TIDMMXCT TIDMTTM

RNS Number : 6880M

MaxCyte, Inc.

18 September 2019

MaxCyte, Inc.

("MaxCyte" or the "Company")

Results for the Six Months ended 30 June 2019

3/4 Strong commercial execution and financial performance with 21%

year-over-year revenue growth

3/4 Cell therapy licenses now exceeding 80 programmes

3/4 Significant clinical progress in CARMA(TM) programme

Gaithersburg, Maryland - 18 September 2019 - MaxCyte (LSE: MXCT,

MXCS), the global cell-based therapies and life sciences company,

announces today its financial results, along with its key commercial

and clinical highlights, for the six months ended 30 June 2019.

HIGHLIGHTS (including post-period-end highlights)

Operational

* Expanded the Company's Life Sciences business to more

than 80 cell therapy programmes (including the

recently announced agreement with Kite, a Gilead

Company; CRISPR Therapeutics; and Precision

BioSciences) of which more than 45 are now licensed

for clinical use

* Aggregate potential milestone payments (excluding

sales-based payments after partners' commercial

launch) from its commercial cell therapy agreements

nearly doubled year-to-date to in excess of $450m

from five commercial licenses

* ExPERT(TM), MaxCyte's next generation family of

instruments and disposables, launched with strong H1

2019 sales as well as positive feedback and interest

from both existing and new customers

* Dosing underway in second cohort of MaxCyte's Phase I

dose-escalation clinical trial with MCY-M11, the

Company's lead, wholly-owned, non-viral mRNA-based

cell therapy candidate from its CARMA platform,

following the successful dosing of patients in

trial's first patient cohort

* Presented at American Society of Gene and Cell

Therapy (ASGCT) on the CARMA platform's unique

manufacturing process that enables faster turnaround

of autologous cell therapy to patients and its

potential for reduced adverse events

* Appointed Dr Dhana Chinnasamy as Vice President,

Non-Clinical and Translational Studies, to support

advancement of programmes from CARMA platform (July

2019)

Financial Key metrics H1 2019 H1 2018

Revenue $8.4m $6.9m

------------- -------------

Gross margin 88% 89%

------------- -------------

CARMA investment ($6.6m) ($2.6m)

------------- -------------

Total operating expenses* ($16.3m) ($10.7m)

------------- -------------

Adjusted EBITDA before

CARMA** ($1.4m) ($1.4m)

------------- -------------

Net profit (loss) before

CARMA expenses ($2.9m) ($2.2m)

------------- -------------

Total assets (as of 30

June) $24.8m $26.8m

------------- -------------

Cash, cash equivalents

and short-term investments

(as of 30 June) $14.9m $18.8m

------------- -------------

* Including CARMA expenses

** Excluding associated non-cash stock-based compensation of $0.3m

and $0.7m in H1 2018 and H1 2019, respectively.

Note: All financial amounts are in USD unless noted otherwise

* Revenue accelerated in the first half of 2019,

increasing approximately 21% over the first half of

2018 ($8.4m compared to $6.9m, respectively) and

in-line with the Company's customary first

half/second half weighting

* Revenues currently driven by high-margin recurring

annual fees from cell therapeutics business, sale of

proprietary single-use disposable processing

assemblies, expansion of products as well as sales

and marketing staff, and clinical milestones

* Management is exploring independent investment to

drive the CARMA opportunity, following recent

positive progress

Commenting on MaxCyte's half-year financial results, Doug Doerfler,

Chief Executive Officer, said: "We have seen a strong start to 2019

during which we have continued to drive substantial growth and progress

across all aspects of our business. Our revenue-generating Life Sciences

business has performed strongly during the period delivering revenue

growth of 21% and approximately 90% margins. We are also particularly

encouraged by the customer response to the recent launch of our industry

leading ExPERT platform and the extension of our relationship with

Kite through a multi-drug clinical and commercial agreement, which

built upon our existing research agreement. We continue to be very

excited for the commercial prospects of our high-growth Life Sciences

business.

"We continue to be encouraged by activity in the cell therapy sector,

including the growing market for our technology arising from the

substantial capital investment, company creation and clinical investments

in the space. We retain the premier position as the cell engineering

technology of choice, particularly in gene editing and immune-oncology.

And our successful research, clinical and commercial licensing business

in this market to date reinforces our confidence in continuing our

focused marketing and sales efforts in cell therapy.

"We are pleased with the clinical progress of our CARMA platform's

lead candidate, MCY-M11, which has advanced into the second cohort

of its Phase I study, validating our streamlined manufacturing platform

for chimeric antigen receptor (CAR) therapies in patients with solid

cancers. In the coming months we look forward to reporting further

progress in establishing CARMA as an autologous cell therapy platform

for targeted cell-based immune therapies. We anticipate this will

include the expansion into additional cancer indications, which we

believe will significantly broaden the opportunity and value for

our stakeholders, especially patients.

"CARMA continues to make positive progress, in particular with the

active ovarian cancer/mesothelioma trial with MCY-M11, the Company's

continued efforts in new product candidate development, and the recent

key hire of our vice president, non-clinical and translational studies.

Based on this progress as well as the strength and maturity of our

Life Sciences business -- and in order to build momentum and grow

the CARMA opportunity appropriately, the management team is evaluating

independent sources of financing for CARMA along with the timing

and level of clinical and pipeline investments beyond the current

trial."

Conference call for analysts

A briefing for analysts will be held at 11.00 am BST on Wednesday,

18 September 2019 at 1 Cornhill, London, EC3V 3NR. There will be

a simultaneous live conference call with Q&A, and the presentation

will be available on MaxCyte's website at http://www.maxcyte.com/

Dial-in details:

Participant dial-in: 0800 279 6547

International dial-in: +44 (0) 2071 928011

Participant code: 3859806

An audio replay file will be made available shortly afterwards via

the Company website:

http://www.maxcyte.com/

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S LETTER

We are pleased to report MaxCyte's financial and operational results

for the six months ended 30 June 2019, during which the Company had

another period of strong growth and made progress across all areas

of the business in-line with its strategic objectives.

Our industry is experiencing the emergence of exciting new modalities

for treating patients, both cellular therapy and gene editing in

particular, and MaxCyte is exceptionally well positioned to support

and benefit from the unprecedented growth of these therapeutic areas.

MaxCyte offers a highly differentiated approach to cell engineering

that is enabling leaders in the field to develop new and groundbreaking

treatments for diseases ranging from ultra-rare indications affecting

a handful of patients, to some of the most common forms of cancer.

Our team is using this core technology to power MaxCyte's own therapeutic

development programmes through CARMA - our proprietary therapeutic

platform for next-generation CAR-based cancer treatments, specifically

in solid tumours.

