TIDMBMN

RNS Number : 7638H

Bushveld Minerals Limited

05 August 2021

5 August 2021

Bushveld Minerals Limited

("Bushveld Minerals", "Bushveld" or the "Company")

Annual General Meeting Results

Bushveld Minerals Limited (AIM: BMN), the AIM quoted, integrated

primary vanadium producer and energy storage provider, with

ownership of high-grade assets in South Africa, announces that all

ordinary resolutions put to shareholders at the Annual General

Meeting held earlier today were duly passed. Resolution 9, which

was a special resolution requiring 75 per cent of votes cast to be

in favour was not passed.

VOTES

--------------------------------------

No. ORDINARY RESOLUTIONS IN FAVOUR AGAINST WITHHELD

------------ ----------- -----------

To receive and adopt the Annual

Financial Statements of the Company

and the Directors report and the

report of the Auditors for the financial

1 year ended 31 December 2020. 215,800,827 46 917 465 650

--------------------------------------------- ------------ ----------- -----------

To approve the Directors Fees as

reflected in Remuneration Report

and in Note 35 of the Annual Financial

2 Statements. 112,093,663 83,495,345 20,724,386

--------------------------------------------- ------------ ----------- -----------

That Messrs RSM UK Audit LLP be

3 reappointed as Auditors to the Company. 210,772,584 5,059,449 481,361

--------------------------------------------- ------------ ----------- -----------

That the Directors be authorised

to approve the remuneration of the

4 Company's Auditors to the Company 184,609,536 31,208,208 495,650

--------------------------------------------- ------------ ----------- -----------

That Anthony Viljoen shall be re-elected

as a Director, having retired by

rotation and offered himself for

5 re-election. 184,543,956 31,736,892 32,546

--------------------------------------------- ------------ ----------- -----------

That Michael Kirkwood shall be re-elected

as a Director, having retired by

rotation and offered himself for

6 re-election. 182,683,621 33,297,227 332,546

--------------------------------------------- ------------ ----------- -----------

7 The Company be generally and unconditionally

authorised for the purposes of Articles

50.3 of the Articles to make on

market acquisitions (as defined

in Article 50.5 of the Articles)

of Ordinary Shares on such terms

and in such manner as the Directors

determine provided that:

(i) the maximum aggregate number

of Ordinary shares which may be

purchased is 119,156,154 Ordinary

Shares;

(ii) the minimum price (excluding

expenses) which may be paid for

each Ordinary share is GBP0.01;

(iii) the maximum price (excluding

expenses) which may be paid for

any Ordinary Share does not exceed

105 per cent of the average closing

price of such shares for the 5 business

days of AIM prior to the date of

purchase; and

(iv) this authority shall expire

at the conclusion of the next Annual

General Meeting of the Company unless

such authority is renewed prior

to that time (except in relation

the purchase of Ordinary Shares

the contract for which was concluded

before the expiry of such authority,

in which case such purchase may

be concluded wholly or partly after

such expiry). 141,968,405 74,313,007 31,982

--------------------------------------------- ------------ ----------- -----------

The Directors of the Company be

and are hereby authorised to exercise

all powers of the Company to issue,

grant rights to subscribe for, or

to convert any securities into,

up 397,187,181 shares (together

"Equity Securities") in the capital

of the Company being approximately

one third of the issued share capital

of the Company (excluding treasury

shares) in accordance with Article

8.3 of the Articles of Incorporation

of the Company such authority to

expire, unless previously renewed,

revoked or varied by the Company

by ordinary resolution, at the end

of the next Annual General Meeting

of the Company or, if earlier, at

the close of business on the date

falling 15 months from the date

of the passing of this Resolution,

but in each case, during this period

the Company may make offers, and

enter into agreements, which would,

or might, require Equity Securities

to be issued or granted after the

authority given to the Directors

of the Company pursuant to this

Resolution ends and the Directors

of the Company may issue or grant

Equity Securities under any such

offer or agreement as if the authority

given to the Directors of the Company

pursuant to this Resolution had

not ended. This Resolution is in

substitution for all unexercised

authorities previously granted to

the Directors of the Company to

issue or grant Equity Securities;

