TIDMADA

RNS Number : 5188S

Adams PLC

26 June 2018

26 June 2018

Adams Plc

("Adams" or the "Company")

Annual Report and Financial Statements 2018

AUDITED RESULTS FOR THE YEARED 31 MARCH 2018

Adams Plc ("Adams" or the "Company) announces its audited

financial results for the year ended 31 March 2018.

Highlights:

- Net assets at 31 March 2018 of GBP2.11 million (2017: GBP0.95 million).

Net assets per share 2.55 pence at 31 March 2018 (2017: 2.29

pence).

- Profit after tax of GBP0.02 million (2017: profit of GBP0.01 million).

- Net proceeds of GBP0.98 million from new share subscriptions.

- Investments at 31 March 2018 valued at GBP2.07 million (2017: GBP0.94 million).

- Spend on new investments of GBP1.59 million (2017: GBP0.02 million).

- Investment realisation proceeds of GBP0.73 million (2017: GBP0.15 million).

- Change in presentational currency from Euros to Pounds Sterling.

- Adoption of revised investing policy.

Michael Bretherton, Chairman, said:

"The Board continues to seek attractive investment opportunities

coupled with a focus on financial discipline as the strategy to

best navigate challenging markets and the uncertain global climate.

We remain committed to delivering additional value for our

shareholders going forward."

The Company's Annual Report 2018 will shortly be posted to

shareholders together with a Circular and Notice of Annual General

Meeting, copies of which will be made available on the Company's

website at www.adamsplc.co.uk under the Investor Relations /

Company & Shareholder Documents section. The Annual General

Meeting is to be held at 11.00 a.m. on Friday 10 August 2018 at

IOMA House, Hope Street, Douglas, Isle of Man, IM1 1AP.

Enquiries:

Adams plc Michael Bretherton Tel: +44 1534 719 761

Nomad Cairn Financial Advisers LLP. Sandy Jamieson, James

Caithie Tel: +44 207 213 0880

Broker Peterhouse Capital Limited. Heena Karani Tel: +44 207 469

3393

Chairman's Statement

Adams Plc (the "Company") is an AIM listed investment company

primarily focused on special situation investment opportunities in

the small to middle-market capitalisation sectors in the UK or

Europe.

The presentational currency of Adams Plc ("Adams" or the

"Company") was changed during the year from Euros to Pounds

Sterling. This change in the reporting currency of the Company was

made to reflect the fact that the Company no longer has Euro based

operations, assets or significant transactions denominated in

Euros. In accordance with accounting standards, the comparative

financial information for the year ended 31 March 2017 as

previously reported in Euros, has been restated into Pounds

Sterling using the procedures outlined in note 2.13 to the

financial statements.

Adams reported a profit after tax of GBP180,000 for the year

ended 31 March 2018 compared to a profit of GBP77,000 in the prior

year. The increase in profitability is principally due to higher

reported gains on the valuation of investments.

During the year, the Company spent GBP1.59 million on the

purchase of additional investments and realised proceeds of GBP0.73

million from investment disposals. The carrying value of

investments at 31 March 2018 was GBP2.08 million, represented by 3

listed and 3 un-listed investment holdings, versus GBP0.94 million

at 31 March 2017, represented by 4 listed and 1 un-listed

investment holdings.

Net assets increased to GBP2.11 million (equivalent to 2.55

pence per share) at the 31 March 2018 balance sheet date, compared

with GBP0.95 million (equivalent to 2.29 pence per share) at the

previous year end. The increase in net assets reflects net proceeds

of GBP0.98 million received from new share subscriptions, together

with the profit of GBP0.18 million reported for the year.

Cash and cash equivalent balances were GBP52,000 at 31 March

2018 compared to cash balances of GBP35,000 at 31 March 2017.

Underwritten open offer and majority shareholder controlled

undertaking

In order to provide the Company with additional resources with

which to fund its investment strategy, the Company raised GBP0.98

million (after expenses) in June 2017 pursuant to an underwritten

open offer of 41,276,616 ordinary shares at 2.5p per share. Under

the open offer, existing shareholders had an opportunity to

subscribe for new shares at the 2.5p issue price by taking up their

respective open offer entitlements which were calculated on a pro

rata basis to their holding in the existing shares.

The open offer was fully underwritten by the Company's largest

shareholder, Richard Griffiths and following the open offer, which

was approved by shareholders on 28 June 2017, the number of Adams

ordinary shares in issue increased to 82,553,232 and consequent to

the subscription and underwriting shares issued to Richard

Griffiths, his holding increased to 63.8 per cent of the Company's

issued share capital. As a result, Adams became a controlled

undertaking of Richard Griffiths who will, if he so wishes, be able

to further increase his interests in Adams shares without making a

mandatory offer to the remaining shareholders. Subsequent to the

open offer, Richard Griffiths has purchased further Adams shares in

the AIM market such that his current holding in the Company is now

77.3 per cent.

