TIDMKAT

RNS Number : 3312X

Katoro Gold PLC

04 May 2021

Katoro Gold plc (Incorporated in England and Wales )

( Registration Number: 9306219)

Share code on AIM: KAT

ISIN: GB00BSNBL022

("Katoro" or "the Company")

04 May 2021

Katoro Gold plc ('Katoro' or the 'Company')

BLYVOOR GOLD TAILINGS PROJECT: CPR RESULTS

Katoro Gold plc (AIM: KAT), the AIM listed gold and nickel

exploration and development company, is pleased to announce the

results of a comprehensive Competent Person's Report ("CPR"), that

reports on the results and findings of additional technical and

financial work that was conducted on the Blyvoor Gold Tailings

Project ("the Project") in response to the recommendations and

findings of the Blyvoor Scoping Study announced in RNS dated: 07

May 2020 and 4 March 2021. Katoro is currently in the processes of

finalizing a comprehensive funding package in accordance with the

Blyvoor Joint Venture ("the JV") that will allow the construction,

commissioning and operation of a mining and processing facility

capable of processing 500,000 tonnes of tailings material per

month, at an average Life of Mine ("LoM") gold grade of 0.29 g/t

and confirmed recovery of 51%, before incorporating recovery gains

from the latest metallurgical optimization tests. The optimization

results indicated that overall recoveries of up to 60% can be

achieved by milling the coarser fraction (+75um) of the feedstock

which comprises around 30% of the total Run of Mine ("RoM").

The findings of the CPR were subject to the results of the

confirmatory and optimization metallurgical test work. Following

receipt of all the outstanding metallurgical test results, the

Company is now able to validate the findings of the CPR and further

engage with prospective funders towards conclusion of funding

arrangements as set out above.

The CPR comprises an advanced Pre-Feasibility level study, a

SAMREC compliant reserve and resource statement, and a South

African Mineral Asset Valuation ("SAMVAL") report for Blyvoor TSF

1, 6 and 7 and Doornfontein TSF 1, 2 and 3 gold tailings storage

facilities.

Note: Previous technical work on the Project was reported in

RNS's dated 15 December 2020 (Resource Results) as well as 30

September, 16 November, and 30 November 2020, (General Updates)

respectively.

Highlights CPR

-- Total project resource size of 1,410,000 oz gold consisting

500,000 oz gold in the measured category (35.5%), 368,000 oz gold

in the indicated category (26.1%), and 542,000 oz gold in the

inferred category (38.4%) (Table 1)

-- TSF 6 and 7 was upgraded to Probable Reserve status

containing 424,000 oz gold and 392,000 oz gold, respectively (Table

2).

-- The mine plan includes 1,325,822 oz gold after applying a 2%

dilution factor, a 95% Mine Call Factor, and accounting for 1% ore

losses.

-- The CPR demonstrates (before incorporation of the results of

the recent metallurgical optimization work):

-- An unlevered Project Net Present Value ('NPV@7.9%') of US$

114 million, a 33% Internal Rate of Return ('IRR') and a Return on

Investment ('ROI') of 64%;

-- LOM of 25 years building to a production capacity of 500,000

tons per month with an overall production of 675, 842 ounces of

gold over LOM;

-- Low-cost operation:

-- With an estimated All-in Sustaining Cost ('AISC') of US$861 per ounce of gold;

-- All-in Cost ('AIC') of US$1,067 per ounce of gold;

-- Total Project capital costs of US$152m across the life of the Project, and

-- Peak funding requirement of US$69m.

-- The study utilised an average gold price of US$1,610 per

ounce compared to the current price of c. US$1,800 per ounce;

-- Additional metallurgical test work confirmed the current

grade vs. recovery model from previous technical studies and no

further metallurgical test work is required;

-- Optimization studies revealed that by milling a portion of

the feedstock (with coarser size fraction (+75 um)), overall

recovery can be increased up to c. 60% from the current confirmed

51% average recovery over LoM and 53.5% for the reserve (TSF 6 and

7); and

-- Following rigorous independent review, evaluation, and

assessment, the Project demonstrates robust technical and economic

viability.

Louis Coetzee, Executive Chairman of Katoro, said: "We are

extremely satisfied and pleased with the results of the projects

thus far. Completion of technical work was delayed substantially by

repeated COVID - 19 restrictions in South Africa, but at the same

time allowed for better and more detailed review and optimization

work to be done.

The completion of the technical work and especially the

independent SAMVAL valuation of the project once again confirms

that the project is very robust in all aspects and puts the Company

in a very strong position to finalize funding discussions as set

out above. We are now in the process of determining to what extent

the higher recovery rates may improve the already robust project

economics and will be updating the market in this regard in due

course".

