UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-12G/A

(Amendment No. 1)

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of

1934

LIVE CURRENT MEDIA INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

88-0346310

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

1130 Pender Street – Suite 820

|

|

|

Vancouver, BC Canada

|

V6E 4A4

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(604) 648-0500

Registrant’s telephone number

Securities to be registered under Section 12(b) of the Exchange

Act:

|

Title of each class to be so registered

|

Name of exchange on which each class is to be

registered.

|

|

NONE.

|

N/A

|

Securities to be registered under Section 12(g) of the Exchange

Act:

Common Stock, $0.001 par value

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

|

(Do not check if a smaller reporting company)

|

|

EXPLANATORY NOTE

This Amendment No. 1 to Live Current Media Inc.’s (the

“Company”) Registration Statement on Form 10 filed on February 1, 2018 (the

“Registration Statement”) is being filed for the purpose of including the

Company’s audited financial statements for the years ended December 31, 2016 and

December 31, 2015 and the Company’s unaudited financial statements for the

interim periods ended September 30, 2017 and September 30, 2016. Other than as

set forth in this Amendment No. 1, the information contained in the Registration

Statement filed on February 1, 2018 remains unchanged.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

1.

|

Audited financial statements for the fiscal

years ended December 31, 2016, including:

|

|

|

|

|

(a)

|

Report of Independent Registered Accounting

Firm;

|

|

|

|

|

(b)

|

Consolidated Balance Sheet for the years ended

December 31, 2015 and 2016;

|

|

|

|

|

(c)

|

Consolidated Statements of Operations for the

years ended December 31, 2015 and 2016;

|

|

|

|

|

(d)

|

Consolidated Statements of Cash Flows for the

years ended December 31, 2015 and 2016;

|

|

|

|

|

(e)

|

Consolidated Statements of Stockholders’

Equity; and

|

|

|

|

|

(f)

|

Notes to the Financial Statements.

|

|

|

|

|

2.

|

Unaudited financial statements for the Nine

Month Period Ended September 30, 2017, including:

|

|

|

|

|

(a)

|

Consolidated Balance Sheet for the Nine Month

Period Ended September 30, 2017;

|

|

|

|

|

(b)

|

Consolidated Statements of Operations for the

Nine Month Period Ended September 30, 2017 and 2016;

|

|

|

|

|

(c)

|

Consolidated Statements of Cash Flows for the

Nine Month Period Ended September 30, 2017 and 2016;

|

|

|

|

|

(d)

|

Consolidated Statements of Stockholders’

Equity; and

|

|

|

|

|

(e)

|

Notes to the financial Statements

|

LIVE CURRENT MEDIA INC.

CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2016

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Live Current

Media Inc.

We have audited the accompanying consolidated balance sheets of

Live Current Media Inc. as of December 31, 2016 and 2015, and the related

consolidated statements of operations, cash flows and stockholders’ equity for

the years then ended. These financial statements are the responsibility of the

Company's management. Our responsibility is to express an opinion on these

financial statements based on our audits.

We conducted our audits in accordance with the standards of the

Public Company Accounting Oversight Board (United States). Those standards

require that we plan and perform an audit to obtain reasonable assurance whether

the financial statements are free of material misstatement. The Company is not

required to have, nor were we engaged to perform, an audit of its internal

control over financial reporting. Our audits included consideration of internal

control over financial reporting as a basis for designing audit procedures that

are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company’s internal control over financial

reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements. An audit also includes assessing the accounting

principles used and significant estimates made by management, as well as

evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our opinion, these financial statements present fairly, in

all material respects, the financial position of Live Current Media Inc. as of

December 31, 2016 and 2015, and the results of its operations and its cash flows

for the years then ended in conformity with accounting principles generally

accepted in the United States of America.

