TIDMINS

RNS Number : 5828U

Instem plc

01 April 2019

Instem plc

("Instem" or the "Group")

Unaudited Results for the Year Ended 31 December 2018

Instem (AIM: INS.L), a leading provider of IT solutions to the

global early development healthcare market, announces its unaudited

full year results for the year ended 31 December 2018.

Financial Highlights:

-- Revenues increased 8% to GBP22.7m (2017 restated*: GBP21.1m)

o Software as a Service (SaaS) revenues increased 25% to GBP5.5m

(2017: GBP4.4m)

o Recurring revenues (annual support and SaaS) increased 6% to

GBP13.7m (2017: GBP12.9m)

-- Adjusted EBITDA** of GBP4.1m (2017 restated*: GBP2.4m)

-- Reported profit before tax of GBP1.7m (2017 restated*: GBP0.3m)

-- Basic earnings per share of 9.2p (2017 restated*: 4.1p)

-- Fully diluted earnings per share of 8.7p (2017 restated*: 4.0p)

-- Adjusted*** fully diluted earnings per share of 15.5p (2017 restated*: 11.0p)

-- Net cash balance as at 31 December 2018 of GBP3.6m (2017: GBP3.1m)

*Restated due to the adoption of IFRS 15 and its impact on

revenue recognition that accounts for GBP0.4m of additional revenue

and GBP0.3m of EBITDA in FY18, which had previously been recognised

in FY17.

**Earnings before interest, tax, depreciation, amortisation and

non-recurring costs.

***After adjusting for the effect of foreign currency exchange

on the revaluation of inter-company balances included in finance

income/(costs), non-recurring items and amortisation of intangibles

on acquisitions. Profit is adjusted in this way to provide a

clearer measure of underlying operating performance.

Operational Highlights:

-- S outsourced services contract wins with two top five global

non-clinical Contract Research Organisations ("CROs") each worth in

excess of GBP1m

-- Growing shift towards a SaaS based delivery and revenue model

-- Contract win with leading Fortune 500 Company which adopted

Samarind RMS solution for its worldwide medical products regulatory

tracking system

-- 500 additional Provantis(R) users licensed by our largest CRO client

Phil Reason, CEO of Instem, said: "With increasing momentum in

the business from recent contract wins and the growing pipeline, we

are confident about the outlook for the Group for 2019 and

beyond."

"While our strategy remains focused on Instem's organic revenue

growth, expanding operational gearing and improving positive

cashflow, management will continue to consider complementary

acquisition targets to further develop our position as a market

leading provider of IT solutions to the global life sciences

market."

For further information, please contact:

Instem plc +44 (0) 1785 825 600

Phil Reason, CEO

Nigel Goldsmith, CFO

N+1 Singer (Nominated Adviser

& Broker) +44 (0) 20 7496 3000

Richard Lindley

Alex Bond

Rachel Hayes

Walbrook Financial PR +44 (0) 20 7933 8780

Paul Cornelius instem@walbrookpr.com

Sam Allen

Nick Rome

About Instem

Instem is a leading provider of IT solutions & services to

the life sciences market delivering compelling solutions for Study

Management and Data Collection; Regulatory Solutions for

Submissions and Compliance; and Informatics-based Insight

Generation.

Instem solutions are in use by over 500 customers worldwide,

including all the largest 25 pharmaceutical companies, enabling

clients to bring life enhancing products to market faster. Instem's

portfolio of software solutions increases client productivity by

automating study-related processes while offering the unique

ability to generate new knowledge through the extraction and

harmonisation of actionable scientific information.

Instem products and services now address aspects of the entire

drug development value chain, from discovery through to market

launch. Management estimate that over 50% of all drugs on the

market have been through some part of Instem's platform at some

stage of their development. To learn more about Instem solutions

and its mission, please visit instem.com.

Chairman's Statement

I am pleased to report a further year of profitable growth for

Instem, with improving revenue, earnings and expanding operating

margins.

All parts of the business: Study Management; Informatics; and

Regulatory Solutions; made a positive contribution to the

performance of the Group. Importantly, our loyal customer base

contributed increased recurring revenue from support &

maintenance contracts and SaaS subscriptions, as well as providing

very encouraging levels of repeat business for our technology

enabled outsourced services.

Results and impact of IFRS 15

The Group is now required to report its financial results under

the new IFRS 15 "Revenue from contracts with customers" accounting

standard. As a consequence, certain adjustments have been made to

both the prior year 2017 and 2018 accounts resulting in GBP0.6m of

revenue and GBP0.5m of EBITDA previously recognised in 2017 spread

into future years, of which GBP0.4m of revenue and GBP0.3m of

EBITDA has been recognised in the 2018 accounts. Prior to the

adjustments the 2018 results would have been revenues of GBP22.3m

(2017 GBP21.7m) and EBITDA of GBP3.7m (2017 GBP3.0m). Our actual

reported results for 2018, post adjustments, are therefore revenues

of GBP22.7m (2017 GBP21.1m) and EBITDA of GBP4.1m (2017

GBP2.4m).

The Board believes IFRS15 will have no material effect on the

Group's 2019 expected reported performance.

Cash

The end of the year cash balance increased to GBP3.6m, which was

less than previously expected, due to a number of delayed customer

payments that have now been received.

Firm Foundations

Organic growth initiatives and complementary acquisitions

completed over the past several years mean we now have a

broad-based product portfolio serving several adjacent market

segments within the global life sciences sector. These diversified

revenue sources improve both the robustness of the business and the

quality of our earnings.

Nevertheless, we continue to invest in our personnel and

operations to ensure that we are fully prepared for future organic

and acquisitive growth opportunities.

