TIDMPOLX

RNS Number : 4465K

Polarean Imaging PLC

02 September 2021

Polarean Imaging Plc

("Polarean" or the "Company")

Half-year Report

Polarean Imaging plc (AIM: POLX), the medical - imaging

technology company, with an investigational drug - device

combination product for magnetic resonance imaging (MRI), announces

its unaudited interim results for the six months ended 30 June 2021

.

Highlights

-- Raised GBP27 million gross proceeds in an oversubscribed

financing, including continued support of strategic investors,

Bracco Imaging S.p.A and Nukem Isotopes GmbH as well as

institutional investor Amati AIM VCT plc, joined by several new UK

and US institutional investors.

-- Appointment of Chief Financial Officer, Chuck Osborne, to the Board

-- Additional research unit order for a 9820 Xenon Polariser

system from the University of British Columbia in Vancouver,

Canada

-- Installation of its 9820 Xenon Polariser system for the

University of Texas MD Anderson Cancer Center

-- Presentation of data at both the American Thoracic Society

("ATS") and the International Society for Magnetic Resonance in

Medicine ("ISMRM") virtual conferences

-- Publication of first peer reviewed COVID-19 research by

Professor Fergus Gleeson at the University of Oxford

-- Net cash of US$38.2m as of 30 June 2021

Post-period end

-- Frequent interactions with the FDA as they review the NDA in

advance of our target PDUFA goal date of 5 October 2021

-- Preparation for launch of product including recruitment of

employees into our sales and marketing organization

-- Planning to broaden the awareness of Polarean technology

through exhibitions at CHEST and RSNA 2021 and numerous topical

conferences

Richard Hullihen, CEO of Polarean, commented : "During the first

half of 2021 the Company raised its largest financing to date with

its oversubscribed GBP27 million gross proceeds financing. We

appreciate the continued support from our existing strategic,

institutional and retail investors and welcome several new

significant institutional investors. The proceeds from this round

are being used to plan and execute the launch of our product in

accordance with our current target PDUFA date of 5 October 2021. We

continue to sell new polarisers systems for research use, as the

amount of polarised Xenon research continues to increase. We look

forward to providing our shareholders with updates regarding

further progress and specifically the status of our target PDUFA

date of 5 October 2021, and we thank them for their continued

support on this exciting journey."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014, as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act

2018.

Enquiries:

Polarean Imaging plc www.polarean.com / www.polarean-ir.com

Richard Hullihen, Chief Executive Officer Via Walbrook PR

Jonathan Allis, Chairman

Stifel Nicolaus Europe Limited (NOMAD and

Sole Corporate Broker)

Nicholas Moore / Ben Maddison / Samira Essebiyea

(Healthcare +44 (0)20 7710

Investment Banking) 7600

Nick Adams / Fred Walsh (Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933 8780 or polarean@walbrookpr.com

Paul McManus / Anna Dunphy Mob: +44 (0)7980 541 893 / +44 (0)7879 741

001

About Polarean (www.polarean.com)

The Company and its wholly owned subsidiary, Polarean, Inc.

(together the "Group") are revenue-generating, investigational

drug-device combination companies operating in the high-resolution

medical imaging research space.

The Group develops equipment that enables existing MRI systems

to achieve an improved level of pulmonary function imaging and

specialises in the use of hyperpolarised Xenon gas ((129) Xe) as an

imaging agent to visualise ventilation. (129) Xe gas is currently

being studied for visualisation of gas exchange regionally in the

smallest airways of the lungs, across the alveolar tissue barrier,

and into the pulmonary bloodstream.

In October 2020, the Group submitted a New Drug Application

("NDA") to the FDA for hyperpolarised (129) Xe used to evaluate

pulmonary function and to visualise the lung using MRI. In December

2020, the Group received confirmation of acceptance of its NDA by

the FDA, with a target PDUFA action date of 5 October 2021.

The Group operates in an area of significant unmet medical need

and the Group's technology provides a novel investigational

diagnostic approach, offering a non-invasive and radiation-free

functional imaging platform. The annual burden of pulmonary disease

in the US is estimated to be over US$150 billion.

CEO Statement

Introduction

The six month period ending 30 June 2021 has seen Polarean make

substantial progress towards its goal of seeking FDA approval for

the Company's drug-device combination. As in the normal course,

post submission, the Company has responded to the question and

answer process with the FDA for our submission, while preparing

itself and verifying the preparation of its suppliers and

providers.