The accompanying financial statements have been prepared

assuming that the Company will continue as a going concern. As discussed in Note

1 to the financial statements, the Company has incurred recurring losses and

further losses are anticipated. These factors raise substantial doubt about the

Company’s ability to continue as a going concern. Management’s plans in this

regard are described in Note 1. The financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

/s/ DMCL LLP

DALE MATHESON CARR-HILTON LABONTE LLP

CHARTERED PROFESSIONAL

ACCOUNTANTS

Vancouver, Canada

November 29, 2017

F-2

|

LIVE CURRENT MEDIA INC

.

|

|

`CONSOLIDATED BALANCE SHEETS

|

|

(expressed in

US dollars)

|

|

|

|

December 31,

|

|

|

December

31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash

|

$

|

1,149,555

|

|

$

|

1,650,303

|

|

|

Receivable

|

|

5,435

|

|

|

5,322

|

|

|

Prepaid expenses

|

|

-

|

|

|

18,799

|

|

|

|

|

1,154,990

|

|

|

1,674,424

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

Intangible

assets

|

|

304,885

|

|

|

335,083

|

|

|

|

$

|

1,459,875

|

|

$

|

2,009,507

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

Accounts payable

|

$

|

436,038

|

|

$

|

566,103

|

|

|

Due to

shareholders of Auctomatic

|

|

17,029

|

|

|

16,822

|

|

|

|

|

453,067

|

|

|

582,925

|

|

|

Stockholders' equity

|

|

|

|

|

|

|

|

Capital stock

|

|

|

|

|

|

|

Authorized:

500,000,000 common shares, par value $0.001 per

share

Issued

and

outstanding:

34,837,625 common shares (37,860,500 at December 31, 2015)

|

|

34,838

|

|

|

37,861

|

|

|

Additional paid in capital

|

|

18,257,563

|

|

|

18,254,540

|

|

|

Accumulated

deficit

|

|

(17,285,593

|

)

|

|

(16,865,819

|

)

|

|

|

|

1,006,808

|

|

|

1,426,582

|

|

|

|

$

|

1,459,875

|

|

$

|

2,009,507

|

|

The accompanying notes are an integral part of these

consolidated financial statements

F-3

|

LIVE CURRENT MEDIA INC.

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(expressed in

US dollars)

|

|

|

|

For the years ended

|

|

|

|

|

December

31,

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

General and administrative

expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and

administrative

|

$

|

76,956

|

|

$

|

43,024

|

|

|

Professional fees

|

|

325,065

|

|

|

320,532

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

(402,021

|

)

|

|

(363,556

|

)

|

|

|

|

|

|

|

|

|

|

Gain on sale of domain names

|

|

206,764

|

|

|

5,000

|

|

|

Litigation

settlement

|

|

(225,000

|

)

|

|

-

|

|

|

Interest Income

|

|

1,396

|

|

|

1,779

|

|

|

Interest expense

|

|

(207

|

)

|

|

(207

|

)

|

|

Other income

|

|

112

|

|

|

10,438

|

|

|

Foreign exchange

|

|

(818

|

)

|

|

5,402

|

|

|

|

|

(17,753

|

)

|

|

(22,412

|

)

|

|

|

|

|

|

|

|

|

|

Net loss for the year

|

$

|

(419,774

|

)

|

$

|

(341,144

|

)

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share

|

$

|

(0.01

|

)

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic common

shares outstanding

|

|

37,164,825

|

|

|

37,860,500

|

|

The accompanying notes are an integral part of these

consolidated financial statements

F-4

|

LIVE CURRENT MEDIA INC.

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(expressed in

US dollars)

|

|

|

|

For the years ended

|

|

|

|

|

December 31, 2016

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

Cash flows used in operating

activities

|

|

|

|

|

|

|

|

Net loss for the year

|

$

|

(419,774

|

)

|

$

|

(341,144

|

)

|

|

Non-cash

items

|

|

|

|

|

|

|

|

Gain on

sale of domain names

|

|

(206,764

|

)

|

|

(5,000

|

)

|

|

Accrued interest

|

|

207

|

|

|

207

|

|

|

Changes in non-cash working capital items

|

|

|

|

|

|

|

|

Receivable

|

|

(113

|

)

|

|

(1,985

|

)

|

|

Prepaid

expenses

|

|

18,799

|

|

|

2,271

|

|

|

Accounts payable and accrued liabilities

|

|

(130,065

|

)

|

|

84,830

|

|

|

Cash used in operating activities

|

|

(737,710

|

)

|

|

(260,821

|

)

|

|

|

|

|

|

|

|

|

|

Cash flows used in investing activities

|

|

|

|

|

|

|

|

Proceeds

from the disposition of domain names

|

|

236,962

|

|

|

5,000

|

|

|

Cash provided by investing activities

|

|

236,962

|

|

|

5,000

|

|

|

|

|

|

|

|

|

|

|

Change in cash

|

|

(500,748

|

)

|

|

(255,821

|

)

|

|

Cash, beginning of year

|

|

1,650,303

|

|

|

1,906,124

|

|

|

Cash, end of year

|

$

|

1,149,555

|

|

$

|

1,650,303

|

|

The accompanying notes are an integral part of these

consolidated financial statements

F-5

|

LIVE CURRENT MEDIA INC.

