TIDMMTVW

RNS Number : 3341R

Mountview Estates PLC

14 June 2018

MOUNTVIEW ESTATES P.L.C.

Preliminary Results for the year ended 31 March 2018

CHIEF EXECUTIVE OFFICER'S STATEMENT

It is always disappointing to report profits that have fallen

but in the present uncertain economic climate I consider that my

team have given a very good performance. In uncertain times

transactions usually take longer to complete and so it is that

during the year ended 31 March 2018 we completed significantly less

sales than in the previous financial year. This fall in the number

of sales has caused the fall in profits to a far greater degree

than any perceived fall in prices.

Whilst the sales figures have fallen, the cost of the purchases

which we have made during this financial year has increased by over

50% compared with the previous year. It is purchases that are the

future of the Company and I am pleased to report that it is not

only the quantity of purchases but also the quality of the

purchases that has improved.

It is now nearly 30 years since regulated tenancies were last

created but this asset class continues to exist in sufficient

quantities to be the mainstay of our business. The percentage of

vacant possession value that has to be paid for such assets has

increased over the years but, given our low gearing, we believe

that we continue to be able to produce the best returns that are

available within our area of expertise in the property industry. We

have made modest diversification into life tenancies and as leases

become shorter where we are the ground landlord there is money to

be made in granting lease extensions. Nevertheless these are only

supplementary to our main business of buying residential properties

that are subject to regulated tenancies and awaiting vacant

possession.

Whilst regulated tenancies continue to exist for longer than may

have been anticipated when the 1988 Rent Act became effective a

business as narrowly focused as our does have a finite life. The

business will continue to prosper but it will become increasingly

difficult to replace stock as it is sold. Some shareholders may

wish to pursue their own avenues of diversification without selling

Mountview shares and so the final dividend payable on 13 August

2018 will be increased to 200 pence per share. This will make a

total of 400 pence per share in respect of the Company's year ended

31 March 2018.

Your Board is aware that the taxation of dividend income has

changed and, while 400 pence per share is an increase of a third

compared with 300 pence per share last year, the 300 pence per

share in respect of the Company's year ended 31 March 2016 was

worth 333 pence gross in the hands of ordinary rate taxpayers. Thus

your Board are happy to admit that the new total dividend is only

an increase of 20% over the total of two years ago. The new

dividend will be nearly twice covered.

This Statement does not seek to deny that profits have fallen

but the business remains soundly based and financially secure. When

Brexit negotiations and other economic uncertainties are resolved

the purchases we are presently able to make will realise good

profits and we can look forward to future increased earnings.

As has always been the case your Board only increase dividends

when they are confident of maintaining that increase and so it is

reasonable to expect the increase to 400 pence per share to be

maintained in future years.

Finally, it is only possible to maintain the Company's high

level of performance because of the quality of the personnel in the

team that I have around me. On behalf of all shareholders, I wish

to thank all my hard-working and loyal staff and colleagues for the

contribution they each make to the continuing well-being of

Mountview Estates P.L.C.

Duncan Sinclair

14 June 2018

MOUNTVIEW ESTATES P.L.C.

FINANCIAL HIGHLIGHTS

2018 2017 (Decrease)/Increase

GBP GBP %

Revenue (millions) 70.3 78.2 (10.1)

Gross Profit

(millions) 43.4 52.1 (16.7)

Profit Before

Tax (millions) 36.9 45.0 (18.0)

Profit Before

Tax excluding

investment properties

revaluation

(millions) 37.3 46.0 (18.9)

Equity Holders'

Funds (millions) 354.5 336.3 5.4

Earnings per

share (pence) 766.4 929.1 (17.5)

Net assets per

share (GBP) 90.91 86.25 5.4

Dividend per

share (pence) 400 300 33.3

Mountview Estates P.L.C. advises its shareholders that,

following the issue of the final results, the relevant dates in

respect of the proposed final dividend payment of 200 pence per

share are as follows:

Ex-dividend 5 July 2018

date

Record date 6 July 2018

Payment date 13 August 2018

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 MARCH 2018

Year Year

ended ended

31.03.2018 31.03.2017

GBP'000 GBP'000

REVENUE 70,272 78,232

Cost of sales (26,915) (26,176)

GROSS PROFIT 43,357 52,056

Administrative expenses (5,507) (5,231)

Gain on sale of investment

properties 145 0

Operating profit before changes

in

fair value of investment properties 37,995 46,825

(Decrease) in fair value of

investment properties (376) (1,020)

PROFIT FROM OPERATIONS 37,619 45,805

Net finance costs (714) (819)

PROFIT BEFORE TAXATION 36,905 44,986

Taxation - current (7,197) (9,234)

Taxation - deferred 173 473

Taxation (7,024) (8,761)

