TIDMMIDW

RNS Number : 2490J

Midwich Group PLC

08 September 2016

For Immediate Release 8 September 2016

Midwich Group plc

("Midwich" or "the Group")

Acquisitions of Holdan Limited and Wired Limited

Midwich, a specialist audio visual and document solutions

distributor to the trade market with operations in the UK and

Ireland, France, Germany and Australasia, is pleased to announce

the acquisition of Holdan Limited ("Holdan" or "the Company") in

the UK for a maximum consideration of approximately GBP7.9m (the

"Holdan Acquisition") and the acquisition of Wired Limited

("Wired") in New Zealand.

Holdan is a value-added distributor of technology solutions

focused on the broadcast, professional video and traditional

audio-visual markets. The company is based in Glossop, near

Manchester and currently employs 35 staff. Holdan is a leader

within the UK broadcast market, and has a significant and growing

export business. The Company traded with 515 mostly specialist

broadcast customers in 2015, an 11% increase on the previous year.

In addition to hardware distribution, the Company provides a broad

spectrum of services, including demonstrations, system design,

configuration, and repair facilities to the trade - providing much

needed support to users of broadcast and professional video

equipment. In the year ended 31 December 2015 Holdan reported

annual turnover of GBP20.6m and profit before tax of GBP1.1

million. The Company has continued to perform well in 2016.

Midwich has acquired 75% of the issued share capital of Holdan

from Chris Daniels and Allan Leonhardsen. In line with the

Company's long term succession plan, Chris Daniels has stepped down

as Holdan's managing director, but will continue with the business

on a full time basis before retiring in 2017. Allan Leonhardsen has

become Holdan's managing director with immediate effect. Allan

joined the business in 2003 and has been the sales director for the

past twelve years. Kieron Seth becomes sales and marketing

director, adding sales to his previous marketing

responsibilities.

The Holdan Acquisition has been funded from the existing cash

resources of the Group. The structure of consideration is in line

with the Group's previous approaches, with 75% of Holdan being

acquired at the time of announcement. Midwich has options to

acquire the remaining 25%, over the next three years on a

pre-determined methodology linked primarily to earnings growth.

Consideration for the initial 75% of the Company is split GBP3

million on completion and GBP1.5 million after 12 months.

In addition, the Group has incurred transaction fees and

expenses in connection with the Holdan Acquisition of approximately

GBP0.1m. The Holdan Acquisition is expected to be immediately

earnings enhancing for the Group.

Wired is a small New Zealand based AV distributor with offices

in Wellington and Auckland specialising in HD distribution

solutions for the domestic and commercial market. The acquisition

augments Midwich's existing market position and capability in the

Australian and New Zealand markets. Wired had a revenue of NZ $2

million in the year to 31 March 2016.

As outlined at the time of IPO, the acquisitions of Holdan and

Wired are in line with Midwich's strategy to grow operations

through a combination of organic development and selective infill

acquisitions. Holdan fits Midwich's UK & Ireland acquisition

criteria as it adds to the Group's growing presence in the

broadcast and professional video market sectors. Furthermore, the

Holdan Acquisition advances the Group's penetration in Europe with

c.18% of Holdan's turnover in the year ended 31 December 2015

derived from sales in mainland Europe. Likewise, Wired provides

some additional scale with a complementary offering in New

Zealand.

Stephen Fenby, Managing Director of Midwich commented:

"I am delighted to welcome Allan, Chris, Kieron and the rest of

the Holdan team to the Midwich Group. We have admired the expertise

and reputation of Holdan for some time and look forward to working

together in the future. We recognised some time ago that the

broadcast and professional video markets are a natural adjunct to

our traditional audio visual activity. Having made some headway in

penetrating these markets ourselves, we believe that the expertise

and focus of Holdan will give Midwich the ability to provide a more

comprehensive value-added service to our customers in the UK and

overseas. Similarly, Midwich's vast reach into the audio visual

market provides Holdan's vendors with an opportunity to expand

further into a growing segment.

We are also pleased to welcome Bruce Mackay and the rest of the

Wired team to the Midwich Group. The acquisition in New Zealand

supports two of our key strategic objectives in the region, to

provide outstanding value added support to our customers and

vendors, and to continue the rapid growth of our display solutions

business."

Midwich will be announcing its Interim Results for the six

months ended 30 June 2016 on Tuesday 13(th) September 2016. A

presentation to analysts will take place at 9.30 am at the offices

of FTI Consulting, 200 Aldersgate, EC1A 4HD.

Enquiries:

Midwich Group plc Tel: +44 (0) 1379

Stephen Fenby, Managing Director 649200

Anthony Bailey, Finance Director

Investec Bank plc Tel: +44 (0) 20 7597

James Ireland / James Rudd 4000

Carlton Nelson / Robert Baker

FTI Consulting Tel: +44 (0) 20 3727

Oliver Winters / Alex Beagley 1000

/ Tom Hufton

Notes to Editors:

Midwich is a specialist AV and document solutions distributor to

the trade market, with operations in the UK and Ireland, France,

Germany and Australasia. The Group's long-standing relationships

with over 300 vendors, including blue-chip organisations such as

Samsung, LG, Epson and NEC, supports a comprehensive product

portfolio across major audio visual categories such as large format

displays, projectors, digital signage and printers. The Group

operates as the sole or largest in-country distributor for a number

of its vendors in their respective product sets. The Directors

attribute this position to the Group's technical expertise,

extensive product knowledge and strong customer service offering

built up over a number of years. The Group has a large and diverse

base of approximately 10,000 customers, most of which are

professional AV integrators and IT resellers serving sectors such

as corporate, education, retail, residential and hospitality.

Although the Group does not sell directly to end users, it believes

that the majority of its products are used by commercial and

educational establishments rather than consumers.

Initially a UK only distributor, the Group now has 493 employees

across the UK, Germany, France, Ireland, Australia and New Zealand,

and in the six months to 30 June 2016, 36 per cent of the Group's

revenues were derived from outside the UK. A core component of the

Group's growth strategy is further expansion of its international

operations and footprint into strategically targeted

jurisdictions.

For further information, please visit

www.midwichgroupplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQDDLFBQKFZBBF

(END) Dow Jones Newswires

September 08, 2016 02:00 ET (06:00 GMT)

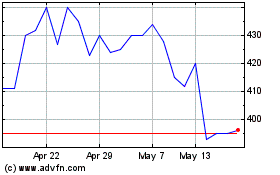

Midwich (LSE:MIDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

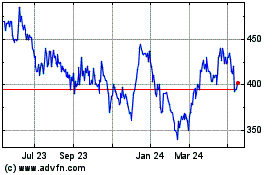

Midwich (LSE:MIDW)

Historical Stock Chart

From Apr 2023 to Apr 2024