TIDMQIF

RNS Number : 4868M

Qatar Investment Fund PLC

14 October 2016

14 October 2016

Qatar Investment Fund plc ("QIF" or the "Company")

Q3 2016 Investment Report

Qatar Investment Fund plc (LSE: QIF), today issues its Q3 2016

Investment Report for the period 1 July 2016 to 30 September 2016,

a pdf copy of which can be obtained from QIF's website at:

www.qatarinvestmentfund.com.

QIF was established to capitalize on the investment

opportunities in Qatar and the Gulf Cooperation Council ("GCC")

region, arising from the economic growth being experienced in the

area. The Company invests in quoted Qatari equities listed on the

Qatar Exchange ("QE") in addition to companies soon to be listed,

with a possible allocation of up to 15% in other listed companies

elsewhere in the GCC region. The Investment Adviser invests using a

top-down screening process combined with fundamental industry and

company analysis.

QIF Quarterly Report - Q3 2016

3 months ended 30 September 2016

Highlights

Ø Qatar Investment Fund Plc's ("QIF") net asset value per share

("NAV") +5.7% vs Qatar Exchange Index ("QE") +5.6%.

Ø The Qatar market was the best performer in the GCC in the

quarter.

Ø Credit rating agencies affirm Qatar outlook as Stable.

Ø Barzan Gas Project production to start in November.

Ø 2016 Qatar credit growth +5.0% to end August (public sector

growth +9.2%).

Ø FTSE Russell upgraded Qatar to Secondary Emerging Markets

status.

Ø 2016 Qatar population +5.5% to 2.56 million.

Performance

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the NAV per share compared to the QIF share

price.

QIF's NAV net of dividends rose 5.7% during Q3 2016, while the

QE rose 5.6%. After outperforming by 0.7% compared to the QE in the

previous quarter, QIF's NAV outperformed by 0.1% for Q3 2016.

On 30 September 2016, the QIF share price was trading at a 13.9%

discount to NAV.

Performance vs QE Index

2007 9M

5M 2008 2009 2010 2011 2012 2013 2014 2015 2016

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------

QIF NAV* 13.9% -36.4% 10.4% 29.9% 1.3% -4.7% 24.2% 20.6% -14.6% 0.0%

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------

QE Index 27.0% -28.8% 1.1% 24.8% 1.1% -4.8% 24.2% 18.4% -15.1% 0.1%

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------

QIF Share

Price 15.5% -67.5% 97.3% 23.0% -2.3% 2.4% 26.4% 17.4% -17.0% -1.3%

----------- ------ ------- ------ ------ ------ ------ ------ ------ ------- ------

*Net of dividends paid

Source: Bloomberg, Qatar Insurance Company

Portfolio Structure

Top 10 Holdings

Company Name Sector % Share of

NAV

--------------------- ------------------- -----------

Qatar National Banks & Financial

Bank Services 18.7%

--------------------- ------------------- -----------

Industries Qatar Industrials 10.8%

--------------------- ------------------- -----------

Banks & Financial

Masraf Al Rayan Services 10.1%

--------------------- ------------------- -----------

Qatar Islamic Banks & Financial

Bank Services 6.9%

--------------------- ------------------- -----------

Qatar Electricity

& Water Co Industrials 6.3%

--------------------- ------------------- -----------

Ooredoo Telecoms 6.3%

--------------------- ------------------- -----------

Gulf International

Services Industrials 5.6%

--------------------- ------------------- -----------

Barwa Real Estate Real Estate 5.4%

--------------------- ------------------- -----------

Commercial Bank Banks & Financial

of Qatar Services 4.3%

--------------------- ------------------- -----------

Qatar Gas Transport Transportation 3.5%

--------------------- ------------------- -----------

The Investment Adviser increased the allocation to Barwa Real

Estate as valuations started to look attractive. As a result, Barwa

Real Estate replaced United Development Company in QIF's top 10

holdings. The Investment Adviser continues to reduce exposure to

Gulf International Services as weak oil prices hit earnings, making

valuations demanding. The holding in Ooredoo increased to 6.3% from

5.8% after the telecom company reported a hike in earnings.

Country Allocation

At 30 September 2016, QIF had 22 holdings: 17 in Qatar and 5 in

UAE (Q2 2016: 23 holdings: 19 in Qatar and 4 in UAE). The

Investment Adviser reduced exposure to UAE to 4.3% from 5.6%. Cash

was higher at 3.5% (Q2 2016: 0.7%).

