TIDMNXT

RNS Number : 4001U

Next PLC

29 July 2020

Date: Embargoed until 07.00hrs, Wednesday 29 July 2020

Contacts: Amanda James, Group Finance Director (analyst calls)

NEXT PLC Tel: 0333 777 8888

Alistair Mackinnon-Musson Email: next@rowbellpr.com

Rowbell PR Tel: 020 7717 5239

Photographs: http://www.nextplc.co.uk/media/image-gallery/campaign-images

This document contains some page and note number

cross-referencing. Please refer to the PDF version of this

statement which is available at

http://www.rns-pdf.londonstockexchange.com/rns/4001U_1-2020-7-28.pdf

or on the NEXT corporate website www.nextplc.co.uk

NEXT PLC

Trading Statement - 29 July 2020

HEADLINES

-- Full price sales in the second quarter were down -28 %

against last year. This is much better than we expected and an

improvement on the best-case scenario given in our April Trading

Statement.

-- Online warehouse picking and despatch capacity is now back at

normal levels and UK and Eire stores are now open.

-- Full year profit before tax, based on our new central sales

scenario, is now estimated at GBP195m(1) .

-- New central scenario year end net debt is forecast to reduce by c.GBP460m.

(1) Profit before tax is quoted on a 52-week basis. The

financial information presented throughout this document does not

reflect the impact of IFRS 16 Leases.

OVERVIEW

As the pandemic retreats, and we learn to operate in a socially

distanced world, we are beginning to better understand both

consumer demand and how the Company's finances will be affected

this year. The key points are:

Sales Warehouse capacity has come back faster than we had

planned, and store sales have been more robust than

anticipated. As a result, our second quarter sales

have been significantly ahead of our internal plan.

Online sales in the second quarter were up +9% and

like-for-like sales in Retail stores, since they re-opened,

were down -32%.

New We have modelled three new scenarios based on full

Stress price sales for the full year being down -18%, -26%

Test and -33%, see page 7. The central -26% scenario is

Scenarios in line with our internal forecast and assumes that

sales in the second half are down -19%.

Cash The Company's cash resources have been enhanced through

a combination of asset sales and the suspension of

dividends and share buybacks. These measures, along

with the cash we anticipate generating from operations,

mean that year end net debt is likely to fall significantly.

Based on our central scenario, year end net debt will

fall by c.GBP 460m to GBP650m, which is comfortably

within the Company's cash resources of GBP1.6bn(2)

and represents 65% of the value of forecast year end

nextpay receivables of GBP1bn.

Profit At our central scenario, we estimate that full year

profit before tax will be GBP195m.

There is still much that remains uncertain and our central

scenario cannot be accorded the same degree of confidence that our

guidance would normally receive at this time of year. The duration

of social distancing rules, post-lockdown consumer behaviour,

earnings, unemployment, and, most importantly, whether there will

be a second wave lockdown, all remain unknowable.

Nonetheless, our experience over the last 13 weeks has given us

much greater clarity on our Online capabilities during lockdown and

the state of consumer demand, and we are now more optimistic about

the outlook for the full year than we were at the height of the

pandemic.

(2) Bond and bank facilities of GBP1.6bn do not include the

Government's COVID Corporate Financing Facility (CCFF). Although

our application to the CCFF was accepted, we do not expect to draw

on this facility.

SALES

Full price sales in the second quarter were down -28%; total

sales (including markdown and clearance sales) were also down -28%.

As would be expected, sales of Childrenswear, Home, Nightwear and

Sportswear along with some adult casual clothing have done much

better than the more formal parts of our adult clothing ranges

associated with work, going out, overseas holidays and large social

events.

Full Price Sales Analysis by Channel by Week

The chart below shows the full price sales by week. Online

product sales are shown in blue, Retail in green and interest

income in grey. Total full price sales for last year are shown for

comparison as an underlaid white bar. As can be seen from the

graph, the situation has steadily improved as lockdown has eased

and in the last six weeks of the season total full price sales have

been down -8%.

Click or paste the following link into your web browser to view

the chart titled 'Full Price Sales by Week'. Refer to page 2 for

this chart.

http://www.rns-pdf.londonstockexchange.com/rns/4001U_1-2020-7-28.pdf

The table below sets out the full price sales performance by

business channel and by quarter versus last year. Retail's

performance in the second quarter is significantly lower than last

year because stores were closed for half of this period,

like-for-like full price sales in re-opened stores were down

-32%.

