Chinese Technology Stocks Have Fallen Harder Than U.S. Peers

March 09 2021 - 6:43AM

Dow Jones News

By Xie Yu and Joanne Chiu

U.S. technology stocks have slipped into correction territory.

Chinese technology stocks have fallen even more.

An index of the largest technology stocks listed in Hong Kong

has dropped 26% in less than three weeks, reflecting how a sudden

turn in the market has snowballed into significant losses for

investors who piled into popular stocks earlier this year.

The Hang Seng Tech Index--which tracks 30 companies including

Chinese internet giants Tencent Holdings Ltd. and Alibaba Group

Holding Ltd., and smartphone maker Xiaomi Corp.--closed Tuesday at

its lowest level in 2021 and is now in bear-market territory,

defined as a drop of at least 20% from a recent high.

In comparison, the Nasdaq Composite closed on Monday 10.5% lower

than the index's recent high on Feb. 12.

Money managers say the trigger for the U.S. and Asia market

declines was similar: a fast and unexpected rise in Treasury bond

yields, which made stocks of fast-growing companies less attractive

and caused some investors to shift from technology into banking,

energy and other less volatile stocks. China's big technology

players have taken a bigger hit, because a flood of money from

investors in mainland China had pushed up their stock prices and

valuations sharply.

"It's hard to call the bottom, but we see this as a healthy

correction, and the market was due for one," said Nicholas Yeo, who

oversees China equities at Aberdeen Standard Investments in Hong

Kong. He said the long-term growth outlook for the country's

internet and technology giants remains intact but that their stocks

are vulnerable to big swings because they were among the main

beneficiaries of excess liquidity in the markets during the

coronavirus pandemic.

Barely a month ago, Meituan, a Beijing-based company that runs a

popular shopping, food-delivery and bookings app, was flying high

as China's third most valuable company, with a market

capitalization in excess of $300 billion. Investor enthusiasm over

Meituan's recent expansion into grocery bulk-buying in China caused

a rapid run-up in its shares, even though the company generates

only a small profit.

Meituan has been one of the biggest casualties of the recent

selloff, which has cut its value by a third since Feb. 17. The

stock was one of the most popular purchases by investors in

mainland China using the Stock Connect trading link to buy stocks

listed in Hong Kong. Outflows through that link have recently

picked up.

Armies of individual investors who have become more active users

of mobile trading apps have also been driving up market

volumes.

As a result, "When things start to go up, they go up very

quickly. But when they start to go down, the whole thing unravels

quickly, too," said Wei Wei Chua, a portfolio manager at Mirae

Asset Global Investments in Hong Kong. He said his firm has rotated

into cyclical financial names, such as insurers, and defensive

plays, such as utility companies.

Ken Peng, head of Asia-Pacific investment strategy at Citi

Private Bank, said that as the world gradually recovers from the

coronavirus pandemic, technology stocks could fall out of favor

with investors. "There's going to be less demand for tech," he

said, "and more demand for leaving your house."

Many individual investors suffered losses in the swift selloff.

Huang Xiaohu, a 35-year-old technology entrepreneur in Shenzhen,

earlier on profited from the strong trading debut of Kuaishou

Technology, an operator of a popular short video app in China.

After selling shares he received in the company's initial public

offering, he decided to buy them back following a recent tumble,

but the shares kept falling, and he is sitting on paper losses

equivalent to more than $10,000.

"I don't want to talk about stocks anymore. My heart is broken,"

said Mr. Huang, who also holds the Hong Kong-listed shares of

Alibaba, with a paper loss of around 20%. He said he plans to keep

both stocks in the hope of a recovery.

Write to Xie Yu at Yu.Xie@wsj.com and Joanne Chiu at

joanne.chiu@wsj.com

(END) Dow Jones Newswires

March 09, 2021 06:28 ET (11:28 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

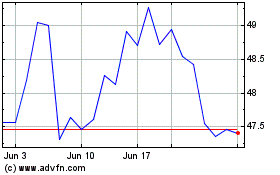

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

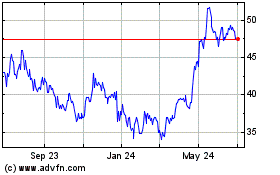

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024