8 and 135,151,861 79,990,646 1,170,887

--------------------------------------------- ------------ ----------- -----------

SPECIAL RESOLUTION

---- -------------------------------------------------------------------------------------

9 If Resolution 8 is passed, the Directors

of the Company be, and they are

hereby authorised to exercise all

powers of the Company to issue

or grant Equity Securities in the

capital of the Company pursuant

to the issue or grant referred to

in Resolution 8 as if the pre-emption

rights contained in Article 9.9

of the Articles of Incorporation

of the Company did not apply to

such issue or grant provided that:

(A) the maximum aggregate number

of Equity Securities that may be

issued or granted under this authority

is 119,156,154 shares, being approximately

10.0 per cent of the issued share

capital of the Company (excluding

treasury shares); and (B) the authority

hereby conferred, unless previously

renewed,

revoked or varied by the Company

by special resolution, shall expire

at the end of the next Annual General

Meeting of the Company or, if earlier,

at the close of business on the

date falling 15 months from the

date of the passing of this Resolution,

save that the Company may before

such expiry make an offer or agreement

which would or might require Equity

Securities to be issued or granted

after such expiry and the Directors

may issue or grant Equity Securities

in pursuance of such an offer or

agreement as if the authority conferred

by the above resolution had not

expired. This Resolution is in substitution

for all unexercised authorities

previously granted to the Directors

of the Company to issue or grant

Equity Securities in the capital

of the Company as if the pre-emption

rights contained in Article 9.9

of the Articles of Incorporation

of the Company did not apply to

such issue or grant. 135,066,664 80,075,843 1,170,887

--------------------------------------------- ----------- -----------

S

Enquiries: info@bushveldminerals.com

Bushveld Minerals +27 (0) 11 268 6555

Fortune Mojapelo, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance

LLP Nominated Adviser & Broker +44 (0) 20 3470 0470

Richard Morrison / Charlie

Bouverat

Grant Baker / Richard Parlons

Peel Hunt Limited Joint Broker +44 (0) 20 7418 8900

Ross Allister / Alexander

Allen

Tavistock Financial PR +44 (0) 20 7920 3150

Gareth Tredway / Tara Vivian-Neal

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low-cost, vertically integrated primary

vanadium producer. It is one of only three operating primary

vanadium producers, owning 2 of the world's 4 operating primary

vanadium processing facilities. In 2020, the Company produced more

than 3,600 mtV, representing approximately three per cent of the

global vanadium market. With a diversified vanadium product

portfolio serving the needs of the steel, energy and chemical

sectors, the Company participates in the entire vanadium value

chain through its two main pillars: Bushveld Vanadium, which mines

and processes vanadium ore; and Bushveld Energy, an energy storage

solutions provider. Bushveld Vanadium is targeting to materially

grow its vanadium production and achieve an annualised steady state

production run rate of between 5,000 mtVp.a. and 5,400 mtVp.a by

the end of 2022, from projects currently being implemented. Beyond

that, pre-feasibility studies are in progress to determine the

optimal path to increase production even further to a steady state

production run rate of between 6,400 mtVp.a. and 6,800 mtVp.a. in

the medium-term and to a steady state production run rate of 8,400

mtVp.a in the long term.

Bushveld Energy is focused on developing and promoting the role

of vanadium in the growing global energy storage market through the

advancement of vanadium-based energy storage systems, specifically

Vanadium Redox Flow Batteries ("VRFBs").

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGUVVVRAVUWRAR

(END) Dow Jones Newswires

August 05, 2021 12:00 ET (16:00 GMT)

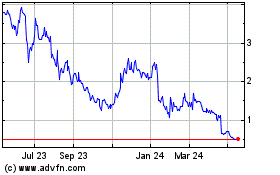

Bushveld Minerals (LSE:BMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

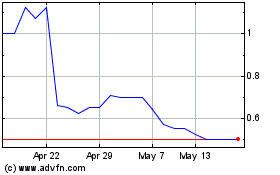

Bushveld Minerals (LSE:BMN)

Historical Stock Chart

From Apr 2023 to Apr 2024