April 2019 saw the launch of ExPERT, MaxCyte's next generation of

instruments and disposables, delivering clinically validated, Flow

Electroporation(R) technology for complex cellular engineering. The

ExPERT range of products builds on the solid technology foundation

at the core of MaxCyte's instrument platforms, which are already

used by a broad client base, including all of the top ten biopharmaceutical

companies by revenue, who are developing increasingly sophisticated

biological and cellular-based therapeutics. MaxCyte's ExPERT instruments

and disposables allow its partners to develop therapeutics through

the continuum from research to commercial launch on a single, versatile

platform. We believe the ExPERT platform and our on-going investment

in our technology will help further solidify MaxCyte's leading position

in the cell therapy and gene editing markets.

80+ Partnered Programmes

MaxCyte's technology continues to help unlock the potential of cutting-edge

product development programmes, enabling many of the leading gene

editing companies in the field and demonstrating our leadership as

the go-to technology for cell engineering. MaxCyte has signed licenses

with partners covering more than 80 cell therapy programmes. This

includes the recently announced agreement with Kite, a Gilead Company,

an expansion of an existing research agreement signed November 2018

that allows Kite to use MaxCyte's Flow Electroporation Technology

to enable non-viral cell engineering for development of multiple

CAR-T drug candidates. Partners with clinical and commercial, multi-target

licenses also include CRISPR Therapeutics and Precision BioScience.

A further undisclosed commercial agreement was recently entered into,

taking the number of commercial licences to five.

More than 45 of our cell therapy programmes are licensed for clinical

use. In particular, MaxCyte is the industry's "go-to partner" for

the development of next-generation off-the-shelf and allogeneic CAR-T

therapies. The aggregate potential milestone payments from commercial

agreements signed to date are currently in excess of $450m.

Clinical Progress and CARMA Strategy

During the period we reported important clinical progress with MaxCyte's

lead, wholly-owned programme, MCY-M11, a non-viral mRNA-based cell

therapy candidate from its CARMA platform. MCY-M11 is a mesothelin-targeting

CAR therapy being tested in individuals with relapsed/refractory

ovarian cancer and peritoneal mesothelioma. Following successful

dosing of patients in the first cohort of a Phase I dose-escalation

clinical trial with MCY-M11 with no safety issues or serious adverse

events observed, the Company began dosing patients in the second

cohort of its trial in May 2019.

The successful completion of patient dosing in the first cohort,

and the initiation of dosing in the second higher-dose cohort, represent

important milestones for MaxCyte as we aim to establish our proprietary

CARMA autologous cell therapy platform. CARMA's offering of a streamlined,

uniquely rapid manufacturing process for autologous cell therapies

is an important differentiator from other CAR technologies. In addition,

the CARMA platform's utilization of Flow Electroporation rather than

viral vectors enables repeat dosing of patients, a feature that may

be key for the successful treatment of solid tumours with a cell

therapy. A further distinguishing feature of MaxCyte's CARMA platform

is its use of mRNA to deliver the CAR into cells rather than DNA.

The transient nature of mRNA may help alleviate some of the safety

limitations seen with other CAR treatment approaches.

Based on the positive progress of our CARMA platform and programme,

the management team is presently evaluating independent sources of

financing for CARMA, along with the timing and level of clinical

and pipeline investments beyond the current trial in order to maximise

the potential of CARMA.

Financial Review

Revenues for the period totaled $8.4m, representing a 21% increase

over the same period of 2018 ($6.9m), reflecting continued expansion

of the Company's Life Sciences customer base. Gross margins remained

strong over the period at 88%, and the Company continues to have

good visibility on future revenues due to its instrument-licensing

and consumables revenue streams.

In February 2019, the Company raised GBP10.0 million through the

placing of a total of 5,908,319 shares of New Common Stock. We thank

our new and existing investors for their support.

The Company's operating expenses for the 2019 period (including

CARMA investment) were $16.3m compared to $10.7m for the same period

in 2018, resulting principally from the $4.1m increase in CARMA investments

associated with clinical progress as well as increased investments

in sales and marketing, product development and other non-CARMA R&D

activities focused on driving and supporting MaxCyte's revenue growth.

Investment in CARMA was $6.6m in 2019 (first half 2018: $2.6m) as

the Company observed continued progress from its in-human clinical

trial of MCY-M11 as it moved into the second dose cohort.

MaxCyte's net loss before taking into consideration expenses from

the CARMA programme was $2.9m for the 2019 period compared to net

loss of $2.2m (also before taking into consideration expenses from

CARMA) for the same period of 2018. The net loss, including the CARMA

investment, was $9.5m for the 2019 period compared to $4.8m in the

same period last year.

EBITDA before CARMA investment and non-cash stock-based compensation

was a loss of $1.4m for the current period (first half 2018: $1.4m).

As of 30 June 2019, MaxCyte held cash and cash equivalents, including

short-term investments, amounting to $14.9m compared to $14.4m as

of 31 December 2018. The 30 June 2019 cash balance reflects the repayment

of the Company's $5m debt facility, which was repaid in full in February,

prior to the GBP10m equity raise. Management expects to have a $5m

debt facility in place by year end.

Outlook

MaxCyte's Board anticipates continued progress for the remainder

of the 2019 financial year and the Company is trading in line with

expectations. MaxCyte will continue investing in the expansion of

its Life Sciences instrument business, including developing new applications

for its technology and new product enhancements to support the expansion

of our customer base. We expect our ExPERT platform to continue to

drive revenue growth from our instruments business and from expanding

our cell therapy partner licenses. In addition, the Company will

continue to develop opportunities to expand its cell therapy pipeline

and is actively seeking to accelerate a number of high-value clinical

and commercial partnerships based on the Company's enabling cell-technology

business in a diverse range of fields, including immuno-oncology,

gene editing and regenerative medicine.

The Company also remains focused on creating value from the advancement

of MCY-M11 through the clinic as well as the CARMA pipeline and opportunity

in general, for the treatment of additional solid and liquid tumour

indications that will significantly broaden the opportunity for the

platform. We look forward to providing additional updates with regard

to the exciting CARMA business.

Doug Doerfler

President and Chief Executive Officer

J. Stark Thompson, Ph.D.

Non-executive Chairman

17 September 2019

About MaxCyte

MaxCyte is a clinical-stage global cell-based therapies and life

sciences company applying its proprietary cell engineering platform

to deliver the advances of cell-based medicine to patients with high

unmet medical needs. MaxCyte is developing novel CARMA therapies

for its own pipeline, with its first drug candidate in a Phase I

clinical trial. CARMA is MaxCyte's mRNA-based proprietary therapeutic

platform for autologous cell therapy for the treatment of solid cancers.

