TIDMNOG

RNS Number : 1126D

Nostrum Oil & Gas PLC

24 June 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION

London, 24 June 2019

Corporate Update and

Assessment of Strategic & Operational Options for

Nostrum

Nostrum Oil & Gas PLC (LSE: NOG) ("Nostrum", or "the

Company"), an independent oil and gas company engaging in the

production, development and exploration of oil and gas in the

pre-Caspian Basin, announces that its Board has commenced a

strategic review to optimise its value and that of its assets,

together with the consideration of appropriate sources of finance

required to pursue the range of growth opportunities available to

it.

The Company has also announced today that it has entered in to

an agreement to acquire 50% of Positive Invest LLP, the owner of

the Stepnoy Leopard licences. Management estimates that the Stepnoy

Leopard licences could hold up to 452 mmboe of in place volumes,

and up to 200 mmboe of Contingent Resources of which over 20% are

estimated to be liquids. The licences are located within 60km-120km

of the Company's infrastructure. Nostrum has the right to acquire a

further 50% of Positive Invest LLP subject to certain conditions

being met by the sellers. This acquisition secures additional

undeveloped, material gas condensate resource that can be processed

through Nostrum's infrastructure in the future.

Over the past 12 months, Nostrum has achieved a number of

additional significant milestones. These include the mechanical

completion of the GTU3 gas treatment unit, the agreement of a gas

tolling contract with Ural Oil and Gas LLP, and recent exploration

success in the northern part of the Chinarevskoye licence area.

Following the successful completion of these milestones, the

Company has identified a broad range of operational and strategic

opportunities for the business to deliver shareholder value, some

of which require the investment of further capital in the business.

These options include (but are not limited to) further throughput

agreements with third party gas suppliers, bolt-on acquisitions in

existing and adjacent fields, farming down stakes in some assets to

expedite their development, and a corporate transaction. The

Company therefore announces that it is launching a process to

review these operational and strategic options for Nostrum and its

shareholders. No decision has been taken yet, and there can be no

certainty that this review of options will result in any

agreement(s) or transaction(s) being concluded.

Formal Sale Process

One of the options that will be considered by Nostrum is a sale

of the Company. The Takeover Panel has agreed that any discussions

with third parties may be conducted within the context of a "formal

sale process" (as defined in the City Code on Takeovers and Mergers

(the "Takeover Code")) to enable conversations with parties

interested in making a proposal to take place on a confidential

basis.

The Company is not in receipt of any approaches at the time of

this announcement.

Parties with a potential interest in making a proposal should

contact Goldman Sachs International (contact details as set out

below).

It is currently expected that any party interested in

participating in the formal sale process will, at the appropriate

time, enter into a non-disclosure agreement and standstill

arrangement with Nostrum on terms satisfactory to the Board of the

Company and on the same terms, in all material respects, as other

interested parties. The Company then intends to provide such

interested parties with certain information on the Group's

business, following which interested parties shall be invited to

submit their proposals to Goldman Sachs International. Further

announcements regarding timings for the formal sale process will be

made when appropriate.

There can be no certainty that an offer will be made, nor as to

the terms on which any offer will be made.

The Board of Nostrum reserves the right to alter or terminate

the process at any time and in such cases will make an announcement

as appropriate. The Board of Nostrum also reserves the right to

reject any approach or terminate discussions with any interested

party at any time.

A copy of this announcement is also available on Nostrum's

website at www.nostrumoilandgas.com/investors/.

Rule 2.9 of the Takeover Code

For the purposes of Rule 2.9 of the Takeover Code, Nostrum

confirms that it has in issue 188,182,958 ordinary shares of

GBP0.01 each. The ISIN for the shares is GB00BGP6Q951.

Rules 2.4(a), 2.4(b) and 2.6(a) of the Takeover Code

The Panel on Takeovers and Mergers (the "Takeover Panel") has

agreed that any discussions with third parties may be conducted

within the context of a formal sale process. Accordingly, it has

granted a dispensation from the requirements of Rules 2.4(a),

2.4(b) and 2.6(a) of the Code such that any interested party

participating in the formal sale process will not be required to be

publicly identified under Rules 2.4(a) or 2.4(b) as a result of

this announcement and any interested party participating in the

formal sale process will not be subject to the 28-day deadline

referred to in Rule 2.6(a) of the Code for so long as it is

participating in the formal sale process. Following this

announcement, the Company is now considered to be in an "offer

period" as defined in the Code, and the dealing disclosure

requirements as set out below will apply.

