EU Banks Would Benefit From US Interest-Rate Environment, Barclays CEO Says

January 22 2020 - 6:05AM

Dow Jones News

By Sabela Ojea

European central banks should start thinking about the

profitability of banks in the way the Federal Reserve does in the

U.S., Barclays PLC (BARC.LN) Chief Executive Jes Staley said in an

interview with CNBC at the World Economic Forum in Davos,

Switzerland on Wednesday.

"If you dropped the European banking industry in to the U.S.

interest-rate environment, you'd see quite an uptick in

profitability," the head of the British lender said.

When asked about whether it would be a good idea to cut rates,

Mr. Staley said markets are predicting some interest-rate cuts by

the European Central Bank, but that the effectiveness of even

looser monetary policy is losing its grip as interest rates get

closer to negative.

Mr. Staley said central banks have adopted a more accommodative

monetary policy like the U.S., "which is taking that and driving a

fiscal stimulus policy," and that he thinks other countries such as

the U.K. will begin to do that as well.

"That's providing a certain floor to the economy, which is

lending itself to more optimism in Davos this year than last year,"

Mr. Staley said.

However, the CEO said central banks are currently more focused

on stability in economies than the banks.

"At some point, central banks across Europe have to look at the

health, or lack thereof, of the European banking system," Mr.

Staley said.

Barclays's performance in 2019 was pivotal for the lender, and

the British bank was the third largest debt underwriter in the U.S.

last year, the CEO said.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

January 22, 2020 05:50 ET (10:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

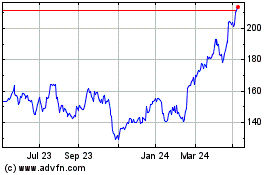

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

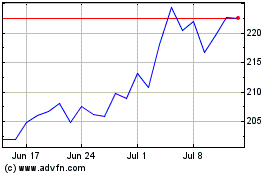

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024