RNS Number:4572Q

Starvest PLC

24 August 2005

RNS announcement for release Wednesday 24 August 2005

Results for the year ended 31 July 2005

Chairman's Statement to Shareholders

I am pleased to present my fourth annual statement to Shareholders for the year

ended 31 July 2005.

Highlights

Your Directors continue to pursue the chosen investment policy which shows every

sign of generating exciting results in the future as it has in the past twelve

months to 31 July 2005 which record:

* a gross profit of #594,219,

* a profit before tax of #389,181, and

* a profit after tax of #304,181.

As at 31 July 2005, the Group had:

* #193,693 cash in the bank;

* net current assets and net assets of #1,698,905, an increase of 22%

during the year;

* trading investments with a mid market valuation of #6,500,000, a fall

of 5.65%;

* unrealised investment profits of #4,891,000.

The underlying net asset value per share based on the mid market quotations as

at 31 July 2005 was 16.9 pence, a reduction since 31 July 2004 when it was 19

pence. However, by the close of business on 19 August 2005, this had recovered

to 18.69 pence. These values are stated on a fully diluted basis but before tax

on unrealised profits.

No dividend is proposed for the year.

Review of business and current activities

Your Company has 90% by value of its current investments in the natural resource

sector where declining sentiment has been a feature of the market and therefore

of share prices during the past few months. Therefore, it is not surprising to

find that the net asset value has fallen since the high point at the end of

January 2005.

This situation presents both challenges and opportunities. Notwithstanding the

market conditions, your Board remains of the opinion that the natural resources

sector holds considerable promise for exciting growth in the medium term. Much

is written about the insatiable demand of China for access to natural resources;

we believe that the population explosion in India, leading to increased economic

growth, will significantly increase its demands too.

The fact that your Company was able to take profits at a high point and so hold

#744,000 of cash at 31 January 2005 has enabled us to acquire three new

investments at attractive prices as well as add to two others during the past

six months.

Your company now holds a spread of eighteen investments of which eleven are

quoted on AIM, six are quoted on OFEX and one which joined OFEX during August.

In addition, we are committed to a further opportunity which is expected to be

quoted on OFEX during September 2005.

Your Company now has board representation on four investee companies: Tony

Scutt is a non executive director of Agricola Resources plc and of Beowulf

Mining plc; John Watkins is a non executive director of Red Rock Resources plc

and of Regency Mines plc.

The Company continues to seek opportunities to invest in small company new

issues and support pre-IPO opportunities so as to enhance shareholder value and

to make disposals as market conditions permit.

Funding requirement

In my 2004 Annual Report, I indicated that a further fundraising was possible by

the end of 2004. In the event, we were able to raise cash to finance new

investment opportunities by taking a very acceptable profit on investments, thus

avoiding the necessity of raising new money at a substantial discount to the net

asset value. Future funding requirements will be met from investment sales and

other opportunities which may arise.

Outlook

Given the increased spread of investments, the Directors look forward with

optimism to reporting increased asset values in the year ahead given the

exciting opportunities which continue to be open to us. We have made an

encouraging start with a 10% increase in net asset value by the close of

business on 19 August 2005.

We look forward to reporting further progress in mid November when we plan to

issue the next Chairman's update.

We will recommend a first dividend as soon as circumstances permit.

We plan to hold our annual general meeting on Tuesday 11 October when we look

forward to meeting those able to attend.

R Bruce Rowan

Chairman & Chief Executive

24 August 2005

Telephone: 020 7486 3997

Review of portfolio

Starvest's trade investment portfolio at 31 July 2005 comprised:

African Platinum plc ("Afplats") - (AIM: APP), formerly, Southern African

Resources plc

Website: www.afplats.com

The progress of Afplats towards establishing itself as a major platinum group

metal (PGM) resource company in Southern Africa has continued, with a

significant broadening of its international institutional investor base. A

successful #15.5m North American placement at 30p in late 2004 will finance the

bankable feasibility study on its PGM +Gold (4E) mine project on the flagship

Leeuwkop prospect on the Bushveld complex in South Africa.