In January, the Company appointed a new Nominated Advisor and

Broker, Stifel Nicolaus Europe Limited, which led to a successful

placing, subscription, and open offer which was oversubscribed in

every category, including its strategic investors Nukem Isotopes

and Bracco. Then in February, Chuck Osborne, the existing CFO, was

appointed to the Board in order to further leverage his extensive

experience in early-stage life science company management, build

out and fund raising.

During challenging times in healthcare and hospital utilization,

we continued to take research orders from leading academic centres

such as BC Children's hospital in Vancouver and also to build and

deliver systems, completing the installation at MD Anderson Cancer

Center in Houston.

Presentation at Medical Conferences and Studies Utilising our

Technology

The Company's technology was once again prominent at the ATS and

ISMRM virtual conference during May 2021 with over 50 abstracts

related to the use of hyperpolarised (129) Xe accepted for

presentation at the two conferences. The content of our

publications and those of our customers, along with our

participation is available on our website at www.polarean.com. The

user base of our polarisers continues to expand and document the

applications of our technology across the spectrum of pulmonary

disease.

Importantly, the first peer reviewed article on COVID-19 Long

Haul patients visualised using (129) Xe have now been published (

https://pubs.rsna.org/doi/10.1148/radiol.2021210033 ). Additional i

nvestigator-initiated government research grants are underway to

study the use of our technology to assess the long-term effects of

COVID-19 infection in patients.

Results overview

Group revenues for the first half were US$0.6m (2020: US$0.3m)

and were largely derived from the sale of a polariser system to MD

Anderson, in contrast to the H1 2020 revenue, which was largely

from our collaboration with the University of Cincinnati for work

under our SBIR grant, which has now been completed. We continue to

sell our polariser systems on a research-use-only basis to academic

institutions in the US, Canada and Europe. Operating expenses for

H1 2021 (US$5.5m) increased from H1 2020 (US$3.4m), as Selling and

Distribution Expenses (H1 2021 US$1.8m, H1 2020 US $0.4m) increased

as we are executing our plans for commercial launch. During H1

2021, the Company recognized Finance Income of US$0.4m due to the

strengthening of the British pound, which more than offset the

US$0.3m forgivable loan under the US Paycheck Protection Program

("PPP") we received and recognized as Finance Income in H1 2020.

Our overall loss before tax increased from US$3.2m to US$4.9m in

the same comparable period, due primarily to the commercial launch

preparation expenses. The Company completed a GBP27m ($37m)

fundraise during H1 2021 via the issue of new equity and as at 30

June 2021 we held US US$38.2m in net cash or cash equivalents.

Post-period end events

FDA review of NDA

We continue to interact with the FDA as they review our NDA with

a target date PDUFA date of 5 October 2021.

Preparation for launch

We continue to prepare for the potential launch of our drug

device combination post FDA approval. In particular, we have been

building a sales and marketing organization with the recent

recruitment of several sales positions.

Planning for conference exhibitions

We are continuing to increase the awareness of Polarean

technology with exhibitions at CHEST in October 2021 and RSNA in

December 2021.

Research polarisers

Researchers continue to apply for and receive grants to purchase

our polariser systems, most recently BC Children's Hospital in

Vancouver, BC. This system has been delivered and is proceeding to

installation. We are in discussions with several research

institutions and anticipate additional possible orders during

calendar year 2021.

Outlook

We continue to demonstrate that Polarean's technology has the

potential to be of tremendous benefit to patients and a powerful

new tool for clinicians in discovering and characterising treatable

traits in pulmonary medicine. In addition, our latest new

techniques lead us into the field of cardiology and pulmonary

vascular disease which is one example of the further potential of

our technology. We also look forward to evaluating new uses of our

technology in pharmaceutical drug development.

The burden of pulmonary disease in the USA is approximately

US$150bn and is widespread and growing, affecting nearly 40 million

Americans and 500 million worldwide, with post COVID patients

comprising a new segment approaching the scale of asthma. Given the

limitations of existing methods of diagnosis and lung disease

monitoring, we estimate that there is a significant unmet need for

safe, non-invasive, quantitative, and cost-effective image-based

diagnosis technology. We believe that our unique medical

drug-device combination utilising 129Xe offers the ideal solution

for improving pulmonary disease diagnosis.