PROFIT ATTRIBUTABLE TO EQUITY

SHAREHOLDERS 29,881 36,225

Basic and diluted earnings

per share (pence) 766.4p 929.1p

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE YEARED 31 MARCH 2018

As at As at

31.03.2018 31.03.2017

GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Property, plant

and equipment 1,771 1,833

Investment properties 27,825 28,741

29,596 30,574

CURRENT ASSETS

Inventories of trading

properties 376,879 347,380

Trade and other

receivables 1,859 1,613

Cash at bank 5,368 825

384,106 349,818

TOTAL ASSETS 413,702 380,392

EQUITY AND LIABILITIES

Share capital 195 195

Capital redemption

reserve 55 55

Capital reserve 25 25

Other reserve 56 56

Retained earnings 354,131 335,948

354,462 336,279

NON-CURRENT LIABILITIES

Long-term borrowings 49,900 29,000

Deferred tax 4,696 4,869

54,596 33,869

CURRENT LIABILITIES

Bank overdrafts

and short-term loans 463 3,042

Trade and other

payables 1,843 1,951

Current tax payable 2,338 5,251

4,644 10,244

TOTAL LIABILITIES 59,240 44,113

TOTAL EQUITY AND

LIABILITIES 413,702 380,392

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MARCH 2018

Capital

Share Capital Redemption Other Retained

Capital Reserve Reserve Reserves Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as

at 1 April

2016 195 25 55 56 311,421 311,752

Profit for

the year 36,225 36,225

Dividends (11,698) (11,698)

Balance as

at 31 March

2017 195 25 55 56 335,948 336,279

Capital

Share Capital Redemption Other Retained

Capital Reserve Reserve Reserves Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as

at 1 April

2017 195 25 55 56 335,948 336,279

Profit for

the year 29,881 29,881

Dividends (11,698) (11,698)

Balance as

at 31 March

2018 195 25 55 56 354,131 354,462

MOUNTVIEW ESTATES P.L.C.

GROUP CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2018

Year Year

ended ended

31.03.2018 31.03.2017

GBP'000

Cash flow from operating

activities

Operating profit 37,619 45,805

Adjustment for:

Depreciation 66 79

Gain on disposal of (145) -

investment properties

Decrease in fair value

of investment properties 376 1,020

Cash flow from operations

before changes in working

capital 37,916 46,904

(Increase) in inventories (29,499) (13,272)

(Increase)Decrease in

receivables (246) 107

(Decrease) in payables (108) (1,049)

Cash generated from

operations 8,063 32,690

Interest paid (714) (819)

Income taxes paid (10,110) (9,458)

Net cash (outflow)/

inflow from operating

activities (2,761) 22,413

Investing activities

Proceeds from disposal 685 -

of investment properties

Capital expenditure

on investment properties - (312)

Purchase of property,

plant and equipment (4) (1)

Net cash inflow/(outflow)

from investing activities 681 (313)

Cash flow from financing

activities

Increase/(Repayment)

of borrowings 20,483 (9,820)

Equity dividend paid (11,698) (11,698)

Net cash inflow/(outflow)

from financing activities 8,785 (21,518)

Net increase in cash

and cash equivalents 6,705 582

Opening cash and cash

equivalents (1,337) (1,919)

Cash and cash equivalents

at the end of the year 5,368 (1,337)

Notes to the Preliminary Announcement

1. Financial Information

The financial information presented within this document does

not comprise the statutory accounts for the financial years ended

31 March 2018 and 31 March 2017, but represents extracts from

them.

The statutory accounts for the financial year ended 31 March

2017 have been filed with the Registrar of Companies. The auditor

reported on those accounts: their report was (i) unqualified, (ii)

did not include references to any matters to which the auditor drew

attention by way of emphasis without qualifying the reports and

(iii) did not contain statements under section 498(2) or (3) of the

Companies Act 2006.

The statutory accounts for the year ended 31 March 2018 are

expected to be finalised and signed following approval by the Board

of Directors and delivered to the Registrar of Companies following

the Company's Annual General Meeting on 8 August 2018.

2. Basis of Preparation

The preliminary announcement has been prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union ("IFRS") but does not contain sufficient information

to comply fully with IFRS. The Financial Statements to be presented

to Members at the 2018 AGM are expected to comply fully with

IFRS.

Ends

This announcement contains information which, prior to its

disclosure, was inside information for the purposes of the Market

Abuse Regulation.

For further information on the Company, visit:

www.mountviewplc.co.uk

SPARK Advisory Partners Limited (Financial Advisor) www.sparkadvisorypartners.com

Miriam Greenwood 0203 368 3553

Mark Brady 0203 368 3551

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BRGDLGBBBGIX

(END) Dow Jones Newswires

June 14, 2018 02:00 ET (06:00 GMT)

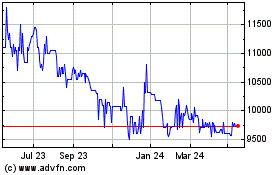

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Mar 2024 to Apr 2024

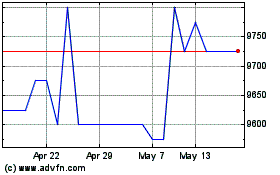

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Apr 2023 to Apr 2024