|

|

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

|

|

(expressed in

US dollars)

|

|

|

|

Common Stock

|

|

|

Additional

|

|

|

|

|

|

Total

|

|

|

|

|

Number

|

|

|

|

|

|

Paid In

|

|

|

Accumulated

|

|

|

Stockholders'

|

|

|

|

|

of Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Equity

|

|

|

Balance, December 31, 2014

|

|

37,860,500

|

|

$

|

37,861

|

|

$

|

18,254,540

|

|

$

|

(16,524,675

|

)

|

$

|

1,767,726

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(341,144

|

)

|

|

(341,144

|

)

|

|

Balance, December 31, 2015

|

|

37,860,500

|

|

|

37,861

|

|

|

18,254,540

|

|

|

(16,865,819

|

)

|

|

1,426,582

|

|

|

Cancellation of common shares

|

|

(3,022,875

|

)

|

|

(3,023

|

)

|

|

3,023

|

|

|

-

|

|

|

-

|

|

|

Net loss for the year

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(419,774

|

)

|

|

(419,774

|

)

|

|

Balance, December 31, 2016

|

|

34,837,625

|

|

$

|

34,838

|

|

$

|

18,257,563

|

|

$

|

(17,285,593

|

)

|

$

|

1,006,808

|

|

The

accompanying

notes are an

integral

part of these

consolidated

financial

statements

F-6

|

LIVE

CURREN T

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

1.

|

NATURE AND CONTINUANCE OF

OPERATIONS

|

Live Current Media Inc. (the “Company” or “Live Current”) was

incorporated under the laws of the State of Nevada on October 10, 1995 under the

name “Troyden Corporation” and changed its name on August 21, 2000 from Troyden

Corporation to “Communicate.com Inc.”. On May 30, 2008, the Company changed its

name from Communicate.com Inc. to Live Current Media Inc. after obtaining the

shareholders’ approval to do so at the annual general meeting in May 2008.

The Company’s wholly owned principal operating subsidiary,

Domain Holdings Inc. (“DHI”), was incorporated under the laws of British

Columbia on July 4, 1994 under the name “IMEDIAT Digital Creations Inc.”. On

April 14, 1999, IMEDIAT Digital Creations, Inc. changed its name to

“Communicate.com Inc.” and was re-domiciled from British Columbia to the

jurisdiction of Alberta. On April 5, 2002, Communicate.com Inc. changed its name

to Domain Holdings Inc.

On March 13, 2008, the Company incorporated a wholly owned

subsidiary in the state of Delaware, Communicate.com Delaware, Inc. On April 21,

2010, the Company changed the name of Communicate.com Delaware, Inc. to

Perfume.com Inc. (Perfume Inc.).

Through DHI, the Company builds consumer Internet experiences

around its portfolio of domain names. DHI’s current business strategy is to

develop, or to seek partners to develop, its domain names to include content,

commerce and community applications.

On June 4, 2014, a judge in Reno, Nevada ordered a receiver to

take charge of the Company’s business. On May 4, 2017 the court in Washoe County

Nevada discharged the company from receivership.

The accompanying financial statements have been prepared

assuming the Company will continue as a going concern. As of December 31, 2016,

the Company has not achieved profitable operations, has incurred recurring

losses in developing its business, and further losses are anticipated. The

Company has an accumulated deficit of $17,285,593. The Company’s ability to

continue as a going concern is dependent upon its ability to obtain the

necessary financing to further develop its business. To date, the Company has

funded operations through the issuance of capital stock and debt. Management

plans to continue raising additional funds through equity or debt financings and

loans from directors. There is no certainty that further funding will be

available as needed. These factors raise substantial doubt about the ability of

the Company to continue operating as a going concern. The ability of the Company

to continue its operations as a going concern is dependent upon its ability to

raise sufficient new capital to fund its operating commitments and ongoing

losses and ultimately on generating profitable operations. The financial

statements do not include any adjustments to be recorded to assets or

liabilities that might be necessary should the Company be unable to continue as

a going concern.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

|

These consolidated financial statements and related notes are

presented in accordance with accounting principles generally accepted in the

United States (“US GAAP’), and are expressed in United States dollars.

