TIDMCFX

RNS Number : 1254D

Colefax Group PLC

29 January 2018

AIM: CFX

29 January 2018

COLEFAX GROUP PLC

("Colefax" or the "Group")

Half Year Results

for the six months ended 31 October 2017

Colefax is an international designer and distributor of

furnishing fabrics & wallpapers and owns a leading interior

decorating business. The Group trades under five brand names,

serving different segments of the soft furnishings marketplace;

these are Colefax and Fowler, Cowtan & Tout, Jane Churchill,

Manuel Canovas and Larsen.

Highlights

-- Group sales up 6.5% to GBP42.08m (2016: GBP39.53m); up by 5.1%

on a constant currency basis

-- Group pre-tax profit up 35% to GBP2.56m (2016: GBP1.90m)

-- improving conditions in core US market

-- better performance from Decorating Division

-- Earnings per share increased by 44% to 18.0p (2015: 12.5p)

-- Net cash increased to GBP9.5m (2016: GBP8.0m)

-- Interim dividend up by 4% to 2.40p per share (2016: 2.30p)

-- Core Fabric Division sales up 4.6% to GBP36.47m

-- up by 3.1% on constant currency basis, reflecting improved

trading in the US

-- Decorating Division performing well in new premises with first

half profits up by GBP297,000 and a strong order book for the

second half of the year

David Green, Chairman, said:

"The Group has made good progress over the last six months

helped by improving trading conditions in our core US market and an

encouraging performance by our Decorating Division. With a strong

order book for the second half, we now expect the Decorating

Division to exceed our original expectations for the full year.

"The Group has a strong balance sheet with cash of GBP9.5

million and we will continue to invest with confidence in our

portfolio of brands and worldwide distribution network."

Enquiries:

Colefax Group plc David Green, Chief Tel: 020 7318 6021

Executive

Rob Barker, Finance

Director

KTZ Communications Katie Tzouliadis, Emma Tel: 020 3178 6378

Pearson, Irene Bermont-Penn

Peel Hunt LLP Adrian Trimmings, George Tel: 020 7418 8900

Sellar

The information contained in this announcement is inside

information for the purposes of article 7 of Regulation

596/2014.

CHAIRMAN'S STATEMENT

Financial Results

Group sales for the six months to 31 October 2017 increased by

6.5% to GBP42.08 million (2016: GBP39.53 million) and increased by

5.1% on a constant currency basis. Pre-tax profits increased by 35%

to GBP2.56 million (2016: GBP1.90 million). Earnings per share

increased to 18.0p (2016: 12.5p). The Group ended the first half of

the year with net cash of GBP9.5 million (2016: GBP8.0

million).

The main reason for the increase in profits in the first six

months was an improvement in trading conditions in our core US

market where Fabric Division sales increased by 4.5.% on a constant

currency basis. In contrast trading conditions in the UK and Europe

remained challenging. Sales in the UK were flat during the period

and sales in Europe increased by 6.5% but by 1.5% on a constant

currency basis. The increase in profit was also due to an improved

contribution from the Decorating Division which made a first half

profit of GBP213,000 compared to a loss of GBP84,000 last year.

Hedging losses arising from US Dollar cover put in place prior

to the Brexit vote were GBP595,000 (2016 GBP755,000) and, excluding

these, the Group's pre-tax profit increased by 18.5% to GBP3.15

million (2016: GBP2.66 million).

In line with our progressive dividend policy the Board has

decided to increase the interim dividend by 4% to 2.40p per share

(2016: 2.30p). The interim dividend will be paid on 9 April 2018 to

shareholders on the register at the close of business on 2 March

2018.

Product Division

-- Fabric Division - Portfolio of Five Brands: "Colefax and

Fowler", "Cowtan and Tout", "Jane Churchill", "Manuel Canovas" and

"Larsen".