Strategic Direction

Looking forward, we have several important elements to our

strategy which will be the drivers of future growth and earnings,

each of these showed progress in the year:

-- A focus on materially increasing SaaS based revenues. We

intend to achieve this through a combination of new business wins

directly onto our SaaS platform and accelerating the conversion of

on-premise customers to SaaS, which will increase margins. SaaS

based revenue increased 25% to GBP5.5m in the period;

-- The expansion of "technology enabled outsourced services",

where 2018 revenue was GBP3.3m (2017 GBP1.1m) and new business

orders were GBP6.5m:

o We remain excited by the potential for our S services

business, where the Group has a market leading offering and

continues to secure the majority of contracts awarded. S outsourced

services new business orders increased over 500% to GBP5.8m during

the period;

o Instem's KnowledgeScan augmented intelligence platform has now

gained industry recognition for its Target Safety Assessment

solution. KnowledgeScan new business orders increased 30% to

GBP0.7m during the period; and

-- Expansion of our market penetration across our existing

client base, cross selling additional software and services.

It was a particularly successful year for our Study Management

solutions. This was highlighted by the purchase of 500 additional

Provantis licenses by our largest client, Charles River

Laboratories. Our Clinical business continued to absorb substantial

development resources, leading to a major new release of Alphadas

in early March 2019 addressing some significant client

requirements.

Summary

I am pleased with our progress in 2018 and believe that the

foundations have now been laid for further operational and

financial progress in 2019 and beyond.

Whilst management will continue to pursue complementary

acquisition targets to further develop our position as a market

leading provider of IT solutions to the global life sciences

industry, we remain focused on achieving organic profitable growth,

expanding margins and improving positive cashflow.

Finally, I should note that as a global business, with

significant recurring revenues and with the majority of our

business outside Europe, we believe that the impact of Brexit,

whatever the outcome, should be minimal.

David Gare

Chairman

31 March 2019

Chief Executive's Report

Strategic Development

The period under review was one of solid progress across the

Group, with the anticipated strong growth in technology enabled

outsourced services and a higher than expected transition of

clients to SaaS deployment. The accelerated growth in SaaS revenue,

in line with our strategy, meant that there were fewer new

perpetual software licenses than planned and correspondingly lower

annual support and maintenance fees. Total revenue growth was

therefore slightly lower than anticipated, but careful cost control

ensured that we met our full-year EBITDA target and enhanced

margins.

We have now largely completed the investment in our technology

and resources to enable the Group to secure a leading share of the

FDA's (Food and Drug Administration) mandated S (Standard for

Exchange of Non-clinical Data) market and to cost effectively

deliver high quality results using a blend of resources in the UK,

US and India.

Certification to the Information Security Management Standard

(ISO27001) in 2018 ensures compliance with EU General Data

Protection Regulation (GDPR) and is an important competitive

differentiator for the Group.

Completion of a group-wide deployment of Oracle NetSuite

provides a key platform for operational and financial management,

enabling the Group to scale efficiently within the highly regulated

markets in which it operates.

Market Review

The pharmaceutical industry continues to represent a significant

proportion of our total life sciences market and the record numbers

of drugs in the R&D pipeline (a 6% increase over the prior

year) and a steadily increasing number of world-wide pharmaceutical

companies has provided a positive business environment. The

specific customer markets in which Instem operates remained

particularly strong in 2018, with record numbers of drugs in the

earlier stages of the R&D lifecycle. This underpins robust

recurring SaaS and software maintenance contract renewal rates as

well as bolstering the pipeline for new business revenue.

Growth was also particularly strong in the Asia-Pacific region,

which represented 14% of total revenue in the period, significantly

helped by the continuing substantial funding of pharmaceutical

R&D by the Chinese government.

Study Management

The majority of new business deals in this area were of modest

size, as expected, with the exception of a significant increase in

Provantis user licenses from our largest CRO client. There was

generally solid order volume, particularly for Provantis, our

market leading non-clinical software suite for organisations

engaged in non-clinical safety studies, where additional users,

modules and upgrade projects underpinned the good momentum.

This area contributes the majority of our annual recurring

income and renewal rates remained high. It also provides the

greatest opportunity for conversion of existing clients from

on-premise to SaaS deployment and the internal project to

accelerate this transition is building momentum. During 2018 the

SaaS transition appealed to all types of customers. The move of

long-standing clients to SaaS deployment, including a top three

chemical company and another existing top 20 pharma client, both in

addition to upgrades to Provantis version 10, provides further

evidence that any prior reluctance to make this move is

evaporating.

Provantis has once again dominated the Chinese market with

existing clients expanding and adding both users and modules.

Investment to enhance Instem's early phase clinical product,

Alphadas, was increased in the period in response to current client

needs. These enhancements will have wider market appeal going

forward.

Informatics

New business orders for KnowledgeScan, which can reduce the

traditional cost of Target Safety Assessment (TSA) development by

up to 50%, increased by 30% year-on-year, mainly from repeat

customers, which is demonstrative of a strong and recurring revenue

stream.

By outsourcing all, or augmenting some, of a customer's TSA

projects to Instem, clients are able to conduct more safety

evaluations without increasing resources or costs. Driven by

leading stage technology, including well proven artificial

intelligence, Instem's KnowledgeScan TSA service offers consistent,

systematic and efficient processes that produce high quality

reliable results.

Regulatory Solutions

Regulatory Information Management

In June, we announced that a leading Fortune 500 Company had

adopted Instem's Samarind RMS solution for its worldwide medical

products regulatory tracking system. The contract is worth

approximately US$750,000, incorporating both perpetual license and

SaaS revenue streams, with c. 80% of the contract being recognised

in 2018 and with annual recurring revenue of US$169,000.

Samarind RMS provides medical device and pharmaceutical

companies with a smarter way to manage their Product Information,

facilitating initial marketing authorisation and supporting ongoing

regulatory compliance. The product is optimised to enable these

companies to register and track their regulated products worldwide

by maintaining a single integrated database of all relevant

information, which is then used to update regulators as products

change over time. The comprehensive functionality provided by

Samarind RMS enables customers to systematically define and execute

complex regulatory activities across a globally dispersed workforce

whilst providing a single place to find, analyse and act on a

wealth of product and regulatory information.

S

The Regulatory Solutions business performed well in 2018

following the December 2017 FDA mandate of the Standard for the

Exchange of Non-clinical Data. S technology enabled outsourced

services was particularly strong with new order value in 2018 over

500% higher than the prior period.

