TIDMAXM

RNS Number : 8604J

Alexander Mining PLC

10 April 2015

10 April 2015

Alexander Mining plc

Audited Results for the Year Ended 31 December 2014

Alexander Mining plc ("Alexander" or the "Company"), the

AIM-listed mining and mineral processing technologies company,

announces its audited results for the year ended 31 December

2014.

Highlights:

-- Further advancement of our proprietary leaching technologies

-- Continued interest from mining companies in leaching technologies

-- Continued success in registration of patents

Chairman's Statement

After an encouraging start, the Company's progress during 2014

was not as rapid as we envisaged. Although significant technical

achievements were made, our commercialisation efforts, due to third

party business circumstances and related decisions beyond our

control, were frustrated.

However, after an indifferent year, I am delighted with the

results of the management team's efforts late in the reporting year

which enabled the release of the most recent news announced in

February 2015 regarding the potentially transformative

commercialisation opportunity with Compass Resources Limited

('Compass'). Subject to the execution of a definitive agreement,

which is currently under negotiation, this will provide for the

granting of an AmmLeach(R) licence and certain technical and

management services for use at Compass' Browns Oxide copper-cobalt

mine. This agreement would bring significant revenue to Alexander

by way of upfront and ongoing services fees, plus a future

production royalty.

Technical work

There was notable research and technical development success,

which underwrites our commercialisation programme. This included

the major development announced in April 2014 of the breakthrough

testwork to produce the world's first zinc cathode using our

AmmLeach(R) technology. That work used conventional leaching,

solvent extraction and electro-winning equipment in the test

facility available for hire at Simulus Engineers ('Simulus'),

Perth, Western Australia. Importantly, supporting one of the most

attractive benefits of the AmmLeach(R) technology, i.e.

significantly lower capital and operating costs, and operating

conditions at ambient temperature and pressure. This represents the

first successful demonstration of AmmLeach(R) technology for zinc

at this scale and the first solvent extraction of zinc from primary

oxide ores using ammoniacal leaching.

We believe that this confirmed our AmmLeach(R) process as the

only economically viable method to unlock the value of hitherto

problematic zinc oxide deposits. The Company has built up an

extensive database of all of the world's major zinc oxide deposits

and has now conducted favourable AmmLeach(R) amenability testwork

on samples from a significant number. The Republic of Turkey is a

particular country of interest.

Zinc oxide deposits are highly attractive in terms of their

tendency to have high average zinc grades both absolutely and

relatively when compared with world averages for sulphide ores. In

addition, the fact that most of the known deposits are at or near

surface generally makes for easier mining. However, the inherent

processing challenges have meant that almost all remain unexploited

except those with grades high enough to justify direct shipment

(+20-25% zinc) to smelters. Those deposits found in the Tethyan

orogenic belt of Turkey are especially prospective.

Commercialisation activities

The results of our commercialisation efforts during the year

were disappointing. In particular, this was due to the unravelling

of the commercial licence, financing and consultancy agreement

('Agreement') announced in February with the Company's large

shareholder the Ebullio Group ('Ebullio'). This was not due to any

technology considerations but with Ebullio's commercial decision to

terminate its agreement to acquire all of the assets in Turkey of

Red Crescent Resources Limited. As this was a condition precedent

the Agreement was terminated. Nevertheless, we continue to have a

close relationship with Ebullio and to support its interest in

developing mining opportunities in Turkey.

In July, the Company announced that Phoenix Global Mining

('PGM') had confirmed its interest in investigating the use of

AmmLeach(R) for highly prospective zinc oxide properties in Turkey.

At that time PGM had an earn-in Agreement with a Turkish industrial

group, to develop their base metals exploration and mining

licences. PGM subsequently decided to drop this opportunity for

commercial reasons.

Alexander announced in September that it had signed an option

agreement ('Option Agreement') with a mid-tier mining company (the

'Entity'). The Entity was a highly regarded mid-tier,

multi-commodity mining company with exploration, development and

operational experience. Under the Option Agreement, the Entity had

been granted an exclusive three months' option period to complete

due diligence on the AmmLeach(R) zinc processing technology. This

was in exchange for the cash payment to Alexander of US$360,000.

(GBP217,000). Exercise of the option would have resulted in further

cash payments in exchange for Alexander equity, as well as a

licence with a gross sales revenue royalty on all metals production

by the Entity using the AmmLeach(R) technology.