QIF added two holdings during Q3: Dubai Islamic Bank and

Emirates National Bank of Dubai. QIF sold its holdings in Al Khalij

Commercial Bank, National Leasing Company and First Gulf Bank.

Sector Allocation

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the overall portfolio allocation by sector as at 30

September 2016.

QIF remains overweight in the Qatar banking sector (including

financial services) at 41.9% compared to a market weighting of

39.1%. Qatar National Bank remains QIF's largest holding (18.7% of

the fund). In the year to end of August Qatar credit grew 5.0%,

mainly driven by the public sector (up 9.2%). The Investment

Adviser believes that public sector loan growth will remain strong,

driven by the government's infrastructure development plans, rising

population and the international expansion of Qatari banks.

Industrials remain QIF's second largest exposure at 24.9% (Q2

2016: 26.8%) mainly in Industries Qatar (10.8% of NAV). We reduced

exposure to Gulf International Services to 5.6% from 6.2% in the

previous quarter, while exposure to Qatar Electricity and Water

reduced from 7.5% to 6.3%.

After re-entering the services and consumer goods sector in Q2,

QIF increased its exposure to 2.3% from 1.8%. Exposure to the

insurance sector also increased from 2.9% to 3.4%.

Regional Market

GCC markets posted mixed performances in Q3, with the Bloomberg

GCC index falling 3.3%, led by a sharp drop in Saudi markets.

Dubai, Bahrain and Kuwait were up 4.9%, 2.8% and 0.6%,

respectively, while the Abu Dhabi and Oman markets fell 0.5% and

0.9%, respectively. The Saudi market led the fall (down 13.5%),

amid concerns of a decline in the value of net foreign assets and

tightening of banking liquidity.

Qatar was the best performer in the GCC in Q3. QE rose 7.3% in

July and 3.6% in August, fueled by earnings momentum and

anticipation of the FTSE Russell Index upgrade to Secondary

Emerging Market, which raised hopes of passive investment flows

into the market. Qatar fell 5.0% in September, finishing at +5.6%

for the quarter. Insurance (+13.6%), banks and the financial

services (+7.8%) and telecoms (7.4%) led the quarterly

increase.

The Qatari market has been relatively resilient to low oil

prices compared to other GCC markets. From 30 June 2014 to 30

September 2016, when the price of a barrel of Brent oil fell 56.2%,

QE declined 9.2% and was the second best performer after Abu Dhabi

(down 1.6%).

The Investment Adviser expects the Qatari market to perform well

over the medium to long term, driven by strong macroeconomic

fundamentals, ongoing infrastructure spending, superior growth

prospects in the non-hydrocarbon sector and a rising population.

Furthermore, the Qatari government is committed to continuing its

infrastructure investment spending programme ahead of the 2022 FIFA

World Cup and in line with the Qatar National Vision 2030.

Inclusion of the Qatari market in the FTSE Russell Secondary

Emerging Market index should attract additional fund flows in the

near term.

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the performance of markets since end of June

2014.

22 Qatar listed entities included in FTSE Secondary Emerging

Index

Qatar has been upgraded to "Secondary Emerging Market" from its

earlier status of "Frontier" by FTSE Russell. Qatar's inclusion in

the index is to be made in two equal tranches - the first tranche

took place in September 2016 and the second will happen in March

2017. A total of 22 QE listed companies were added to the FTSE

Russell's secondary emerging market index in September.

The FTSE All-Emerging Index, which is a combination of secondary

and advanced emerging markets indices attracts around US$ 70

billion of investment. Qatar is expected to attract passive flows

of around US$ 1 billion following the upgrade.

OPEC reaches preliminary agreement to curb oil production

In its September meeting, OPEC reached a preliminary accord to

limit output to a range of 32.5-33.0 million barrels per day

(mbpd), a reduction of around 700,000 bpd from OPEC's current

estimated output of 33.24 mbpd. The production quota for each OPEC

member country will be decided at the next meeting in November,

when non OPEC countries may be invited to make cuts, like

Russia.

Analysts expect that Russia and Saudi Arabia will bear most of

the brunt of the proposed cuts, while Iran, Libya and Nigeria could

be allowed to produce at "maximum levels that make sense".

According to S&P Global Platts estimates, this production

cut would lift prices by US$12 in 2017, as US producers would not

be able to fill the void quickly, partly because some have too much

debt and not enough cash to finance new drilling.

