TIDMSSE

RNS Number : 0543G

SSE PLC

22 July 2021

SSE PLC

Q1 2021/22 TRADING STATEMENT

22 JULY 2021

This Trading Statement provides an update on operational

performance ahead of today's AGM and captures key developments

since the publication of SSE's Preliminary Full-year Results

Statement on 26 May 2021. SSE remains committed to the five-year

dividend plan to March 2023, and will provide guidance on full-year

adjusted earnings per share later in the year.

KEY DEVELOPMENTS

-- Setting out a strong, stakeholder-led business plan in Distribution

On 1 July, SSEN Distribution published its ambitious

stakeholder-led draft business plan for 2023 to 2028, setting out

how it will deliver improvements for customers and accelerate

investment in its networks to 'power communities to net zero' over

the course of the RIIO-ED2 price control period. The plan includes

GBP4.1bn of investment, representing an increase of around 35%

compared to an equivalent period in ED1, and would see SSEN

Distribution's regulated asset value increase to over GBP6bn from

around GBP4bn at the end of the current price control.

-- Creating value from non-core disposals

Good progress continues to be made on SSE's disposals programme

which is on course to realise more than GBP2bn from the sale of

non-core assets and businesses that are not a good fit with SSE's

net zero strategy. The sale of SSE's Contracting business to

Aurelius, first announced on 1 April, was successfully completed on

30 June 2021. As reported in May, SSE has initiated a sale process

for its stake in SGN, targeting an agreed sale by the end of the

calendar year.*

-- Projects under construction and future pipeline

Construction continues to progress on SSE's major projects in

Transmission and in Renewables, in line with the update provided in

May. These include building the world's largest offshore wind farm

at Dogger Bank, Scotland's largest offshore wind farm at Seagreen

and one of Europe's most productive onshore wind farms at Viking on

Shetland, as well as the associated link connecting the island to

the mainland.

SSE continues to expect that capital expenditure and investment

will total around GBP2bn in 2021/22 (net of project finance

development expenditure refunds).

Looking further ahead, SSE is seeking to add to its considerable

pipeline in Renewables and has submitted bids, with its partners

Marubeni and CIP, for a number of sites through the ScotWind seabed

leasing process.

-- Pursuing growth options in Transmission

SSEN Transmission remains on track to submit Initial Needs Cases

to Ofgem for the Skye Reinforcement this summer and the Argyll

275kV upgrade this autumn. A Final Needs Case for the first of two

planned East Coast HVDC links from Peterhead to England is also

expected to be submitted by the end of 2021. These are over and

above SSEN Transmission's RIIO-T2 Certain View which, alongside

additional Uncertainty Mechanism expenditure needed to deliver a

pathway towards net zero, could bring total RIIO-T2 expenditure to

over GBP4bn, with the associated Transmission RAV potentially

increasing to over GBP6bn over the same period.

-- Appointing new members of the SSE Board

In June, SSE announced the appointment of two new non-Executive

Directors, The Rt Hon Elish Angiolini QC and Debbie Crosbie, both

of whom will join the Board and Nomination Committee on 1 September

2021.

Gregor Alexander, Finance Director, said:

"We have delivered on our purpose through the coronavirus

pandemic and are continuing to progress growth opportunities and

options arising from our net zero strategy.

"We have an enviable offshore wind pipeline which we are seeking

to expand and diversify, options to develop new thermal and pumped

storage hydro technologies that will be vitally important in the

transition to net zero, and we see significant RAV growth potential

in our regulated electricity businesses.

"This represents an exciting future for SSE, and we look forward

to updating the market on our capital expenditure and investment

plans at our interim results in November. In the meantime, our

focus remains on strategic delivery across the group, in doing so

creating sustainable value for shareholders and society."

*Given a sales process has been initiated, SSE expects its share

of SGN will be treated as held for sale for the 2021/22 financial

year.

OPERATIONAL PERFORMANCE

SSE Renewables

Output of electricity from renewable sources in which SSE has an

ownership interest across the UK and Ireland was 403GWh, or around

19%, below plan in the quarter to 30 June 2021, mainly due to

weather conditions. This shortfall represents less than 4% of the

annual forecast total output.

Actual output Planned output Actual output

for 3 months for 3 months for 3 months

to to to

30 June 2021 30 June 2021 30 June

2020

Onshore wind generation output

- GWh inc. constrained off

output 791 988 878

-------------- --------------- --------------

Offshore wind generation

output - GWh inc. constrained

off output 290 393 410

-------------- --------------- --------------

Conventional hydro generation

output - GWh 593 696 674

-------------- --------------- --------------

Total renewables output (excl.

pumped storage) - GWh 1,674 2,077 1,962

-------------- --------------- --------------

Pumped storage generation

output - GWh 48 - 26

-------------- --------------- --------------

Total renewables output -

GWh 1,722 - 1,988

-------------- --------------- --------------

Wind output based on SSE's contractual share.

Output in the three months to 30 June 2021 includes 28GWh of

onshore and 0.5GWh of offshore compensated constrained off

generation, the same period in 2020 includes 132GWh of onshore, and

nil offshore, compensated constrained off generation.

Pumped storage volumes excluded from planned comparison as

financial performance of site less affected by volumes

generated.

SSEN Distribution

3 months 3 months

to to

30 June 2021 30 June 2020

Customer minutes lost (SHEPD) - average

per customer 10 10

-------------- --------------

Customer minutes lost (SEPD) - average

per customer 11 10

-------------- --------------

Customer interruptions (SHEPD) - per 100

customers 13 14

-------------- --------------

Customer interruptions (SEPD) - per 100

customers 10 12

-------------- --------------

Electricity transported through SSEN Distribution

- TWh 8.7 7.7

-------------- --------------

SSE Thermal

Output of electricity from SSE's gas-fired generation plant for

the three months to 30 June was around 9% lower than in the same

period in 2020, reflecting plant availability and market

conditions. Flexible thermal generation continues to play a key

part in the GB and Irish energy markets as we transition to net

zero, creating value by providing vital balancing services to the

system.

3 months to 30 3 months to 30

June 2021 June 2020

Gas-fired generation output

(GB)- GWh 2,840 3,467

--------------- ---------------

Gas-fired generation output

(ROI)- GWh 911 654

--------------- ---------------

Total gas-fired generation output

- GWh 3,751 4,121

--------------- ---------------

Output includes 177GWh of oil-fired generation in the three

months to 30 June 2021 and 64GWh of oil-fired generation in the

same period in 2020, primarily older Irish plant.

SSE announced the sale of its stake in Ferrybridge and Skelton

Grange multifuel assets on 13 October 2020.

AGM AND NOTIFICATION OF CLOSE PERIOD

This Trading Statement is published in advance of SSE's Annual

General Meeting 2021, which takes place today, 22 July, at 12.30pm

in Perth. SSE will issue a further business update with its

Notification of Close Period statement on 29 September 2021.

ENQUIRIES

Investors and analysts ir@sse.com +44(0)345 0760 530

Media media@sse.com +44(0)345 0760 530

S

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFVIDSILFIL

(END) Dow Jones Newswires

July 22, 2021 02:00 ET (06:00 GMT)

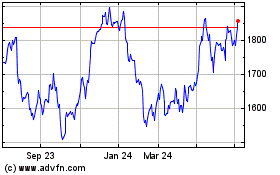

Sse (LSE:SSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

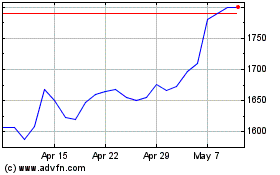

Sse (LSE:SSE)

Historical Stock Chart

From Apr 2023 to Apr 2024