Although a highly detailed and favourable technical due

diligence was conducted, unfortunately the Entity had a change in

its corporate plans due to a need to focus more on its domestic

growth strategy. Accordingly, in December the Entity informed the

Company that it would not exercise its option. It advised that its

due diligence on the use of the AmmLeach(R) process for zinc

production was favourable and it had formed the view that there is

value in the technology. It also said that it remained interested

in continuing to build its relationship with Alexander.

Intellectual property

The results of the programme, in conjunction with Wrays, the

Company's patent attorney, to protect our leaching technology

intellectual property ('IP'), measured by patents granted by method

and country have been excellent. This includes patents granted in

Mexico, Canada, Mongolia, Botswana, Mozambique, Namibia, Tanzania

and Zambia

Developments in 2015

In late February 2015, the Company was delighted to announce

that it had signed a non-binding Heads of Agreement ('HoA') with

Compass, a listed Australian public company (ASX:CMR), for

executing a definitive agreement ('Agreement') covering an

AmmLeach(R) licence and certain technical management services for

Compass in the Northern Territory, Australia. These arrangements

should significantly accelerate the first commercial adoption of

Alexander's proprietary AmmLeach(R) technology with particular

relevance to copper/cobalt resources.

We greatly look forward to working closely together with Compass

under this transformative agreement. Assuming the completion of a

positive AmmLeach(R) feasibility study and production go-ahead, the

mine would partner our AmmLeach(R) technology with existing high

quality mining assets.

The plan is to generate significant economic value from the

Browns Oxide mine and the first step is the completion of an

AmmLeach(R) feasibility study, with a pilot plant programme funded

by Compass. This pilot plant programme would be carried out at the

independent commercial facilities of Simulus, under the supervision

of Alexander's technical personnel. This would lead to the

completion of a feasibility study into commercial production and is

dependent upon statutory approval and obtaining all necessary

permits required to recommence production.

Compass is currently working to complete a financing facility

with sophisticated institutional investors as the first stage in a

proposed major refinancing and relisting of the company. The

proceeds of their financing will be used for various purposes,

including payments due under the Agreement to Alexander and for the

third party AmmLeach(R) pilot plant and feasibility study costs.

Moreover, Australia is one of the world's leading mining countries

and together with Alexander's metallurgical team based in Perth,

Western Australia, it provides an exemplary project to work on

together with Compass.

Compass and Alexander believe that market conditions are the

most favourable for several years for growth by attractively priced

corporate acquisitions. Accordingly, the companies expect to form a

strategic alliance in Australia to investigate the acquisition by

Compass of copper resources which can be exploited using the

proprietary Leaching Technologies of Alexander. This will be on

terms to be agreed in respect of each such project.

Financial

The Company has maintained its very tight rein on costs whilst

ensuring the protection of its intellectual property through patent

applications. In January 2015, the Company raised GBP360,000

(gross) through the issue of 72,000,000 new ordinary shares to

institutional and other investors. The net proceeds of the Placing

were for general working capital purposes. In conjunction with the

expected revenue from the agreement with Compass, this should

ensure adequate funding for the next twelve months on the current

budget.

Outlook

In these uncertain economic times, especially for the mining

business,

I believe that Alexander is better placed than most in the

junior sector. Although global economic recovery is volatile and

commodity prices have fallen significantly of late, the Company

will continue to work hard to succeed with the commercialisation of

its technology. Indeed the weakness in most base metals prices

during the last year and the deleterious impact on operating

margins has led to an imperative for companies to cut costs

wherever possible. In this environment, we believe that the scope

for major operating and capital cost savings for existing and

potential mines using our technology should be of ever greater

interest. Particularly as the opportunity offered has significant

environmental benefits.

The exciting opportunity with Compass offers Alexander a most

encouraging start to 2015 and I look forward with considerable

optimism.

As always, I would like to thank the Company's shareholders for

their support and also our employees, consultants and directors for

their highly-valued effort during the last year.

Matt Sutcliffe

Executive Chairman

10 April 2015

Enquiries

Alexander Mining plc

Martin Rosser Matt Sutcliffe

Chief Executive Officer Executive Chairman

Mobile: +44 (0) 7770 865 Mobile: +44 (0) 7887 930

341 758

Email: mail@alexandermining.com

Website: www.alexandermining.com

Northland Capital Partners

Limited

Nominated Adviser and

Broker

Tel: +44 (0) 20 7382 1100

Matthew Johnson / Gerry

Beaney

(Corporate Finance)

John Howes / Mark Treharne

(Corporate Broking)