First quarter Second quarter First half

Full price sales (VAT exclusive) to 25 April to 25 July to 25 July

================================= ============= ============== ===========

Online - 32% +9% - 11%

Retail - 52% - 72% - 62%

Retail like-for-like sales since

re-opening - 32%

============= ============== ===========

Product full price sales - 41% - 29% - 35%

Finance interest income +2% - 11% - 5%

============= ============== ===========

Total full price sales including

interest income - 38% - 28% - 33%

============= ============== ===========

Markdown Sales

Stock was well controlled in the period. A combination of

reduced stock purchases, carefully controlled cancellations and the

hibernation of core lines for next year, meant that we went into

the end of season Sale with only +1% more stock than last year (for

further details see the Appendix on page 12).

Markdown sales(3) were down -12% and worse than the performance

of full price sales in the same weeks, which were down -8%. There

are two reasons for this underperformance. Firstly, in Retail we

did not want to create the large queues normally associated with

our end of season Sale, so we did not advertise the Sale and we

started the event early on a Thursday rather than Saturday to

reduce the risk of overcrowding. Secondly, we limited the stock

available in our Online Sale in line with reduced picking

capacities caused by social distancing.

(3) Markdown sales are defined as Retail store sales plus Online

orders less expected returns. Some of the stock ordered in the

Online Sale will be despatched in Q3.

WAREHOUSE OPERATIONS

Online Warehouse Capacity

Over the last 13 weeks, since closing our warehouses in March,

we have steadily built back our Online picking and packing capacity

to operate at a level commensurate with current demand. This

capacity has been achieved safely and in full compliance with

Government social distancing guidelines.

The solid red line in the graph below shows the volumes of items

picked this year, the dotted red line shows our forecast picking

capacity for the rest of this year (assuming social distancing

measures do not significantly change). For comparison, last year's

picking volumes are given in the shaded grey. We anticipate that

our forecast picking capacity will be higher than last year's pick

volumes throughout most of the second half of this year. The only

material exceptions being the sharp peaks caused by the mid-season

and end of season Sale in September and January respectively.

Click or paste the following link into your web browser to view

the graph titled 'Weekly Picking Volumes - Main Boxed Warehouse'.

Refer to page 4 for this graph.

http://www.rns-pdf.londonstockexchange.com/rns/4001U_1-2020-7-28.pdf

Plans to Improve Capacity in the Second Half

That our warehouses have managed to recover and adapt so rapidly

is testament to the hard work, ingenuity and commitment of our

warehouse management team, our operatives, and our recognised Trade

Union USDAW over the last four months. They have worked together to

ensure the effective and safe operation of warehouses in very

difficult and changing circumstances.

There is more that we can do, and we are taking active steps to

further increase the picking capacity of our Online warehouses

through the introduction of new 24-hour working shift patterns,

along with greater support for warehouse activities in our stores

during peak Sale periods.

The Beneficial Effect of Lower Returns Rates

During lockdown our returns rate has been significantly lower

than last year; this is because the product categories that have

sold well (such as Childrenswear and Homeware) have much lower

returns rates than the areas that have fared badly (such as dresses

and formalwear). In addition, during lockdown, customers were

unable to return items through stores and relied on courier

collections instead. As a result, we believe customers were more

selective when placing orders and ordered items they were more

likely to keep.

The reduction in returns has meant that, in the second quarter,

although we despatched -17% less full price stock than last year we

saw a +9% increase in full price sales. The table below

demonstrates the effect on sales from lower returns.

Second quarter, full price VAT

ex. (GBPm) This year Last year Var %

=============================== ========= ========= =====

Despatches 640 768 - 17%

Estimated returns - 150 - 319 - 53%

========= ========= =====

Net full price sales 490 449 +9%

Returns rate % 23% 42%

Service Constraints

In part, warehouse capacity has come at the expense of our

delivery promise. We are currently operating an 8 pm cut off for

next day delivery (rather than our normal 12 midnight cut off).