To help manage this additional workflow effectively, Instem

recruited an additional 29 staff to its outsourced services team in

2018; 21 in India, four in the US and four in the UK, making 47 in

total globally, substantially more than our competitors. While

expansion will continue in 2019, the rate of recruitment is

moderating as the existing team becomes fully billable and our

technology platform and processes are optimised and leveraged to

increase study throughput.

Financial Review

Instem's revenue model consists of perpetual licence income with

annual support and maintenance contracts, professional fees,

technology enabled outsourced services fees and SaaS

subscriptions.

The Group is now required to report its financial results under

the new IFRS 15 "Revenue from contracts with customers" accounting

standard. As a result, certain adjustments have been made to both

the prior year 2017 and 2018 accounts, resulting in GBP0.6m of

revenue and GBP0.5m of EBITDA previously recognised in 2017 spread

into future years of which GBP0.4m of revenue and GBP0.3m of EBITDA

has been recognised in the 2018 accounts. Prior to the adjustments

the 2018 results would have been revenues of GBP22.3m (2017

GBP21.7m) and EBITDA of GBP3.7m (2017 GBP3.0m). The actual reported

results for 2018, post adjustments, are revenues of GBP22.7m (2017

GBP21.1m) and EBITDA of GBP4.1m (2017 GBP2.4m). After a review

during 2018 of the Group's revenue recognition policy the Group

concluded it was compliant with the new standard (IFRS15) for

recognising the majority of its revenues.

Three contracts for sales of software licences were identified

that required an amendment to the accounting treatment that had

been originally applied to comply with the new standard, two where

the licence revenue had been recognised in full in 2017 and one

which had accelerated revenue in 2018. The nature of the

adjustments had the effect of spreading the revenue from the

respective licence sales over the contract period on a

straight-line basis rather than taking all the licence income to

profit at the point of shipment. A more thorough explanation of the

impact on revenue and EBITDA in 2018 and 2017 from adopting IFRS15

in 2018 and the corresponding updated accounting policy on revenue

recognition applied during 2018 is set out in the notes below. All

prior period comparisons that have been impacted by IFRS15 have

been restated and designated as such.

A key performance indicator of the Group is recurring revenue.

During the year, the total recurring revenue, from support &

maintenance contracts and SaaS subscriptions, increased 6% to

GBP13.7m (2017: GBP12.9m), representing 60% of total revenue (2017:

61%).

Operating costs reflected prudent control whilst investing in

the future by continuing to build the infrastructure to support the

Group's expansion plans, which included the successful

implementation of Oracle NetSuite, a new financial accounting and

reporting system. The Group benefited from a full year of the cost

savings realised during 2017 with overall costs remaining flat year

on year despite the growth in revenues, thus contributing to a

much-improved profit performance.

Earnings before interest, tax, depreciation and amortisation and

non-recurring items ("Adjusted EBITDA") for the year was GBP4.1m

(2017: GBP2.4m as restated) after adding the net positive impact of

the IFRS 15 adjustments. The EBITDA margin increased in the year to

17.8% from 11.5% in 2017.

Adjusted profit before tax (i.e. adjusting for the effect of

foreign currency exchange on the revaluation of inter-company

balances included in finance costs, non-recurring items and

amortisation of intangibles on acquisitions) was GBP2.8m (2017:

GBP1.4m as restated). The unadjusted reported profit before tax for

the year was GBP1.7m (2017: GBP0.3m).

The non-recurring costs in the year included GBP0.4m of legal

and professional fees, plus a GBP0.1m estimated provision created

for the cost of GMP equalisation in the Group's defined benefit

pension scheme. The actual cost to the scheme is being calculated

by the scheme's pension advisers with the scheme's trustees and

will be reflected in a future actuarial calculation of the scheme's

liabilities.

Development costs incurred during the year were GBP3.1m (2017:

GBP3.3m), of which GBP1.5m (2017: GBP1.4m) was capitalised. The

Group claimed research and development tax credits in respect of

the prior year 2017 of GBP0.5m (2017 in respect of 2016: GBP0.6m).

At the year-end the Group had estimated available trading tax

losses to offset future trading profits of GBP2.9m.

Basic and fully diluted earnings per share calculated on an

adjusted basis were 16.4p and 15.5p, respectively (2017: 11.3p

basic and 11.0p fully diluted, as restated). The reported basic and

fully diluted earnings per share were 9.2p and 8.7p, respectively

(2017: 4.1p basic and 4.0p fully diluted).

The Group generated net cash from operating activities of

GBP2.2m (2017: GBP1.4m), assisted by a net cash inflow on tax

following the R&D tax credit claim. The Group had net cash

reserves of GBP3.6m at 31 December 2018, compared with GBP3.1m as

at 31 December 2017. The Group paid the previously flagged final

instalment of GBP0.2m in respect of deferred consideration during

the year, which extinguished the remaining liability in respect of

prior period acquisitions. The Group continued to invest in its

comprehensive suite of software products through its own

development teams, representing the majority of the GBP1.5m spent

on intangible assets in the year (2017: GBP1.5m).

The Group's legacy defined benefit pension scheme has remained

closed to new members since 2000 and to future accrual since 2008.

During the year the April 2017 actuarial valuation was concluded

and the impact was reflected in the IAS19 calculation at 31

December 2018. The valuation resulted in a substantial net decrease

of GBP1.6m in the funding deficit moving from GBP3.8m in 2017 to

GBP2.2m in 2018, the main impact (circa GBP1m) arising from the

valuation of certain liabilities on a CPI rather than RPI basis

following Counsel's ruling. This represents a substantial benefit

to the Group and has been reflected in the future agreed cash

contributions which will remain around an annual level of GBP0.5m

payable through to October 2024, by when the funding liability is

scheduled to be eliminated. The overall deficit at the year-end

stood at GBP2.2m (2017: GBP3.8m), represented by the fair value of

assets of GBP10.4m (2017: GBP10.8m) and the present value of funded

obligations of GBP12.6m (2017: GBP14.5m). The next triennial

valuation will be calculated as at 5 April 2020.