Consolidated income statement for the year ended 31 December

2014

2014 2013

GBP'000 GBP'000

------------------------------------------ --- --------- ----------

Continuing operations

Revenue 507 26

Cost of sales - -

------------------------------------------ --- --------- ----------

Gross profit 507 26

Administrative expenses (989) (1,010)

Research and development

expenses (367) (390)

Profit on disposal of property,

plant and equipment - 4

Operating loss (849) (1,370)

Finance income 1 5

Loss before taxation (848) (1,365)

Income tax expense - -

------------------------------------------ --- --------- ----------

Loss for the year from continuing

operations (848) (1,365)

Loss for the year from discontinued

operations (62) -

------------------------------------------- --------- --------

Loss for the year (910) (1,365)

Basic and diluted loss per

share (pence):

from continuing operations (0.48)p (0.84)p

from continuing and discontinued

operations (0.52)p (0.84)p

from discontinued operations (0.04)p -

All components of profit or loss for the year

are attributable to equity holders of the parent.

Consolidated statement of comprehensive income for the year

ended 31 December 2014

2014 2013

GBP'000 GBP'000

------------------------------------- -------- --------

Loss for the year (910) (1,365)

Other comprehensive income:

Items that will or may be

reclassified to profit or

loss:

Exchange differences on translating

foreign operations - (1)

Exchange differences realised

on disposal of subsidiary 61 -

Total comprehensive loss

for the year attributable

to equity holders of the

parent (849) (1,366)

-------------------------------------- -------- --------

Consolidated balance sheet as at 31 December 2014

2014 2013

GBP'000 GBP'000

------------------------------- --------- ---------

Assets

Property, plant and equipment - -

Total non-current assets - -

------------------------------- --------- ---------

Trade and other receivables 67 60

Cash and cash equivalents 116 398

-------------------------------- --------- ---------

Total current assets 183 458

-------------------------------- --------- ---------

Total assets 183 458

-------------------------------- --------- ---------

Equity attributable to owners

of the parent

Issued share capital 13,639 13,633

Share premium 13,298 13,020

Translation reserve - (61)

Accumulated losses (27,211) (26,423)

-------------------------------- --------- ---------

Total equity (274) 169

-------------------------------- --------- ---------

Liabilities

Current liabilities

Trade and other payables 439 289

Provisions 18 -

------------------------------- --------- ---------

Total current liabilities 457 289

-------------------------------- --------- ---------

Total liabilities 457 289

-------------------------------- --------- ---------

Total equity and liabilities 183 458

-------------------------------- --------- ---------

Consolidated statement of cash flows for the year ended 31

December 2014

2014 2013

GBP'000 GBP'000

---------------------------------- -------- --------

Cash flows from operating

activities

Operating loss - continuing

operations (849) (1,370)

Operating loss - discontinued

operations (1) -

Depreciation and amortisation

charge - 8

Decrease / (Increase) in

trade and other receivables (7) 7

Increase in trade and other

payables 150 95

Increase in provisions 18 -

Shares issued in payment

of expenses 52 69

Share option charge 21 21

Profit on disposal of property,

plant and equipment - (4)

Inter-company recharges - -

---------------------------------- -------- --------

Net cash outflow from operating

activities (616) (1,174)

----------------------------------- -------- --------

Cash flows from investing

activities

Amounts remitted to subsidiary

companies - -

Interest received 1 1

Proceeds from sale of subsidiary - 101

Proceeds from sale of property,

plant and equipment - 12

----------------------------------- -------- --------

Net cash inflow/(outflow)

from investing activities 1 114

----------------------------------- -------- --------

Cash flows from financing

activities

Proceeds from the issue

of share capital 232 935

Proceeds from lapsed share

issue, net of costs 62 -

Proceeds from issue of

share options 39 -

---------------------------------- -------- --------

Net cash inflow from financing

activities 333 935

----------------------------------- -------- --------

Net decrease in cash and

cash equivalents (282) (125)

Cash and cash equivalents

at beginning of year 398 519

Exchange differences - 4

----------------------------------- -------- --------

Cash and cash equivalents

at end of year 116 398

----------------------------------- -------- --------

Consolidated statement of changes in equity for the year ended

31 December 2014

Share Share Shares Translation Accumulated Total

capital premium to be reserve losses equity

issued

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2013 13,606 12,043 - (60) (25,079) 510

-------------------------- --------- --------- -------- ------------ ------------ --------

Accumulated loss

for year - - - - (1,365) (1,365)

Translation difference - - - (1) - (1)

-------------------------- --------- --------- -------- ------------ ------------ --------

Total comprehensive

loss for the

year attributable

to equity holders

of the parent - - - (1) (1,365) (1,366)

