By Rhiannon Hoyle

SYDNEY-- BHP Billiton Ltd. announced its largest-ever write-down

Friday, a roughly US$7.2 billion pretax charge against its U.S.

onshore energy assets as the downturn in global commodity prices

bites deeper into industry profits.

Free-falling oil prices are the latest headache for the global

mining giant, which is already grappling with a dam burst at a

Brazilian mining venture and a collapse in prices for iron ore, the

focus of its biggest division. The company's shares have plunged

16% in the early days of 2016.

The write-down against the energy unit surpasses US$5.5 billion

of charges reported in 2013 across several assets, previously its

biggest impairment on record. It also adds to a series of

write-downs against that business, including a pretax charge of

US$2.8 billion last year, and another of similar size in 2012.

BHP isn't alone. Resources giants around the world have written

down the value of assets amid the sharp downturn in markets.

This week, Sherritt International Corp. of Canada said it

expects a write down of US$2.4 billion against a nickel project in

Madagascar it owns with Japanese trading company Sumitomo Corp. and

state-run Korea Resources Corp.

Some of the world's biggest oil companies, including Royal Dutch

Shell PLC, have also been writing down the value of assets as

prices slump.

BHP plowed about $20 billion into U.S. shale-gas businesses in

2011, and has since spent billions a year exploring and developing

assets to become one of the biggest petroleum producers outside of

the large integrated oil companies such as Shell and Exxon Mobil

Corp. Chief Executive Andrew Mackenzie designated oil and gas as

one of "four pillars" of BHP's business, alongside iron ore, copper

and coal.

Investors previously rewarded BHP for having big operations in a

range of commodities including energy -- a strategy designed to

insulate the company from different price cycles. But it has now

come under pressure as prices have tumbled across the board.

For investors, the latest write-down wasn't unexpected, although

its scale caught some off guard.

"A US$7.2-billion write-down is huge in anyone's book, even a

company the size of BHP," said Angus Nicholson, a Melbourne-based

analyst at broker IG.

Still, many fund managers argue the charge, described as

disappointing by Mr. Mackenzie, takes second billing to something

much more important to investors: the dividend outlook.

In August BHP recorded its worst annual profit result since

2003. It has since been beset with problems following a major dam

burst in November at a mine operated by Samarco Mineracao SA, a

50-50 joint venture with Brazil's Vale SA.

Prices of key commodities such as iron ore and copper have

fallen to their lowest in as much as a decade amid a global

oversupply as concerns about China's economy have increased.

BHP's share price has plunged by 40% over the past three months,

and it is now under pressure to cut its dividend to shore up its

balance sheet.

"BHP is being penalized by investors for the uncertainty over

its dividend policy," said Pengana Capital fund manager Ric Ronge,

calling it a "more pressing issue that management has to

address."

"Its dividend payout isn't really reflecting its earning

ability," he said.

Barclays forecasts the miner will be forced to cut investor

payouts by half.

BHP said Friday's write-down, which would total about $4.9

billion after taxes, reflects downgraded projections for energy

prices and revisions to its development plans, "which have more

than offset substantial productivity improvements."

It said its investment plans for the U.S. onshore business for

the rest of the fiscal year through June are under review, with the

focus is on preserving cash flow.

Meanwhile, the company will this quarter cut the number of rigs

it operates in the business to five from seven, retaining three in

the Black Hawk field in the southern Texas Eagle Ford region, and

two in the nearby Permian Basin.

Oil prices this week slipped below $30 a barrel for the first

time in more than 10 years. The sharp downturn from above US$100 as

recently as 2014 has been greased by a global glut of crude. U.S.

inventories of crude and refined products rose modestly to stay

near highs not seen this time of year in at least eight decades,

the U.S. Energy Information Administration said.

The market also anticipates an increase of Iranian oil exports

as international sanctions against Tehran's nuclear program are

lifted. This would add to the persistent oversupply of crude around

the globe, analysts say.

Morgan Stanley recently called the energy-pricing environment

"worse than 1986," the last big oil bust that lasted for years.

American oil-and-gas producers are projected to slash their budgets

by 51% to US$89.6 billion from 2014, a cut that exceeds the worst

years of the 1980s, according to Cowen Co.

"Oil and gas markets have been significantly weaker than the

industry expected," Mr. Mackenzie said.

BHP said the write-down would reduce the net value of its

onshore U.S. operating assets to about $16 billion.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

January 15, 2016 02:33 ET (07:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

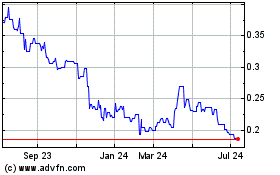

Sherritt (PK) (USOTC:SHERF)

Historical Stock Chart

From Mar 2024 to Apr 2024

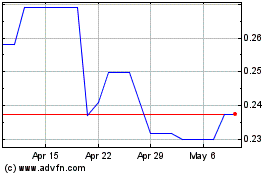

Sherritt (PK) (USOTC:SHERF)

Historical Stock Chart

From Apr 2023 to Apr 2024