A three-dimensional survey on the Leeuwkop prospect was completed in April with

final data interpretation due for completion by end 2005; initial results having

confirmed the company's geological model. Updated resource numbers show 50m

ounces of 4E, with 8m ounces indicated and 42m inferred. Further prospecting

rights granted could result in a resource base of over 100m ounces of 4E in its

greater Leeuwkop development plan.

A secondary listing is expected this year on the American Stock Exchange.

Agricola Resources plc - (OFEX: AGC)

Website: www.agricolaresources.com

Agricola has broadened its base by acquiring two uranium exploration areas over

153 sq km of Finland. The first consists of ten claims in Eastern Finland,

including the only previously operated uranium mine in Finland which produced 30

tonnes of uranium in yellowcake (solid uranium oxide) during a test mining

operation in 1960-61; the second comprises seven claims in northern Finland.

Agricola has been encouraged by advice received from the Geological Survey of

Finland and radon survey results; further radon testing is planned before

drilling later in 2005. The Finnish Government plans to build a fifth nuclear

power plant so demand is expected to grow; until now all its uranium

requirements have been imported.

Agricola's interests in platinum exploration and development are confined to the

island of Unst in the Shetland and to the Klappsjo area of Central Sweden.

Belmore Resources (Holdings) plc - (OFEX: BEL)

Belmore was successfully admitted to OFEX in March 2005, enjoying a 30%

over-subscription. A net 320,000 Euros was raised at 5p per share to finance

its programme of exploration drilling in County Clare, as well as desk studies

and fieldwork on its other licences in the Republic of Ireland and Northern

Ireland. A further placing was made in June at 5.75p for working capital

purposes. Belmore's principal County Clare project targets zinc where it has a

50% interest in eight prospecting licences covering 330 sq. km.

Beowulf Mining plc - (AIM: BEM)

Website: www.beowulfmining.com

Beowulf graduated from OFEX to AIM in May 2005 and remains focused on

exploration for world-class copper, gold and uranium deposits in Northern Sweden

encouraged by the county's favourable fiscal climate for incoming mining and

exploration companies. Beowulf's interests include Jokkmokk where a world-class

drill intersection was obtained on the Majves 1 exploration permit. Most of the

initial exploration was undertaken by Phelps Dodge Exploration Sweden; they have

recently withdrawn for undisclosed reasons, but Beowulf will continue alone or

seek another partner. In addition, Beowulf has: Grundtrask, with mineral rights

over 43 sq. km; Ballek with two exploration permits over 78 sq km issued in May

2005 where uranium rich boulders have been discovered and Gold Fields

Exploration has a right of first refusal which it is hoped will lead to a joint

venture; Ussalahti with three exploration permits seen as prospective for

massive sulphide copper and gold deposits.

Review of portfolio, continued

Black Rock Oil & Gas plc - (AIM: BLR)

Website: www.blackrockpetroleum.com.au

This oil and gas exploration company has a broad range of exploration interests

including four licences in Southern England, one in Jordan and minor interests

in Western Australia. In addition, it has a licence in Colombia where it has

farm-in terms with Kappa Energy, a privately-owned company with bases in Bogota

and Calgary, from which it has taken 50% of the Las Quinchas licence in the

Middle Magdalena Basin, a province with a prolific production history.

Black Rock has indicated that it is seeking further deals to expand its

interests outside the UK and Ireland, with the emphasis on near-term production

and low-risk exploration. In May it raised #880,000 at 1.4p per share for such

future deals. Black Rock will come to attention if the Sandhills project on the

Isle of Wight, in which it holds a 5% interest, meets with drilling success

early in 2006. Before then drilling results on its 40% interest gas well in the

Southern North Sea are expected.

Brazilian Diamonds Limited - (AIM: BDY)

Website: www.braziliandiamonds.com

Brazilian Diamonds is starting to benefit from the diamond exploration data

bases acquired in cash and shares from De Beers, which is now a 3% shareholder.

