained in this

Announcement, any information previously published by or on behalf

of the Company or otherwise. Each Placee further represents,

warrants and agrees that the only information on which it is

entitled to rely and on which such Placee has relied in committing

itself to subscribe for the Placing Shares is contained in this

Announcement, any information publicly announced to a Regulatory

Information Service by or on behalf of the Company on or prior to

the date of this Announcement, such information being all that it

deems necessary to make an investment decision in respect of the

Placing Shares, and that it has neither received nor relied on any

other information given or investigations, representations,

warranties or statements made by either of the Bookrunner or the

Company, or any of their respective affiliates or any person acting

on behalf of any of them (including in any research report prepared

by any of them) and none of the foregoing persons will be liable

for any Placee's decision to accept an invitation to participate in

the Placing based on any such other information, representation,

warranty or statement. Each Placee further acknowledges and agrees

that it has relied on its own investigation of the business,

financial or other position of the Company in deciding to

participate in the Placing and that neither the Bookrunner nor any

of its Affiliates have made any representations to it, express or

implied, with respect to the Company, the Placing and the Placing

Shares or the truth, accuracy, completeness or adequacy of any

publicly available information about the Company or any other

information that has otherwise been made available to Placees

concerning the Company, whether at the date of publication, the

date of this Announcement or otherwise, and each of them expressly

disclaims any liability in respect thereof. Nothing in this

paragraph or otherwise in this Announcement excludes the liability

of any person for fraudulent misrepresentation made by that

person;

5 each Placee confirms, represents and warrants that it is

sufficiently knowledgeable to understand and be aware of the risks

associated with, and other characteristics of, the Placing Shares

and, among others, of the fact that it may not be able to resell

the Placing Shares except in accordance with certain limited

exemptions under applicable securities legislation and regulatory

instruments;

6 each Placee confirms, represents and warrants, if a company or

partnership, that it is a valid and subsisting company or

partnership and has all the necessary capacity and authority to

execute its obligations in connection with the Placing

Participation and confirms, represents and warrants that any person

who confirms to Shore Capital on behalf of a Placee an agreement to

subscribe for Placing Shares is duly authorised to provide such

confirmation to Shore Capital;

7 each Placee agrees that the entry into the Placing Agreement

or the exercise by Shore Capital of any right of termination or any

right of waiver exercisable by Shore Capital contained in the

Placing Agreement or the exercise of any discretion is within the

absolute discretion of Shore Capital, and Shore Capital will not

have any liability to any Placee whatsoever in connection with any

decision to exercise or not exercise any such rights. Each Placee

acknowledges that if: (i) any of the conditions in the Placing

Agreement are not satisfied (or, where relevant, waived); (ii) the

Placing Agreement is terminated; or (iii) the Placing Agreement

does not otherwise become unconditional in all respects; the

Placing will lapse and such Placee's rights and obligations in

relation to the Placing shall cease and determine at such time and

no claim shall be made by any Placee in respect thereof;