In addition, through its life sciences business, MaxCyte leverages

its Flow Electroporation(R) Technology to enable its biopharmaceutical

partners to advance the development of innovative medicines, particularly

in cell therapy. MaxCyte has placed its flow electroporation instruments

worldwide, including with all of the top ten global biopharmaceutical

companies. The Company now has more than 80 partnered programme licenses

in cell therapy with more than 45 licensed for clinical use, including,

five commercial licenses (four of which have been previously announced).

Aggregate potential pre-commercial milestones from all license deals

total more than $450m. With its robust delivery technology platform,

MaxCyte helps its partners to unlock the full potential of their

products. For more information, visit www.maxcyte.com.

This announcement contains inside information for the purposes of

Article 7 of Regulation (EU) No 596/2014 (MAR).

MaxCyte Inc.

Doug Doerfler, Chief Executive Officer

Ron Holtz, Chief Financial Officer +1 301 944 1660

Nominated Adviser and Joint Corporate

Broker

Panmure Gordon

Emma Earl

Freddy Crossley

Corporate Broking

James Stearns +44 (0)20 7886 2500

Joint Corporate Broker

Numis Securities Limited

James Black

Duncan Monteith +44 (0)20 7260 1000

Financial PR Adviser

Consilium Strategic Communications +44 (0)203 709 5700

Mary-Jane Elliott maxcyte@consilium-comms.

Chris Welsh com

Sukaina Virji

--------------------------------------------------------------

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed to

be, forward looking statements. Forward looking statements are identi

ed by their use of terms and phrases such as "believe", "could",

"should", "expect", "envisage", "estimate", "intend", "may",

"plan", "potentially", "will" or the negative of those, variations

or comparable expressions, including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions regarding

the Company's future growth, results of operations, performance,

future capital and other expenditures (including the amount, nature

and sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements re ect

the Directors' current beliefs and assumptions and are based on information

currently available to the Directors.

A number of factors could cause actual results to differ materially

from the results and expectations discussed in the forward-looking

statements, many of which are beyond the control of the Company.

In particular, the outcome of clinical trials (including, but not

limited to the Company's CARMA trial) may not be favourable, potential

milestone payments associated with the Company's licensed programmes

may not be received or the ability to enter into future partnered

programmes may be limited. In addition, other factors which could

cause actual results to differ materially include risks associated

with vulnerability to general economic and business conditions, competition,

regulatory changes, actions by governmental authorities, the availability

of capital markets, reliance on key personnel, ability to attract

new talent, uninsured and underinsured losses, any future litigation

and other factors. Although any forward-looking statements contained

in this announcement are based upon what the Directors believe to

be reasonable assumptions, the Company cannot assure investors that

actual results will be consistent with such forward looking statements.

Accordingly, readers are cautioned not to place undue reliance on

forward looking statements. Subject to any continuing obligations

under applicable law or any relevant AIM Rule requirements, in providing

this information the Company does not undertake any obligation to

publicly update or revise any of the forward looking statements or

to advise of any change in events, conditions or circumstances on

which any such statement is based.

MaxCyte, Incorporated

Unaudited Condensed Financial Statements

as of 30 June 2019 and 31 December 2018

and for the six months ended

30 June 2019 and 2018

MaxCyte, Inc.

Unaudited Condensed Balance Sheets

(amounts in U.S. dollars, except share amounts)

31 December

30 June 2019 2018

----------------------------------------------- ---------------------------

Assets

Current assets:

Cash and cash equivalents $ 11,468,500 $ 11,248,000

Short-term investments,

at amortized cost 3,439,900 3,191,000

Accounts receivable, net 2,791,900 4,904,500

Inventory 3,494,500 2,242,800

Other current assets 915,700 863,700

----------------------------------------------- ---------------------------

Total current assets 22,110,500 22,450,000

Property and equipment,

net 2,370,800 1,817,900

Other assets 291,600 -

Total assets $ 24,772,900 $ 24,267,900

=============================================== ===========================

Liabilities and stockholders' equity

Current liabilities:

Accounts payable and accrued expenses $ 4,291,500 $ 4,123,300

Other current liabilities 318,900 -

----------------------------------------------- ---------------------------

Deferred revenue 3,768,100 2,449,300

----------------------------------------------- ---------------------------

Total current liabilities 8,378,500 6,572,600

Note payable, net of discount, deferred fees - 5,056,300

Other liabilities 315,100 357,300

----------------------------------------------- ---------------------------

Total liabilities 8,693,600 11,986,200

----------------------------------------------- ---------------------------

Commitments and contingencies (Note 8)

Stockholders' equity

Common stock, $0.01 par; 200,000,000 shares authorized,

57,388,583 and 51,332,764 shares issued and outstanding

at 30 June 2019 and 31 December 2018, respectively. 573,900 513,300

Additional paid-in capital 95,490,500 82,279,300

Accumulated deficit (79,985,100) (70,510,900)

----------------------------------------------- ---------------------------

Total stockholders' equity 16,079,300 12,281,700

----------------------------------------------- ---------------------------

Liabilities and stockholders' equity $ 24,772,900 $ 24,267,900

=============================================== ===========================

See accompanying notes to the financial statements.

MaxCyte, Inc.

Unaudited Condensed Statements of Operations

For the Six Months Ended 30 June,

(amounts in U.S. dollars,

except

share amounts)

2019 2018

------------------------------------ ------------------

Revenue $ 8,373,300 $ 6,930,000

Costs of goods sold 1,043,200 753,500

------------------------------------ ------------------

Gross profit 7,330,100 6,176,500

------------------------------------ ------------------

Operating expenses:

Research and development 9,695,000 4,912,700

Sales and marketing 3,824,200 3,255,500

General and administrative 2,769,600 2,493,500

------------------------------------ ------------------

Total operating expenses 16,288,800 10,661,700

Operating loss (8,958,700) (4,485,200)

------------------------------------ ------------------

Other income (expense):

Interest expense (609,800) (308,800)

Interest and other

income 94,300 7,600

------------------------------------ ------------------

Total other income (expense) (515,500) (301,200)

------------------------------------ ------------------

Net loss $ (9,474,200) $ (4,786,400)

==================================== ==================

Basic and diluted net loss per common share $ (0.17) $ (0.09)

==================================== ==================

Weighted average common shares outstanding, basic

and diluted 55,376,683 51,077,283

==================================== ==================

See accompanying notes to the financial statements.

MaxCyte, Inc.