This deal was funded by an earlier #1.8 million placing of shares and by the

disposal of a 16% interest it held in Hidefield. As a result, Brazilian

Diamonds expects to start mining diamonds in 2006 from its 200,000 hectares in

Minas Gerias, a province south of Brasilia. Other projects may also soon be

productive: its Canastra licences await clearance from the Federal Environment

Agency; drilling on its Tuscano 1 project has successfully intercepted

kimberlite; two further projects on the Santo Antonio de Bonito River north of

Canastra could yet yield a large-scale alluvial diamond mine, the kimberlite

source of which Brazilian Diamonds may have located separately. Brazilian

Diamonds seems to have a realistic chance of becoming Brazil's first kimberlite

diamond producer.

Carpathian Resources Limited - (AIM: CPNR and Sydney ASX)

Carpathian Resources, based in Perth, Western Australia, is an oil and gas

exploration and production company focusing on Central Europe, currently on the

Czech Republic and Slovakia. It has recently carried out a re-mapping and

re-evaluation of its Ja11 prospect (Unigeo operator) following re-processing of

its related seismic data and announced the results as "extremely encouraging".

The well, in which Carpathian holds 60%, is now targeting a gas prospect with

the potential to hold up to 6.5 BCF of gas. Drilling of Ja11 should be

completed by mid-September and with the well only 1.5 km from the 2004 Ja3a gas

discovery, the results will be important for the Company.

Franconia Minerals Corporation - (OFEX: FRA and Toronto TSV-V)

Website: www.franconiaminerals.com

Alberta based Franconia Minerals has three areas of exploration acreage in the

USA: the first is the Birch Lake property in the Duluth Complex of Minnesota

with an inferred platinum-group metal, copper, nickel resource of an estimated

51 million tones; the second is the San Francisco property, a high-grade zinc

exploration target covered by a joint venture agreement with Teck Cominco, and

with a successful limited previous drilling history; and the third is the

Mahoney property, a high-grade zinc target in New Mexico, with

platinum-palladium targets in the Duluth Complex of Minnesota.

Franconia recently reported positive pressure leaching results undertaken on the

Birch Lake property, which Franconia's President described as strengthening

their belief in the potential economic viability of the project.

Review of portfolio, continued

Gippsland Limited - (AIM: GIP and Sydney ASX)

Website: www.gippslandltd.com.au

Gippsland is a natural resources developer of world-scale mining projects in

Egypt and Tasmania. These consist of the Abu Dabbab and Nuweibi tantalum, tin,

feldspar projects and the Wadi Allaqi gold, copper, nickel projects, both in

Egypt; and the Zeehan tin project in Tasmania.

The Abu Dabbab deposit is covered by exploration leases in which Gippsland has

an equal interest with the Egyptian Government. The project has an end capital

requirement of some $65 million which is expected to be funded by a combination

of debt and equity. The project could be the world's second largest tantalum

producer from which the anticipated 650,000 lbs production has been pre-sold for

the first 5 years.

Gippsland has 50% interests in both the Nuweibi and the Wadi Allaqi projects,

and a 40% joint venture interest in the Zeehan project with the insolvent public

company Western Metals Ltd presently in administration. With the price of tin

having recently improved, Gippsland is considering various commercial and

technical options resolving the present impasse.

Hidefield Gold plc - (AIM: HIF)

Website: www.hidefield.co.uk

Hidefield acquires and develops gold projects of merit in North and South

America where it has a large portfolio. Hidefield's management seeks to

maximize opportunity while reducing the considerable risks associated with

mineral exploration by identifying and acquiring projects at the lowest cost

possible and having them independently funded and managed by associate companies

in which Hidefield has a substantial interest and board representation. Its

North American assets are managed in this manner, whereas its projects in Brazil

and Argentina are directly owned, its principal operational activities being the

Cata Preta gold project in the "Iron Quadrangle" of Minas Gerais, Brazil.