This allows us to spread more work into the early hours of the

morning and avoids the normal late night peak working, which

requires staff densities that are not currently achievable whilst

maintaining social distancing rules. As we move to new shift

patterns, we believe that we can progressively move the cut off for

next day delivery to later in the day. We estimate that we can

achieve at least a 10 pm cut off within the next few months.

RETAIL STORE OPENINGS

Retail Sales Pre 15 June

Home stores in England were permitted by the Government to open

before fashion stores. Between 17 May and 14 June our 78 Home

stores took GBP4m of sales on Home products and, on a like-for-like

basis, full price sales were down -37%.

Retail Sales 15 June Onwards

We started to open our fashion stores in England on Monday 15

June and within two weeks 97% of our UK and Eire stores (by

turnover) were open. The chart below sets out the store opening

timeline, from 15 June. The red line shows the number of stores

(left axis) and the blue bars show the percentage of the Company's

Retail sales that these stores account for (right axis).

Click or paste the following link into your web browser to view

the graph titled 'Store Opening Timeline'. Refer to page 6 for this

graph.

http://www.rns-pdf.londonstockexchange.com/rns/4001U_1-2020-7-28.pdf

Retail Like-for-Like Sales from 15 June Onwards

Like-for-like Retail full price sales since 15 June were down

-32%. The weekly and cumulative like-for-like performance is shown

on the chart below. As a general rule, our out-of-town retail parks

have significantly outperformed shopping centres and high street

locations.

Click or paste the following link into your web browser to view

the chart titled 'Like-for-like Full Price Retail Sales Versus Last

Year'. Refer to page 6 for this chart.

http://www.rns-pdf.londonstockexchange.com/rns/4001U_1-2020-7-28.pdf

SALES, PROFIT AND CASH SCENARIOS

The aim of this section is to give shareholders a better

understanding of how the Company's annual cash flow, costs and year

end net debt are likely to turn out in three different sales

scenarios. We have calculated an estimated central scenario, which

is in line with our internal budgets. We have also modelled an

upside and a downside scenario.

The scenarios are valuable in that they give a feel for how the

Company might perform in very different trading environments and

the underlying strength of the Company's finances. But they are a

long way from pinpoint accuracy and these assumptions about sales

and costs need to be treated with some caution. So many factors are

unforeseeable: the progress and development of the pandemic, the

treatments available, the wider economic environment along with

public policy responses both in the UK and overseas, could all make

a huge difference to consumer demand, our supply base and operating

costs.

The steps are as follows:

1. Set out three scenarios for sales performance versus last year(4) .

2. Calculate, for each scenario, the cost of lost sales less any

operating cost savings and reduced nextpay lending.

3. Add cash resources generated by suspending dividends and other corporate measures.

4. Calculate total cash flows, change in year end net debt and the implied profit before tax.

(4) Please note that the values shown in this section for the

changes in sales, costs, and the additional measures to conserve

and generate cash are all relative to last year. This is different

to our April Trading Statement that compared sales, costs and cash

generating measures to our original budget for this year, referred

to in our April Trading Statement as our 'base case'.

1. FULL PRICE SALES SCENARIOS

The table below sets out our revised full price sales scenarios

for the second half and for the full year. The central scenario,

with full price sales in the year being down -26% on last year, is

in line with our internal budget and what we consider to be most

likely at this time. Within that number we are assuming that Retail

will be down -33% and Online sales will be down -7%.

The downside scenario, with full price sales down -33% on last

year, assumes that sales in the second half perform in line with

the first half. This scenario reflects a level of sales decline

that seems most likely if we experience a second wave of the

pandemic along with another lockdown.

The upside scenario assumes a more dramatic recovery and

probably represents the top end of what is achievable with the

stock that is now available for the second half.

Central Downside

Full price sales versus last year Upside scenario scenario scenario

================================== =============== ========= =========

First half - 33% - 33% - 33%

Second half scenario - 5% - 19% - 33%

=============== ========= =========

Full year - 18% - 26% - 33%

2. COST OF LOST SALES, LESS SAVINGS AND REDUCED LING

The table below sets out the cash flow impact of lost sales

after cost saving measures but without the corporate actions we

have taken to conserve or generate cash (such as cancelling

dividends).

