BlackRock Income Portfolio Update

November 24 2021 - 7:41AM

UK Regulatory

TIDMBRIG

The information contained in this release was correct as at 31 October 2021.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK INCOME & GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16)

All information is at 31 October 2021 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five Since

Month Months Year Years Years 1 April

2012

Sterling

Share price -1.0% -2.1% 22.2% 16.8% 23.3% 102.3%

Net asset value 0.8% 1.6% 30.4% 16.6% 26.7% 95.6%

FTSE All-Share Total Return 1.8% 3.5% 35.4% 17.6% 31.4% 94.1%

Source: BlackRock

BlackRock took over the investment management of the Company with effect from 1

April 2012.

At month end

Sterling:

Net asset value - capital only: 198.50p

Net asset value - cum income*: 203.15p

Share price: 191.00p

Total assets (including income): £47.5m

Discount to cum-income NAV: 6.0%

Gearing: 6.0%

Net yield**: 3.8%

Ordinary shares in issue***: 21,398,842

Gearing range (as a % of net assets): 0-20%

Ongoing charges****: 1.2%

* Includes net revenue of 4.65 pence per share

** The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 3.8% and includes the 2020

final dividend of 4.60p per share declared on 01 February 2021 and paid to

shareholders on 17 March 2021 and the 2021 interim dividend of 2.60p per share

declared on 23 June 2021 and paid to shareholders on 1 September 2021.

*** excludes 10,081,532 shares held in treasury.

**** Calculated as a percentage of average net assets and using expenses,

excluding performance fees and interest costs for the year ended 31 October

2020.

Sector Analysis Total assets (%)

Support Services 15.1

Pharmaceuticals & Biotechnology 8.9

Household Goods & Home Construction 7.8

Financial Services 6.3

Media 6.3

Oil & Gas Producers 5.8

Mining 5.4

Banks 5.1

Life Insurance 5.0

Personal Goods 4.2

Nonlife Insurance 3.7

Tobacco 3.5

General Retailers 3.3

Health Care Equipment & Services 2.7

Travel & Leisure 2.7

Electronic & Electrical Equipment 2.5

Food & Drug Retailers 2.3

General Industrials 1.3

Software & Computer Services 1.3

Electricity 0.9

Real Estate Investment Trusts 0.8

Technology Hardware & Equipment 0.8

Food Producers 0.8

Industrial Engineering 0.6

Net Current Assets 2.9

-----

Total 100.0

=====

Country Analysis Percentage

United Kingdom 89.9

United States 4.3

France 2.9

Net Current Assets 2.9

-----

100.0

=====

Top 10 holdings Fund %

AstraZeneca 7.0

RELX 5.1

Royal Dutch Shell 'B' 4.6

Reckitt Benckiser 4.4

Unilever 3.8

3i Group 3.7

Rio Tinto 3.6

British American Tobacco 3.5

Electrocomponents 3.3

Ferguson 3.3

Commenting on the markets, representing the Investment Manager noted:

Performance Overview:

The Company returned 0.8% during the month, underperforming the FTSE All-Share

which returned 1.82%.

Global equities rose in October on the back of a strong start to US Q3

earnings; 80% of reporting companies beat consensus despite concerns around

supply and cost pressures.

Banks performed relatively well after a broad rise in global bond yields,

notably the UK 10-year gilt which hit a two-year high, and by strong results in

the US banking sector.

The Energy sector gained as crude touched a seven-year high after OPEC+ stuck

with its existing output plans. US employment report was sufficiently mixed to

revive the debate over whether the US Federal Reserve will really go ahead with

the planned tapering.

There was limited equity market impact from the UK Budget, however, the greater

than expected degree of fiscal stimulus delivered by the Chancellor sparked

debate about Bank of England plans to withdraw monetary policy support. The

proposed alcohol duty changes provided a boost for the pub stocks and travel &

leisure sector.