Some doubt that these price supporting measures are sufficient

to ease the oil supply glut. Also, significant oil price upside

will be countered by higher prices bringing US shale players back

into business.

Qatar sees sign of easing liquidity

With oil-rich GCC countries struggling to balance their books

hit by prolonged low oil prices, local and external sovereign bond

issues are being used by governments as a tool to finance budget

deficits, including by attracting international investors.

Lingering worldwide uncertainty is expected to push fiscal and

current account deficits higher this year and in 2017. Although oil

prices have recovered to an extent, the rising pressure of

subsidies and entitlements have forced GCC governments to rely on

the issuance of debt.

By mid-2016, GCC states had issued bonds worth US$ 263 billion,

of which US$ 39 billion (15% of the total) were issued in H1 2016.

GCC government issuances made up 51% of total GCC bond issuances in

H1 2016. The relative size of the bond issuance highlights the

strong credit ratings of the GCC issuers.

Please refer to the IMS on the Company's website

www.qatarinvestmentfund.com/publications/quarterly-reports/ for a

chart depicting the GCC bond market.

Qatar's banking system, similar to its GCC peers, faced

liquidity concerns earlier this year. Reduced state revenues from

lower natural gas prices cut flows of new petrodollars into

Qatari's banking system, pushing money rates higher and resulting

in cancellation of several monthly sales of short-bills. The

central bank also reduced the size of its Treasury bill issuance in

order to improve liquidity.

In May 2016, Qatar sold US$ 9 billion of Eurobonds to increase

supply of funds in the Qatari banking system. This helped second

quarter performance as the cost of borrowing eased.

Qatar Central bank (QCB) successfully issued its first QAR 4.6

billion (US$ 1.26 billion) of domestic conventional and Islamic

government bonds in August, followed by a second issue of QAR 4.6

billion in September.

We therefore expect liquidity conditions to ease further,

pushing money rates lower. The Investment Adviser therefore

believes the near-to-medium outlook for the Qatari economy and of

the banking sector to remain strong.

Qatar: H1 2016 corporate profits up marginally, excluding

one-offs

Net profits of Qatari listed companies fell 10.2% during the

first six months of 2016 compared to the same period last year.

This drop was mainly attributed to a one-off gain of US$742.2

million (QAR 2.7 billion) reported in Q1 2015 by Barwa Real Estate.

Excluding this one-off 2015 gain, H1 2016 net profits would have

increased 1.0%.

Sector profitability (net profit/loss in US$000s)

Sectors H1 H1 % Change Q2 Q2 % Change

2015 2016 2015 2016

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Banking & Financial

Services 2,838,379 2,937,682 3.5% 1,459,860 1,537,789 5.3%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Insurance 226,665 208,613 -8.0% 100,922 89,279 -11.5%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Industrial 1,406,729 1,206,012 -14.3% 784,544 699,502 -10.8%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Services & Consumer

Goods 254,170 242,372 -4.6% 137,436 129,412 -5.8%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Real Estate 1,352,343 692,360 -48.8% 235,519 274,039 16.4%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Telecoms* 275,381 401,609 45.8% 137,699 160,225 16.4%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Transportation 337,591 317,119 -6.1% 165,237 141,759 -14.2%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

Total 6,691,257 6,005,767 -10.2% 3,021,216 3,032,005 0.4%

--------------------- ---------- ---------- --------- ---------- ---------- ---------

* Excluding Vodafone Qatar because of 31 March year end

Source: Qatar Exchange

Profits in the banking and financial services sector rose 3.5%

in H1 2016 compared with H1 2015. Growth was primarily driven by a

2.6% rise in sector income. During first six months of 2016,

lending was up 4.6%, primarily in the public sector (up 9.9%).

Qatar National Bank, the largest bank in Qatar, reported profit

growth of 11.8% during the period. Net profit of Islamic banks rose

9.3% during H1 2016, compared to a 1.3% rise in the profits of

conventional banks. The rise in the profits of conventional banks

was limited by a sharp fall in the profit of Commercial Bank of

Qatar (-51.2%). Qatar Islamic Bank, Masraf Al Rayan and Qatar

International Islamic Bank reported profit growth of 17.9%, 5.3%

and 1.1%, respectively.

Profits in the industrials sector declined 14.3% during H1. This

was primarily due to a 18.9% fall in profit of Industries Qatar and

a 73.5% decline in profit of Gulf International Services, caused by

the fall in petrochemical and oil prices. However, Mesaieed

Petrochemical Holding reported a 21.6% rise in profit in H1

2016.