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

CPR key outcomes and discussion

CPR Element Findings

Project Financials For the total resource, the Study demonstrated

an unlevered Project Net Present Value ('NPV@7.9%')

of US$ 114 million, and a 33% Internal Rate

of Return ('IRR') and a Return on Investment

('ROI') of 64%.

Total estimated free cash flow of US$257.4m

across the life of the Project.

Note - The study utilised:

* An average exchange rate of ZAR 17.02/USD over life

of project.

* An average gold price of US$1,610 per ounce over life

of project.

Capital Cost The Project has a peak funding requirement

of US$69m ( ZAR1.183 billion, comprising of

ZAR1.177 billion capital and ZAR6 million rehabilitation

premiums) in the construction year (Year 0),

with a payback period of 2.6 years from the

start of production.

Note - The study utilised:

* Capital estimates based on PFS level designs,

utilising supplier quotations and benchmarking.

Operational Cost The AISC was calculated as ZAR69/feed t which

translates to US$861/oz

The AIC was calculated as ZAR85/feed t which

equates to US$1,067/oz

Note - The study utilised:

* Mining operating costs have been obtained from mining

contractors. A 20% contingency has been applied to

the selected contractor operating cost to make

provision for the required level of accuracy.

* On-mine overheads operating costs estimated from

first principles, utilizing supplier quotations and

benchmarking.

* Processing operating costs estimated from first

principles, utilizing supplier quotations and

benchmarking.

* Tailings operating costs estimated from first

principles, utilizing supplier quotations and

benchmarking.

Mineral Reserve Total resource size of 1,410,000 oz gold of

and Resource which 500,000 oz gold is measured status (35.5%),

368,000 oz gold is indicated status (26.1%),

and 542,000 oz gold is in inferred status (38.4%)

(Table 1).

TSF 6 and 7 was upgraded to Probable Reserve

status containing 424,000 oz gold and 392,000

oz gold, respectively (Table 2).

Total ounces in mine plan are 1,325,822 oz

gold after applying a 2% dilution factor and

a 95% Mine Call Factor, and accounting for

1% ore losses.

* Mineral Resource estimates were conducted and

reported in accordance with the requirements of the

SAMREC Code.

* TSFs No. 6 and 7 contain mostly Measured and

Indicated Mineral Resources and the resource

estimation component is at Definitive Feasibility

Study level.

* TSF No.1, Doornfontein TSF's No. 1, 2 and 3 are only

Inferred and are thus at Scoping Study level

* Mineral Reserve estimates have been completed in

accordance with the requirements of the SAMREC Code.

* Measured and Indicated Mineral Resources have been

converted into Probable Mineral Reserves. Additional

work is required to upgrade Probable Mineral Reserves

to Proven Mineral Reserves.

Table 1: Mineral resource statement for Blyvoor Gold Mine TSFs

effective 22 January 2021.

The operator for the Project is the Katoro Joint Venture.

TSF Mineral Resource Total 50% Attributable to Katoro

Classification

Tonnes Grade Au Content Tonnes Grade Au Content

-------- -------- ------ ------------

Mt g/t koz Mt g/t koz

-------- ------- ------------ -------- ------ ------------

TSF No. 6 Measured 30.5 0.32 318 15.25 0.32 159

------------------------ -------- ------- ------------ -------- ------ ------------

TSF No. 7 Measured 18.0 0.31 182 9.0 0.31 91

------------------------ -------- ------- ------------ -------- ------ ------------

Total Measured 48.5 0.32 500 24.25 0.32 250

-------- ------- ------------ -------- ------ ------------

TSF No. 6 Indicated 13.9 0.30 134 6.95 0.30 67

------------------------ -------- ------- ------------ -------- ------ ------------

TSF No. 7 Indicated 21.0 0.35 234 10.5 0.35 117

------------------------ -------- ------- ------------ -------- ------ ------------

Total Indicated 34.9 0.33 368 17.45 0.33 184

-------- ------- ------------ -------- ------ ------------

Total Measured and Indicated 83.5 0.32 868 41.75 0.32 434

-------- ------- ------------ -------- ------ ------------

TSF No. 1 Inferred 7.2 0.25 58 3.6 0.25 29

----------------------- -------- ------- ------------ -------- ------ ------------

TSF No. 6 Inferred 0.5 0.25 4.1 0.25 0.25 2.05

----------------------- -------- ------- ------------ -------- ------ ------------

TSF No. 7 Inferred 0.7 0.52 12 0.35 0.52 6

----------------------- -------- ------- ------------ -------- ------ ------------

Doornfontein TSF No. 1 Inferred 23.7 0.31 234 11.85 0.31 117

----------------------- -------- ------- ------------ -------- ------ ------------

Doornfontein TSF No. 2 Inferred 9.3 0.32 96 4.65 0.32 48

----------------------- -------- ------- ------------ -------- ------ ------------

Doornfontein TSF No. 3 Inferred 18.1 0.24 137 9.05 0.24 68.5

----------------------- -------- ------- ------------ -------- ------ ------------

Total Inferred 59.5 0.28 542 29.75 0.28 271

-------- ------- ------------ -------- ------ ------------

Notes:

No cut-off applied.