Unaudited Condensed Statements of Changes in Stockholders' Equity

For the Six Months Ended 30 June,

(amounts in U.S. dollars)

Additional

Paid-in Accumulated Total Stockholders'

Common Stock Capital Deficit Equity

-------------------------------------------- --------------------- ------------------------ --------------------

Shares Amount

Balance 1

January

2018 50,896,376 $ 509,000 $80,729,400 $ (61,641,700) $ 19,596,700

Stock-based

compensation

expense - - 377,700 - 377,700

Exercise of

stock

options 375,638 3,800 161,400 - 165,200

Net loss - - - (4,786,400) (4,786,400)

--------------------- --------------------- --------------------- ------------------------ --------------------

Balance 30

June

2018 51,272,014 $ 512,800 $ 81,268,500 $ (66,428,100) $ 15,353,200

===================== ===================== ===================== ======================== ====================

Additional

Paid-in Accumulated Total Stockholders'

Common Stock Capital Deficit Equity

---------------------------------------------- ---------------------- ------------------------ --------------------

Shares Amount

Balance 1

January

2019 51,332,764 $ 513,300 $ 82,279,300 $ (70,510,900) $ 12,281,700

Issuance of

stock

in public

offering 5,908,319 59,100 12,271,200 - 12,330,300

Stock-based

compensation

expense - - 823,900 - 823,900

Exercise of

stock

options 147,500 1,500 116,100 - 117,600

Net loss - - - (9,474,200) (9,474,200)

---------------------- ---------------------- ---------------------- ------------------------ --------------------

Balance 30

June

2019 57,388,583 $ 573,900 $ 95,490,500 $ (79,985,100) $ 16,079,300

====================== ====================== ====================== ======================== ====================

See accompanying notes to the financial statements.

MaxCyte, Inc.

Unaudited Condensed Statements of Cash Flows

For the Six Months Ended 30 June,

(amounts in U.S. dollars)

2019 2018

----------------------- -----------------------

Cash flows from operating activities:

Net loss $ (9,474,200) $ (4,786,400)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization 256,600 165,800

Net book value of consigned equipment

sold - 20,900

Loss on disposal of fixed assets 2,300 -

Stock-based compensation 823,900 377,700

Bad debt expense 5,000 -

Amortization of discounts on short-term

investments (12,500) (400)

Non-cash interest expense 49,200 19,200

Changes in operating assets and liabilities:

Accounts receivable 1,957,600 (567,000)

Inventory (1,521,800) (856,200)

Other current assets (52,000) (433,900)

Other assets 227,100 -

Accounts payable and accrued expenses 201,600 (1,293,800)

Deferred revenue 1,468,800 744,900

Other liabilities (284,400) 150,900

----------------------- -----------------------

Net cash used in operating activities (6,352,800) (6,458,300)

----------------------- -----------------------

Cash flows from investing activities:

Purchases of short-term investments (3,436,400) (2,732,700)

Maturities of short-term investments 3,200,000 -

Purchases of property and equipment (532,700) (290,500)

----------------------- -----------------------

Net cash used in investing activities (769,100) (3,023,200)

----------------------- -----------------------

Cash flows from financing activities:

Net proceeds from sale of common stock 12,330,300 -

Principal payments on notes payable (5,105,500) -

Proceeds from exercise of stock options 117,600 165,200

Principal payments on capital leases - (3,200)

Net cash provided by financing activities 7,342,400 162,000

----------------------- -----------------------

Net (decrease)increase in cash and cash

equivalents 220,500 (9,319,500)

Cash and cash equivalents, beginning of

period 11,248,000 25,341,700

Cash and cash equivalents, end of period $ 11,468,500 $ 16,022,200

======================= =======================

Supplemental cash flow information:

Cash paid for interest $ 650,100 $ 262,900

Supplemental non-cash information:

Property and equipment purchases included

in accounts payable $ 9,000 $ -

See accompanying notes to the financial statements.

Notes to Financial Statements

1. Organization and Description of Business

MaxCyte, Inc. (the "Company" or "MaxCyte") was incorporated on

31 July 1998, under the laws and provisions of the state of

Delaware, and commenced operations on 01 July 1999.

MaxCyte is a global life sciences company utilizing its

proprietary cell engineering technology to enable the programmes of

its biotechnology and pharmaceutical company customers who are

engaged in cell therapy, including gene editing and

immuno-oncology, and in drug discovery and development, and

biomanufacturing as well as development of CARMA, MaxCyte's

proprietary, mRNA-based immuno-oncology cell therapy platform. The

Company licenses and sells its instruments and technology and sells

its consumables to developers of cell therapies and to

pharmaceutical and biotechnology companies for use in drug

discovery and development and biomanufacturing.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared in

accordance with accounting principles generally accepted in the

United States of America ("U.S. GAAP"). These unaudited interim

condensed financial statements do not include all the information

and footnotes required by U.S. GAAP for complete audited financial

statements. These unaudited interim condensed financial statements

should be read in conjunction with the audited financial statements

and accompanying notes for the year ended 31 December 2018. In the

opinion of management, the unaudited interim condensed financial

statements reflect all the adjustments (consisting of normal

recurring adjustments) necessary to state fairly the Company's

financial position as of 30 June 2019 and the results of operations

for the six months ended 30 June 2019 and 2018. The interim

condensed results of operations are not necessarily indicative of

the results that may occur for the full fiscal year. The 31

December 2018 balance sheet included herein was derived from the

audited financial statements, but do not include all disclosures

including notes required by U.S. GAAP for complete audited

financial statements.

The Company operates in a single business segment.

Use of Estimates

The preparation of financial statements in conformity with U.S.

GAAP requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amount of revenues and

expenses during the reporting period. In the accompanying financial

statements, estimates are used for, but not limited to, revenue

recognition, stock-based compensation, allowance for doubtful

accounts, allowance for inventory obsolescence, accruals for

contingent liabilities, deferred taxes and valuation allowance, and

the depreciable lives of fixed assets. Actual results could differ

from those estimates.

Concentration

During the six months ended 30 June 2019 and 2018, no single

customer represented more than 10% of net revenues.

During the six months ended 30 June 2019, the Company purchased

approximately 57% of its inventory from a single supplier. During

the six months ended 30 June 2018, the Company purchased

approximately 65% of its inventory from two suppliers. As of 30

June 2019 and 2018, amounts payable to these suppliers totaled 22%

and 23% of total accounts payable, respectively.

Foreign Currency

The Company's functional currency is the U.S. dollar;

transactions denominated in foreign currencies are transacted at

the exchange rate in effect at the date of each transaction.

Differences in exchange rates during the period between the date a

transaction denominated in foreign currency is consummated and the

date on which it is either settled or at the reporting date are

recognized in the Statements of Operations as general and

administrative expense. The foreign currency transaction gains

(losses) were ($21,100) and $7,200 for the six months ended 30 June

2019 and 2018, respectively.