Insurance sector profits fell 8.0%, with all companies reporting

reduced profits, except Qatar Insurance Company, which saw profit

growth of 4.3%.

Profits in the services & consumer goods sector dropped 4.6%

during H1 2016 compared to H1 2015. Sector heavyweight, Qatar Fuel

Company, recorded flat profits while Al Meera Consumer Goods and

Zad Holdings rose 1.5% and 3.6%, respectively.

Real estate sector profits declined sharply, mainly driven by a

significant drop from Barwa Real Estate (down 65.2%). The company

had reported a one-off profit on the sale of properties of US$742.2

million (QAR 2.70 billion) in H1 2015. As a result, the company

reported lower profit in H1 2016. Excluding this one-off gain, real

estate sector profits would have been up 13.5%.

The telecom sector comprises Vodafone Qatar and Ooredoo.

Vodafone Qatar is excluded since its fiscal year ends on 31 March.

Ooredoo, reported a 45.8% rise in profit in H1 2016, helped by

foreign exchange gains from its Indonesian and Myanmar

operations.

In the transportation sector, profits declined 6.1%, as Qatar

Navigation, the largest profit contributor, reported a drop of

15.1%. However, Gulf Warehousing Company and the Qatar Gas

Transport Company reported a rise of 15.5% and 2.1%,

respectively.

Recent Developments

International Credit rating agencies affirmed their ratings on

Qatar with Stable Outlook

Credit rating agencies Fitch and S&P are positive on Qatar.

Fitch Ratings affirmed Qatar's long-term foreign and local-currency

IDRs at 'AA'. It also affirmed an 'AA' rating on Qatar's senior

unsecured foreign currency bonds. S&P Global ratings affirmed

its 'AA' long-term and 'A-1+' short-term sovereign credit

ratings.

According to Fitch, 'AA' ratings reflect Qatar's large sovereign

assets, its fiscal adjustment efforts, large hydrocarbon endowment

and one of the world's highest GDP per capita ratio.

Projects worth over QAR 38 billion are underway

As a part of Ashghal's plan to develop the country's

expressways, projects amounting to more than QAR 38 billion are

progressing in Qatar. As part of its ambitious Expressway Project,

construction projects worth QAR 49.8 billion have been awarded by

Ashghal. As per the Annual report of Ashghal, currently 11

Expressway Projects are in different stages of construction and 10

projects are in the design phase.

Qatar to launch Barzan Gas Project in November 2016

Operations are due to start on Qatar's Barzan Gas Project, which

will boost the country's gas production by up to 2 billion cubic

feet per day once the full capacity is reached in 2017.

Qatar Stock Exchange commenced margin trading activity from

5(th) October 2016

In an effort to boost liquidity in the market and provide new

financing channels for investors, the Qatar Stock Exchange (QSE)

introduced margin trading from 5th October 2016. This facility is

applicable for 20 stocks.

Qatar tops GCC's banking sector growth

In Q2 2016, Qatari banks outperformed GCC peers and witnessed

the strongest growth in terms of total assets, net profits, net

interest income and non-net interest income.

Driven by robust performance of Qatar National Bank (led by its

acquisition of Finansbank) and loan book expansion of other banks,

the total assets of GCC banks expanded 8.4% YoY in Q2 2016. Qatari

banks witnessed the strongest growth in total assets (up 24% YoY),

followed by UAE and Saudi banks (up 7.6% and 2.2%,

respectively).

Profits of Qatari banks also increased most (up 3.5% YoY),

followed by Kuwait (up 2.1% YoY) and Saudi Arabia (up 1.8% YoY),

whereas UAE banks reported a fall in net earnings (down 3.3%

YoY).

2022 FIFA World Cup Projects to be delivered on time

A senior official from the Supreme Committee for Delivery and

Legacy has confirmed that all projects related to the Qatar 2022

FIFA World Cup will be delivered on time. Ali Ghanim al-Kuwari -

Executive Director, further stated that work on the Qatar 2022

projects is proceeding as planned and all the projects are in an

advanced stage of design and implementation. The first World Cup

stadium, Khalifa International, is expected to be delivered at the

beginning of 2017.

Qatar's insurance market to grow at a CAGR of 18.0% till

2020

In its annual report, Oxford Business Group estimated that

Qatar's insurance market will grow at a CAGR of 17.8% till 2020,

making it the fastest-growing insurance market in the GCC

region.