Sales in the Fabric Division, which represent 87% of the Group's

sales, increased by 4.6% to GBP36.47 million (2016: GBP34.87

million) and by 3.1% on a constant currency basis. Excluding

hedging losses of GBP595,000 (2016: GBP755,000) operating profits

increased by 7% to GBP2.92 million (2016: GBP2.73 million)

reflecting improved trading conditions in our core US market.

Sales in the US, which represent 60% of the Fabric Division's

turnover, increased by 5.4% in reported terms and by 4.5% on a

constant currency basis. The improvement was broadly based with

sales in most territories ahead of last year, reflecting favourable

market conditions. In recent years we have invested heavily in our

US distribution network and our own showrooms now account for over

75% of US sales.

Sales in the UK, which represent just under 18% of the Fabric

Division's turnover, were flat during the period reflecting

challenging market conditions. We attribute this to the very weak

high end housing market which continues to be adversely affected by

high rates of stamp duty as well as economic uncertainty over the

outcome of Brexit negotiations. Our business tends to lag changes

in the high end housing market and as a result we believe market

conditions could become more difficult over the next twelve

months.

Sales in Continental Europe, which represent 20% of the Fabric

Division's turnover, increased by 6.5% on a reported basis but were

up by 1.5% on a constant currency basis. There is more optimism in

Europe than we have seen for some years although the performance by

country remains mixed. Sales in France, which is our largest

market, were down by 9% in the period but this was mainly due to a

significant contract order in the prior year. In Germany, sales

increased by 1% on a constant currency basis and, in Italy, sales

increased by 3%. Together these three markets account for 56% of

our sales in Europe.

Sales in the rest of the world, which represent less than 3% of

the Fabric Division's turnover, increased by 7% on a constant

currency basis. The focus of our sales efforts in the rest of the

world remain on our major territories, namely the Middle East,

China and Russia. .

-- Furniture - Kingcome Sofas

Sales for the six months to October 2017 increased by 4% to

GBP1.19 million (2016: GBP1.15 million) and the Company made a

small operating profit of GBP22,000 compared to GBP9,000 in 2016.

At the half year end the order book was up by 18% compared to last

year and ahead of our expectations based on market conditions. The

majority of furniture sales are in the UK, centred on London and we

expect future trading to be challenging due to the slowdown in the

high end housing market.

Interior Decorating Division

Decorating sales, which account for just over 10% of Group

turnover, increased by 26% in the period to GBP4.4 million (2016:

GBP3.5 million) and the Division made a first half profit of

GBP213,000 compared to a loss of GBP84,000 for the same period last

year.

In December 2016 the Decorating business moved to new office and

showroom premises at 89-91 Pimlico Road in Belgravia. The new

location is well suited to the needs of the business and trading

has been encouraging since the move. Sales and profits in the

Decorating Division can vary significantly from year to year

depending on the timing of contract completions. We have a number

of major projects scheduled for completion in the second half of

the year and therefore anticipate a stronger than expected overall

performance for the year. Although the high end market in London

has been challenging the weakness of Sterling is favourable for the

business and we have seen an increase in the proportion of overseas

contracts.

Prospects

The Group has made good progress over the last six months helped

by improving trading conditions in our core US market. Trading

conditions in the UK look challenging due to a weak high end

housing market caused by high rates of stamp duty and continuing

uncertainty over Brexit. However, our exposure to the UK is limited

by the fact that over 82% of Fabric Division sales are made

overseas. There is also increased optimism in Europe but this

follows two years of sales decline and it is too early to assess

the extent of any recovery.

Our Decorating Division delivered an encouraging first half

contribution and we expect it to exceed our original expectations

for the full year.

The Group has a strong balance sheet with net cash of GBP9.5

million and we will continue to invest with confidence in our

portfolio of brands and worldwide distribution network.