The FTSE All Share rose 1.82% during October with Utilities, Financials and

Health Care as top performing sectors while Telecommunications, Technology and

Consumer Goods underperformed.

Stocks:

In terms of detractors from performance, THG fell during the month given a

slow-down in trading as e-commerce trends lap very strong 2020 COVID

comparators. We are encouraged to see the company improve its governance,

announcing the search for an executive chairman, removing the golden share and

improving disclosure. Two companies which the Company doesn't own, HSBC and

GlaxoSmithkline were detractors during the month as good results led to strong

share price performance during the month. Rio Tinto was another detractor from

the portfolio given continued weakness in the price of iron ore.

Standard Chartered and 3i benefitted from strength in the Financials sector;

both were top contributors to the Company during the month. Electrocomponents

rose after delivering a strong earnings statement continuing its impressive

operational performance through the COVID era; we remain excited about the

long-term growth potential here. RELX was again a top contributor on the back

of strong results reported previously.

Portfolio Activity:

During the period, we bought a new holding in Pearson as we believe the

education company can successfully navigate the transition from print to

digital in the long term. Whilst we expect the journey will be volatile, the

current strong balance sheet, strong new management team and well invested base

gives us confidence that the company can achieve this. We sold Bodycote as we

felt the shares were fully valued for the opportunities we can see in the

medium term; the company has been a successful long-term holding. We also sold

Intermediate Capital which is a holding we purchased during the covid crisis at

significantly lower prices; the shares have nearly doubled since and have been

sold given a move back towards fair value.

Outlook:

As the world approaches some sort of post-covid normalisation and economies

reopen, many opportunities and risks are being presented. We are closely

monitoring how earnings react to factors including the retraction of government

stimulus, changes in consumer wallets and behaviours. Much like the structural

change of digitisation that arose in the throes of Covid, we monitor these

aforementioned factors and others for signs of other structural changes.

The growth in economic activity has caused some strains on supply chains with

specific industry shortages as well as building inflationary pressures which

can squeeze companies' margins. We continue to concentrate the portfolio on

those businesses who display pricing power and thus able to protect margins

over the medium and long-term. We continue to monitor the bond market to

determine if the current surge in inflation is transitory or, fuelled by a more

relaxed Fed, a phenomenon that may persist. We are also cognisant of the

evolution of relationships between China and the West and the potential impact

on industries and shares.

After five years under a Brexit-induced cloud, the relative position of the UK

in the eyes of global investors appears to have improved, helped by the

vaccination programme, and evidenced by the resurgence in takeover activity as

bidders look to capitalise on the discount at which UK equities trade relative

to global peers. Specifically, we've seen acquisitions of real assets and a

desire to find unlevered free cash flow.

Amidst market normalisation, we see cash generation improving and dividends

payments recovering. Broadly speaking we've been surprised by how quickly

dividends have come back with large contributions from the mining sector where

the likes of Rio Tinto and BHP have been able to pay large special dividends.

While dividends are not far off from pre-Covid levels as the majority of

companies are paying dividends once more, we note the large contribution from

special dividends that may not persist. We view the outlook for ordinary

dividends for the UK market with optimism as most companies have emerged from

the Covid crisis with appropriate dividend policies.

We continue to have conviction in cash-generative companies that have delivered

for the Company and we foresee delivering into the future. As always, we are

focused on stock-specifics and selecting holdings that are best placed to

perform well amidst market normalisation. At present, we feel liquidity

conditions are relatively supportive and we are excited by the approaching

economic recovery and the opportunity to deliver strong capital and dividend

growth for our clients over the long-term.

23 November 2021.

END

(END) Dow Jones Newswires

November 24, 2021 07:41 ET (12:41 GMT)

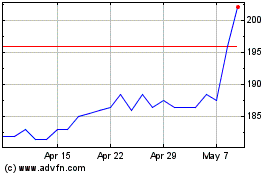

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024