Central Downside

Upside scenario scenario scenario

Change versus last year GBPm (e) - 18% - 26% - 33%

======================================= =============== ========= =========

Full price sales (VAT ex) - 700 - 975 - 1,250

Markdown sales (VAT ex) - 95 - 85 - 70

=============== ========= =========

TOTAL LOST SALES (VAT ex) - 795 - 1,060 - 1,320

Reduction in cost of stock (See Note

1) +195 +280 +305

Reduced wages (See Note 2) +120 +140 +165

Other operational cost savings (See

Note 3) +20 +45 +50

Reduced business rates +80 +80 +80

Reduced Corporation Tax +15 +40 +75

NET CASH FROM LOST SALES - 365 - 475 - 645

Inflow from reduction in nextpay

lending +155 +265 +285

=============== ========= =========

NET CASH AFTER REDUCED NEXTPAY LING - 210 - 210 - 360

Cost Scenarios and Variability to Sales

In our central scenario, we anticipate wage cost savings versus

last year of GBP140m and other cost savings of GBP45m. Details of

the forecast savings in the central scenario are provided in the

Appendix, notes 1 to 3.

In the upside scenario, where full price sales improve by

+GBP275m, we expect to incur GBP45m of additional costs which

represents 16% of the additional sales. This increase would reflect

additional staffing, logistics and marketing costs. However, in our

downside scenario as sales reduce our ability to reduce costs

further becomes harder to achieve and we would anticipate saving

only GBP30m, 11% of the value of lost sales.

In all scenarios the wage savings do not include any benefit

from the GBP1,000 (per retained employee) furlough bonus scheme

announced by the Chancellor in July as we do not intend to apply

for this scheme.

Explanation of Change in nextpay Lending

In our upside scenario we have assumed the increased sales are

weighted towards Online, which increases our lending to customers

and so reduces the cash inflow from nextpay lending. In the

downside scenario, we have weighted the sales reduction towards

Retail and so there is a much smaller effect on nextpay

lending.

3. GENERATION OF ADDITIONAL CASH RESOURCES

The table below sets out our forecast for discretionary cash

flows this year versus last year and shows the measures we have

taken to generate and conserve the Company's cash resources. We

have 1) halted shareholder distributions, 2) sold and leased back a

warehouse complex and our Head Office, 3) reduced capital

expenditure and, 4) paused share purchases for our Employee Share

Option Trust (ESOT). As a result, we expect to generate a year on

year cash flow benefit of +GBP690m after accounting for an increase

in pension contributions.

For completeness, the final column of the table shows the

equivalent forecast at the time of our April Trading Statement. The

most significant change since April has been the ESOT loan recall,

which we have reversed during the second quarter due to the Group's

improved cash position.

Jan 21

vs Jan April

20 GBPm forecast

Category Description (e) var GBPm

================= ============================================ ======== =========

We spent GBP19m on share buybacks in

early February but suspended buybacks

once the scale of the crisis became

Share buybacks apparent. +281 +281

Shareholder distributions have been

Dividends suspended until the situation stabilises. +214 +214

================= ============================================ ======== =========

SUB TOTAL Total shareholder distributions +495 +495

We have sold and leased back a warehouse

complex (GBP106m) and our Head Office

Asset sales in Enderby (GBP51m). +157 +155

We are currently forecasting to spend

GBP112m on capital expenditure during

the year, this compares an initial

plan of GBP145m and GBP139m last year.

Against our plan we have cut store

capex by GBP10m, head office by GBP5m

and reduced warehouse capex by GBP18m.

The warehouse capex saving was a result

of lockdown delays rather than a conscious

Capex decision to reduce costs. +27 +39

We suspended purchases of shares into

ESOT purchases our ESOT. +27 +27

The ESOT loan recall transaction that

was completed in May was reversed in

ESOT loan recall July as our cash position improved. 0 +87

The recent revaluation in our final

salary pension fund in June resulted

in a technical deficit of GBP67m. This

has triggered an increase in Company

Pension contributions. - 16 - 4

================= ============================================ ======== =========

TOTAL Total cash flow +690 +799

4. TOTAL CASH FLOWS, CHANGE IN YEAR NET DEBT AND IMPLIED PROFIT

BEFORE TAX

The table below sets out the forecast net cash flows this year

and the reduction in net debt at the end of the year. The last two

lines give our forecasts for (52 week) profit before tax and EBITDA

in each scenario. In all three scenarios we anticipate that the

Company will significantly reduce year end debt and deliver a full

year profit. Please note that the current year is a 53 week year

and the additional week is likely to add a further +GBP12m of

profit to our reported profit number for each scenario.