Hidefield has been active in securing new interests in the past year; a recent

transaction was its agreement with Minera Sud Argentina SA whereby it obtained

the option to acquire a 50% participating interest in sixteen gold exploration

licences in the Santa Cruz, Chubut and Rio Negro provinces of Argentina.

India Star Energy plc - (AIM: INDY)

India Star Energy, an investment company seeking to invest in the oil, gas and

metals sectors was introduced to AIM following a placement of shares in February

2005. It has recently acquired a 50% share in a joint venture with East West

Resources Corporation to develop uranium properties, the first being a North

West Ontario property called Maggotte where surface geophysical studies are to

be undertaken.

Matisse Holdings plc - (AIM: MAT)

Matisse is a cash shell, with the objective of investing in publishing

businesses. It is pursuing a number of opportunities which, if completed, are

likely to be classified under AIM rules as a reverse take-over.

Myhome International plc - (OFEX: MYH)

Website: www.myhomeplc.com

Myhome, established originally by Unilever which remains a shareholder, is a

leading home services franchise business currently enjoying an impressive

expansion rate across the UK. By careful selection and training policies,

Myhome management has ensured that its franchise partners have developed a sound

reputation for providing premium house cleaning services to the residential

market. Currently these are limited to cleaning and carpet care, but could be

extended to gardening services, lawn and pool care, home security etc. Thirty

new franchises a year has been set as an internal target. Myhome's franchise

programme has been accredited by the British Franchise Association.

Review of portfolio, continued

The valuable experience gained in converting its localized direct services into

franchise operations UK wide has led Myhome to promote Franchise Investment

Strategies plc - (OFEX: FIN), a consultancy venture aimed at applying its

franchising model to other lines of business. Myhome and Starvest both hold

interests in this new venture which joined OFEX on 18 August 2005.

Red Rock Resources plc - (AIM: RRR)

Website: www.rrrplc.com

Red Rock Resources was admitted to AIM at the end of July 2005 following a

placing to raise #476,000 net of expenses. It has been established as a mineral

exploration and development company focused on iron ore and manganese projects

in Western Australia and in Tasmania where it has acquired a total of nine

tenements of which it will be a 100% beneficiary. Mapping, geophysics and

drilling will be carried out for further evaluation purposes. Regency Mines plc

holds a controlling interest.

Regency Mines plc - (AIM: RGM)

Website: www.regency-mines.com

Regency Mines was admitted to AIM in February 2005 following a successful offer

that was over-subscribed at a time when the market was enjoying a minor boom in

resource stock valuations. Its objective of investing in established projects

in the mining and minerals sector, more especially in producing assets, and

primarily Australian-based, was soon evidenced with a flurry of acquisitions of

iron ore and gold projects in Western Australia and two iron ore projects in

Tasmania. Regency has since spun off 28% of its subsidiary Red Rock Resources

but retains direct ownership of its Bundarra copper-gold project in Queensland

and of various nickel assets.

Sheba Exploration (UK) plc - (OFEX: SHE)

Website: www.shebagold.com

This UK registered company was incorporated in July 2004 to acquire the whole of

the capital of the Sheba Exploration Ltd, a gold explorer in Ethiopia with the

Amora Hill gold mineralization discovery in the Mereto concession to its credit.

During September 2004 it was admitted to OFEX.

A detailed trench survey at Amora Hill has been completed with encouraging

results. Wider regional grassroots exploration work and the acquisition of

further new licences, not just within Ethiopia, are being considered by

management as an appropriate near-term work-plan.

St Helen's Capital plc - (OFEX: STH)

Website: www.sthelenscapital.co.uk

St Helen's Capital is a dynamic and innovative integrated corporate finance

house that has rapidly established itself as a conduit for the introduction of

fledgling companies to the junior London markets. As an FSA regulated financial

advisor and arranger of funding and financial services, St Helen's is a valuable

contributor to the surge of interest shown in the OFEX market in which it

specialises, arranging regular introductions and acting as corporate adviser to

a growing list of OFEX companies. St Helen's saw its client Oakdene Homes plc

win the OFEX Company of the Year award, and was itself nominated for the Best

Corporate Adviser of the Year award.