No geological loss applied.

Mineral Resources are stated inclusive of Mineral reserves.

Mineral Resources are reported as total Mineral Resources and are not attributed.

Table 2: Blyvoor TSF No.6 and TSF No.7 Mineral Reserve

estimation effective 22 January 2021.

The operator for the Project is the Katoro Joint Venture.

TSF Mineral Total 50% Attributable to Katoro

Reserve

Classification

Tonnes Grade Au Content Tonnes Grade Au Content

------- ------ ----------- -------- ------- ------------

Kt g/t koz Kt g/t koz

------- ------ ----------- -------- ------- ------------

TSF No.6 Probable 44,860 0.29 424 22,430 0.29 212

----------------- ------- ------ ----------- -------- ------- ------------

TSF No.7 Probable 39,408 0.31 392 19,704 0.31 196

----------------- ------- ------ ----------- -------- ------- ------------

Total Probable 84,276 0.30 816 42,138 0.30 408

----------------- ------- ------ ----------- -------- ------- ------------

Notes:

No Mineral Reserve cut-off applied.

Mineral Reserves are reported as total Mineral Reserves and are

not attributed

Grade and Recovery Recent metallurgical test work confirmed historical

results and the recovery utilized in the CPR

and Valuation of 51% over LoM and 53.5% for

the reserve (TSF 6 and 7).

Further optimization tests revealed that significant

increased recovery of up to 60% can be obtained

by milling the coarser fraction of the Run

of Mine before leaching. Process design trade

off studies are currently being completed to

understand the exact impact of this on the

project economics.

Next Steps Sufficient work has been completed to enter

the detailed design phase with Mining, TSF

and Plant contractors. The high-level next

steps are:

* Preparation of scope for bidding documents for

Contractors by Owners Engineer.

* Bidding and Evaluation.

* Final Detailed designs

* Construction

* Operation

Review by Qualified Persons

Information in this announcement that relates to the Blyvoor

Mineral Resource is taken from the report titled "

P20-006a_Katoro_BlyvoorTSF_CPR_Final" date 22 January 2021 (the

"Report"). The Report contains a SAMREC-compliant Mineral Resource

estimate, PFS and SAMVAL and was prepared for the Katoro TSF Gold

Project (Blyvoor Joint Venture) in which Katoro Gold plc holds a

50% attributable interest. The Competent Person responsible for the

submission of this document is Mr Daniel (Daan) van Heerden

(Director, Minxcon): B Eng (Min.), MCom (Bus. Admin.), MMC, Pr.Eng.

(Reg. No. 20050318), FSAIMM (Reg. No. 37309), AMMSA. Mr van Heerden

has worked in the mining industry for over 30 years. He has

extensive experience in managing underground and open cast mining

operations in South Africa and abroad for world-class mining majors

and junior mining companies. He was responsible for new business

development for two major mining companies and has experience in

mining mergers and acquisitions. He is currently heading the Mining

Engineering division of Minxcon, where he is integrally involved in

activities such as valuation, due diligence, finance structuring,

change management required post the event, feasibility studies,

life of mine plans, technical reviews and writing of technical

reports for various commodities.

Information contained in this announcement has also been

reviewed by Mr. Noel O'Keeffe, geologist, BSC. P.Geo, who is a

Member of the Institute of Geologists of Ireland. Mr. O'Keeffe has

several years' experience in the evaluation of gold projects.