Update on historic contract dispute

As originally highlighted in the preliminary results

announcement for the year ended 31 December 2017, released on 26

March 2018, the Group made a cost provision related to historical

contract disputes.

A dispute, which does not affect ongoing operations of the

Group, is now being heard by the German courts, with the initial

hearing held on 22 January 2019. Instem has taken legal advice and

is defending the action. The Group strongly believes that the claim

should be dismissed. Notwithstanding this, the cost provision made

in 2017 will be maintained in the 2018 accounts.

Further announcements will be made as and when appropriate.

Principal risks and uncertainties

The directors consider that the global pharmaceutical market is

likely to continue to provide growth opportunities for the

business. The combination of the high level of annual support

renewals and low levels of customer attrition provides revenue

visibility to underpin the Group strategy on product and market

development.

The Group seeks to mitigate exposure to all forms of risk

through a combination of regular performance review and a

comprehensive insurance programme.

The global nature of the market means that the Group is exposed

to currency risk as a consequence of a significant proportion of

its revenue being earned in US Dollars, some of which is mitigated

by operating costs incurred by its US operation. The Group

continually assesses the most appropriate approach to managing its

currency exposure in line with the overall goal of achieving

predictable earnings growth. The Group also generates material cash

reserves through its Chinese subsidiary that are not readily

available to the UK group at short notice and as such the Group has

to maintain sufficient working capital headroom to accommodate any

delays in repatriating cash from China.

The Group's credit risk is primarily attributable to its trade

receivables and the Group has policies in place to ensure that

sales of products and services are made to customers with

appropriate creditworthiness.

The Group manages liquidity risk through regular cash flow

forecasting and monitoring of cash flows, management review and

regular review of working capital and costs. The Group regularly

monitors its available headroom under its borrowing facilities. At

31 December 2018, its GBP0.5m bank facility was undrawn (2017:

GBP2.0m facility undrawn).

Brexit - whilst the outcome of Brexit remains uncertain, there

is always the associated risk of adverse implications for the

business, including the impact on exchange rate fluctuations.

However, the Group has experienced no negative impact on its

business to date and does not expect to do so in the future. Instem

operates in a global market with a multinational customer base and

its revenues and costs spread around the globe without over

reliance on Europe or exposure to it. The 2016 acquisition of

Notocord in France provides the Group with a presence in Europe

that we expect to help mitigate any impact that might arise from

the Brexit outcome. The Group will continue to monitor the progress

of the Brexit situation and its possible effects.

Outlook

We are very pleased with the performance of the business during

2018 with regulatory requirements delivering the expected

significant increase in demand for our technology enabled

outsourced services.

Growth was also particularly strong in the Asia-Pacific region,

with bookings up 37% on the prior year, primarily attributable to

the continuing funding of pharmaceutical Research & Development

by the Chinese government.

With increasing momentum in the business from recent contract

wins and the growing pipeline, we are confident about the outlook

for the Group for 2019 and beyond.

While our strategy remains focused on Instem's strong organic

revenue growth, expanding operational gearing and improving

positive cashflow, management will continue to consider

complementary acquisition targets to further develop our position

as a market leading provider of IT solutions to the global life

sciences market.

Phil Reason

Chief Executive

31 March 2019

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2018

Restated

(See note 3)

Unaudited Audited

Year ended Year ended

Continuing Operations Note 31 December 2018 31 December 2017

GBP000 GBP000

REVENUE 2 22,705 21,071

Operating expenses (18,437) (18,497)

Share based payment (216) (157)

EARNINGS BEFORE INTEREST, TAXATION, DEPRECIATION, AMORTISATION AND

NON-RECURRING COSTS ('EBITDA') 4,052 2,417

Depreciation (144) (186)

Amortisation of intangibles arising on acquisition (788) (931)

Amortisation of internally generated intangibles (738) (473)

PROFIT BEFORE NON-RECURRING COSTS 2,382 827

Non-recurring costs 6 (539) (443)

PROFIT FROM OPERATIONS 1,843 384

Finance income 7 33 186

Finance costs 8 (199) (318)

PROFIT BEFORE TAXATION 1,677 252

Taxation 5 (207) 390

PROFIT FOR THE YEAR 1,470 642

OTHER COMPREHENSIVE INCOME

Items that will not be reclassified to profit and loss account:

Actuarial gain on retirement benefit obligations 1,300 664

Deferred tax on actuarial gain (221) (113)

1,079 551

Items that may be reclassified to profit and loss account:

Exchange differences on translating foreign operations (193) (565)

OTHER COMPREHENSIVE INCOME/(EXPENSE) FOR THE YEAR 886 (14)

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 2,356 628

PROFIT ATTRIBUTABLE TO OWNERS OF THE PARENT COMPANY 1,470 642

TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO OWNERS OF THE PARENT

COMPANY 2,356 628

Earnings per share from continuing operations

Basic 9 9.2p 4.1p

Diluted 9 8.7p 4.0p

Consolidated Statement of Financial Position

As at 31 December 2018

Restated

(See note 3)

Unaudited Audited

31 December 2018 31 December 2017

ASSETS GBP000 GBP000 GBP000 GBP000

NON-CURRENT ASSETS

Intangible assets 17,411 17,440

Property, plant and equipment 300 299

Deferred tax asset - 393

TOTAL NON-CURRENT ASSETS 17,711 18,132

CURRENT ASSETS

Inventories 37 29

Trade and other receivables 7,807 9,470

Current tax receivable 1,013 1,267

Cash and cash equivalents 3,572 3,064

TOTAL CURRENT ASSETS 12,429 13,830

TOTAL ASSETS 30,140 31,962

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 2,156 2,725

Deferred income 8,625 10,967

Current tax payable 401 226

Financial liabilities 34 220

Deferred tax liabilities 12 -

TOTAL CURRENT LIABILITIES 11,228 14,138

NON-CURRENT LIABILITIES

Financial liabilities 18 51

Retirement benefit obligations 2,249 3,750

Provision for liabilities

and charges 250 250

TOTAL NON-CURRENT LIABILITIES 2,517 4,051

TOTAL LIABILITIES 13,745 18,189

EQUITY

Share capital 1,592 1,589

Share premium 12,535 12,488

Merger reserve 1,598 1,598

Shares to be issued 1,010 794

Translation reserve 290 483

Retained earnings (630) (3,179)

TOTAL EQUITY ATTRIBUTABLE 13,773

TO OWNERS OF THE PARENT 16,395

TOTAL EQUITY AND LIABILITIES 30,140 31,962

The adoption of IFRS 15 Revenue from Contracts with Customers

did not impact the reported Balance Sheet as at 31 December

2016.

