Contributions are paid to provide for the cost of benefit

accrual. The rate of contribution agreed with the Trustee is 16%

(2013: 16%) paid by the employer plus 5% (2013: 5%) member

contributions, in each case of pensionable earnings, and additional

contributions as agreed with the Trustee. Contributions totalled

GBP2.6 million at 31 December 2014 (2013: GBP2.8 million).

The funding position of the Fund is assessed every three years

by an independent qualified actuary. Contributions are made at the

funding rates recommended by the actuary and typically include

adjustments to amortise any funding surplus or shortfall over a

period. Amounts paid under the scheme are charged to Syndicate 2001

or other Group companies. The last completed formal valuation of

the Fund was as at 31 March 2013 and was completed in June 2014 by

Mr D Wilding, Fellow of the Institute of Actuaries, and used the

projected unit credit actuarial method.

On 20 June 2014, the Group agreed a schedule of contributions

with the Trustee, to run over ten years. The schedule requires four

separate payments of GBP2.0 million to the Fund, followed by six

separate payments of GBP1.2 million to the Fund. The present value

of the future payments attributable to past service has been

recognised as a liability at 31 December 2014, to the extent that

the contributions will not be available after they are paid into

the Fund through a refund or a reduction in future

contributions.

The Group has also entered into an agreement with the Trustee to

hold certain funds within an escrow account. The Group has made

payments totalling GBP14.0 million to the escrow account, with the

most recent made in May 2013, and it is now fully funded. Following

the 2013 triennial actuarial valuation, the escrow account is being

held as security against certain of the assumptions used in the

valuation. Further details are provided in note 12(j).

Other schemes

Funding for the other schemes in operation is in accordance with

related insurance arrangements and regulations described above.

Restriction to defined benefit asset due to asset ceiling

The Lloyd's Superannuation Fund's rules do not allow the Group

to receive a refund of contributions in any circumstances.

Therefore, the present value of the future payments has been

recognised as a liability at 31 December 2014, to the extent that

the contributions will not be available after they are paid into

the Fund. A restriction to the defined benefit asset has therefore

been recognised.

Risks to which the Group is exposed through its defined benefit

schemes

The defined benefit schemes expose the Group to the following

risks:

-- Changes in bond yields - The discount rate used in

calculating the present value of the defined benefit obligation is

based upon the yield of high-quality debt instruments issued by

blue chip companies, with maturities consistent with those of the

defined benefit obligations. A decrease in bond yields is likely to

increase the defined benefit obligation.

-- Asset volatility - There is a risk that the return on the

plan assets underperforms the yield on corporate bonds, thereby

reducing the surplus or increasing the deficit.

-- Inflation risk - The defined benefit obligation is linked to

inflation and therefore should the inflation rate increase, there

will be an increase in the plan obligation.

-- Life expectancy - The present value of the defined benefit

obligation is calculated based on certain mortality assumptions as

stated below. An increase in the life expectancy of the plan

participants will result in an increase in the defined benefit

obligation.

-- Risk of insurer default - Where the schemes have entered into

insurance arrangement, if the insurer is unable to meet its

obligations, or if the contract is cancelled by either party; it

will fall to the Group to provide the benefits to members in

accordance with the relevant scheme assets.

Significant actuarial assumptions

The significant actuarial assumptions used as at 31 December

2014 were:

UK The Netherlands Belgium Switzerland

% pa % pa % pa % pa

Discount rate for pension benefits 3.6 2.1 1.4 1.0

Price inflation (CPI/RPI for UK) 2.1/3.1 2.0 1.9 1.3

Expected salary increases - general - 1.5-2.0 1.9 2.3

Indexation for active and formerly active employees - 1.0-1.5 - -

---------------------------------------------------- ------- --------------- ------- -----------

For the Lloyd's Superannuation Fund, there are no expected

salary increases (2013: nil) because the plan participants'

salaries have been capped at the date of buy out. They continue to

accrue additional years' service but do not benefit from salary

increases.