Fair Value

Fair value is the price that would be received from the sale of

an asset or paid to transfer a liability assuming an orderly

transaction in the most advantageous market at the measurement

date. U.S. GAAP establishes a hierarchical disclosure framework

which prioritizes and ranks the level of observability of inputs

used in measuring fair value. These tiers include:

-- Level 1-Quoted prices (unadjusted) in active markets that are

accessible at the measurement date for identical assets or

liabilities. The fair value hierarchy gives the highest priority to

Level 1 inputs.

-- Level 2-Observable market-based inputs other than quoted

prices in active markets for identical assets or liabilities.

-- Level 3-Unobservable inputs are used when little or no market

data is available. The fair value hierarchy gives the lowest

priority to Level 3 inputs.

See Note 6 for additional information regarding fair value.

Cash, Cash Equivalents and Short-term Investments

Cash and cash equivalents consist of financial instruments

including money market funds and commercial paper with original

maturities of less than 90 days. Short-term investments consist of

commercial paper with original maturities greater than 90 days and

less than one year. All money market funds and commercial paper are

recorded at amortized cost unless they are deemed to be impaired on

an other-than-temporary basis, at which time they are recorded at

fair value using Level 2 inputs.

The following table summarizes the Company's investments at 30

June, 2019:

Gross unrecognized Gross unrecognized

Amortized holding holding Aggregate

Description Classification cost gains losses fair value

Money market Cash

funds equivalents $ 6,697,900 $ - $ - $ 6,697,900

Commercial Cash

Paper equivalents 2,876,700 500 - 2,877,200

Commercial Short-term

Paper investments 3,439,900 3,200 - 3,433,100

------------------- ---------------------- ----------------------- -----------------

Total Investments $ 13,014,500 $ 3,700 $ - $ 13,018,200

=================== ====================== ======================= =================

The following table summarizes the Company's investments at 31

December, 2018:

Gross unrecognized Gross unrecognized

Amortized holding holding Aggregate

Description Classification cost gains losses fair value

Money market Cash

funds equivalents $ 5,945,200 $ - $ - $ 5,945,200

Commercial Cash

Paper equivalents 3,455,700 500 - 3,456,200

Commercial Short-term

Paper investments 3,191,000 500 - 3,191,500

------------------- ---------------------- ----------------------- -----------------

Total Investments $ 12,591,900 $ 1,000 $ - $ 12,592,900

=================== ====================== ======================= =================

At times the Company's cash balances may exceed federally

insured limits and cash may also be deposited in foreign bank

accounts that are not covered by federal deposit insurance. The

Company does not believe that this results in any significant

credit risk.

Inventory

The Company sells or licenses products to customers. The Company

uses the average cost method of accounting for its inventory and

adjustments resulting from periodic physical inventory counts are

reflected in costs of goods sold in the period of the adjustment.

Inventory consisted of the following at:

30 June 31 December

2019 2018

-------------- -----------------

Raw materials inventory $ 1,711,600 $ 884,200

Finished goods inventory 1,782,900 1,358,600

Total Inventory $ 3,494,500 $ 2,242,800

============== =================

The Company determined no allowance for obsolescence was

necessary at 30 June 2019 or 31 December 2018.

Accounts Receivable

Accounts receivable are reduced by an allowance for doubtful

accounts, if needed. The allowance for doubtful accounts reflects

the best estimate of probable losses determined principally on the

basis of historical experience and specific allowances for known

troubled accounts. All accounts or portions thereof that are deemed

to be uncollectible or to require an excessive collection cost are

written off to the allowance for doubtful accounts. The Company

recorded an allowance for doubtful accounts of $84,000 and $239,000

at 30 June 2019 and 31 December 2018, respectively.

Property and Equipment

Property and equipment is stated at cost. Depreciation is

computed using the straight-line method. Office equipment

(principally computers) is depreciated over an estimated useful

life of three years. Laboratory equipment is depreciated over an

estimated useful life of five years. Furniture is depreciated over

a useful life of seven years. Leasehold improvements are amortized

over the shorter of the estimated lease term or useful life.

Instruments represent equipment held at a customer's site that is

typically leased to customers on a short-term basis and is

depreciated over an estimated useful life of five years.

Property and equipment includes capitalized costs to develop

internal-use software. Applicable costs are capitalized during the

development stage of the project and include direct internal costs,

third-party costs and allocated interest expenses as

appropriate.

Property and equipment consist of the following:

30 June 31 December

2019 2018

------------ ---------------

Furniture and equipment $1,874,200 $ 1,743,200

Instruments 982,500 735,600

Leasehold improvements 280,600 280,600

Internal-use software under

development 200,300 666,700

Purchased software 902,200 28,300

Accumulated depreciation

and amortisation (1,869,000) (1,636,500)

Property and equipment,

net $2,370,800 $ 1,817,900

============ ===============

For the six months ended 30 June 2019 and 2018, the Company

transferred $270,100 and $164,600, respectively of instruments

previously classified as inventory to property and equipment leased

to customers.

For the six months ended 30 June 2019 and 2018, the Company

incurred depreciation and amortization expense of $256,600 and

$165,800 respectively. Maintenance and repairs are charged to

expense as incurred.

Management reviews property and equipment for impairment

whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable. Recoverability

of the long-lived asset is measured by a comparison of the carrying

amount of the asset to future undiscounted net cash flows expected

to be generated by the asset. If such assets are considered to be

impaired, the impairment to be recognized is measured by the amount

by which the carrying amount of the assets exceeds the estimated

fair value of the assets. The Company recognized no impairment in

either of the six months ended 30 June 2019 or 2018.

Revenue Recognition

The Company analyzes contracts to determine the appropriate

revenue recognition using the following steps: (i) identification

of contracts with customers, (ii) identification of distinct

performance obligations in the contract, (iii) determination of

contract transaction price, (iv) allocation of contract transaction

price to the performance obligations and (v) determination of

revenue recognition based on timing of satisfaction of the

performance obligations.

In some arrangements, product and services have been sold

together representing distinct performance obligations. In such

arrangements the Company allocates the sale price to the various

performance obligations in the arrangement on a relative selling

price basis. Under this basis, the Company determines the estimated

selling price of each performance obligation in a manner that is

consistent with that used to determine the price to sell the

deliverable on a standalone basis.

The Company recognizes revenue upon the satisfaction of its

performance obligation (generally upon transfer of control of

promised goods or services to its customers) in an amount that

reflects the consideration to which it expects to be entitled in

exchange for those goods or services.