Consolidated Statement of Cashflows

For the year ended 31 December 2018

Unaudited Audited

Year ended Year ended

31 December 2018 31 December 2017

GBP000 GBP000 GBP000 GBP000

CASH FLOWS FROM OPERATING

ACTIVITIES

Profit before taxation 1,677 252

Adjustments for:

Depreciation 144 186

Amortisation of intangibles 1,526 1,404

Share based payment 216 157

Retirement benefit obligations (498) (461)

Finance income (33) (186)

Finance costs 199 318

Decrease in deferred contingent

consideration - (148)

CASH FLOWS FROM OPERATIONS BEFORE

MOVEMENTS IN WORKING CAPITAL 3,231 1,522

Movements in working capital:

(Increase)/Decrease in inventories (7) 700

Decrease/(Increase) in trade

and other receivables 1,997 (3,043)

(Decrease)/Increase in trade

& other payables and deferred

income (3,448) 2,353

CASH GENERATED FROM OPERATIONS 1,773 1,532

Finance income 33 186

Finance costs (11) (112)

Income taxes 408 (214)

NET CASH GENERATED FROM OPERATING

ACTIVITIES 2,203 1,392

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchase of intangible assets (1,497) (1,517)

Purchase of property, plant

and equipment (145) (117)

Payment of deferred contingent

consideration (200) (687)

Repayment of capital from

finance leases (31) (30)

NET CASH USED IN INVESTING

ACTIVITIES (1,873) (2,351)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from issue of share

capital (net of fees) 50 29

Finance lease interest (4) (6)

NET CASH GENERATED FROM FINANCING

ACTIVITIES 46 23

NET INCREASE/(DECREASE) IN CASH

AND CASH EQUIVALENTS 376 (936)

Cash and cash equivalents

at start of year 3,064 4,189

Effects of exchange rate changes

on the balance of cash held

in foreign currencies 132 (189)

CASH AND CASH EQUIVALENTS

AT OF YEAR 3,572 3,064

Consolidated Statement of Changes in Equity

Attributable to Owners of the Company

Restated

Called (See note

up share Share Merger Shares Translation Retained 3)

capital premium reserve to be reserve earnings Total

issued equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance as

at

1 January 2017 1,577 12,462 1,432 864 1,048 (4,599) 12,784

Profit for

the year - - - - - 642 642

Other comprehensive

income/(expense)

for the year - - - - (565) 551 (14)

Total comprehensive

income - - - - (565) 1193 628

Shares issued 12 26 166 - - - 204

Share based

payment - - - 157 - - 157

Reserve transfer

on lapse of

share options - - - (227) - 227 -

Balance as

at

31 December

2017 - Audited

- Restated 1,589 12,488 1,598 794 483 (3,179) 13,773

Profit for

the year - - - - - 1,470 1,470

Other comprehensive

income/(expense)

for the year - - - - (193) 1,079 886

Total comprehensive

income - - - - (193) 2,549 2,356

Shares issued 3 47 - - - - 50

Share based

payment - - - 216 - - 216

__

Balance as

at

31 December

2018 -Unaudited 1,592 12,535 1,598 1,010 290 (630) 16,395

Notes to the Financial Statements

1. Basis of Preparation

FINANCIAL INFORMATION

The preliminary financial information does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006 but is derived from accounts for the years ended

31 December 2018 and 31 December 2017. The figures for the year

ended 31 December 2017 were audited. The preliminary financial

information is prepared on the same basis as will be set out in the

statutory accounts for the year ended 31 December 2018. The figures

for the year ended 31 December 2018 are unaudited.

The preliminary financial information was approved for issue by

the Board of Directors on 31 March 2019.

The audit of the statutory accounts for the year ended 31

December 2018 is not yet complete. These accounts will be finalised

on the basis of the financial information presented by the

directors in the preliminary announcement. The statutory accounts

for the year ended 31 December 2018 will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting. Statutory accounts for the year ended 31 December 2017

have been filed with the Registrar of Companies. The auditor's

report on those 2017 accounts was unqualified and did not contain

any statement under Section 498 (2) or (3) of the Companies Act

2006.

GENERAL INFORMATION

The principal activity of the Group is the provision of world

class information solutions for Life Sciences research and

development in the early phase drug development market. Instem plc

is a company incorporated in England and Wales under the Companies

Act 2006 and domiciled in the UK. The registered office is Diamond

Way, Stone Business Park, Stone, Staffordshire, ST15 0SD, UK.

BASIS OF ACCOUNTING

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRS), as adopted by the European Union (EU), this

announcement does not in itself contain sufficient information to

comply with IFRSs.

The Group's accounting reference date is 31 December.

KEY ACCOUNTING POLICIES

IFRS 15 Revenue from Contracts with Customers is effective for

the Group for the period starting 1 January 2018. The Group has

applied IFRS 15 retrospectively to each prior reporting period and

will utilise certain practical expedients available in IFRS 15.

The adoption of IFRS 15 does not alter the total contract value

or timing of cash flows. The revenue recognition from annual

support fees and SaaS subscriptions does not change, as these

continue to be spread rateably over the term of the contract.

Management will continue to assess the revenue recognition from

SaaS and maintenance and support services and whether they are a

combined or distinct performance obligation on a contract by

contract basis.

