TIDMRRR

RNS Number : 1700Q

Red Rock Resources plc

08 September 2017

Red Rock Resources PLC

("Red Rock" or the "Company")

Update on Steelmin Investment

08 Sept 2017

Further to the announcements of 23 June and 3 July 2017, Red

Rock Resources Plc, the natural resource development company with

interests in gold, manganese and oil production, announces an

update in relation to its investment in Steelmin Limited

("Steelmin")

Highlights:

o Red Rock has now been issued an additional 1% of Steelmin

bringing its total interest to 17%

o Major components ordered and scheduled to be delivered and

installed between October and early to mid-December

o The on-site team has expanded from 45 to 70 with an eventual

planned workforce of 150

o Offsite team training of management to create corporate

culture to begin mid-October

Under the terms of the Loan, an 8 month secured loan note of

EUR3,874,560, announced on 23 June 2017, Red Rock received as

partial consideration for the Loan 16% of the fully diluted equity

of Steelmin, which would increase by 1% if the Loan was not fully

repaid by 1 September 2017 and a further 1% each month until April

2018, 0.9% in May, 1.1% in June, and then 1% per month up to a

maximum holding of 30%.

Andrew Bell, Chairman of Red Rock comments: "A great deal of

progress has occurred since we invested just over two months ago,

and the project appears to be on track and under budget. The

sustained rise in Asian ferrosilicon prices has begun to feed

through to the European market, which is another positive factor.

We look forward to taking key investors and advisors on a field

visit in early October when the final phase of works will be under

way."

Steelmin - Background

The Steelmin plant and facility is located in central Bosnia,

104 kilometres north west of Sarajevo. The complex, formerly part

of Electrobosna, was originally built in the 1970s by Elkem, a

major silicon and alloy producer based in Norway, and was one of

the largest and best known producers of ferrosilicon and silicon

metal in Europe. It was closed down in 1992 due to the Bosnian War,

was then privatised and the six furnaces were sold off in two

separate parts in 2000. The plant was brought back online until

finally being shuttered again in 2004 due to increasing exports

pressure from Chinese producers.

Anti-dumping regulations have since been implemented by the

European Commission; which significantly reduced both Chinese and

Russian exports into Europe, allowing prices to stabilize and rise

over time. The second, smaller, facility split off from the

original is now being operated by the Italian ferro-alloy producer

Metalleghe, and has been successfully producing next to Steelmin's

plant for the past 12 years.

Steelmin controls furnaces IV and V from the original

Electrobosna complex. Furnace V has a 48MVA installed power Elkem

furnace, and is connected to two chimneys on the roof of the

production hall. Furnace IV, the smaller of the two, has a 30 MVA

Tagliaferri furnace with three chimneys, preventing the emission of

gases in ambient air to comply with EU regulatory requirements.

Given its larger total capacity Steelmin has decided to bring

furnace V on initially and then move to recommission furnace IV

later in 2018.

Current activity is aimed at completing the rehabilitation of

the plant and furnace V this year and starting production.

In addition to the two furnaces, the facility in Jajce houses a

filtration plant, warehouse storage for raw materials, pouring and

dispatch hall as well as a plant for process water

recirculation.

Steelmin intends to produce ferrosilicon containing 75% silicon

and 25% iron, a product primarily used as a deoxidising agent and

to add electrical conductivity and corrosion resistance to steel. A

by-product of ferrosilicon production will be microsilica, which is

a dust used in the manufacture of speciality concretes in the

construction industry as well as in advanced refractories and

ceramics. Furnace V is expected to produce 29,000t of ferrosilicon

per annum as well as 5,800t of microsilica.

Over time Steelmin is expected to produce both ferrosilicon as

well as additional silicon alloys that offer higher margins and

additional upside.

European ferrosilicon production depends critically on access to

cheap power (locally generated hydroelectric power in the case of

Jajce) since this is up to half the cost of production. Prices are

historically driven by steel production levels, the level of

Chinese pricing and production allowed into Europe, as well as the

associated export and anti-dumping tariffs. Since late 2016 overall

Chinese export prices have risen, positively impacting European

produce prices. Key input costs such as metallurgical coal are also

closely correlated to realized ferrosilicon prices.

EU supplies of ferrosilicon are generally heavily constrained,

with 70% coming from Norway and Iceland and few if any new

producers coming online. Given Bosnia's ideal location closer to

key steel customers in Germany, Austria and Northern Italy,

Steelmin is well poised to service these major markets.

Steelmin currently projects operating revenues of EUR35m in its

first full year of operations with gross margins expected to come

in around 33%. These figures assume production of 85 tonnes per day

over 339 days a year and a Ferrosilicon selling price of EUR1,200/t

(current pricing cEUR1,350/t).

For further information, please contact:

Andrew Bell 0207 747 9990 Chairman Red Rock Resources Plc

Scott Kaintz 0207 747 9990 Director Red Rock Resources Plc

Roland Cornish/ Rosalind Hill Abrahams 0207 628 3396 NOMAD Beaumont Cornish Limited

Neil Badger 0129 351 7744 Broker Dowgate Capital Stockbrokers

Ltd

Glossary

Ferrosilicon: ferrosilicon produced at Steelmin contains 75%

silicon, and is primarily used as a deoxidising agent in steel

production, adding electrical conductivity and corrosion-resistance

properties to steel

Microsilica: a by-product of silicon and ferrosilicon

production, used in the construction industry for its added

strength and abrasion resistance

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDMGGLRNGGNZM

(END) Dow Jones Newswires

September 08, 2017 02:00 ET (06:00 GMT)

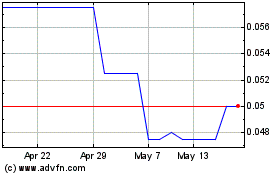

Red Rock Resources (LSE:RRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

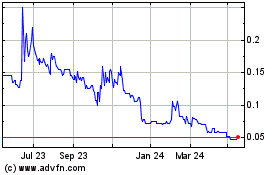

Red Rock Resources (LSE:RRR)

Historical Stock Chart

From Apr 2023 to Apr 2024