The significant actuarial assumptions used as at 31 December

2013 were:

UK The Netherlands Belgium Switzerland

% pa % pa % pa % pa

Discount rate for pension benefits 4.4 3.7 2.5 2.3

Price inflation (CPI/RPI for UK) 2.5/3.5 2.0 2.0 1.5

Expected salary increases - general - 2.0 2.0 2.5

Indexation for active and formerly active employees - 2.0 - -

---------------------------------------------------- ------- --------------- ------- -----------

The mortality assumptions used in the 31 December 2014 valuation

included the following life expectancies:

UK The Netherlands Belgium Switzerland

--------------------------------

Life expectancy (years) at age

60

for a member currently: Male Female Male Female Male Female Male Female

-------------------------------- ---- ------ ----------- --------------- ------ -------- -------- ------------

Aged 60 28.2 30.0 26.8 28.0 26.7 30.9 26.4 29.0

Aged 45 29.7 31.6 27.9 28.8 26.7 30.9 27.7 30.3

-------------------------------- ---- ------ ----------- --------------- ------ -------- -------- ------------

The mortality assumptions used in the 31 December 2013 valuation

included the following life expectancies:

UK The Netherlands Belgium Switzerland

--------------------------------

Life expectancy (years) at age

60

for a member currently: Male Female Male Female Male Female Male Female

-------------------------------- ---- ------ ----------- --------------- ------ -------- -------- ------------

Aged 60 28.0 29.4 26.8 28.0 26.7 30.9 26.3 28.9

Aged 45 30.0 31.0 27.9 28.8 26.7 30.9 27.7 30.3

-------------------------------- ---- ------ ----------- --------------- ------ -------- -------- ------------

Significant actuarial assumptions - sensitivities

The table below shows the impact on the defined benefit

obligation that a change in certain key assumptions would have:

2014 2013

Assumption change GBPm GBPm

(Increase)/decrease in discount rate by 0.25% (22.9)/25.5 (18.2)/20.5

(Decrease)/increase in inflation rate by 0.25% (9.7)/12.1 (10.9)/11.3

(Decrease)/increase in salary rate by 0.5% (1.3)/1.5 (0.5)/0.6

(Decrease)/increase in indexation rate by 0.5% (9.4)/11.5 (6.6)/7.6

(Decrease)/increase in life expectancy by one year (19.0)/19.0 (13.6)/13.5

-------------------------------------------------- ----------- -----------

The above sensitivities of the significant actuarial assumptions

have been calculated by changing each assumption in turn whilst all

remaining assumptions are held constant. The limitation of this

sensitivity analysis is that in practice assumptions may be

correlated and therefore are unlikely to change in isolation.

Analysis of scheme assets

The analysis of the scheme assets at the reporting date is as

follows:

31 December 2014 31 December 2013

Quoted Unquoted Total Total Quoted Unquoted Total Total

GBPm GBPm GBPm % GBPm GBPm GBPm %

------------------------------------------------------ ------ -------- ----- ----- ------ -------- ----- -----

Cash and cash equivalents - 13.7 13.7 2.6 - 15.8 15.8 3.4

Equity instruments

United Kingdom 77.0 - 77.0 14.5 72.8 - 72.8 15.6

Europe 12.0 - 12.0 2.2 12.2 - 12.2 2.6

North America 30.6 - 30.6 5.7 27.0 - 27.0 5.8

Asia 6.6 - 6.6 1.2 5.5 - 5.5 1.2

Rest of World 6.6 - 6.6 1.2 8.1 - 8.1 1.7

Bonds

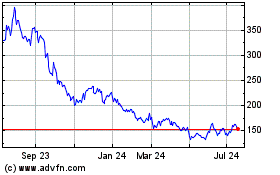

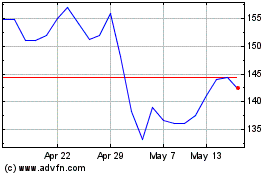

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2023 to Apr 2024