TIDMEUZ

RNS Number : 5116W

Europa Metals Ltd

19 August 2020

Not for distribution, in whole or in part, directly or

indirectly, to United States or Australian newswire services or

dissemination in, into or from the United States (including its

territories and possessions, any State of the United States and the

District of Columbia) or Australia or any jurisdiction where to do

so would constitute a violation of the relevant laws or regulations

of such jurisdiction

19 August 2020

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

Equity Fundraising of GBP2,000,000

Europa Metals, the European focused lead-zinc and silver

developer, is pleased to announce that it has raised GBP2,000,000

(before expenses) (the "Fundraising") via the issue of, in

aggregate, 15,686,274 new ordinary shares of no par value each in

the capital of the Company ("Ordinary Shares") (the "Fundraising

Shares") at an issue price of 12.75 pence per share (the "Issue

Price") to certain existing and new investors.

The Fundraising comprises a placing of 15,529,412 new Ordinary

Shares, arranged by Turner Pope Investments (TPI) Limited ("Turner

Pope"), the Company's broker, as agent of the Company, and a

subscription for a further 156,862 new Ordinary Shares by certain

Directors of the Company.

The Fundraising is conditional on admission of the Fundraising

Shares to trading on AIM ("Admission") and, following Admission,

the Fundraising Shares will represent, in aggregate, approximately

31.9 per cent. of the Company's enlarged issued share capital.

The Fundraising Shares will be issued fully paid and will rank

pari passu in all respects with the Company's existing Ordinary

Shares. The Issue Price represents a discount of approximately 22.7

per cent. to the closing mid-market price of an Ordinary Share on

AIM of 16.50 pence on 18 August 2020 , being the last business day

prior to the date of this announcement.

Use of Proceeds

The net proceeds from the Fundraising will primarily be utilised

towards completion of certain key components of a Pre-Feasibility

Study ("PFS") in respect of the Company's wholly owned Toral

lead-zinc-silver project located in the Castilla y León region,

northern Spain ("Toral" or the "Toral Project"), as well as for the

Company's general working capital requirements. The PFS workstreams

concerned will include:

-- Hydrogeological studies to ascertain sub surface water conditions;

-- Drilling targeting increases in the confidence level of the

overall mineable resource for Toral; and

-- Further metallurgical, geotechnical, waste management and environmental work components.

The Board of Europa Metals believes that completion of the above

PFS components will further demonstrate the viability of the Toral

Project by advancing the Company's understanding of metallurgy and

hydrogeological conditions, defining the parameters for waste

management and environmental considerations, as well as potentially

upgrading areas of the current resource into higher

categorisations.

As previously announced, the Company has commissioned ongoing

metallurgical work and ore sorting analysis in respect of Toral

(being carried out by Wardell Armstrong International and Bara

Consulting respectively) and will thereafter seek to obtain updated

preliminary economic parameters for the Toral Project from Bara

Consulting, taking into account the significant work completed and

data obtained since the 2018 Scoping Study. The Company is also

awaiting the renewal of its Investigation Permit for a further

three-year exploration term and is in the process of seeking to

secure certain EU/regional grant monies.

Directors' Participation

The Company is pleased to announce that both Laurence Read, CEO,

and Myles Campion, Executive Chairman, have participated in the

Fundraising by way of subscriptions for 78,431 new Ordinary Shares

and 78,431 new Ordinary Shares at the Issue Price respectively. On

Admission, the resultant shareholdings of Messrs Read and Campion

will be as follows:

Director No. of Ordinary Percentage interest

Shares held on Admission in the Company on Admission

Laurence Read 126,257 0.26%

-------------------------- -----------------------------

Myles Campion 248,793 0.51%

-------------------------- -----------------------------

Related Party Transactions

Pursuant to the abovementioned Fundraising, Deutsche Balaton

Aktiengesellschaft ("DBA") is investing GBP400,000, via the

placing, for 3,137,255 new Ordinary Shares. DBA has been a

substantial shareholder of the Company within the last 12 months

and, accordingly, is considered to be a related party under the AIM

Rules for Companies (the "AIM Rules"). The participation of DBA in

the Fundraising is therefore deemed to constitute a related party

transaction pursuant to Rule 13 of the AIM Rules. Accordingly, the

independent Directors of Europa Metals, being Daniel Smith and Evan

Kirby consider, having consulted with Strand Hanson Limited, the

Company's nominated adviser, that the terms of DBA's participation

in the Fundraising are fair and reasonable insofar as the Company's

shareholders are concerned.

Messrs Read and Campion are Directors of the Company and their

respective participations in the Fundraising are therefore also

considered to be related party transactions pursuant to Rule 13 of

the AIM Rules. Accordingly, the independent Directors, being Daniel

Smith and Evan Kirby, having consulted with the Company's nominated

adviser, Strand Hanson Limited, further consider the participation

of Messrs Read and Campion in the Fundraising to be fair and

reasonable insofar as the Company's shareholders are concerned.

Admission to trading

Application will be made to the London Stock Exchange for

admission of the Fundraising Shares to trading on AIM and to the

Johannesburg Stock Exchange for quotation on AltX. It is expected

that Admission will become effective and dealings in the

Fundraising Shares commence at 8.00 a.m. on or around 26 August

2020.

Following Admission, the total issued ordinary share capital of

the Company will comprise 49,130,649 Ordinary Shares with voting

rights. This figure may be used by shareholders in the Company as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change in

their interest in, the Company's share capital.

Commenting today, Myles Campion, Executive Chairman of Europa

Metals, said :

"With the completion of this significant Fundraising, Europa

Metals can see a clear pathway to completing major items that will

form part of a PFS. The net proceeds will enable us to continue the

efficient work that our team has been carrying out at Toral and

increase our level of activity at site to move the project forward

in respect of the key workstreams outlined."