The Company, Cairn Financial Advisers LLP (who are the Company's

Nominated Advisor) and Richard Griffiths entered into a

relationship agreement dated 2 June 2017, which governs the

relationship between the Company and Richard Griffiths following

the open offer, to ensure that the Company shall be managed

independently for the benefit of shareholders as a whole.

Business model and change of investing policy

On 8 September 2017, shareholders approved a proposal by the

Company's directors to revise the investing policy to one which

provides the Board with a broader, more flexible approach to

creating shareholder value. The existing policy at that time was

focused on targeting undervalued or pre-commercialisation projects

and assets in the biotechnology sector, whilst also considering

opportunities in the wider technology and other sectors.

Under the revised investing policy, the Board is seeking to

acquire interests in special situation investment opportunities

that have an element of distress, dislocation, dysfunction or other

special situation attributes and that they perceive to be

undervalued. The principal focus is in the small to middle-market

capitalisation sectors in the UK or Europe, but the directors will

also consider possible special situation opportunities anywhere in

the world if they believe there is an opportunity to generate added

value for shareholders.

Investment Portfolio

The listed investments currently held by the Company comprise

Petrofac Limited, Eland Oil & Gas Plc and Communisis Plc. In

addition, the Company holds shares and loan notes in unquoted

Sherwood Holdings Limited and unquoted shares in both Abaco Capital

Plc and Oxford Pharmascience Limited.

Petrofac is a multinational service provider to the oil and gas

production and processing industry. The company designs, builds,

operates and maintains oil and gas facilities with a focus on

delivering first class project execution, cost control and

effective risk management. Petrofac has a 36-year track record and

has grown significantly to become a constituent of the FTSE 250

Index. The company has 31 offices and approximately 13,500 staff

worldwide, comprising more than 80 nationalities.

Eland is an independent oil and gas company with the principal

business objective of identifying, acquiring and developing

interests in oil and gas assets in West Africa, focused initially

on Nigeria including the prolific Niger Delta.

Communisis is a leading provider of outsourced digital asset

management and personalised customer communication services.

Abaco Capital (formerly Oxford Pharmascience Plc) underwent a

demerger of its Oxford Pharmascience Limited business on 21

December 2017 and subsequently cancelled its AIM listing on 9 May

2018. The company is now in the process of undertaking a members'

voluntary liquidation and a distribution of funds to shareholders.

The total amount expected to be available to distribute to

shareholders is circa GBP19.0 million, on which basis Adams would

receive approximately GBP30,000, and the distribution is expected

to occur in the period around September to November 2018.

Oxford Pharmascience (as demerged from Abaco Capital) is a drug

development company that re-develops approved drugs to make them

better, safer and easier to take and it has a current focus to

develop improved formulations of non-steroidal anti-inflammatory

drugs (NSAIDs) and statins.

Source Bioscience is an international provider of state of the

art laboratory services and products and has an expertise in

clinical diagnostics, genomics, proteomics, drug discovery &

development research and analytical testing services.

Corporate action proposals

Following the change in the presentational currency of Adams

from Euros to Pounds Sterling during the year, it is proposed that

a redenomination of the Company's share capital from Euros into

Pounds Sterling is also undertaken, with the par value of the

ordinary shares converting from EUR0.01 to GBP0.01, and that the

AIM quotation of its ordinary shares is also subsequently changed

from Euros to Pounds Sterling.

In addition, it is proposed that part of the Company's share

premium be applied to eliminate the foreign currency translation

reserve and that the balance of the share premium be reclassified

as distributable reserves and that the Directors are authorised to

purchase the Company's own ordinary shares in the open market

subject to certain conditions and limited to a maximum of 14.99 per

cent of the issued share capital of the Company. The Directors

believe that the ability of the Company to purchase its own shares

offers an important mechanism for managing capital efficiently. In

particular, the Directors may wish to take advantage of

circumstances where a purchase of its own shares would represent

good use of the Company's available cash resources and increase net

asset value per share and shareholder value.

The full detail of these corporate action proposals is included

in the Notice of Annual General Meeting for the AGM which is to be

held at IOMA House, Hope Street, Douglas, Isle of Man, IM1 1AP on

10 August 2018 at 11a.m.

Outlook

Global economic growth was stronger than expected in 2017, with

a recovery in investment, manufacturing, and trade becoming

visible. More moderate economic growth is forecast for 2018 as

central banks gradually remove their post crisis fiscal

accommodation. However, these positive growth trends must be

tempered by the increasing threat of a decrease in liberalised

global trade and the potential for the escalation of political

tensions between advanced trading nations. Despite these macro

considerations the Adams directors are confident in the underlying

fundamentals, technologies and growth potential of the companies

within our investment portfolio.

The Board continues to seek attractive investment opportunities

coupled with a focus on financial discipline as the strategy to

best navigate challenging markets and the uncertain global climate.

We remain committed to delivering additional value for our

shareholders going forward.