Basis of Presentation

These consolidated financial statements include the accounts of

the Company and its subsidiaries. All significant intercompany balances have

been eliminated on consolidation.

F-7

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

|

Use of Estimates

The preparation of financial statements in conformity with US

GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. The Company regularly

evaluates estimates and assumptions. The Company bases its estimates and

assumptions on current facts, historical experience and various other factors it

believes to be reasonable under the circumstances, the results of which form the

basis for making judgments about the carrying values of assets and liabilities

and the accrual of costs and expenses that are not readily apparent from other

sources. The actual results experienced by the Company may differ materially and

adversely from the Company’s estimates. To the extent there are material

differences between the estimates and the actual results, future results of

operations will be affected.

Cash and cash equivalents

All highly liquid investments, with an original term to

maturity of three months or less are classified as cash and cash equivalents.

Cash and cash equivalents are stated at cost which approximates market value.

Intangible Assets not subject to amortization

Intangible assets not subject to amortization consist of direct

navigation domain names. While the domain names are renewed annually, through

payment of a renewal fee to the applicable registry, the Company has the

exclusive right to renew these names at its option. The Company has determined

that there are currently no legal, regulatory, contractual, economic or other

factors that limit the useful life of these domain names on an aggregate basis

and accordingly treat the portfolio of domain names as indefinite life

intangible assets.

The Company reviews individual domain names in the portfolio

for potential impairment throughout the fiscal year in determining whether a

particular URL should be renewed. Impairment is recognized for names that are

not renewed. The Company performs an annual assessment of the portfolio of

domain names on an aggregate basis to determine whether it is more likely than

not that the fair market value of the portfolio of domain names was less than

the carrying amount. When it is determined that the fair value of the portfolio

is less than the carrying amount, impairment is recognized

Foreign Currency Translation

The Company’s functional currency is the US dollar and

reporting currency is the United States dollar. The Company translates assets

and liabilities to US dollars using year-end exchange rates, stockholders’

deficit accounts are translated at historical exchange rates, and translates

revenues and expenses using average exchange rates during the period. Gains and

losses arising on settlement of foreign currency denominated transactions or

balances are included in the Statement of Operations.

F-8

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

|

Income taxes

The Company follows the liability method of accounting for

income taxes. Under this method, current income taxes are recognized for the

estimated income taxes payable for the current year. Deferred income tax assets

and liabilities are recognized in the current year for temporary differences

between the tax and accounting basis of assets and liabilities as well as for

the benefit of losses available to be carried forward to future years for tax

purposes. Deferred income tax assets and liabilities are measured using tax

rates and laws expected to apply in the years in which those temporary

differences are expected to be recovered or settled. The effect of a change in

tax rates on deferred income tax assets and liabilities is recognized in

operations in the year of change. A valuation allowance is recorded when it is

“more likely-than-not” that a deferred tax asset will not be realized. Deferred

tax assets and deferred tax liabilities, along with any associated valuation

allowance, are offset and shown in the financial statements as a single

noncurrent amount when these items arise within the same tax jurisdiction.

The Company and its subsidiaries are subject to U.S. federal

income tax and Canadian income tax, as well as income tax of multiple state and

local jurisdictions. Based on the Company’s evaluation, the Company has

concluded that there are no significant uncertain tax positions requiring

recognition in the Company’s financial statements.

Share Based Payments

The Company accounts for all stock-based payments and awards

under the fair value based method. The Company accounts for the granting of

stock options to employees using the fair value method whereby all awards to

employees will be measured at fair value on the date of the grant. The fair

value of all stock options are expensed over their vesting period with a

corresponding increase to additional paid-in capital. Upon exercise of stock

options, the consideration paid by the option holder, together with the amount

previously recognized in additional paid-in capital is recorded as an increase

to share capital. Stock options granted to employees are accounted for as

liabilities when they contain conditions or other features that are indexed to

other than a market, performance or service condition. Stock-based payments to

non-employees are measured at the fair value of the consideration received, or

the fair value of the equity instruments issued, or liabilities incurred,

whichever is more reliably measurable. The fair value of stock-based payments to

non-employees is periodically re-measured until the counterparty performance is

complete, and any change therein is recognized over the vesting period of the

award and in the same manner as if the Company had paid cash instead of paying

with or using equity based instruments. The fair value of the stock-based

payments to non-employees that are fully vested and non-forfeitable as at the

grant date are measured and recognized at that date.

