BlackRock Frontiers Portfolio Update

July 26 2017 - 4:38AM

UK Regulatory

TIDMBRFI

BLACKROCK FRONTIERS INVESTMENT TRUST PLC (LEI: 5493003K5E043LHLO706)

All information is at 30 June 2017 and unaudited.

Performance at month end with net income reinvested.

One Three One Three Five Since

month months year years years Launch*

% % % % % %

Sterling:

Share price 0.4 2.4 32.2 40.2 141.9 83.8

Net asset value 0.9 2.0 24.9 35.5 125.3 82.7

MSCI Frontiers Index (NR) 0.0 2.2 22.7 18.7 82.4 47.5

MSCI Emerging Markets Index (NR) 0.4 2.3 27.4 35.9 46.6 28.0

US Dollars:

Share price 1.0 6.4 28.4 6.6 100.7 53.6

Net asset value 1.5 6.0 21.3 2.9 86.8 52.4

MSCI Frontiers Index (NR) 0.6 6.1 19.2 -9.8 51.1 22.8

MSCI Emerging Markets Index (NR) 1.0 6.3 23.7 3.3 21.4 6.7

Sources: BlackRock and Standard & Poor's Micropal

* 17 December 2010.

At month end

Ordinary Shares

US Dollar

Net asset value - capital only: 185.34c

Net asset value - cum income: 188.36c

Sterling:

Net asset value - capital only: 142.69p

Net asset value - cum income: 145.02p

Share price: 148.50p

Total assets (including income): GBP255.0m

Premium to cum-income NAV: 2.4%

Gearing: nil

Gearing range (as a % of gross assets): 0-20%

Net yield*: 3.5%

Ordinary shares in issue: 175,843,108

Ongoing charges**: 1.4%

Ongoing charges plus taxation and performance fee: 2.4%

*The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 3.5% and includes the 2016

final dividend of 4.00 cents per share declared on 22 November 2016 and paid to

shareholders on 17 February 2017 and the 2017 interim dividend of 2.70 cents

per share announced on 25 May 2017 and paid to shareholders on 30 June 2017.

**Calculated as a percentage of average net assets and using expenses,

excluding performance fees and interest costs for the year ended 30 September

2016.

Sector Gross Country Gross

Analysis assets(%)* Analysis assets(%)*

Financials 32.1 Argentina 15.1

Consumer Staples 16.3 Romania 9.5

Energy 10.6 Kuwait 9.1

Health Care 8.7 Vietnam 8.5

Telecommunication Services 8.6 Kazakhstan 8.1

Materials 7.5 Morocco 6.8

Utilities 5.6 Egypt 5.9

Real Estate 4.7 Ukraine 5.7

Industrials 4.2 Sri Lanka 5.4

Information Technology 4.0 Bangladesh 5.0

Consumer Discretionary 1.6 Nigeria 3.9

----- Kenya 3.8

Total 103.9 Pakistan 3.3

----- Eurasia 2.9

Short positions 0.0 Philippines 2.2

===== Colombia 2.0

Estonia 1.8

Saudi Arabia 1.8

Slovenia 1.7

Tanzania 1.2

United Arab Emirates 0.2

-----

Total 103.9

-----

Short positions 0.0

=====

*reflects gross market exposure from contracts for difference (CFDs).

Market Exposure

31.07 31.08 30.09 31.10 30.11 31.12 31.01 28.02 31.03 30.04 31.05 30.06

2016 2016 2016 2016 2016 2016 2017 2017 2017 2017 2017 2017

% % % % % % % % % % % %

Long 103.4 105.7 104.0 106.4 102.3 108.4 115.0 115.8 112.1 108.9 105.0 103.9

Short 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Gross 103.4 105.7 104.0 106.4 102.3 108.4 115.0 115.8 112.1 108.9 105.0 103.9