David Green, Chairman

COLEFAX GROUP PLC

INTERIM GROUP INCOME STATEMENT

Unaudited Unaudited Audited

Six months Six months Year to

to 31 to 31 30 April

Oct 2017 Oct 2016 2017

GBP'000 GBP'000 GBP'000

Revenue 42,083 39,529 80,475

Profit from operations 2,559 1,903 2,937

Finance income - - 1

Finance expense (2) - (1)

(2) - -

Profit before taxation 2,557 1,903 2,937

Tax expense (729) (628) (1,042)

Profit for the period attributable to

equity holders of the parent 1,828 1,275 1,895

Basic earnings per share 18.0p 12.5p 18.6p

Diluted earnings per share 18.0p 12.5p 18.6p

COLEFAX GROUP PLC

INTERIM GROUP STATEMENT OF COMPREHENSIVE

INCOME

Unaudited Unaudited Audited

Six months Six months Year to

to 31 to 31 30 April

Oct 2017 Oct 2016 2017

GBP'000 GBP'000 GBP'000

Profit for the year 1,828 1,275 1,895

Other comprehensive income / (expense):

Items that will not be reclassified to

profit and loss:

Exchange differences on translation of

foreign operations 335 2,543 1,628

Remeasurement of defined benefit pension

scheme - - 101

Tax relating to items that will not be

reclassified to profit and loss (411) (617) (449)

----------- ----------- ----------

(76) 1,926 1,280

Items that will or may be reclassified

to profit and loss:

Cash flow hedges:

Gains / (losses) recognised directly in

equity 108 (3,309) (2,611)

Transferred to profit and loss for the

year 595 755 2,006

Tax relating to items that will or may

be reclassified to profit and loss (133) 511 109

----------- ----------- ----------

570 (2,043) (496)

Total other comprehensive income / (expense) 494 (117) 784

Total comprehensive income for the period

attributable to equity holders of the

parent 2,322 1,158 2,679

---------------------------------------------- ----------- ----------- ----------

COLEFAX GROUP PLC

INTERIM GROUP STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

At 31 Oct At 31 At 30 April

2017 Oct 2016 2017

GBP'000 GBP'000 GBP'000

Non-current assets:

Property, plant and equipment 9,771 9,135 9,669

Deferred tax asset 257 839 386

10,028 9,974 10,055

Current assets:

Inventories and work in progress 14,203 13,825 13,938

Trade and other receivables 12,056 12,604 11,805

Current corporation tax - - 170

Cash and cash equivalents 9,499 8,024 6,710

35,758 34,453 32,623

--------------------------------------- ---------- ---------- ------------

Current liabilities:

Trade and other payables 15,054 16,617 13,961

Current corporation tax 184 27 -

15,238 16,644 13,961

---------- ---------- ------------

Net current assets 20,520 17,809 18,662

---------- ---------- ------------

Total assets less current liabilities 30,548 27,783 28,717

--------------------------------------- ---------- ---------- ------------

Non-current liabilities:

Deferred rent 1,905 2,003 1,992

Pension liability 3 177 55

Deferred tax liability 636 954 734

---------- ---------- ------------

Net assets 28,004 24,649 25,936

======================================= ========== ========== ============

Capital and reserves attributable to

equity holders of the Company:

Called up share capital 1,022 1,022 1,022

Share premium account 11,148 11,148 11,148

Capital redemption reserve 1,852 1,852 1,852

ESOP share reserve (113) (113) (113)

Foreign exchange reserve 2,703 3,485 2,779

Cash flow hedge reserve (409) (2,526) (979)

Retained earnings 11,801 9,781 10,227

Total equity 28,004 24,649 25,936

======================================= ========== ========== ============

COLEFAX GROUP PLC

INTERIM GROUP STATEMENT OF CASH FLOWS

Unaudited Unaudited Audited

Six months Six months Year to

to 31 Oct to 31 Oct 30 April

2017 2016 2017

GBP'000 GBP'000 GBP'000

Operating activities

Profit before taxation 2,557 1,903 2,937

Finance income - - (1)

Finance expense 2 - 1

Depreciation 1,382 1,279 2,720

----------- ----------- ----------

Cash flows from operations before changes

in working capital 3,941 3,182 5,657

Increase in inventories and work in

progress (330) (862) (1,140)

Increase in trade and other receivables (322) (2,672) (2,172)