The Company defers incremental costs of obtaining a customer

contract and amortizes the deferred costs over the period that the

goods and services are transferred to the customer. The Company had

no material incremental costs to obtain customer contracts in any

period presented.

Deferred revenue results from amounts billed in advance to

customers or cash received from customers in advance of services

being provided.

Research and Development Costs

Research and development costs consist of independent

proprietary research and development costs and the costs associated

with work performed for fees from third parties. Research and

development costs are expensed as incurred. Research costs

performed for fees from customers are included in costs of goods

sold.

Stock-Based Compensation

The Company grants stock-based awards in exchange for employee,

consultant and non-employee director services. The value of the

award is recognized as expense on a straight-line basis over the

requisite service period.

The Company utilizes the Black-Scholes option pricing model for

estimating fair value of its stock options granted. Option

valuation models, including the Black-Scholes model, require the

input of highly subjective assumptions, and changes in the

assumptions used can materially affect the grant-date fair value of

an award. These assumptions include the expected volatility,

expected dividend yield, risk-free rate of interest and the

expected life of the award. A discussion of management's

methodology for developing each of the assumptions used in the

Black-Scholes model is as follows:

Expected volatility

Volatility is a measure of the amount by which a financial

variable such as a share price has fluctuated (historical

volatility) or is expected to fluctuate (expected volatility)

during a period. The Company does not currently have sufficient

history with its common stock subsequent to its 2016 initial public

offering to determine its actual volatility. The Company has been

able to identify several public entities of similar size,

complexity and stage of development; accordingly, historical

volatility has been calculated at 49% for the six months ended 30

June 2019 and 47% for the six months ended 30 June 2018 using the

volatility of these companies.

Expected dividend yield

The Company has never declared or paid common stock dividends

and has no plans to do so in the foreseeable future.

Risk-free interest rate

This approximates the U.S. Treasury rate for the day of each

option grant during the year, having a term that closely resembles

the expected term of the option. The risk-free interest rate was

between 2.3% and 2.6% for the six months ended 30 June 2019 and

2.7% and 2.9% for the six months ended 30 June 2018.

Expected term

This is the period of time that the options granted are expected

to remain unexercised. Options granted have a maximum term of ten

years. The Company estimates the expected term of the options to be

6.25 years for options with a standard four-year vesting period,

using the simplified method. Over time, management intends to track

estimates of the expected term of the option term so that estimates

will approximate actual behavior for similar options.

Expected forfeiture rate

The Company records forfeitures as they occur.

Income Taxes

The Company uses the asset and liability method of accounting

for income taxes. Deferred tax assets and liabilities are

determined based on differences between the financial reporting and

tax basis of assets and liabilities and are measured using the

enacted tax rates and laws that are expected to be in effect when

the differences are expected to reverse. The effect on deferred tax

assets and liabilities of a change in tax rates is recognized in

the period that such tax rate changes are enacted. The measurement

of a deferred tax asset is reduced, if necessary, by a valuation

allowance if it is more-likely-than-not that all or a portion of

the deferred tax asset will not be realized.

Management uses a recognition threshold and a measurement

attribute for the financial statement recognition and measurement

of tax positions taken or expected to be taken in a tax return, as

well as guidance on derecognition, classification, interest and

penalties and financial statement reporting disclosures. For those

benefits to be recognized, a tax position must be

more-likely-than-not to be sustained upon examination by taxing

authorities. The Company recognizes interest and penalties accrued

on any unrecognized tax exposures as a component of income tax

expense. The Company has not identified any uncertain income tax

positions that could have a material impact to the financial

statements.

The Company is subject to taxation in various jurisdictions in

the United States and abroad and remains subject to examination by

taxing jurisdictions for 2015 and all subsequent periods. The

Company had a Federal Net Operating Loss ("NOL") carry forward of

$40.5 million as of 31 December 2018, which was generally available

as a deduction against future income for US federal corporate

income tax purposes, subject to applicable carryforward

limitations. As a result of the March 2016 initial public offering,

the Company's NOLs are limited on an annual basis, subject to

certain carryforward provisions, pursuant to Section 382 of the

Internal Revenue Code of 1986, as amended, as a result of a greater

than 50% change in ownership that occurred in the three-year period

ending at the time of the March AIM IPO. The Company has calculated

that for the period ending 31 December 2022, the cumulative

limitation amount exceeds the NOLs subject to the limitation.

Leases

In transactions where the Company is the lessee, at the

inception of a contract, the Company determines if the arrangement

is, or contains, a lease. Right-of-use ("ROU") assets represent the

Company's right to use an underlying asset for the lease term and

lease liabilities represent its obligation to make lease payments

arising from the lease. Operating lease ROU assets and liabilities

are recognized at commencement date based on the present value of

lease payments over the lease term. Rent expense is recognized on a

straight-line basis over the lease term.

The Company has made certain accounting policy elections for

leases where it is the lessee whereby the Company (i) does not

recognize ROU assets or lease liabilities for short-term leases

(those with original terms of 12-months or less) and (ii) combines

lease and non-lease elements of its operating leases. Operating

lease ROU assets are included in leased assets and operating lease

liabilities are included in other current and non-current

liabilities in the Company's consolidated balance sheets. As of 30

June, 2019, the Company did not have any finance leases. See Note 8

for further discussion.

All transactions where the Company is the lessor are short-term

(one year or less) and have been classified as operating leases.

The Company's leases to third parties generally require upfront

payments and thus, there are no material future payments expected

to be received from existing leases. See Note 3 for details over

revenue recognition related to lease agreements.

Loss Per Share

Basic loss per share is computed by dividing net loss available

to common shareholders by the weighted average number of shares of

common stock outstanding during the period.

For periods of net income, and when the effects are not

anti-dilutive, diluted earnings per share is computed by dividing

net income available to common shareholders by the weighted-average

number of shares outstanding plus the impact of all potential

dilutive common shares, consisting primarily of common stock

options and stock purchase warrants using the treasury stock

method.

For periods of net loss, diluted loss per share is calculated

similarly to basic loss per share because the impact of all

dilutive potential common shares is anti-dilutive. The number of

anti-dilutive shares, consisting of stock options and stock

purchase warrants, which has been excluded from the computation of

diluted loss per share, was 9.9 million and 7.2 million for the six

months ended 30 June 2019 and 2018, respectively.

Recent Accounting Pronouncements

Recently Adopted

On 1 January, 2019, the Company adopted new guidance addressing

the accounting for leases. The Company adopted this guidance using

a modified retrospective method. The Company elected certain

practical expedients including retaining the original lease

classification and historical accounting for initial direct costs

for leases existing prior to the adoption date. Additionally, the

Company made ongoing accounting policy elections whereby the

Company does not recognize ROU assets or lease liabilities for

short-term leases (those with original terms of 12-months or less)

and combines lease and non-lease elements of its operating leases.