Forfeitures are estimated at the time of grant and revised, if

necessary, in subsequent periods if actual forfeitures differ from those

estimates. The Company assesses forfeiture rates for each class of grantees;

executive management and directors, corporate directors, and general staff

members. Executive management and directors are relatively few in number and

turnover is considered remote, therefore the Company estimates forfeitures for

this class of grantees to be 10%. Corporate directors are high level senior

staff members with a forfeiture rate of 25% and general staff members have a

higher forfeiture rate due to higher average turnover rates at 35%. Estimate of

forfeitures is reviewed on an annual basis. Stock-based compensation is expensed

on a straight-line basis over the requisite service period.

The Company uses the Black-Scholes option pricing model to

calculate the fair value of stock options. The use of the Black-Scholes option

pricing model requires management to make assumptions with respect to the

expected term of the option, the expected volatility of the common stock

consistent with the expected term of the option, risk-free interest rates, the

value of the common stock and expected dividend yield of the common stock.

Changes in these assumptions can materially affect the fair value estimate.

F-9

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

|

Fair Value of Financial Instruments

The estimated fair values for financial instruments are

determined based on relevant market information. These estimates involve

uncertainties and cannot be determined with precision. The estimated fair value

of cash, receivable, accounts payable and amounts due to shareholders of

Auctomatic approximate their carrying value due to the short-term nature of

those instruments.

ASC 820 establishes a fair value hierarchy based on the level

of independent, objective evidence surrounding the inputs used to measure fair

value. A financial instrument’s categorization within the fair value hierarchy

is based upon the lowest level of input that is significant to the fair value

measurement. ASC 820 prioritizes the inputs into three levels that may be used

to measure fair value:

Level 1 – Quoted prices in active markets for identical assets

or liabilities;

Level 2 – Inputs other than quoted prices included within Level

1 that are either directly or indirectly observable; and

Level 3 – Unobservable inputs that are supported by little or

no market activity, there for requiring an entity to develop its own assumptions

about the assumption that market participants would use in pricing.

The Company had no Level 3 assets or liabilities required to be

recorded at fair value on a recurring basis in accordance with US GAAP as at

December 31, 2016 and 2015.

Basic and Diluted Income (Loss) per Share

Earnings or loss per share (“EPS”) is computed by dividing net

income (loss) available to common stockholders by the weighted average number of

common shares outstanding for the period. Diluted EPS is computed by dividing

net income (loss) by the weighted-average of all potentially dilutive shares of

the common stock that were outstanding during the years presented. The treasury

stock method is used in calculating diluted EPS for potentially dilutive stock

options and share purchase warrants, which assumes that any proceeds received

from the exercise of in-the-money stock options and share purchase warrants,

would be used to purchase common shares at the average market price for the

period.

Recent Accounting Pronouncements

In August 2014, the FASB issued ASU 2014-15,

Presentation of

Financial Statements - Going Concern (Subtopic 205-40): Disclosure of

Uncertainties about an Entity’s Ability to Continue as a Going Concern

,

which is intended to define management’s responsibility to evaluate whether

there is substantial doubt about an organization’s ability to continue as a

going concern within one year after the date that the financial statements are

issued (or within one year after the date that the financial statements are

available to be issued when applicable) and to provide related footnote

disclosures. The ASU provides guidance to an organization’s management, with

principles and definitions that are intended to reduce diversity in the timing

and content of disclosures that are commonly provided by organizations today in

the financial statement footnotes. The ASU is effective for annual periods

ending after December 15, 2016, and interim periods within annual periods

beginning after December 15, 2016, which for the Company is April 1, 2017. Early

adoption is permitted. The adoption of this standard did not have a material

impact on the Company’s financial position or results of operations.

F-10

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

|

Recent Accounting Pronouncements

(continued)

In August 2016, the FASB issued ASU No. 2016-15,

Statement

of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash

Payments.

This ASU is effective for annual periods beginning after December

15, 2018 and interim periods within fiscal years beginning after December 15,

2019. ASU No 2016-15 addresses eight specific cash flow issues with the

objective of reducing the existing diversity in practice. The adoption of this

standard will not have a material impact on the Company’s financial position or

results of operations.