This is an exciting time for the Company, as we enter the final

stages of submitting our NDA and look towards a potential

commercial launch before the end of 2021.

Richard Hullihen

Chief Executive Officer

2 September 2021

POLAREAN IMAGING PLC

Consolidated unaudited statement of comprehensive income

for the six months ended 30 June 2021

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30.6.21 ended 30.6.20 ended 31.12.20

US$ US$ US$

Note

Revenue 621,874 327,896 1,056,766

Cost of sales (323,185) (41,387) (346,300)

--------------- --------------- ----------------

Gross profit 298,689 286,509 710,466

Administrative expenses (2,915,214) (2,724,411) (5,049,246)

Depreciation (81,320) (73,204) (150,224)

Amortisation (375,861) (359,677) (734,058)

Selling and distribution expenses (1,799,324) (351,754) (917,783)

Share based payment expense (367,397) (213,906) (474,716)

--------------- --------------- ----------------

Loss from operations (5,240,427) (3,436,443)) (6,615,562)

Finance expense (8,261) (9,647) (19,730)

Finance income 393,392 267,155 100,769

--------------- --------------- ----------------

Loss on ordinary activities

before taxation 3 (4,855,296) (3,178,935) (6,534,523)

Taxation - - -

--------------- --------------- ----------------

Loss and total other comprehensive

expense (4,855,296) (3,178,935) (6,534,523)

Basic and fully diluted loss

per share (US$) 3 (0.026) (0.023) (0.044)

POLAREAN IMAGING PLC

Consolidated unaudited statement of financial position

at 30 June 2021

Unaudited Unaudited Audited

As at 30.6.21 As at 30.6.20 As at 31.12.20

US$ US$ US$

Assets Note

Non-current assets

Property, plant and equipment 233,044 312,287 271,264

Intangible assets 2,502,268 3,119,120 2,810,694

Right-of-use asset 116,778 224,414 184,213

Trade and other receivables 5,539 5,539 5,539

-------------- -------------- ---------------

2,857,629 3,661,360 3,271,710

Current assets

Inventories 1,246,311 950,674 977,924

Trade and other receivables 397,473 522,625 348,067

Cash and cash equivalents 38,197,203 9,190,862 6,282,665

-------------- -------------- ---------------

39,840,987 10,664,161 7,608,656

-------------- -------------- ---------------

Total assets 42,698,616 14,325,521 10,880,366

-------------- -------------- ---------------

Equity

Share capital 4 101,545 77,518 78,200

Share premium 59,003,465 23,573,058 23,840,571

Group reorganisation reserve 7,813,337 7,813,337 7,813,337

Share-based payment reserve 2,212,848 1,584,640 1,845,450

Accumulated losses (29,699,500) (21,488,616) (24,844,204)

-------------- -------------- ---------------

Total equity 39,431,695 11,559,936 8,733,354

Liabilities

Non-current liabilities

Deferred income 219,954 192,817 219,954

Lease liability 5 21,017 149,487 91,609

Contingent consideration 316,000 316,000 316,000

-------------- -------------- ---------------

556,971 658,304 627,563

Current liabilities

Trade and other payables 2,549,096 1,985,828 1,348,866

Lease liability 5 137,589 102,213 129,819

Deferred income 23,265 19,239 40,763

-------------- -------------- ---------------

2,709,950 2,107,280 1,519,449

-------------- -------------- ---------------

Total equity and liabilities 42,698,616 14,325,521 10,880,366

-------------- -------------- ---------------

POLAREAN IMAGING PLC

Consolidated unaudited statement of changes in equity

at 30 June 2021

Share-based

Share Group payment Accumulated

capital Share premium re-organisation reserve losses Total equity

--------- --------------- -------------------- ------------- -------------- --------------

Balance as at 31

December 2019

(audited) 55,776 13,659,912 7,813,337 1,370,734 (18,309,681) 4,590,078

Loss and total

comprehensive

income for the

period - - - - (3,178,935) (3,178,935)

Issue of shares 21,742 10,427,537 - - - 10,449,279

Share issue costs - (514,391) - - - (514,391)

Share-based payments - - - 213,906 - 213,906

--------- --------------- -------------------- ------------- -------------- --------------

Balance as at 30

June 2020

(unaudited) 77,518 23,573,058 7,813,337 1,584,640 (21,488,616) 11,559,937

Comprehensive income

Loss and total

comprehensive

income for the

period - - - - (3,355,588) (3,355,588)