Consolidated profit and loss account

for the year ended 31 July 2005

Year ended Year ended

31 July 2005 31 July 2004

# #

Operating income 628,019 305,232

Direct costs (33,800) (36,250)

Gross profit 594,219 268,982

Administrative expenses (205,038) (203,172)

Profit on ordinary activities before taxation 389,181 65,810

Tax on profit on ordinary activities 85,000 9,500

Profit on ordinary activities after taxation 304,181 56,310

Retained profit for the year 304,181 56,310

Earnings per share - basic 0.82 pence 0.18 pence

Earnings per share - diluted 0.74 pence 0.17 pence

There are no recognised gains or losses in either year other than the profit for

the year.

All of the operations are considered to be continuing.

The accompanying accounting policies and notes form an integral part of these

financial statements.

Consolidated balance sheet

As at 31 July 2005

31 July 2005 31 July 2004

# #

Fixed assets

Tangible assets - -

Current assets

Debtors 50,538 22,727

Trade investments 1,578,456 793,857

Cash at bank 193,693 606,417

1,822,687 1,423,001

Creditors - amounts due within one (123,782) (28,277)

year

Net current assets 1,698,905 1,394,724

Total assets less current 1,698,905 1,394,724

liabilities

Share capital and reserves

Called-up share capital 372,173 372,173

Share premium account 2,026,396 2,026,396

Profit and loss account (1,124,074) (1,428,255)

Merger reserve 424,410 424,410

Equity shareholders' funds 1,698,905 1,394,724

Company balance sheet

As at 31 July 2005

31 July 2005 31 July 2004

# #

Fixed assets

Investments 435,794 435,794

Current assets

Debtors 50,538 22,727

Trade investments 1,578,456 793,857

Cash at bank 193,693 606,417

1,822,687 1,423,001

Creditors - amounts due within one (559,576) (464,071)

year

Net current assets 1,263,111 958,930

Total assets less current 1,698,905 1,394,724

liabilities

Share capital and reserves

Called-up share capital 372,173 372,173

Share premium account 2,026,396 2,026,396

Profit and loss account (699,664) (1,003,845)

Equity shareholders' funds 1,698,905 1,394,724

Consolidated cash flow statement

for the year ended 31 July 2005

Year ended Year ended

31 July 2005 31 July 2004

# #

Net cash outflow from operating activities (404,865) (339,707)

Taxation paid (7,859)

Cash outflow before management of liquid resources (412,724) (339,707)

and financing

Management of liquid resources - (559,502)

Financing - issue of Ordinary share capital - 769,664

Decrease in cash in the year (412,724) (129,545)

The financial information set out above does not constitute statutory accounts

as defined in section 240 of the Companies Act 1985.

The balance sheets at 31 July 2005, the consolidated profit and loss account,

and the consolidated cash flow statement for the year then ended have been

extracted from the Group's statutory financial statements upon which the

auditors' opinion is unqualified and does not include any statement under

Section 237 of the Companies Act 1985.

Copies of the report and financial statements will be posted to Shareholders on

12 September and be available for one month from the Company Secretary at the

registered office from Tuesday 20 September 2005.

123 Goldsworth Road, Woking, Surrey, GU21 6LR

email: email@starvest.co.uk

Alternatively, the report may be downloaded from the Company's website,

www.starvest.co.uk.

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR QZLFLEVBLBBV

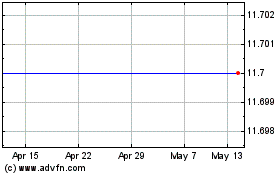

Starvest (LSE:SVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Starvest (LSE:SVE)

Historical Stock Chart

From Apr 2023 to Apr 2024