Laurence Read, CEO of Europa Metals, further commented :

"The Toral project has been continually advanced by Europa

Metals and last week we reported a resource update estimating a

3.8Mt Indicated resource at 8.3% Zn Equivalent (including Pb

credits) and 17Mt total resource at 6.9% Zn Equivalent (including

Pb credits), at a 4% cut-off. With a total resource containing

720,000 tonnes of zinc, 510,000 tonnes of lead and 14 million

ounces of silver and testwork recoveries of 83.7% lead recovery to

a 60% concentrate , 77% zinc recovery to a 59.1% concentrate and

87.1% silver recovery to 1,350ppm Ag within lead concentrate, we

have taken the decision to raise funds to complete certain key

components of a PFS.

"The Fundraising has been successfully completed by Turner Pope

following, inter alia, the Company's recent share consolidation and

a series of operational updates pertaining to, amongst other

things, a new resource estimate, and appointment of a marketing and

sales agency to progress the potential future concentrate sales

strategy for Toral.

"The Fundraising will enable the Company to undertake key work

items necessary for the eventual completion of a full PFS including

advancing the resource categorisation of the block model. I look

forward to announcing further updates shortly from work already in

progress including metallurgical and ore sorting analysis and

thereafter new preliminary economics for the Toral Project,

updating the parameters in the 2018 Scoping Study to reflect the

significant work completed since its publication.

"We continue to endeavour to advance Toral as a realisable,

robust future source of lead, zinc and silver with excellent

recoveries and grade, situated within a proven mining region of the

EU with well established road, rail and power infrastructure."

For further information on the Company, please visit www.europametals.com or contact:

Europa Metals Ltd

Laurence Read, CEO (UK)

T: +44 (0)20 3289 9923

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Strand Hanson Limited (Nominated Adviser)

Rory Murphy / Matthew Chandler

T: +44 (0)20 7409 3494

Turner Pope Investments (TPI) Limited ( Broker)

Andy Thacker

T: +44 (0)20 3657 0050

Sasfin Capital Proprietary Limited (a member of the Sasfin

group)

Sharon Owens

T (direct): +27 11 809 7762

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR").

This announcement is not intended to, and does not, constitute

or form part of any offer or invitation, or the solicitation of an

offer, to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities in the United States of

America or Australia or any jurisdiction in contravention of

applicable law. The Company's securities have not been and will not

be registered under the United States Securities Act of 1933 (the

"1933 Act") or under the securities laws of any State or other

jurisdiction of the United States and may not be offered, sold,

re-sold, delivered, distributed or otherwise transferred, directly

or indirectly, in or into, the United States or to U.S. Persons (as

defined in the 1933 Act) unless registered under the 1933 Act and

applicable state securities laws, or an exemption from such

registration is available.

PDMR Notification Forms

The notifications below are made in accordance with the

requirements of MAR.

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Myles Campion

-------------------------------- --------------------------------

2. Reason for the Notification

------------------------------------------------------------------

a) Position/status Executive Chairman

-------------------------------- --------------------------------

b) Initial notification/amendment Initial notification

-------------------------------- --------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Europa Metals Ltd

-------------------------------- --------------------------------

b) LEI 2138008QU5PGK777XM59

-------------------------------- --------------------------------

4. Details of the transaction(s):section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description of the Financial Ordinary Shares of no par value

instrument, type of instrument

-------------------------------- --------------------------------

Identification code AU0000090060

-------------------------------- --------------------------------

b) Nature of the Transaction Participation in fundraising

-------------------------------- --------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

12.75 pence per

share 78,431

----------

-------------------------------- --------------------------------

d) Aggregated information N/A

Aggregated volume price

-------------------------------- --------------------------------

e) Date of the transaction 19 August 2020

-------------------------------- --------------------------------

f) Place of the transaction AIM (LSE)

-------------------------------- --------------------------------

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Laurence Read

-------------------------------- --------------------------------

2. Reason for the Notification

------------------------------------------------------------------

a) Position/status CEO

-------------------------------- --------------------------------

b) Initial notification/amendment Initial notification

-------------------------------- --------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Europa Metals Ltd

-------------------------------- --------------------------------

b) LEI 2138008QU5PGK777XM59

-------------------------------- --------------------------------

4. Details of the transaction(s):section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description of the Financial Ordinary Shares of no par value

instrument, type of instrument

-------------------------------- --------------------------------

Identification code AU0000090060

-------------------------------- --------------------------------

b) Nature of the Transaction Participation in fundraising

-------------------------------- --------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

12.75 pence per

share 78,431

----------

-------------------------------- --------------------------------

d) Aggregated information N/A

Aggregated volume price

-------------------------------- --------------------------------

e) Date of the transaction 19 August 2020

-------------------------------- --------------------------------

f) Place of the transaction AIM (LSE)

-------------------------------- --------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEEAEPPFDAEEAA

(END) Dow Jones Newswires

August 19, 2020 02:00 ET (06:00 GMT)

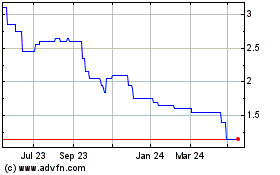

Europa Metals (LSE:EUZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

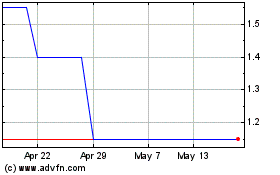

Europa Metals (LSE:EUZ)

Historical Stock Chart

From Apr 2023 to Apr 2024