Other recent accounting pronouncements issued by the FASB

(including its Emerging Issues Task Force), the American Institute of Certified

Public Accountants, and the SEC did not, or are not believed by management to,

have a material impact on the Company's present or future financial position,

results of operations or cash flows.

|

3.

|

DUE TO SHAREHOLDERS OF

AUCTOMATIC

|

The Company acquired Entity, Inc., commonly referred to as

“Auctomatic”, on May 22, 2008, through an agreement and plan of merger dated

March 25, 2008. The consideration for the acquisition was $2 million cash (minus

assumed liabilities of $152,305) and 1,000,007 shares of the Company’s common

stock at a deemed price of $3 per share, all payable pro rata to the eighteen

Auctomatic shareholders in stages:

|

|

•

|

$1,046,695 on closing (paid)

|

|

|

•

|

340,001 shares on closing (issued)

|

|

|

•

|

$800,000 on May 22, 2009

|

|

|

•

|

246,402 shares, issued at closing but distributable

one-third at a time on each of May 22, 2009, 2010 and 2011 (issued)

|

|

|

•

|

413,604 shares issuable pro rata to the three Auctomatic

founders one-third at a time on each of May 22, 2009, 2010 and 2011

subject to their being employed on the payment date

|

There were 91,912 shares were issued pro rata to the two

founders who were employed on May 22, 2009. One of the Auctomatic founders

resigned during the first quarter of 2009 and forfeited his right to 137,868

founders’ shares. The remaining two founders terminated their employment by

agreement in August 2009 and forfeited their rights to the total of 183,824

shares of the Company’s common stock that were due to be issued to them in each

of May 2010 and 2011.

The payment terms for the cash consideration payable on May 22,

2009, were renegotiated in 2009 and again in 2010 resulting in promissory notes

being issued to twelve of the eighteen Auctomatic shareholders: five of the

notes (Convertible Notes to Shareholders of Auctomatic) were convertible to

shares of the Company’s common stock and bore interest at the rate of 10% per

annum; seven of the notes (Non-Convertible Notes to Shareholders of Auctomatic)

were not convertible and bore interest at the rate of 8% per annum. The six

Auctomatic shareholders who opted not to participate in the Non-Convertible and

Convertible share offer continued to hold debt in the Company payable on May 22,

2009 with no interest accruing (see Due to Shareholders of Auctomatic below).

During the first quarter of 2013 the Company and most of the

Auctomatic note and debt holders agreed to settle the outstanding debt. The

Company paid $172,844 to settle debt of $508,006, which included principal and

interest, resulting in a gain on the settlement of debt in the amount of

$335,162.

F-11

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

3.

|

DUE TO SHAREHOLDERS OF AUCTOMATIC

(continued)

|

The breakdown of the amounts due to the Shareholders of

Auctomatic at December 31, 2016 follows below:

|

Due to shareholders’

of Auctomatic, December 31, 2016 and 2015

|

$

|

13,193

|

|

|

Non-convertible notes payable to

shareholders of Auctomatic:

|

|

|

|

|

Balance, December 31, 2014

|

|

3,422

|

|

|

Accrued interest

|

|

207

|

|

|

Balance, December 31, 2015

|

|

3,629

|

|

|

Accrued interest

|

|

207

|

|

|

Balance, December 31, 2016

|

|

3,836

|

|

|

|

$

|

17,029

|

|

The Company was involved in a number of law suits involving its

former CEO, C. Geoffrey Hampson as described below:

|

|

•

|

On May 14, 2010, David Jeffs and Richard Jeffs

(plaintiffs) filed a complaint in the Circuit Court of Cook County,

Illinois, County Department, Chancery Division in which they, derivatively

on behalf of the Company, sued C. Geoffrey Hampson, James Taylor, Mark

Benham and Boris Wertz (defendants) and Live Current (nominal defendant).

On October 22, 2010, the Company took over as plaintiff in the complaint.

The Company alleges, among other matters, that (i) the defendant members

of the board of directors breached their fiduciary duties of loyalty,

trust, good faith and due care by failing to properly supervise Mr.

