Barclays Capital Securities Limited Post-Stabilisation Period Announcement (2927Z)

December 13 2017 - 12:50PM

UK Regulatory

TIDMSBRE

RNS Number : 2927Z

Barclays Capital Securities Limited

13 December 2017

13 December 2017

Not for release, publication or distribution, in whole or in

part, directly or indirectly, in or into the United States of

America, Australia, Canada, Japan or South Africa or any

jurisdiction in which such distribution would be unlawful.

Sabre Insurance Group plc

Pre-Stabilisation Period Announcement

Further to the pre-stabilisation period announcement dated 06

December 2017 Barclays Bank PLC ('Barclays') (Ben West; telephone:

+44 20 7773 9531) hereby gives notice that as Stabilising

Coordinator, the Stabilisation Manager named below undertook

stabilisation (within the meaning of Article 3.2(d) of the Market

Abuse Regulation (EU/596/2014) and of the rules of the Financial

Conduct Authority) in relation to the offer of the following

securities, as set out below.

The securities:

-----------------------------------------------------------------------------------------

Issuer: Sabre Insurance Group plc

----------------------------- ----------------------------------------------------------

Aggregate nominal 125,000,000 Ordinary Shares (excluding the over-allotment

amount/Offering size: option)

----------------------------- ----------------------------------------------------------

Description: Ordinary Shares in Sabre Insurance Group plc

with a nominal value of GBP0.001. ISIN: GB00BYWVDP49

----------------------------- ----------------------------------------------------------

Offer price: 230p

----------------------------- ----------------------------------------------------------

Stabilisation:

-----------------------------------------------------------------------------------------

Stabilisation Manager: Barclays Capital Securities Limited, 5 The North

Colonnade, Canary Wharf, London, E14 4BB, United

Kingdom

----------------------------- ----------------------------------------------------------

Stabilisation started 6(th) December 2017

on:

----------------------------- ----------------------------------------------------------

Stabilisation last 13(th) December 2017

occurred on:

----------------------------- ----------------------------------------------------------

Stabilisation transactions: Although stabilisation bids were made, no stabilisation

transactions were carried out

----------------------------- ----------------------------------------------------------

In connection with the offer of the above securities, the

Stabilisation Manager may over-allot the securities or effect

transactions with a view to supporting the market price of the

securities at a level higher than that which might otherwise

prevail. However, stabilisation may not necessarily occur and any

stabilisation action, if begun, may cease at any time. Any

stabilisation action or over--allotment shall be conducted in

accordance with all applicable laws and rules.

This announcement is for information purposes only and does not

constitute an invitation or offer to underwrite, subscribe for or

otherwise acquire or dispose of any securities of the Issuer in any

jurisdiction.

This announcement is only addressed to and directed at persons

outside the United Kingdom and persons in the United Kingdom who

have professional experience in matters related to investments

falling within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 (the Order) or who are

high net worth persons falling within Article 49 of the Order and

must not be acted on or relied on by other persons in the United

Kingdom.

In addition, if and to the extent that this announcement is

communicated in any EEA Member State that has implemented Directive

2003/71/EC (together with any applicable implementing measures in

any Member State, the "Prospectus Directive") before the

publication of a prospectus in relation to the securities to which

this announcement relates which has been approved by the competent

authority in that Member State in accordance with the Prospectus

Directive (or which has been approved by a competent authority in

another Member State and notified to the competent authority in

that Member State in accordance with the Prospectus Directive),

this announcement is only addressed to and directed at persons in

that Member State who are qualified investors within the meaning of

the Prospectus Directive (or who are other persons to whom the

offer may lawfully be addressed) and must not be acted on or relied

on by other persons in that Member State.

This announcement does not constitute, or form part of, an offer

to sell, or a solicitation of an offer to purchase any securities

in the United States or any other jurisdiction. The securities

referred to herein have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the "Securities Act"),

and may not be offered or sold in the United States except to

"qualified institutional buyers" as defined in, and in reliance on,

Rule 144A under the Securities Act or another exemption from, or

transaction not subject to, the registration requirements of the

Securities Act. All offers and sales of securities outside of the

United States will be made in reliance on, and in compliance with,

Regulation S under the Securities Act. There is no intention to

register any securities referred to herein in the United States or

to make a public offering of the securities in the United

States.

This information is provided by RNS

The company news service from the London Stock Exchange

END

STAGGGBCPUPMGMW

(END) Dow Jones Newswires

December 13, 2017 12:50 ET (17:50 GMT)

Sabre Insurance (LSE:SBRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

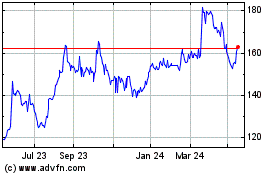

Sabre Insurance (LSE:SBRE)

Historical Stock Chart

From Apr 2023 to Apr 2024