As a result of the adoption, the Company recognized ROU assets of

$518,700 and lease liabilities of $565,500. The adoption did not

have any effect on the Company's equipment leases where it is the

lessor.

On 1 January, 2019, the Company adopted new guidance simplifying

the accounting for nonemployee stock-based compensation awards. The

guidance aligned the measurement and classification for employee

stock-based compensation awards to nonemployee stock-based

compensation awards. Under the guidance, nonemployee awards will be

measured at their grant date fair value. Upon transition, the

existing nonemployee awards were measured at fair value as of the

adoption date. The adoption did not have a material effect on the

Company's financial statements.

Unadopted

In June 2016, the FASB issued guidance with respect to measuring

credit losses on financial instruments, including trade

receivables. The guidance eliminates the probable initial

recognition threshold that was previously required prior to

recognizing a credit loss on financial instruments. The credit loss

estimate can now reflect an entity's current estimate of all future

expected credit losses. Under the previous guidance, an entity only

considered past events and current conditions.

The guidance is effective for fiscal years beginning after 15

December 2020, including interim periods within those fiscal years.

Early adoption is permitted for fiscal years beginning after 15

December 2018, including interim periods within those fiscal years.

The adoption of certain amendments of this guidance must be applied

on a modified retrospective basis and the adoption of the remaining

amendments must be applied on a prospective basis. The Company is

currently evaluating the impact, if any, that this new accounting

pronouncement will have on its financial statements.

In August 2018, the FASB issued guidance addressing the

accounting for implementation, setup and other upfront costs paid

by a customer in a cloud computing or hosting arrangement. The

guidance aligns the accounting treatment of these costs incurred in

a hosting arrangement treated as a service contract with the

requirements for capitalization and amortization costs to develop

or obtain internal-use software. The guidance is effective for

fiscal years beginning after December 15, 2019. The guidance can be

adopted either retrospectively or prospectively. Early adoption is

permitted. The Company is currently evaluating the impact, if any,

that this guidance will have on the financial statements.

In August 2018, the FASB issued guidance addressing the

disclosure requirements for fair value measurements. The guidance

intends to improve the effectiveness of the disclosures relating to

recurring and nonrecurring fair value measurements. The guidance is

effective for fiscal years beginning after December 15, 2019.

Portions of the guidance are to be adopted prospectively while

other portions are to be adopted retrospectively. Early adoption is

permitted. The Company is currently evaluating the impact, if any,

that this guidance will have on the financial statements.

The Company has evaluated all other issued and unadopted

Accounting Standards Updates and believes the adoption of these

standards will not have a material impact on its results of

operations, financial position, or cash flows.

3. Revenue

Revenue is principally from the sale or lease of instruments and

processing assemblies, as well as from extended warranties. In some

arrangements, product and services have been sold together

representing distinct performance obligations. In such arrangements

the Company allocates the sale price to the various performance

obligations in the arrangement on a relative selling price basis.

Under this basis, the Company determines the estimated selling

price of each performance obligation in a manner that is consistent

with that used to determine the price to sell the deliverable on a

standalone basis.

Revenue is recognized at the time control is transferred to the

customer and the performance obligation is satisfied. Revenue from

the sale of instruments and processing assemblies is generally

recognized at the time of shipment to the customer, provided no

significant vendor obligations remain and collectability is

reasonably assured. Revenue from equipment leases are recognized

ratably over the contractual term of the lease agreement. Licensing

fee revenue is recognized ratably over the license period. Revenue

from fees for research services is recognized when services have

been provided.

Disaggregated revenue for the six months ended 30 June 2019 is

as follows:

Revenue Revenue

(ASC 606 (Non- ASC

Revenue) 606 Revenue) Total Revenue

--------------------

Product Sales $ 4,828,900 $ - $ 4,828,900

Leased Equipment - 2,702,300 2,702,300

Other 163,500 678,600 842,100

Total $ 4,992,400 $ 3,380,900 $ 8,373,300

==================== ============== ================

Disaggregated revenue for the six months ended 30 June 2018 is

as follows:

Revenue Revenue

(ASC 606 (Non- ASC

Revenue) 606 Revenue) Total Revenue

-------------------

Product Sales $ 4,239,100 $ - $ 4,239,100

Leased Equipment - 2,361,200 2,361,200

Other 118,100 211,600 329,700

Total $ 4,357,200 $ 2,572,800 $ 6,930,000

=================== ============== ===============

Additional disclosures relating to Revenue from Contracts with

Customers (ASC 606)

Changes in short and long term deferred revenue for the six

months ended 30 June 2019 were as follows:

Balance at 1 January 2019 $2,770,100

Revenue recognized in the current period

from

amounts included in the beginning

balance 1,849,400

Current period deferrals, net of amounts

recognized in the current period 3,162,600

Balance at 30

June 2019 $4,083,300

============

Changes in short- and long-term deferred revenue for the six

months ended 30 June 2018 were as follows:

Balance at 1 January 2018 $2,223,000

Revenue recognized in the current period

from

amounts included in the beginning balance 1,655,300

Current period deferrals, net of amounts

recognized in the current period 2,493,600

Balance at 30

June 2018 $3,061,300

============

Remaining contract consideration for which revenue has not been

recognized due to unsatisfied performance obligations with a

duration greater than one year was approximately $424,400 at 30

June 2019, the majority of which the Company expects to recognize

over the next four years.

In the six months ended 30 June 2019, the Company did not incur,

and therefore did not defer, any material incremental costs to

obtain contracts or costs to fulfill contracts.

4. Debt

The Company originally entered into a credit facility with

Midcap Financial SBIC, LP ("MidCap") in March 2014. The Company

amended the MidCap facility multiple times through August 2018 to,

among other things, (i) revise certain covenants, (ii) extend the

maturity date to 1 June 2023, (iii) extend the interest only period

to 1 July 2020 and change the exit fee to 4.75% and (iv) increase

the principal amount to $5,105,400.

In February 2019, the Company paid off the MidCap credit

facility in full in accordance with its terms and conditions. As a

result of the payoff the Company recognized a loss of $515,000

included as interest expense in its statement of operations.

In the six months ended 30 June 2019 and 2018, the Company

capitalized approximately $9,800 and $3,700 of interest expense

related to capitalized software development projects.