Hampson, and (ii) that Mr. Hampson breached his fiduciary duties and his

employment agreement and defrauded the Company by failing to devote the

time necessary to manage the Company’s business and failing to disclose to

the board of directors his activities relating to other businesses. The

Company sought compensatory damages of no less than $50,000,000, punitive

damages, and attorney’s fees and other costs of bringing the action. The

complaint against Messrs. Hampson, Taylor, Benham and Wertz was stayed in

Illinois pending the outcome of arbitration, detailed below, commenced by

C. Geoffrey Hampson against the Company on January 28, 2011 in British

Columbia. The May 14, 2010 complaint filed in Illinois was stayed pending

the conclusion of the arbitration.

|

|

|

|

|

|

|

•

|

On January 26, 2011, C. Geoffrey Hampson, the Company’s

former CEO, filed a third-party complaint in the Circuit Court of Cook

County, Illinois, against Live Current. The claim sought indemnification

to cover the costs for the former CEO for his costs of defending a

defamation suit filed against him during his time as CEO of the Company.

|

|

|

|

|

|

|

•

|

On January 28, 2011, C. Geoffrey Hampson initiated

arbitration in British Columbia seeking severance pay and expenses of

$300,698. The claim is subject to arbitration as set out in his employment

agreement.

|

|

|

|

|

|

|

•

|

On June 18, 2013, , the Company, David Jeffs, Messrs.

Geoffrey and Christopher Hampson and Hampson Equities agreed to a global

binding arbitration to take place in Las Vegas, Nevada to resolve all of

the outstanding lawsuits and arbitration involved in the dispute. The

arbitration took place in October of 2013.

|

|

|

|

|

|

|

•

|

On June 4, 2014, the arbitrator delivered his findings.

As a result of the arbitration, C. Geoffrey Hampson was ordered to repay

the Company $297,747 and the arbitrator ordered a receiver to be put in

charge of the assets of the Company to determine whether or not the

Company should be dissolved

|

F-12

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

4.

|

CONTINGENCIES

(continued)

|

|

|

•

|

On February 16, 2016, the appointed receiver of the

Company negotiated a final settlement and mutual release with C. Geoffrey

Hampson in which the Company agreed to pay a sum of $225,000 in full and

final settlement of the disputes between C. Geoffrey Hampson and the

Company. The release absolutely and unconditionally releases, acquits and

forever discharges the Company, from any and all claims for relief,

actions, suits, damages, debts, liabilities, judgments, executions and

other claims of every kind and nature whatsoever.

|

On March 9, 2000, a former chief executive officer of DHI

commenced a legal action against DHI for wrongful dismissal and breach of

contract. He is seeking, at a minimum, 18.39% of the outstanding shares of DHI,

specific performance of his contract, special damages of approximately $30,000,

aggravated and punitive damages, interest and costs. On June 1, 2000, DHI filed

a defense and counterclaim claiming damages and special damages for breach of

fiduciary duty and breach of his employment contract. The plaintiff has taken no

further action.

On August 10, 2016, in connection with the settlement reached

with the Company’s former CEO (Note 4), there were 3,022,875 common shares

returned to treasury and subsequently cancelled.

The Company used the par value method to record this share

cancellation whereby the par value of the shares cancelled totaling $3,023 was

deducted from share capital with a corresponding increase in additional paid-up

capital.

Stock options

The board of directors and stockholders approved the 2007 Stock

Incentive Plan and adopted it on August 21, 2007 (the “Plan”). The Company has

reserved 5,000,000 shares of its common stock for issuance to directors,

employees and consultants under the Plan. The Plan is administered by the board

of directors. Vesting terms of the options range from the date on which the

options are granted to five years from the date of grant; and no options can be

exercisable for a period of more than ten years.

At December 31, 2016, no options are outstanding (December 31,

2015 – no options outstanding).

The Company is subject to United States federal income taxes at

an approximate rate of 35%. The reconciliation of the provision for income taxes

at the United States federal statutory rate compared to the Company’s income tax

expense as reported is as follows

:

|

|

|

|

December

|

|

|

December

|

|

|

|

|

|

31, 2016

|

|

|

31, 2015

|

|

|

|

|

$

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

(419,774

|

)

|

|

(341,144

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Statutory tax rate

|

|

35%

|

|

|

35%

|

|

|

|

Expected recovery of income taxes computed at

statutory rates

|

|

(147,000

|

)

|

|

(119,000

|

)

|

|

|

Reconciliation of tax rates

and other

|

|

(19,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in valuation allowance

|

|

166,000

|

|

|

119,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

-

|

|

|

-

|

|

F-13

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

December

31,

2016

|

|

6.