-------------------------- --------- --------- -------- ------------ ------------ --------

Share option

costs - - - - 21 21

Shares issued 27 977 - - - 1,004

-------------------------- --------- --------- -------- ------------ ------------ --------

At 31 December

2013 13,633 13,020 - (61) (26,423) 169

-------------------------- --------- --------- -------- ------------ ------------ --------

Accumulated loss

for year - - - - (910) (910)

Realisation of

foreign exchange

losses upon sale

of subsidiary - - - 61 - 61

-------------------------- --------- --------- -------- ------------ ------------ --------

Total comprehensive

loss for the

year attributable

to equity holders

of the parent - - - 61 (910) (849)

-------------------------- --------- --------- -------- ------------ ------------ --------

Share option

costs - - - - 21 21

Share issue subscription - - 100 - - 100

Costs of share

issue subscription - - (38) - - (38)

Share issue lapsed - - (62) - 62 -

Share option

issued - - - - 39 39

Shares issued 6 278 - - - 284

-------------------------- --------- --------- -------- ------------ ------------ --------

At 31 December

2014 13,639 13,298 - - (27,211) (274)

-------------------------- --------- --------- -------- ------------ ------------ --------

Notes

1. Financial statements

The financial information set out in this announcement does not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006 for the year ended 31 December 2014 or for

the year ended 31 December 2013, but is derived from those

accounts. The financial statements for 2014 will be delivered to

the Registrar of Companies following the Company's Annual General

Meeting. The auditors have issued an unqualified report on these

accounts. The auditor has issued an unqualified opinion in respect

of the financial statements which does not contain any statements

under the Companies Act 2006, Section 498(2) or Section 498(3). The

auditor has raised an Emphasis of Matter in relation to going

concern and the availability of project finance as follows:

"In forming our opinion, which is not modified, we have

considered the adequacy of the disclosures made in note 2(a) to the

financial statements concerning near-term corporate developments

and the possibility that the company may need to raise further

finance within the next twelve months in order to continue its

operations and to meet its commitments. If the company is unable to

secure such additional funding, this may have a consequential

impact on the company's and the group's ability to continue as a

going concern.

The outcome of any corporate developments or fundraising cannot

presently be determined. These conditions, along with the other

matters explained in note 2(a) to the financial statements,

indicate the existence of a material uncertainty which may cast

significant doubt about the Company's and the Groups' ability to

continue as a going concern. The financial statements do not

include the adjustments that would result if the Company was unable

to continue as a going concern."

2. Summary of significant accounting policies

a) Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRSs") in force at

the reporting date and their interpretations issued by the

International Accounting Standards Board ("IASB") as adopted for

use within the European Union.

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) made up to 31 December each year.

Going Concern

Based on a review of the Group's budgets and cash flow

forecasts, the directors have identified that if current and

near-term corporate development opportunities are unsuccessful in

providing adequate funding then the Company will need to raise

finance within the next twelve months in order to continue its

operations and to meet its commitments.

In common with many mining, exploration and intellectual

property development companies, the Company needs to raise finance

for its activities in discrete tranches to finance its activities

for limited periods. The Directors are confident that the Company

currently has a range of corporate development opportunities, which

could include significant funding outcomes and moreover that, if

necessary, any further funding can be raised as and when required.

(Accordingly, attention is drawn to Note 4, Post Balance Sheet

events, where details of potential significant business development

funding opportunities are provided). On this basis, the Directors

have concluded that it is appropriate to draw up the financial

statements on the going concern basis. However, there can be no

certainty that either development opportunities or alternative

funding will be secured in the necessary timescales. This indicates

the existence of a material uncertainty that may cast significant

doubt on the ability of the company and the group to continue as a

going concern and therefore, that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business. The financial statements do not include the adjustments

that would result if the Company and Group were unable to continue

as a going concern.

b) Research and development expenditure

Research costs are recognised in the income statement as an

expense as incurred. Development costs are recognised in the income

statement as an expense as incurred unless the development project

meets specific criteria for deferral and amortisation. No

development costs have been deferred to date because there is

insufficient information at the balance sheet date to quantify the

expected future economic benefits from the proprietary leaching

technologies.

3. Dividends

The directors do not recommend the payment of a dividend (2013:

nil).

