Clear Leisure Plc Debt Buy Back and New Loan Facility

May 10 2017 - 2:00AM

UK Regulatory

TIDMCLP

10 May 2017

Clear Leisure plc

("Clear Leisure", "the Company" or "the Group")

Debt Buy-Back and New Loan Facility

Clear Leisure (AIM: CLP), the leisure and property focused investment company,

is pleased to announce it has bought back EUR 3.14 million of the debt of one

of its subsidiaries previously owed to three Italian banks at a 76.15 per cent

discount.

This represents a pro-rata improvement, after costs, of approximately EUR 2.394

million (GBP 2.014 million) in the Company's consolidated balance sheet,

equivalent to 0.70p per share.

New loan facility

Eufingest S.A. ("Eufingest"), the Company's largest shareholder, has provided a

new convertible loan of EUR 1.2 million (GBP 1.009 million).

The new loan is being used in part to complete the EUR 3.14 million debt

buy-back. Including the new loan, the total of loans drawn and outstanding with

Eufingest is now EUR 2.475 million (approximately GBP 2.083 million), including

accrued interest. The Board has agreed with Eufingest to bring together all the

outstanding balances into one loan of EUR 2.475 million repayable by 28 April

2020 (the "Consolidated Loan").

The Consolidated Loan will carry an interest rate of 1 per cent and will be

secured on certain of the Group's assets. At any time before 28 April 2020, the

Company may repay the Consolidated Loan without penalty and Eufingest may

convert the Consolidated Loan into shares at the rate of 0.89p per share being

a premium of 0.19p on the closing share price on 9 May 2017. The conversion

price has been calculated by taking the weighted average conversion price of

all previous loans and of the new loan which has a conversion price of 1p.

Eufingest is the beneficial holder of more than 10 per cent of the ordinary

share capital of the Company. Eufingest is therefore a "related party" for the

purposes of the AIM Rules and the Directors of the Company (each of whom is

independent from Eufingest), having consulted with the Company's NOMAD,

consider the terms of the Consolidated Loan to be fair and reasonable insofar

as shareholders are concerned.

Francesco Gardin, Chairman and CEO of Clear Leisure, commented, "We aim to take

any opportunities to materially strengthen our balance sheet by reducing the

amount of debt owed by some of our subsidiaries to third parties. The new

agreement with our longest standing shareholder Eufingest will also assist in

the realisation of the Group's assets."

-ends-

For further information please contact:

Clear Leisure

plc

+39 335 296573

Francesco Gardin, CEO and Executive Chairman

ZAI Corporate Finance (Nominated Adviser) +44 (0)20

7060 2220

Tim Cofman/Peter

Trevelyan-Clark

Peterhouse Corporate Finance (Broker) +44 (0)

20 7469 0935

Lucy Williams / Heena Karani

Cadogan Leander (Financial PR) +44

(0) 7795 168 157

Christian Taylor-Wilkinson

About Clear Leisure Plc

Clear Leisure plc (AIM: CLP) is an AIM listed investment company with a

portfolio of companies primarily encompassing the leisure and real estate

sectors mainly in Italy. The focus of management is to pursue the monetisation

of all of the Company's existing assets, through selected realisations,

court-led recoveries of misappropriated assets and substantial debt-recovery

processes. For further information, please visit, www.clearleisure.com

END

(END) Dow Jones Newswires

May 10, 2017 02:00 ET (06:00 GMT)

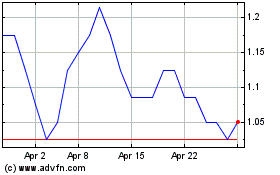

Quantum Blockchain Techn... (LSE:QBT)

Historical Stock Chart

From Apr 2024 to May 2024

Quantum Blockchain Techn... (LSE:QBT)

Historical Stock Chart

From May 2023 to May 2024