Disclosure of inside information in accordance with Article 17

of Regulation (EU) 596/2014 (16 April 2014) relating to Nostrum Oil

& Gas PLC.

LEI: 2138007VWEP4MM3J8B29

Further information

For further information please visit www.nog.co.uk

Further enquiries

Nostrum Oil & Gas PLC - Investor Relations

Kirsty Hamilton-Smith

Amy Barlow

+44 203 740 7433

ir@nog.co.uk

Goldman Sachs International

Nimesh Khiroya

Brian O'Keeffe

+44 (0) 207 774 1000

Instinctif Partners - UK

David Simonson

Sarah Hourahane

Dinara Shikhametova

+ 44 (0) 207 457 2020

nostrum@instinctif.com

Promo Group Communications - Kazakhstan

Asel Karaulova

Irina Noskova

+ 7 (727) 264 67 37

Notifying person

Thomas Hartnett

Company Secretary

About Nostrum Oil & Gas

Nostrum Oil & Gas PLC is an independent oil and gas company

currently engaging in the production, development and exploration

of oil and gas in the pre-Caspian Basin. Its shares are listed on

the London Stock Exchange (ticker symbol: NOG). The principal

producing asset of Nostrum is the Chinarevskoye field, in which it

holds a 100% interest and is the operator through its wholly-owned

subsidiary Zhaikmunai LLP. In addition, Nostrum holds a 100%

interest in and is the operator of the Rostoshinskoye, Darinskoye

and Yuzhno-Gremyachenskoye oil and gas fields through the same

subsidiary. Located in the pre-Caspian basin to the north-west of

Uralsk, these exploration and development fields are situated

between approximately 60 and 120 kilometres from the Chinarevskoye

field.

Additional information

Goldman Sachs International, which is authorised by the

Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority in the

United Kingdom, is acting exclusively for Nostrum Oil & Gas PLC

and no one else in connection with the matters referred to in this

announcement and will not be responsible to anyone other than

Nostrum Oil & Gas PLC for providing the protections afforded to

clients of Goldman Sachs International, or for providing advice in

connection with the contents of this announcement or any other

matter referred to in this announcement.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

Forward-Looking Statements

Some of the statements in this document are forward-looking.

Forward-looking statements include statements regarding the intent,

belief and current expectations of the Company or its officers with

respect to various matters. When used in this document, the words

"expects", "believes", "anticipates", "plans", "may", "will",

"should" and similar expressions, and the negatives thereof, are

intended to identify forward-looking statements. Such statements

are not promises or guarantees, and are subject to risks and

uncertainties that could cause actual outcomes to differ materially

from those suggested by any such statements.

No part of this announcement constitutes, or shall be taken to

constitute, an invitation or inducement to invest in the Company or

any other entity, and shareholders of the Company are cautioned not

to place undue reliance on the forward-looking statements. Save as

required by the Listing Rules and applicable law, the Company does

not undertake to update or change any forward-looking statements to

reflect events occurring after the date of this announcement.

Dealing Disclosure Requirements of the City Code on Takeovers

and Mergers

Under Rule 8.3(a) of the Code, any person who is interested in 1

per cent. or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s).

An Opening Position Disclosure by a person to whom Rule 8.3(a)

applies must be made by not later than 3.30 pm (London time) on the

10th business day following the commencement of the offer period

and, if appropriate, by not later than 3.30 pm (London time) on the

10th business day following the announcement in which any

securities exchange offeror is first identified. Relevant persons

who deal in the relevant securities of the offeree company or of a

securities exchange offeror prior to the deadline for making an

Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by not later than 3.30 pm

(London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Takeover Panel's Market

Surveillance Unit on +44 (0)20 7638 0129 if you are in any doubt as

to whether you are required to make an Opening Position Disclosure

or a Dealing Disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLIFFIRFISFIA

(END) Dow Jones Newswires

June 24, 2019 02:01 ET (06:01 GMT)

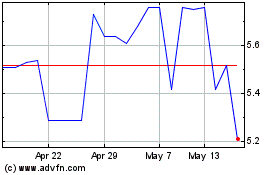

Nostrum Oil & Gas (LSE:NOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nostrum Oil & Gas (LSE:NOG)

Historical Stock Chart

From Apr 2023 to Apr 2024