Increase in trade and other payables 1,880 2,547 1,835

Cash generated from operations 5,169 2,195 4,180

----------- ----------- ----------

Taxation paid

UK corporation tax paid (14) (132) (224)

Overseas tax paid (358) (623) (1,141)

-----------

(372) (755) (1,365)

----------- ----------- ----------

Net cash inflow from operating activities 4,797 1,440 2,815

----------- ----------- ----------

Investing activities

Payments to acquire property, plant

and equipment (1,614) (1,705) (4,126)

Receipts from sales of property, plant

and equipment - 27 40

Interest received - - 1

Net cash outflow from investing (1,614) (1,678) (4,085)

----------- ----------- ----------

Financing activities

Purchase of own shares - (2,583) (2,583)

Interest paid (2) - (1)

Equity dividends paid (254) (244) (478)

Net cash outflow from financing (256) (2,827) (3,062)

----------- ----------- ----------

Net increase / (decrease) in cash and

cash equivalents 2,927 (3,065) (4,332)

Cash and cash equivalents at beginning

of period 6,710 10,085 10,085

Exchange (losses) / gains on cash and

cash equivalents (138) 1,004 957

Cash and cash equivalents at end of

period 9,499 8,024 6,710

------------------------------------------- ----------- ----------- ----------

COLEFAX GROUP PLC

NOTES

1. The Group prepares its annual financial statements in accordance

with International Financial Reporting Standards (IFRS). These

interim results have been prepared in accordance with the accounting

policies expected to be applied in the next annual financial

statements for the year ending 30 April 2018.

These standards and interpretations are subject to ongoing review

and endorsement by the EU or possible amendment by interpretive

guidance from the International Financial Reporting Interpretations

Committee ('IFRIC') and are therefore still subject to change.

2. During the financial period ended 31 October 2017, the Company

paid a final dividend for the year ended 30 April 2017 of 2.50p

per ordinary share amounting to GBP254,000.

The proposed interim dividend of 2.40p (2016: 2.30p) per share

is payable on 9 April 2018 to qualifying shareholders on the

register at the close of business on 2 March 2018.

3. Basic earnings per share have been calculated on the basis of

earnings of GBP1,828,000 (2016: GBP1,275,000) and on 10,160,000

(2016: 10,207,315) ordinary shares being the weighted average

number of ordinary shares in issue during the period.

4. Diluted earnings per share have been calculated on the basis

of earnings of GBP1,828,000 (2016: GBP1,275,000) and on 10,160,000

(2016: 10,207,315) ordinary shares being the weighted average

number of ordinary shares in the period adjusted to assume conversion

of all dilutive potential ordinary shares of nil (2016: nil).

5. The financial information for the year ended 30 April 2017 does

not constitute the full statutory accounts for that period. The

Annual Report and Financial Statements for the year ended 30

April 2017 have been filed with the Registrar of Companies. The

Independent Auditors' Report on the Annual Report and Financial

Statements for the year ended 30 April 2017 was unqualified,

did not draw attention to any matters by way of emphasis, and

did not contain a statement under 498(2) or 498(3) of the Companies

Act 2006.

6. Copies of the interim report are being sent to shareholders and

will be available from the Company's website on www.colefaxgroupplc.com.

Copies will also be made available on request to members of the

public at the Company's registered office at 19-23 Grosvenor

Hill, London W1K 3QD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFEELAITFIT

(END) Dow Jones Newswires

January 29, 2018 02:00 ET (07:00 GMT)

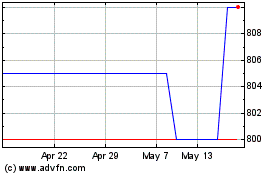

Colefax (LSE:CFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

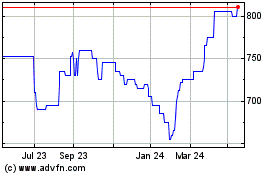

Colefax (LSE:CFX)

Historical Stock Chart

From Apr 2023 to Apr 2024