Net 103.4 105.7 104.0 106.4 102.3 108.4 115.0 115.8 112.1 108.9 105.0 103.9

Ten Largest Equity Investments

Company Country of Risk % of gross assets

Halyk Savings Bank Kazakhstan 3.6

Equity Group Kenya 3.1

Banco Marco Argentina 3.1

Mobile Telecommunications Kuwait 2.7

Pampa Energia Argentina 2.6

Integrated Diagnostics Egypt 2.6

S.N.G.N. Romgaz Romania 2.5

Square Pharmaceuticals Bangladesh 2.5

MHP Ukraine 2.5

Maroc Telecom Morocco 2.4

Commenting on the markets, Sam Vecht and Emily Fletcher, representing the

Investment Manager noted:

In June, the Company's NAV rose by 1.5%, outperforming its benchmark (the MSCI

Frontiers Index) which rose by 0.6% (on a US Dollar basis with net income

reinvested and net of ongoing charges). The MSCI Emerging Markets Index rose by

1.0% over the same period.

Stock selection in Kazakhstan was a significant contributor to performance this

month. Halyk Bank rallied 18% as it announced the agreement of the much

anticipated merger with KKB to create a dominant banking franchise in the

domestic market. We believe the merger will differentiate Halyk given the

growth in deposit market share which will give them a sustainable competitive

advantage in cost of funding versus peers. Earnings will benefit from the

deployment of capital by Halyk through the merger and hence we continue to have

high conviction that valuation remains attractive and this position continues

to be a large weighting within the portfolio.

Our position in Egyptian diagnostic testing company, Integrated Diagnostics

Holding, contributed to performance as the stock increased 14% following a

positive trading statement the previous month and benefiting from investors

increased appetite for Egyptian assets. We believe the stock has an

advantageous competitive position in a sector which should see structural

growth. We also like exposure to Egypt, we believe domestic rates are now

sufficiently high to attract international investors (corroborated by inflows

of greater than $9bn into the domestic Treasury bill market), and that these

flows will support the Egyptian pound at these levels and allow recovery of the

domestic economy.

Turkish-listed Coca Cola Icecek, the Eurasian Coca-Cola bottler, rallied close

to 10% through the month on continued good volumes and consumption trends in

the region. We like the company for its unique regional footprint and

attractive valuations.

Performance this month also came from actively avoiding having any exposure to

the Oman stock market. The index corrected 7% through the period. It is a

market that we have avoided for some time as we believe that the currency is

unsustainable at current levels with the oil price around $50 per barrel.

The Romanian market was volatile this month as incoming ministers talked of

dismantling the existing pension system. Although the news was quickly denied,

it is a good reminder of the potential uncertainty some of these frontier

markets carry.

Pakistan had a volatile month as well with the index finishing down 8% as the

hype around the MSCI's reclassification to 'emerging market' faded away and the

currency faced new selling pressures on continued deterioration of the

country's current account balances. We have significantly reduced our exposure

to the Pakistani market from 9% at the end of May to just over 3% at the end of

June, believing that it is very difficult for frontier stock markets to perform

in environment where the FX is under pressure.

We have significantly reduced exposure to Bangladesh over the past few months,

with exposure around 5% at month end having fallen from 9% at the start of the

year. We have taken profits from positions in Bangladesh, including a position

in Grameenphone, which has risen 27% since purchase in September 2016 where we

believe that valuations are no longer attractive. As anticipated the fall in

allocation to South Asian markets has correlated with an increase in allocation

to African markets where exposure has risen over the last three months from 17%

to 22% now.

Broadly, Frontier Markets continue to exhibit strong GDP growth and low

government debt levels, and represent an opportunity to invest in companies

with strong cash flow and high dividend yields, on some of the lowest

valuations in the world.

26 July 2017

ENDS

Latest information is available by typing www.blackrock.co.uk/brfi on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on BlackRock's website (or any other

website) is incorporated into, or forms part of, this announcement

END

(END) Dow Jones Newswires

July 26, 2017 04:38 ET (08:38 GMT)

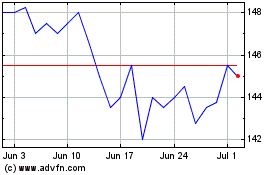

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Frontiers Inve... (LSE:BRFI)

Historical Stock Chart

From Apr 2023 to Apr 2024