There are two key areas where the adoption of IFRS 15 changes

current revenue recognition:

Bundled contracts:

Software licences, professional services and annual support are

often bundled together in a contract. Under IFRS 15, a contract by

contract assessment is completed to identify the performance

obligations in each contract and may identify that the promise in

the contract is a single performance obligation resulting in the

total value of the contract being combined as one obligation and

recognised over the contract term. The impact of this is a

reduction of revenue previously recognised; an increase in deferred

income and an increase in monthly recurring revenue going forward.

Previously under IAS 18 revenue from professional services was

recognised as the work was completed, revenue from the software

licence was recognised when the risks and rewards of ownership of

the product were transferred to the customer and revenue from the

annual support was recognised over the term of the contract. This

resulted in the revenue being recognised earlier in the contract

period. For the years 2017 and 2018 Management identified three

contracts where a single contractual obligation existed, resulting

in the licence fee income being recognised over the period of the

contracts rather than at the point of delivery.

Where software licenses, professional services and annual

support are not part of a bundled contract or where a bundled

contract is deemed not to represent a single performance obligation

the revenue recognition for each revenue element does not change

under IFRS15. Management will assess whether software licences,

professional services and annual support are distinct performance

obligations on a contract by contract basis.

Contract costs:

Under IFRS 15, sales commissions that are incremental to

obtaining the contract and are expected to be recovered are

capitalised as a cost of obtaining the contract and amortised over

the life of the contract. These costs were previously expensed to

the income statement as incurred.

Costs associated with the installation of software are

capitalised as contract fulfilment assets and amortised over the

life of the contract. Installation costs were previously expensed

to the income statement as incurred.

REVENUE RECOGNITION

The Group has adopted IFRS 15 (Revenue from Contracts with

Customers) in determining appropriate revenue recognition

principles.

The Group generates revenue from the provision of software

licences, annual support, SaaS subscriptions, professional services

and technology enabled outsourced services.

At contract inception, an assessment is completed to identify

the performance obligations in each contract. Performance

obligations in a contract are either goods or services that are

distinct or part of a series of goods or services that are

substantially the same and have the same pattern of transfer to the

customer. Promises that are not distinct are combined with other

promised goods or services in the contract, until a performance

obligation is satisfied.

At contract inception, the transaction price is determined,

being the amount that the group expects to receive for transferring

the promised goods or services. The transaction price is allocated

to the performance obligations in the contract based on their

relative standalone selling prices. The group has determined that

the contractually stated price represents the standalone selling

price for each performance obligation.

Revenue is recognised when a performance obligation has been

satisfied by transferring the promised product or service to the

customer.

Software licences

Revenue from the sale of the software licences is recognised

when the customer takes possession of the software which is usually

when the license key is provided to the customer. This is because

the software is functional at the time the licence transfers to the

customer and the Group is not required or expected to undertake

activities that significantly affect the utility of the

intellectual property by the customer.

Annual support

Customers typically enter into a support contract for a period

of twelve months. This contract provides the customer with access

to technical support and software upgrades. The promises in these

contracts are a single performance obligation, which is satisfied

over time as the customer consumes the benefits of the service.

Revenue in respect of the single performance obligation is

recognised evenly over the contract term.

SaaS subscription and support

Customers typically enter into a SaaS contract for a period of

twelve months and pay a fixed amount in exchange for the right to

access software on a hosted server along with access to maintenance

and support. Initial SaaS contracts may also include some

installation or customisation of the software and training for

staff. The promises in this contract are considered to be a single

performance obligation and the revenue is recognised over the

period of the contract on a straight-line basis.

Professional services and technology enabled outsourced

services

Customers typically enter into a service contract to provide

distinct service work based on clear statements of work. Service

work includes, but is not limited to, implementation services,

training and outsourced services work relating to S and

KnowledgeScan. The promises in this contract are considered to be a

single performance obligation and the revenue is recognised on a

percentage completion basis for fixed price contracts or as

services are provided in respect of time and materials

contracts.

Bundled contracts

Software licences, professional services and annual support are

often bundled together in a contract.

Unless otherwise noted during the contract assessment, the three

revenue elements are considered to be separate performance

obligations on the basis that the software licence can be delivered

with or without the professional services and annual support and

management has determined that, although the annual support

provides the customer with access to software upgrades, these

upgrades are rarely utilised within the initial contract period and

do not significantly enhance the intellectual property of the

purchased software licence, therefore the products and services are

not interdependent or interrelated with another good or service. In

allocating the consideration to the separate performance

obligations the standalone selling price is used.

Where the contract assessment identifies that the sale does not

meet the criteria to be a distinct performance obligation, promises

that are not distinct are combined with other promised goods or

services in the contract, until a performance obligation is

satisfied. Revenue in respect of this bundled performance

obligation is recognised over the period of the contracted

obligation on a straight-line basis.

Deferred and accrued income

In most cases, customers are invoiced and payment is received in

advance of revenue being recognised in the income statement.

Deferred and accrued income is the difference between amounts

invoiced to customers and revenue recognised under the policy

described above. If the amount of revenue recognised exceeds the

amounts invoiced the excess amount is included within amounts

recoverable on contracts.

Contract costs

The incremental costs associated with obtaining a contract are

recognised as an asset if the group expects to recover the costs.

Costs that are not incremental to a contract are expensed as

incurred. Management determine which costs are incremental and meet

the criteria for capitalisation.

Costs to fulfil a contract, which are not in the scope of

another standard, are recognised separately as a contract

fulfilment asset to the extent that they relate directly to a

contract which can be specifically identified; the costs generate

or enhance resources that will be used to satisfy the performance

obligation and the costs are expected to be recovered. Management

applies judgement to determine which contract fulfilment costs meet

the recognition criteria, and in particular if the costs generate

or enhance resources used to satisfy the performance

obligation.

Costs to fulfil a contract which do not meet the criteria above

are expensed as incurred.

Contract fulfilment asset

Contract fulfilment assets are amortised over the expected

contract period on a systematic basis representing the pattern in

which control of the associated service is transferred to the

customer.

CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Certain year end asset and liability amounts reported in the

financial information are based on management estimates and

assumptions. There is therefore a risk of significant changes to

the carrying amounts of these assets and liabilities within the

next financial year. The estimates and assumptions are made on the

basis of information and conditions that existed at the time of the

valuation.

Recognition of deferred tax assets

The recognition of deferred tax assets is based upon whether it

is more likely than not that sufficient and suitable taxable

profits will be available in the future against which the reversal

of temporary differences can be deducted. Where the temporary

differences are related to losses, relevant tax law is considered

to determine the availability of the losses to offset against the

future taxable profits. The amount recognised in the consolidated

financial statements is derived from management's best estimation

and judgement incorporating forecasts and all available

information. Recognition therefore involves judgement regarding the

future financial performance of the particular legal entity or tax

group in which the deferred tax asset has been recognised.

Provision for liabilities and charges

Provisions are recognised when the Group has a present

obligation (legal or constructive) as a result of a past event, it

is probable that the Group will be required to settle the probable

outflow of resources, and a reliable estimate can be made of the

amount of the obligation. As at 31 December 2018, the Group was

carrying a provision of GBP0.25m in respect of historical contract

disputes as the directors have considered that the above provision

conditions have been met. The provision represents the best

estimate of the risks and considers all information and legal

advice received by the Group.

Impairment

At each reporting date, the Group reviews the carrying amounts

of goodwill and investments. The recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit (CGU) to which the asset

belongs. A key factor which could result in an impairment of

goodwill or investments is lower than predicted profitability. The

CGU with the most sensitivity to obtaining future custom and

profitability is Instem Clinical where an additional increase of

28% in the discount rate or a reduction in revenues of 31% would

result in the recoverable amount of the CGU being equal to its

carrying amount. The forecasts to support Clinical's carrying value

are reliant on winning future contracts that have not yet been

agreed.

GOING CONCERN

Having made appropriate enquiries, the directors consider that

the Group has adequate resources to enable it to continue in

operation for the foreseeable future. The Group has a significant

proportion of recurring revenue from a well-established global

customer base, supported by a largely fixed cost base.

The financial position of the Group, its cash flows and

liquidity position are set out in the primary statements of this

financial information. Detailed projections have been made for the

12 months following the approval of the financial statements and

sensitivity analysis undertaken. This work gives the directors

confidence as to the future trading performance.

Accordingly, the directors continue to adopt the going concern

basis for the preparation of the financial statements.

2. Segmental Reporting

For management purposes, the Group is currently organised into

one operating segment - Global Life Sciences.

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis.

Restated

Unaudited Audited

2018 2017

GBP000 GBP000

REVENUE BY PRODUCT TYPE

Licence fees 3,491 5,194

Annual support fees 8,160 8,446

SaaS subscriptions 5,509 4,424

Professional services 2,204 1,891

Technology enabled outsourced

services 3,341 1,116

22,705 21,071

Restated

Unaudited Audited

2018 2017

GBP000 GBP000

REVENUE BY GEOGRAPHICAL LOCATION

UK 3,504 2,073

Rest of Europe 4,534 4,567

USA and Canada 11,507 12,246

Rest of World 3,160 2,185

22,705 21,071

Restated

Unaudited Audited

2018 2017

GBP000 GBP000

NON-CURRENT ASSETS EXCLUDING

DEFERRED TAXATION BY GEOGRAPHICAL

LOCATION

UK 16,896 17,167

Rest of Europe 624 320

USA and Canada 133 214

Rest of World 58 38

17,711 17,739

MAJOR CUSTOMERS

There were no customers which represented more than 10% of the

Group revenue in 2018 (2017: none).

3. Reconciliation to previously reported information

The table below reconciles key line items in these financial

statements to the information provided in the financial statements

for the year ended 31 December 2017 and the opening statement

financial position at 1 January 2018. The changes relate to the

fully retrospective adoption of IFRS15, Revenue from Contracts with

Customers.

As previously

reported IFRS 15 As Restated

adoption

Income statement for 2017 GBP000 GBP000 GBP000

REVENUE 21,668 (597) 21,071

Operating expenses (18,549) 52 (18,497)

Share based payment (157) - (157)

EARNINGS BEFORE INTEREST, TAXATION,

DEPRECIATION, AMORTISATION AND

NON-RECURRING COSTS ('EBITDA') 2,962 (545) 2,417

Depreciation and Amortisation (1,590) - (1,590)

PROFIT BEFORE NON-RECURRING COSTS 1,372 (545) 827

PROFIT BEFORE TAXATION 797 (545) 252

Taxation 297 93 390

PROFIT FOR THE YEAR 1,094 (452) 642

As previously

reported IFRS 15 As Restated

adoption

Statement of Financial Position GBP000 GBP000 GBP000

as at 31 December 2017

Non-current assets 18,039 93 18,132

Deferred tax asset 300 93 393

Total assets 31,869 93 31,962

Current liabilities 13,593 545 14,138

Trade and other payables 2,777 (52) 2,725

Deferred income 10,370 597 10,967

Total liabilities 17,644 545 18,189

Total equity attributable to

the owners of the parent 14,225 (452) 13,773

Retained earnings (2,727) (452) (3,179)

4. Impact of IFRS 15, Revenue from Contracts with Customers, on

the Income statement for the year ended 31 December 2018

The table below shows the impact of IFRS15, Revenue from

Contracts with Customers, on key line items in the Income statement

for the year ended 31 December 2018.