4. Post balance sheet events

On 13 January 2015, the Company issued 72,000,000 new shares of

0.1p each for cash at 0.5p each to raise GBP360,000 (gross). In

connection with that placing, the Company issued 3,600,000

warrants, valid for two years, to subscribe for ordinary shares at

0.5p per share

On 13 January 2015 the Company also issued 1,090,909 new shares

of 0.1p each, at a price of 0.825p per share, in lieu of GBP9,000

in fees due to the Company's nominated advisor and 1,500,000 new

shares of 0.1p each at a price of 0.80p per share in lieu of

GBP12,000 in fees due to a consultant for investor relations and

advisory services.

On 22 January 2015, the Company issued 5,000,000 new shares of

0.1p each, at a price of 0.6p per share, to Cove House Investments

Limited, in respect of consultancy and advisory services.

Following admission of the above shares, the Company has a total

of 255,910,288 ordinary shares in issue.

On 23 February 2015 the Company announced a non-binding Heads of

Agreement ("HoA") signed with Compass Resources Limited ("Compass")

a listed Australian public company, for an AmmLeach(R) licence and

certain technical and management services relating to a feasibility

study planned for the use of AmmLeach(R) at Compass's treatment

plant and mine in Australia for copper, cobalt and nickel

production.

Compass and Alexander are currently working to finalise the

definitive agreement ('Agreement'), conditional on completion of

Compass' proposed financing. The key commercial terms agreed in the

HoA are:

On completion of the definitive agreement, the Company will

grant to Compass a licence to use Alexander's leaching technologies

(AmmLeach(R)). The principal terms of the licence and technical

consultancy and management services will include:

I. Cash payments by Compass totalling A$1,100,000 to Alexander

on commencement of the Agreement;

II. Compass will also pay to Alexander:

a. A$400,000 three months after the initial fee payment; and

b. A$425,000 upon delivery of the feasibility study;

III. A$550,000 during the construction and commissioning stage,

dependent on a construction go-ahead decision; and

IV. A royalty of 2.6077% on saleable metal production after capped third party royalties.

Conditional upon the Agreement being executed, and subject to

Alexander shareholders' approval at the 2015 AGM, the Company will

grant to Compass the following share options:

I. options over 5 million ordinary shares of 0.1p each at an

exercise price of 7.5p per share for 18 months from issue; and

II. options over 5 million ordinary shares of 0.1p each at an

exercise price of 10.0p per share for 24 months from issue.

Annual Report

The Annual Report will be posted to all shareholders by 17 April

2015 and will be available on the Company's website at

www.alexandermining.com. Additional copies will be made available

to the public, free of charge, from the Company's registered office

at 35 Piccadilly, London W1J 0DW.

Annual General Meeting

The Company's Annual General Meeting will be held at the East

India Club, 16 St James's Square, London, SW1Y 4LH at 10:30am on

Wednesday 13 May 2015. The Notice of the AGM and the associated

explanatory notes relating to the resolutions to be proposed at

that meeting will accompany the Company's annual report.

Disclaimers and forward looking statements

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This news release contains forward looking or future-oriented

financial information, being information which is not historical

fact, including, without limitation, statements regarding potential

results of metallurgical testwork, anticipated applications for the

Company's intellectual property and discussions of future plans and

objectives. Although the Company believes that the expectations

reflected by such information are reasonable, these statements are

based on assumptions and factors concerning future events that may

prove to be inaccurate. Such statements are necessarily based upon

a number of estimates and assumptions based on information

available to the Company about itself and the business in which it

operates. Information used in developing forward-looking

information has been acquired from various sources including third

party consultants, suppliers, regulators and other sources and is

subject to numerous risks and uncertainties that could cause actual

results and future events to differ materially from those

anticipated or projected. Important factors that could cause actual

results to differ materially from the Company's expectations are

the continuing availability of capital resources to fund the

commercialisation of Alexander's technologies; continued positive

results from trials and applications of Alexander's AmmLeach(R) and

HyperLeach(R) technologies and other factors as disclosed in

Company documents filed from time to time. Management uses

forward-looking statements because it believes they provide useful

information to the shareholders with respect to proposed

transactions involving Alexander, and cautions readers that the

information may not be appropriate for other purposes and should

not be read as guarantees of future performance or results.

The Company disclaims any intention or obligation to revise or

update such statements unless required by law.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFDSUSFISESL

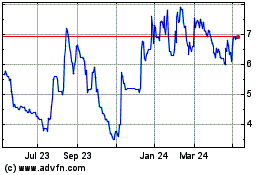

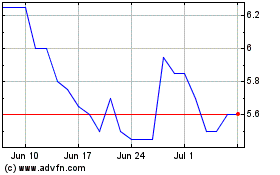

Eenergy (LSE:EAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eenergy (LSE:EAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024