Upside Central Downside

scenario scenario scenario

GBPm (e) - 18% - 26% - 33%

================================= ========= ========= =========

NET CASH FROM LOST SALES - 365 - 475 - 645

Inflow from reduction in nextpay

lending +155 +265 +285

================================= ========= ========= =========

NET CASH AFTER REDUCED NEXTPAY

LING - 210 - 210 - 360

Cash generated from additional

measures +690 +690 +690

================================= ========= ========= =========

CASH GENERATED VERSUS LAST YEAR 480 480 330

Last year increase in net debt - 16 - 16 - 16

================================= ========= ========= =========

THIS YEAR DECREASE IN NET DEBT 464 464 314

IMPLIED PROFIT BEFORE TAX (52 week) 330 195 15

IMPLIED EBITDA (52 week) 500 365 185

Anticipated Non-Recurring Profit and Loss Items

Within our three profit scenarios there are some material items

that we do not expect to be repeated. Although the values of these

non-recurring items are individually significant, when combined,

the net effect on profit is not material.

As shown in the table below, we anticipate that the profit

generated from the sale and leaseback of properties (forecast at

GBP47m) will be fully offset in the profit and loss account by the

cost of store impairment and an increase in onerous lease

provisions for Retail stores. In addition, based on our central

scenario, we have increased our provisions for unsold stock and

fabric (GBP50m) and we have provided for a potential increase in

bad debt rates (GBP20m). These two costs have been offset by the

GBP80m reduction in business rates.

Central scenario

GBPm (e) profit impact

============================================================ ================

Property profit from the sale and leaseback of properties +47

Property provisions for store impairment and onerous leases - 47

Stock and fabric provisions - 50

Bad debt provisions (see note 4 on page 13) - 20

Business rates reduction +80

Total profit impact +10

Net Debt, Financing and Headroom

Based on the three given sales scenarios, our net debt will have

peaked in February at GBP1.15bn. In our central scenario we expect

net debt to close the year at GBP648m, which would be a reduction

of GBP464m in the year.

The chart below shows our weekly net debt for the first half of

the year and forecast for the second half of the year. As can be

seen, we expect to remain comfortably within our bond and bank

facilities of GBP1,575m in all scenarios. Based on our central

scenario, at the year end, we will have cash resources of GBP477m

and further bank facilities of GBP450m, giving the Group financial

headroom of over GBP900m.

Click or paste the following link into your web browser to view

the chart titled 'Net Debt and Financing'. Refer to page 11 for

this graph.

http://www.rns-pdf.londonstockexchange.com/rns/4001U_1-2020-7-28.pdf

SUMMARY

In summary, the Company is in a much better position than we

anticipated three months ago: consumer demand has held up better

than expected and our Online warehouses have achieved much higher

capacities than we thought possible. Costs have been well

controlled, and we have taken steps to ensure that our balance

sheet is secure.

Whilst much of our time has been focussed on managing the

business through the pandemic, we have not lost sight of the fact

our sector was already experiencing far-reaching structural changes

as consumers increase their expenditure Online. If anything, these

changes are likely to accelerate as a result of the crisis. So, we

have continued to move the business forward, actively investing in

the systems, Online capacity and business ideas that we believe

will be important in a post pandemic world.

INTERIM RESULTS

We are scheduled to announce our results for the first half of

the year on Thursday 17 September 2020.

APPIX:

PROFIT SCENARIOS: STOCK AND COSTS

The following sections provide more detail on how we have

managed stock purchases this year and how we expect our other costs

to change this year versus last year. The figures shown relate to

our central scenario where full price sales for the year are down

-26% on last year. Please note the analysis below compares costs to

last year, which is different to our April Trading Statement which

compared costs to our original budget for this year, referred to as

our 'base case'.