Transactions with

owners

Issue of shares 682 275,836 - - - 276,518

Share issue costs - (8,323) - - - (8,323)

Share-based payments - - - 260,810 - 260,810

Balance as at 31

December 2020

(audited) 78,200 23,840,571 7,813,337 1,845,450 (24,844,204) 8,733,354

--------- --------------- -------------------- ------------- -------------- --------------

Loss and total

comprehensive

income for the

period - - - - (4,855,296) (4,855,296)

Issue of shares 23,345 37,260,511 - - - 37,283,856

Share issue costs - (2,097,617) - - - (2,097,617)

Share-based payments - - - 367,398 - 367,398

Balance as at 30

June 2021

(unaudited) 101,545 59,003,465 7,813,337 2,212,848 (29,699,500) 39,431,695

========= =============== ==================== ============= ============== ==============

POLAREAN IMAGING PLC

Consolidated unaudited cash flow statement

for the six months ended 30 June 2021

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30.6.21 ended 30.6.20 ended

US$ US$ 31.12.20

US$

Cash flows from operating activities

Loss for the period before taxation (4,855,296) (3,178,935) (6,534,522)

Adjustments for non-cash/non-operating

items:

Depreciation of plant and equipment 81,320 73,204 150,224

Amortisation of intangible assets 375,861 359,677 734,058

Share based compensation 367,398 213,906 474,716

Interest paid - - 19,730

Interest received (470) (92) (100,769)

(4,031,187) (2,532,240) (5,256,563)

Changes in working capital:

Increase in inventories (268,387) (396,462) (423,093)

Increase in trade and other receivables (49,406) 114,157 288,096

Increase/(decrease) in trade and

other payables 1,310,426 189,407 (424,714)

Increase/(decrease) in deferred

revenue (127,696) (27,085) 21,576

--------------- --------------- ------------

Net cash flows used from operating

activities (3,166,250) (2,652,223) (5,794,698)

Cash flows from investing activities

Purchase of plant and equipment (43,099) (29,534) (65,531)

--------------- --------------- ------------

Net cash used in investing activities (43,099) (29,534) (65,531)

Cash flows from financing activities

Issue of shares 37,283,856 10,449,279 10,725,797

Cost of issue (2,097,617) (514,391) (522,714)

Interest paid - - -

Interest received 470 92 100,769

Funds received from PPP loan - 22,840 -

Principal elements of lease payments (71,083) (56,717) (103,097)

Interest elements of lease payments 8,261 9,647 (19,730)

--------------- --------------- ------------

Net cash generated from financing

activities 35,123,887 9,910,750 10,181,025

Net increase in cash and equivalents 31,914,538 7,228,993 4,320,796

Cash and equivalents at beginning

of period 6,282,665 1,961,869 1,961,869

Cash and equivalents at end of

period 38,197,203 9,190,862 6,282,665

NOTES TO THE INTERIM ACCOUNTS

1. Basis of presentation

The accounting policies adopted are consistent with those of the

previous financial year ended 31 December 2020.

This interim consolidated financial information for the six

months ended 30 June 2021 has been prepared in accordance with AIM

rule 18, 'Half yearly reports and accounts'. This interim

consolidated financial information is not the group's statutory

financial statements within the meaning of section 434 of the

Companies Act 2006 (and information as required by section 435 of

the Companies Act 2006) and should be read in conjunction with the

annual financial statements for the year ended 31 December 2020,

which have been prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain statements

under section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 June 2021 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2020 are also unaudited.

This interim consolidated financial information is presented in

US Dollars ($).

2. Going concern

The interim consolidated financial information for the six

months ended 30 June 2021 have been prepared on the going concern

basis.

The Directors consider the going concern basis of preparation to

be appropriate in preparing the financial statements. In

considering the appropriateness of this basis of preparation, the

Directors have received the Group's working capital forecasts for a

minimum of 12 months from the date of the approval of this

financial information. Based on their consideration the Directors

have reasonable expectation that the Group has adequate resources

to continue for the foreseeable future and that carrying values of

intangible assets are supported. Thus, they continue to adopt the

going concern basis of accounting in preparing this financial

information.

