BBGI SICAV S.A. New Credit Facility (3793W)

November 14 2017 - 2:00AM

UK Regulatory

TIDMBBGI

RNS Number : 3793W

BBGI SICAV S.A.

14 November 2017

BBGI SICAV S.A.

(the "Company")

New Credit Facility

BBGI SICAV S.A. (LSE ticker: BBGI), the global infrastructure

investment company, is pleased to announce that the Group has

secured a new Revolving Credit Facility ('RCF') of GBP180 million

from ING Bank ('ING') and KfW IPEX-Bank ('KfW'). The RCF will

replace the current GBP180 million facility with ING and KfW, when

it expires in January 2018.

The tenor of the RCF will be four years, commencing in January

2018. The borrowing margin will decrease from 185 bps over LIBOR

under the current facility to 165 bps over LIBOR under the new RCF.

The arrangement fee and the commitment fee will also decrease.

Under the new RCF, BBGI will retain the flexibility to consider

larger transactions by virtue of having structured a further GBP70

million incremental accordion tranche, for which no commitment fees

will be paid.

The multi-currency RCF will be used primarily to fund

acquisitions and provide letters of credit for investment

obligations, and the intention will be to repay the facility from

time to time through equity fundraisings.

Duncan Ball, Co-CEO remarked:

"The facility gives BBGI the ability to complete large portfolio

transactions or acquisitions from multiple vendors very quickly. We

continue to be excited about the growth opportunities available to

BBGI over the next four years and this new credit facility will

support the continued development of the business."

Frank Schramm, Co-CEO remarked:

"We are pleased to have been able to reduce the borrowing margin

by 20 basis points, increase the tenor from three to four years and

improve the commercial terms of the facility. We have also

contributed to lower costs by virtue of having structured an

additional GBP70 million incremental accordion tranche for which no

standby fees are payable. Both the multi-currency facility and the

standby facility allow BBGI to borrow in the currency of the

underlying assets or in sterling."

For further information, please contact:

BBGI Management Team +352 263 479-1

Duncan Ball

Frank Schramm

BBGI owns a global portfolio of 43 infrastructure assets. These

assets are PPP assets and are supported by contracted, public

sector-backed revenue streams, with inflation-protection

characteristics.

Further information about BBGI is available on its website at

www.bb-gi.com *.

Any reference to the Company or BBGI refers also to its

subsidiaries (where applicable).

*Neither the NSM website nor the Company's website nor the

content of any website accessible from hyperlinks on those websites

(or any other website) is (or is deemed to be) incorporated into,

or forms (or is deemed to form) part of this announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFFLFUDFWSEDF

(END) Dow Jones Newswires

November 14, 2017 02:00 ET (07:00 GMT)

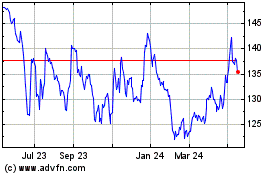

Bbgi Global Infrastructure (LSE:BBGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

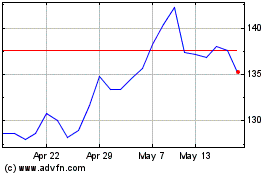

Bbgi Global Infrastructure (LSE:BBGI)

Historical Stock Chart

From Apr 2023 to Apr 2024