**S**

For further information please visit www.katorogold.com

Bhavesh Patel +44 20 3440 6800 RFC Ambrian Limited Nominated Adviser

Andrew Thomson

---------------- ----------------- -------------------- -------------------

Nick Emmerson +44 (0) 1483 413 SI Capital Ltd Broker

Sam Lomanto 500

---------------- ----------------- -------------------- -------------------

Isabel de Salis +44 (0) 20 7236 St Brides Partners Investor and Media

Beth Melluish 1177 Ltd Relations Adviser

Glossary of Technical Terms

Au Chemical symbol for gold

"Cut-off The cut-off grade is the level below which material

grade" within an ore body does not contain sufficient value

to economically justify processing into a final saleable

form

------------------------------------------------------------------

"density" Measure of the relative "heaviness" of objects in terms

of constant

volume. Density =-mass/volume

------------------------------------------------------------------

"g" Gram - a metric unit of weight

------------------------------------------------------------------

"g/t" Grams per metric tonne - a measure of weight of the

economic mineral (e.g. gold) is in each metric tonne

of material to be mined

------------------------------------------------------------------

"Indicated That part of a mineral resource for which tonnage,

Mineral densities, shape, physical characteristics, grade and

Resource" quality can be estimated with a moderate level of confidence.

Based on exploration, sampling and testing information

gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill-holes.

The data-point locations are appropriate to confirm

physical continuity, while they are too widely or inappropriately

spaced to confirm quality continuity. However, such

locations are spaced closely enough for quality continuity

to be assumed.

------------------------------------------------------------------

"Inferred That part of a mineral resource for which tonnage,

Mineral grade and quality can be estimated with a low level

Resource" of confidence. It is inferred from geological evidence

and assumed but not verified physical continuity with

or without coal quality continuity. Based on exploration,

sampling and testing information gathered through appropriate

techniques from locations such as outcrops, trenches,

pits, workings and drill-holes which is limited or

of uncertain quality or reliability.

------------------------------------------------------------------

"kg" Kilogram (one thousand grams) - a measure of weight

------------------------------------------------------------------

"koz" One thousand ounces - a measure of weight

------------------------------------------------------------------

"m" A metre - a measure of length or thickness

------------------------------------------------------------------

"Measured A Measured Mineral Resource is that part of a Mineral

Mineral Resource for which quantity, grade or quality, densities,

Resource" shape, and physical characteristics are estimated with

confidence sufficient to allow the application of Modifying

Factors to support detailed mine planning and final

evaluation of the economic viability of the deposit

------------------------------------------------------------------

"Mineral A "Mineral Resource" is a concentration or occurrence

Resource of diamonds, natural solid inorganic material, or natural

solid fossilised organic material including base and

precious metals, coal, and industrial minerals in or

on the Earth's crust in such form and quantity and

of such a grade or quality that it has reasonable prospects

for economic extraction. The location, quantity, grade,

geological characteristics, and continuity of a Mineral

Resource are known, estimated or interpreted from specific

geological evidence and knowledge.

------------------------------------------------------------------

"Mt" Abbrev. for megaton (measure of weight). Equals 1 million

tonnes

------------------------------------------------------------------

"Probable "Probable Mineral Reserve" is the economically mineable

Mineral material derived from a Measured or Indicated Mineral

Reserve" Resource or both. It is estimated with a lower level

of confidence than a Proved Mineral Reserve. It includes

diluting and contaminating materials and allows for

losses that are expected to occur when the material

is mined. Appropriate assessments to a minimum of a

Pre-Feasibility Study for a project or a Life of Mine

Plan for an operation must have been carried out, including

consideration of, and modification by, realistically

assumed mining, metallurgical, economic, marketing,

legal, environmental, social and governmental factors.

Such modifying factors must be disclosed (SAMREC definition).

------------------------------------------------------------------

"Proved A "Proved Mineral Reserve" is the economically mineable

Mineral material derived from a Measured Mineral Resource.

Reserve" It is estimated with a high level of confidence. It

includes diluting and contaminating materials and allows

for losses that are expected to occur when the material

is mined. Appropriate assessments to a minimum of a

Pre-Feasibility Study for a project or a Life of Mine

Plan for an operation must have been carried out, including

consideration of, and modification by, realistically

assumed mining, metallurgical, economic, marketing,

legal, environmental, social and governmental factors.

Such modifying factors must be disclosed. (SAMREC definition).

------------------------------------------------------------------

"SAMREC" South African Code for Reporting Exploration Results,

Mineral Resources and Ore Reserves

------------------------------------------------------------------

SAMVAL South African Code for the Reporting of Asset Valuations

------------------------------------------------------------------

"t" A metric tonne - a measure of weight

------------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLDZGGKRFLGMZM

(END) Dow Jones Newswires

May 04, 2021 02:00 ET (06:00 GMT)

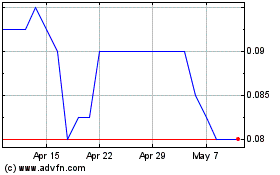

Katoro Gold (LSE:KAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Katoro Gold (LSE:KAT)

Historical Stock Chart

From Apr 2023 to Apr 2024