3. Loss per share

The basic and diluted loss per share for the period ended 30

June 2021 was US$0.026 (2020: US$0.023) The calculation of loss per

share is based on the loss of US$4,855,296 for the period ended 30

June 2021 (2020: loss of US$3,178,935) and the weighted average

number of shares in issue during the period for calculating the

basic profit per share of 184,552,681 shares (2020:

137,598,239).

4. Called up share capital

Unaudited Unaudited Audited

30.6.21 30.6.20 31.12.20

US$ US$ US$

Allotted, issued and fully paid

Ordinary Shares 101,545 77,518 78,200

---------- ---------- ---------

The number of shares in issue was as follows: Number of shares

Balance at 1 January 2020 114,438,600

Issued during the period 11,666,667

Exercised warrants 766,410

-----------------

Balance at 30 June 2020 161,830,007

Issued during the period 1,318,800

Exercised warrants 64,128

-----------------

Balance at 31 Dec 2020 163,212,935

Issued during the period 44,932,142

Exercised warrants 928,089

-----------------

Balance at 30 June 2021 209,073,166

-----------------

5. Borrowings

Unaudited Unaudited Audited

30.6.21 30.6.20 31.12.20

US$ US$ US$

Non-current

Lease liability 21,017 149,487 91,609

---------- ---------- ---------

Current

Lease Liability 137,589 102,213 129,819

---------- ---------- ---------

Total 158,606 251,700 221,428

---------- ---------- ---------

6. Share based payments

Share Options

The Company grants share options as its discretion to Directors,

management and employees. These are accounted for as equity settled

transactions. Should the options remain unexercised after a period

of ten years from the date of grant the options will expire unless

an extension is agreed to by the board. Options are exercisable at

a price equal to the Company's quoted market price on the date of

grant or an exercise price to be determined by the board.

Details of share options granted, exercised, forfeited and

outstanding at the year-end are as follows:

Number of share options Weighted average exercise price

(US$)

Outstanding at 1 January 2021 16,884,322 0.19

Granted during period 1,250,000 1.12

Outstanding at 30 June 2021 18,134,322 0.26

-------------------------------- ------------------------ --------------------------------

Exercisable at 30 June 2021 12,699,615 0.14

-------------------------------- ------------------------ --------------------------------

There were 1,250,000 options granted in the period to 30 June

2021. No options were exercised or forfeited during the period.

The weighted average contractual life of the share options

outstanding at the reporting date is 4 years and 361 days.

Share Warrants

The Company grants share warrants at its discretion to

Directors, management, employees, advisors and lenders. These are

accounted for as equity settled transactions. Terms of warrants

vary from agreement to agreement.

Details for the warrants exercised, lapsed and outstanding at

the period ending 30 June 2021 are as follows:

Number of Weighted average exercise price (US$)

share warrants

Outstanding at 1 January 2021 3,994,165 0.09

Exercised during the period (928,089) 0.20

Forfeited during the period (11,947) 0.20

Outstanding at 30 June 2021 3,054,129 0.01

-------------------------------- ---------------- --------------------------------------

Exercisable at 30 June 2021 3,054,129 0.01

-------------------------------- ---------------- --------------------------------------

On 24 February 2021, 61,563 new ordinary shares were issued in

the Company following the exercise of warrants at an exercise price

of 15 pence per warrant. On 25 March 2021, the Company issued a

further 358,713 new ordinary shares following an exercise of

warrants at an exercise price of 15 pence per warrant. On 16 April

2021 and 17 May 2021, an additional 467,733 and 40,080,

respectively, new ordinary shares were issued in the Company

following the exercise of warrants at an exercise price of 15 pence

per warrant.

The weighted average contractual life of the share warrants

outstanding at the reporting date is 2 years and 122 days.

7. Events after the reporting period

On 7 July 2021, the Company granted options over a total of

5,250,000 ordinary shares of GBP 0.00037 each in the capital of the

Company to certain Directors and employees of the Company. The

options vest over four years and have an exercise price of 93 pence

per share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDCIBGDGBB

(END) Dow Jones Newswires

September 02, 2021 02:00 ET (06:00 GMT)

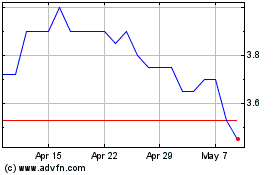

Polarean Imaging (LSE:POLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polarean Imaging (LSE:POLX)

Historical Stock Chart

From Apr 2023 to Apr 2024