Qatargas signed an agreement to supply 1.3 mtpa of LNG to

Pakistan for 20 years

Qatargas, the world's largest producer of LNG, signed a 20 year

sale and purchase agreement with Global Energy Infrastructure

Limited (GEIL) to supply 1.3 mtpa of LNG to Pakistan, with

provision for the volume to increase to 2.3 mtpa.

Qatar named among the top 20 best performing economies in the

world

Qatar is ranked 2(nd) in the Gulf region and 18(th) globally in

the World Economic Forum's Global Competitiveness Index 2016-17.

Although it slipped from its top position in the GCC region, it

topped the region in efficiency in many areas such as macroeconomic

environment, financial market development, innovation, health and

primary education, and higher education and training.

Qatar's PM to ease work visa procedures in order boost private

sector

The Prime Minister of Qatar promised to develop the legislative

framework and simplify procedures in order to improve the ease of

doing business and investing in Qatar. The government will also

simplify the process of obtaining working visas.

Macroeconomic Update

According to the Ministry of Development Planning and Statistics

(MDPS), the Qatari economy continued to grow in Q1 2016, with GDP

rising 1.1% compared to Q1 2015. The non-hydrocarbon sector GDP

grew 5.5%, mainly driven by expansion in electricity, construction,

transportation, and financial services. The hydrocarbon sector GDP

shrank 3.0% due to lower oil prices.

Going forward, the Investment Adviser believes that Qatar's real

GDP growth will continue, driven by strong growth in the

non-hydrocarbon sector, as investment spending remains strong. Amid

lower oil prices, MDPS expects Qatar to remain the fastest growing

economy in the MENA region in 2016 and 2017, growing by 3.9% and

3.8%. Moreover, the Barzan gas project should help in raising

hydrocarbon output once it is fully operational in 2017.

Qatar's population grew 5.5% between December 2015 and September

2016, to reach 2.56 million. Population growth is expected to

remain strong in coming years, as large projects related to the

2022 FIFA World Cup continue to attract expatriates. A growing

population and a high level of personal consumption is expected to

continue to encourage domestic consumer and services sector

companies.

Valuations

Market Market PE (x) PB Dividend

Cap. (x) Yield (%)

----------- -------- -------------- ------ -----------

US$ Mn 2016E 2017E 2016E 2016E

----------- -------- ------ ------ ------ -----------

Qatar 130,439 13.2 12.0 1.6 3.9%

----------- -------- ------ ------ ------ -----------

Saudi

Arabia 343,525 11.6 10.6 1.3 4.3%

----------- -------- ------ ------ ------ -----------

Dubai 82,508 11.1 9.3 1.2 4.0%

----------- -------- ------ ------ ------ -----------

Abu Dhabi 120,294 11.7 11.2 1.4 5.6%

----------- -------- ------ ------ ------ -----------

Oman 16,756 8.8 8.4 1.1 5.1%

----------- -------- ------ ------ ------ -----------

Source: Bloomberg, Prices as of 02 October 2016

Outlook

The Investment Adviser believes that Qatar is well positioned

for continued growth as macroeconomic fundamentals remain strong.

Despite the fall in hydrocarbon revenues, the Qatari government is

committed to planned major infrastructural projects in line with

the Qatar National Vision 2030. Long term LNG contracts, Qatar's

fiscal buffers and sizeable assets should help it maintain its

position as one of the fastest growing economies in the GCC

region.

Ongoing high investment spending will continue to underpin

Qatar's non-hydrocarbon sector growth, coupled with output gains in

the hydrocarbon sector from the Barzan gas facility to be launched

in November.

Banking sector credit growth is likely to be attractive on the

back of higher consumer lending and project financing activities.

The Investment Adviser believes that for these reasons, the Qatari

economy and the Qatari stock market is likely to remain attractive

to investors.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBXBDGLGBBGLX

(END) Dow Jones Newswires

October 14, 2016 02:00 ET (06:00 GMT)

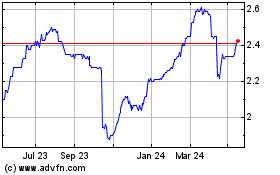

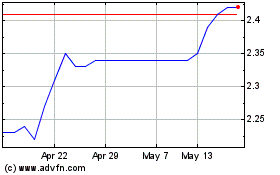

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Apr 2023 to Apr 2024