Nestle Sales Rise on Higher U.S. Prices, Petcare -- Update

April 18 2019 - 4:22AM

Dow Jones News

By Brian Blackstone and Anthony Shevlin

ZURICH-- Nestlé SA saw a pickup in North American sales led by

price increases and pet care, as the Swiss consumer goods giant

posted first-quarter growth that exceeded analysts'

expectations.

Nestlé said sales for the period were 22.18 billion Swiss francs

($21.98 billion) compared with 21.26 billion francs in the first

quarter of 2018. On an organic basis, sales rose 3.4%, above the

2.8% gain analysts had expected, according to estimates compiled by

the company.

The results were "at least modestly positive," said Jefferies'

analyst Martin Deboo. Nestlé shares were up 1.3% in early trading

Thursday.

Organic sales in the Americas rose 3.4% in the first quarter to

7.51 billion francs, Nestlé said, up from last year's growth rate

of 2%. The gain was driven by a "significant" improvement in

pricing in the U.S., its biggest market, and Brazil. Prices across

regions increased 1.2% in the first quarter.

The sales boost puts Nestlé on track to achieve its goal of

reaching sales growth rates in the mid to single digits by 2020.

Two years ago, the company abandoned its longstanding organic

growth target of 5% to 6% after Chief Executive Mark Schneider took

the helm at the start of 2017. It has a huge portfolio of products,

ranging from Maggi noodles to Purina pet food and DiGiorno frozen

pizza.

The early months of 2019 saw a pause in Nestlé's acquisitions

and divestments after an active 2018 when the company sold its U.S.

confectionery business to Italian candy maker Ferrero International

SA and purchased the rights to offer Starbucks Corp.'s coffee and

tea products in grocery and retail stores for more than $7 billion.

Nestlé said it launched 24 coffee products under the Starbucks

brand during the first quarter.

The company said its portfolio management is "fully on track"

with the strategic reviews of its skin-health and Herta cold-cuts

businesses to be completed by mid and late 2019, respectively.

Nestlé confirmed its guidance for the year, with continued

improvement in organic sales growth and underlying trading

operating profit margin.

The company expects underlying earnings per share at constant

currency rates and capital efficiency to increase as part of its

2020 targets.

The company's waters division was one weak spot with organic

growth of just 2% last quarter. Sales in Europe were down due to

weakness in the U.K. and Germany.

Nestlé "needs to find a solution here," said Mr. Deboo.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

April 18, 2019 04:07 ET (08:07 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

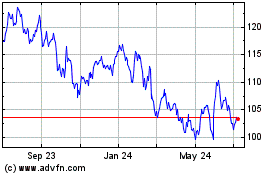

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024