Amounts

excluding IFRS 15 As reported

IFRS 15 adoption

Income statement for 2018 GBP000 GBP000 GBP000

REVENUE 22,322 383 22,705

Operating expenses (18,397) (40) (18,437)

Share based payment (216) - (216)

EARNINGS BEFORE INTEREST, TAXATION,

DEPRECIATION, AMORTISATION AND

NON-RECURRING COSTS ('EBITDA') 3,709 343 4,052

Depreciation and Amortisation (1,670) - (1,670)

PROFIT BEFORE NON-RECURRING COSTS 2,039 343 2,382

5. Income Taxes

Restated

Unaudited Audited

2018 2017

GBP000 GBP000

Current tax:

UK corporation tax on result for the - -

year

UK corporation tax in respect of previous

years (85) 306

Adjustments in respect of R&D tax credit 477 567

Foreign tax (403) (379)

Foreign tax in respect of previous years (12) 337

Total current tax (23) 831

Deferred tax:

Current year charge (101) (28)

Adjustment in respect of previous years (83) (357)

Retirement benefit obligation - (56)

Total deferred tax (184) (441)

Total income tax (charge)/credit recognised

in the current year (207) 390

6. Non-recurring costs

Unaudited Audited

2018 2017

GBP000 GBP000

Guaranteed Minimum Pension (GMP) equalisation

provision - see note below (126) -

Legal costs and cost provision relating

to historical contract disputes (49) (250)

Professional fees (364) -

Restructuring costs - (341)

Amendment to contingent consideration

post acquisition - 148

(539) (443)

Note - Pension schemes are legally required to equalise pension

benefits for the effects of unequal Guaranteed Minimum Pensions

(GMPs) between males and females that were accrued since May 1990.

The Group has included a reserve for the cost of GMP equalisation,

based on information from the Group's pension advisors.

7. Finance income

Audited

Unaudited 2017

2018 GBP000

GBP000

Foreign exchange gains 25 184

Other interest 8 2

33 186

8. Finance costs

Unaudited Audited

2018 2017

GBP000 GBP000

Bank loans and overdrafts 11 112

Unwinding discount on deferred

consideration 12 71

Net interest on pension scheme 172 129

Finance lease interest 4 6

199 318

9. Earnings per share

Basic and fully diluted

Basic earnings per share are calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year. Diluted

earnings per share is calculated by adjusting the weighted number

of ordinary shares outstanding to assume conversion of all dilutive

potential shares arising from the share option schemes. The

dilutive impact of the share options is calculated by determining

the number of shares that could have been acquired at fair value

(determined as the average market share price of the Company's

shares) based on the monetary value of the subscription rights

attached to the outstanding share options.

2018 2017

Profit after Weighted Earnings per Restated Weighted Restated

tax average number share Profit average number Earnings per

of shares after tax of shares share

'000 '000

GBP000 Pence GBP000 Pence

Earnings per

share - Basic 1,470 15,909 9.2 642 15,831 4.1

Potentially

dilutive

shares - 940 - - 328 -

---------------- --------------- ---------------- ----------- --------------- ---------------

Earnings per

share -

Diluted 1,470 16,849 8.7 642 16,159 4.0

================ =============== ================ =========== =============== ===============

The adoption of IFRS 15 (Revenue from Contracts with Customers)

has impacted Earnings per share (basic and fully diluted). The

pre-restated 2017 position is:

Pre-restated 2017 Pre- restated

Profit Weighted average number of shares Earnings per share

after tax

'000

Pence

GBP000

Earnings per share - Basic 1,094 15,831 6.9

Potentially dilutive shares - 328 -

------------- -------------------------------------- --------------------

Earnings per share - Diluted 1,094 16,159 6.8

============= ====================================== ====================

Adjusted

Adjusted earnings per share is calculated after adjusting for

the effect of foreign currency exchange on the revaluation of

inter-company balances included in finance income/(costs),

non-recurring items and amortisation of intangibles on

acquisitions. Diluted adjusted earnings per share is calculated by

adjusting the weighted number of ordinary shares outstanding to

assume conversion of all dilutive potential shares arising from the

share option schemes. The dilutive impact of the share options is

calculated by determining the number of shares that could have been

acquired at fair value (determined as the average market share

price of the Company's shares) based on the monetary value of the

subscription rights attached to the outstanding share options.

2018 2017

Adjusted Weighted Adjusted Restated Weighted Restated

Profit after average number Earnings per Adjusted average number Adjusted

tax of shares share Profit after of shares Earnings per

tax share

'000 '000

GBP000 Pence GBP000 Pence

Earnings per

share - Basic 2,611 15,909 16.4 1,782 15,831 11.3

Potentially

dilutive

shares - 940 - - 328 -

--------------- --------------- --------------- --------------- --------------- ---------------

Earnings per

share -

Diluted 2,611 16,849 15.5 1,782 16,159 11.0

=============== =============== =============== =============== =============== ===============

The adoption of IFRS 15 Revenue from Contracts with Customers

has impacted Earnings per share (adjusted basic and fully diluted).

The pre-restated 2017 position is:

Pre-restated 2017 Pre- restated

Profit Weighted average number of shares Earnings per share

after tax

'000

Pence

GBP000

Earnings per share - Basic 2,234 15,831 14.1

Potentially dilutive shares - 328 -

------------- -------------------------------------- --------------------

Earnings per share - Diluted 2,234 16,159 13.8

------------- -------------------------------------- --------------------

Reconciliation of reported profit before tax

to adjusted profit before tax and adjusted

profit after tax: Restated

Unaudited Audited

2018 2017

GBP'000 GBP'000

Reported profit before tax 1,677 252

Non-recurring costs 539 443

Amortisation of acquired intangibles 788 931

Foreign exchange differences on revaluation

of inter-co balances (186) (234)

Adjusted profit before tax 2,818 1,392

Tax (207) 390

------------ -----------

Adjusted profit after tax 2,611 1,782

============ ===========

10. Annual report and accounts

Copies of the Annual Report and Accounts will be posted to the

Group's shareholders in due course and will be available, along

with this announcement, on Instem's website at

http://investors.instem.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SDUEFFFUSEFD

(END) Dow Jones Newswires

April 01, 2019 02:00 ET (06:00 GMT)

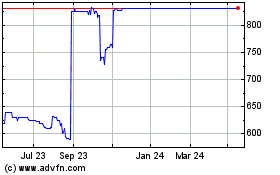

Instem (LSE:INS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Instem (LSE:INS)

Historical Stock Chart

From Apr 2023 to Apr 2024