Michael Bretherton

Chairman

26 June 2018

Statement of Income

Year ended Year ended

31 March 2018 31 March 2017

GBP'000 GBP'000

----------------------------------------------- --------------- ----------------

Dividend income 45 15

Gain on investments 280 204

------------------------------------------------ --------------- ----------------

Investment return 325 219

Expenses

Administrative expenses (155) (147)

------------------------------------------------ --------------- ----------------

Operating profit 170 72

Interest income 10 5

------------------------------------------------ --------------- ----------------

Profit on ordinary activities before taxation 180 77

Tax on profit on ordinary activities - -

----------------------------------------------- --------------- ----------------

Profit for the year 180 77

------------------------------------------------ --------------- ----------------

Basic and diluted profit per share 0.25p 0.18p

------------------------------------------------ --------------- ----------------

Statement of Comprehensive Income

Year ended Year ended

31 March 2018 31 March 2017

GBP'000 GBP'000

-------------------------------------------------------------- --------------- ----------------

Profit for the year 180 77

--------------------------------------------------------------- --------------- ----------------

Other comprehensive expense

Exchange differences arising on change in reporting currency - (2)

--------------------------------------------------------------- --------------- ----------------

Total comprehensive gain for the year 180 75

--------------------------------------------------------------- --------------- ----------------

Statement of Financial Position at 31 March 2018

31 March 2018 31 March 2017 31 March 2016

GBP'000 GBP'000 GBP'000

------------------------------ -------------------- ---------------- ----------------

Assets

Non-current assets

Investments 2,076 935 690

------------------------------------- -------------- ---------------- ----------------

Current assets

Prepayments 2 2 2

Cash and cash equivalents 52 35 204

------------------------------------- -------------- ---------------- ----------------

Current assets 54 37 206

------------------------------------- -------------- ---------------- ----------------

Total assets 2,130 972 896

------------------------------------- -------------- ---------------- ----------------

Liabilities

Current liabilities

Trade and other payables (21) (26) (25)

------------------------------------- -------------- ---------------- ----------------

Total liabilities (21) (26) (25)

------------------------------------- -------------- ---------------- ----------------

Net current assets 33 11 181

------------------------------------- -------------- ---------------- ----------------

Net assets 2,109 946 871

------------------------------------- -------------- ---------------- ----------------

Equity

------------------------------ ---- -------------- ---------------- ----------------

Called up share capital 1,001 636 636

Share premium 1,401 783 783

Foreign currency translation

reserve (244) (244) (242)

Accumulated losses (49) (229) (306)

------------------------------------- -------------- ---------------- ----------------

Total shareholder equity 2,109 946 871

------------------------------------- -------------- ---------------- ----------------

Statement of Changes in Equity as at 31 March 2018

Share Foreign currency translation Accumulated

Share Capital Premium reserve Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2016 636 783 (242) (306) 871

Changes in equity

Total comprehensive gain - - (2) 77 75

--------------------------- -------------- --------- ------------------------------------ ------------ --------

At 31 March 2017 636 783 (244) (229) 946

--------------------------- -------------- --------- ------------------------------------ ------------ --------

Changes in equity

Issue of shares 365 618 - - 983

Total comprehensive gain - - - 180 180

--------------------------- -------------- --------- ------------------------------------ ------------ --------

At 31 March 2018 1,001 1,401 (244) (49) 2,109

--------------------------- -------------- --------- ------------------------------------ ------------ --------

Statement of Cash Flows for the year ended 31 March 2018

Year ended Year ended

31 March 2017

31 March

2018 *Restated

GBP'000 GBP'000

Profit for the year 180 77

Unrealised gain on revaluation of

portfolio investments (237) (188)

Realised gain on disposal of portfolio

investments (43) (16)

Decrease in prepaid expenses - 1

Decrease in trade and other payables (5) (2)

---------------------------------------------- ----------- --------------

Net cash outflow from operating activities (105) (128)

---------------------------------------------- ----------- --------------

Cash flows from investing activities

Purchase of portfolio investments (1,591) (191)

Proceeds from sales of investments 730 150

---------------------------------------------- ----------- --------------

Net cash used in investing activities (861) (41)

---------------------------------------------- ----------- --------------

Cash flows from financing activities

Issue of ordinary share capital 983 -

Net cash generated from financing -

activities 983

-------------------------------------------- ----------- --------------

Net increase / (decrease) in cash

and cash equivalents 17 (169)

Cash and cash equivalents at beginning

of year 35 204

---------------------------------------------- ----------- --------------

Cash and cash equivalents at end of

year 52 35

---------------------------------------------- ----------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FKPDDABKDFAB

(END) Dow Jones Newswires

June 26, 2018 02:00 ET (06:00 GMT)

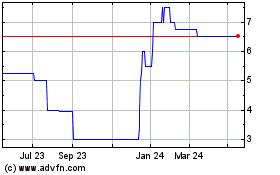

Adams (LSE:ADA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adams (LSE:ADA)

Historical Stock Chart

From Apr 2023 to Apr 2024