1. Stock Cancellations (GBP280m)

The table below sets out the value of stock, at retail selling

value, that we have either cancelled or deducted from our original

buy budget. This has saved the cost value of the stock, less

compensation paid to suppliers and commission to NEXT Sourcing (our

internal sourcing agent).

GBPm (e)

==================================================== ========

Cancelled stock at retail selling value 450

Reduced future buy at retail selling value 630

========

Total reduction in stock at retail selling value 1,080

Cost of stock saved, less supplier compensation and

NEXT sourcing commission 280

Stock Carried into Spring Summer 2021

In addition to cancelling stock, we have identified GBP150m (at

retail selling value) of Spring Summer 2020 stock that can be

carried forward into Spring Summer 2021. This will represent around

7% of the total Spring Summer 2021 buy. This number is much lower

than we initially anticipated because we have sold more of it in

the second quarter.

2. Wages (GBP140m)

The fall in sales has resulted in lower staffing requirements

across all operations. We forecast that at our central scenario,

wage costs will be -GBP140m lower than last year. This represents

around 20% of last year's wage bill.

We initially furloughed 88% of our staff across the business,

mainly as a result of the closure of our stores and warehouses.

Most staff have now returned to work as the business has reopened.

Around 10% of our staff currently remain on furlough, the majority

of whom are in Retail stores. We anticipate that the vast majority

of these staff will return to work as trade builds in the Christmas

period.

3. Other Operational Cost Savings (GBP45m)

Based on our central scenario, we expect to reduce operational

costs (excluding wage costs) by

-GBP45m compared to last year.

These forecast savings can be split into three categories: (1)

COVID related cost savings (-GBP77m) generated from business

actions following lockdown, (2) COVID related cost increases

(+GBP22m), which have been incurred as a direct result of the

pandemic, and (3) underlying operational net cost increases

(+GBP10m), which are not related to the COVID pandemic. The

following table provides details on the nature of the savings and

increases.

COST AREA Cost versus last year GBPm (e)

====================================================================================== ==============================

COVID COST SAVINGS

Retail and Online marketing, catalogues and photography - 38

Store costs including service charge, repairs and maintenance, electricity, cleaning,

credit

card commission, bags and hangers - 27

Distribution costs - 8

Overseas travel costs - 4

====================================================================================== ==============================

SUBTOTAL: COVID COST SAVINGS - 77

COVID COST INCREASES

Store and warehouse set up costs for ensuring a safe COVID environment for both staff

and

customers +10

Additional storage costs in the UK +3

Unrecovered international Online distribution surcharges +9

====================================================================================== ==============================

SUBTOTAL: COVID COST INCREASES +22

UNDERLYING OPERATIONAL COST INCREASES VERSUS LAST YEAR

Includes increased investment in systems costs and warehouse infrastructure, offset

by reductions

in store rents achieved on lease renewal +10

TOTAL CHANGE IN COSTS VERSUS LAST YEAR - 45

4. Additional Bad Debt Provision

We have not experienced any change in the speed at which

customers are paying down their accounts versus last year or

observed any material change in default rates. However, we have

increased our bad debt provisions by GBP20m to account for any

defaults that may occur as furlough schemes come to an end later in

the year.

Forward Looking Statements

Certain statements in this Trading Update are forward looking

statements. These statements may contain the words "anticipate",

"believe", "intend", "aim", "expects", "will", or words of similar

meaning. By their nature, forward looking statements involve risks,

uncertainties or assumptions that could cause actual results or

events to differ materially from those expressed or implied by

those statements. As such, undue reliance should not be placed on

forward looking statements. Except as required by applicable law or

regulation, NEXT plc disclaims any obligation or undertaking to

update these statements to reflect events occurring after the date

these statements were published.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFVLLLBDLZBBZ

(END) Dow Jones Newswires

July 29, 2020 02:00 ET (06:00 GMT)

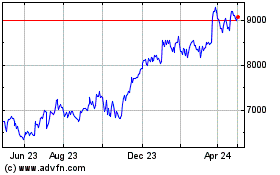

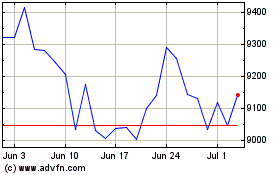

Next (LSE:NXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Next (LSE:NXT)

Historical Stock Chart

From Apr 2023 to Apr 2024