5. Stockholders' Equity

Common Stock

In March 2019, the Company completed an equity capital raise

issuing approximately 5.9 million shares of Common Stock at a price

of LIR1.70 (or approximately $2.25). The transaction generated

gross proceeds of approximately LIR10 million (or approximately

$13.3 million). In conjunction with the transaction, the Company

incurred costs of approximately $1.0 million which resulted in the

Company receiving net proceeds of approximately $12.3 million.

During the year ended 31 December 2018, the Company issued

436,388 shares of Common Stock as a result of stock option

exercises, receiving gross proceeds of $230,000. During the six

months ended 30 June 2019, the Company issued 147,500 shares of

Common Stock as a result of stock option exercises, receiving gross

proceeds of $117,600.

Stock Options

The Company adopted the MaxCyte, Inc. Long-Term Incentive Plan

(the "Plan") in January of 2016 to amend and restate the MaxCyte

2000 Long-Term Incentive Plan to provide for the awarding of (i)

stock options, (ii) restricted stock, (iii) incentive shares, and

(iv) performance awards to employees, officers, and directors of

the Company and to other individuals as determined by the Board of

Directors. Under the Plan, the maximum number of shares of Common

Stock of the Company that the Company may issue is (a) 6,264,682

shares plus (b) ten percent (10%) of the shares that are issued and

outstanding at the time awards are made under the Plan.

On 21 February 2018, the Company's Board resolved to increase

the number of stock options under the Plan by 2,000,000 to provide

sufficient shares to allow competitive equity compensation in its

primary markets for staff and consistent with practices of

comparable companies.

The Company has not issued any restricted stock, incentive

shares, or performance awards under the Plan. Stock options granted

under the Plan may be either incentive stock options as defined by

the Internal Revenue Code or non-qualified stock options. The Board

of Directors determines who will receive options under the Plan and

determines the vesting period. The options can have a maximum term

of no more than 10 years. The exercise price of options granted

under the Plan is determined by the Board of Directors and must be

at least equal to the fair market value of the Common Stock of the

Company on the date of grant.

In the six months ended 30 June 2019, the Company granted

1,993,500 stock options with a weighted-average exercise price of

$2.34 per share. The weighted-average fair value of the options

granted during the six months ended 30 June 2019 and 2018 was

estimated to be $1.17 and $1.68, respectively.

At 30 June 2019, there were 9,924,508 stock options outstanding

with a weighted-average exercise price of $1.65 per share. As of 30

June 2019, total unrecognized compensation expense was $5,202,000

which will be recognized over the next 3.0 years.

Stock-based compensation expense for the six months ended 30

June was as follows:

2019 2018

-----------

General and administrative $ 385,800 $174,200

Sales and marketing 146,300 74,300

Research and development 291,800 129,200

Total $ 823,900 $377,700

=========== ===========

6. Fair Value

The Company's Balance Sheets include various financial

instruments (primarily cash and cash equivalents, short-term

investments, accounts receivable and accounts payable) that are

carried at cost, which approximates fair value due to the

short-term nature of the instruments. Notes payable and capital

lease obligations are reflective of fair value based on market

comparable instruments with similar terms.

Financial Assets and Liabilities Measured at Fair Value on a

Recurring Basis

The Company has no financial assets or liabilities measured at

fair value on a recurring basis.

Financial Assets and Liabilities Measured at Fair Value on a

Non-Recurring Basis

Money market funds and commercial paper classified as

held-to-maturity are measured at fair value on a non-recurring

basis when they are deemed to be impaired on an

other-than-temporary basis. No such fair value impairment was

recognized during the six months ended 30 June, 2019 or 2018.

Non-Financial Assets and Liabilities Measured at Fair Value on a

Recurring Basis

The Company has no non-financial assets and liabilities that are

measured at fair value on a recurring basis.

Non-Financial Assets and Liabilities Measured at Fair Value on a

Non-Recurring Basis

The Company measures its long-lived assets, including property

and equipment, at fair value on a non-recurring basis. These assets

are recognized at fair value when they are deemed to be impaired.

No such fair value impairment was recognized during the six months

ended 30 June, 2019 or 2018.

7. Retirement Plan

The Company sponsors a defined-contribution 401(k) retirement

plan covering eligible employees. Participating employees may

voluntarily contribute up to limits provided by the Internal

Revenue Code. The Company matches employee contributions equal to

50% of the salary deferral contributions, with a maximum Company

contribution of 3% of the employees' eligible compensation. In the

six months ended 30 June, 2019 and 2018, Company matching

contributions amounted to $111,400 and $104,200, respectively.

8. Commitments and Contingencies

The Company entered into a five-year non-cancelable operating

lease agreement for office and laboratory space in February 2009

with an initial expiration of 31 January 2014 which was

subsequently extended to January 2020. In April 2017, the Company

entered into leases for additional office and laboratory space. A

member of the Company's Board of Directors is the CEO and Board

member of the lessor in the April 2017 lease. Rent payments under

the April 2017 lease totaled $157,900 and $153,500 in the six

months ended 30 June 2019 and 2018, respectively.

All the Company's office and laboratory leases expire in January

2020 and provide for annual 3% increases to the base rent. The

current monthly base lease payment for all leases is approximately

$258,400. In addition to base rent, the Company pays a pro-rated

share of common area maintenance ("CAM") costs for the entire

building, which is adjusted annually based on actual expenses

incurred. Two of the Company's office leases each contain a one

5-year renewal option, none of which have been assumed to be

certain of being exercised.

As of 30 June 2019, all the Company's existing leases are

classified as operating leases. The Company used a discount rate of

10% in calculating its lease liability under its operating

leases.

Total rent expense, including base rent and CAM for the six

months ended 30 June, 2019 and 2018, was $341,900 and $344,700,

respectively. Rent expense is recognized on a straight-line basis

in the accompanying financial statements.

Lease costs for the six months ended 30 June 2019, consisted of

the following:

Operating lease

cost $ 268,500

Variable lease costs 99,000

Total $ 367,500

=============

Estimated future minimum payments, all due within 12 months,

under the operating leases are as follows:

Total $ 330,100

Discount factor (11,200)

Lease liability 318,900

Current lease liability (318,900)

Non-current lease

liability $ -

9. Subsequent Events

In preparing these financial statements, the Company has

evaluated events and transactions for potential recognition or

disclosure through 16 September 2019, the date the financial

statements were available to be issued.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR GGUBCBUPBPUM

(END) Dow Jones Newswires

September 18, 2019 02:01 ET (06:01 GMT)

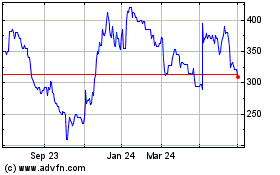

Maxcyte (LSE:MXCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Maxcyte (LSE:MXCT)

Historical Stock Chart

From Apr 2023 to Apr 2024