|

INCOME TAXES (continued)

|

The significant components of deferred income tax assets at

December 31, 2016 and December 31, 2015 are as follows:

|

|

|

|

December

|

|

|

December

|

|

|

|

|

|

31, 2016

|

|

|

31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income tax

assets:

|

|

|

|

|

|

|

|

|

Net operating losses

|

|

2,647,000

|

|

|

2,481,000

|

|

|

|

Intangible assets

|

|

(79,000

|

)

|

|

(79,000

|

)

|

|

|

|

|

2,568,000

|

|

|

2,402,000

|

|

|

|

Valuation allowance

|

|

(2,568,000

|

)

|

|

(2,402,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income tax

assets, net

|

|

-

|

|

|

-

|

|

At December 31, 2016, the Company had accumulated non-capital

loss carry-forwards of approximately $7,700,000 that expire from 2025 through

2036.

The potential future tax benefits of these expenses and losses

carried-forward have not been reflected in these financial statements due to the

uncertainty regarding their ultimate realization.

Tax attributes are subject to review, and potential adjustment

by tax authorities.

On January 11, 2017, the court in Washoe County Nevada entered

an order terminating the receiver’s possession of assets of the Company

resulting in the operations of the Company being returned to the directors of

the company.

F-14

LIVE CURRENT MEDIA INC.

CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2017

(Unaudited)

F-15

LIVE

CURRENT

MEDIA

INC.

CONSOLIDATED

BALANCE

SHEETS

Expressed

In

U.S.

Dollars

|

|

|

September 30, 2017

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

December 31, 2016

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

861,279

|

|

$

|

1,149,555

|

|

|

Accounts receivable

|

|

5,435

|

|

|

5,435

|

|

|

Total current assets

|

|

866,714

|

|

|

1,154,990

|

|

|

|

|

|

|

|

|

|

|

Intangible assets

|

|

267,385

|

|

|

304,885

|

|

|

Total Assets

|

$

|

1,134,099

|

|

$

|

1,459,875

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

$

|

185,550

|

|

$

|

436,038

|

|

|

Due to shareholders of Auctomatic

|

|

17,184

|

|

|

17,029

|

|

|

Total current liabilities

|

|

202,734

|

|

|

453,067

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

Common stock

|

|

|

|

|

|

|

Authorized:

500,000,000 common shares, $0.001 par

value

Issued and

outstanding: 34,837,625 common shares (December 31, 2016–34,837,625)

|

|

34,838

|

|

|

34,838

|

|

|

Additional paid–in-capital

|

|

18,257,563

|

|

|

18,257,563

|

|

|

Accumulated deficit

|

|

(17,361,036

|

)

|

|

(17,285,593

|

)

|

|

|

|

931,365

|

|

|

1,006,808

|

|

|

Total Liabilities and Stockholders' Equity

|

$

|

1,134,099

|

|

$

|

1,459,875

|

|

See accompanying notes to consolidated financial

statements

F-16

LIVE

CURRENT

MEDIA

INC.

CONSOLIDATED

STATEMENTS

OF

OPERATIONS

Expressed

In

U.S.

Dollars

(Unaudited)

|

|

|

Three months

ended

|

|

|

Nine months

ended

|

|

|

|

|

September 30, 2017

|

|

|

September 30, 2016

|

|

|

September 30, 2017

|

|

|

September 30, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General

and administrative

|

$

|

17,813

|

|

$

|

15,108

|

|

$

|

70,816

|

|

$

|

29,539

|

|

|

Management fees

|

|

30,000

|

|

|

–

|

|

|

86,773

|

|

|

–

|

|

|

Professional fees

|

|

16,971

|

|

|

96,287

|

|

|

63,082

|

|

|

227,905

|

|

|

Loss

from Operations for the period

|

|

(64,784

|

)

|

|

(111,395

|

)

|

|

(220,671

|

)

|

|

(257,444

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of domain names

|

|

–

|

|

|

86,962

|

|

|

–

|

|

|

206,764

|

|

|

Litigation Settlement

|

|

–

|

|

|

–

|

|

|

–

|

|

|

(225,000

|

)

|

|

Impairment of intangible

assets

|

|

(37,500

|

)

|

|

–

|

|

|

(37,500

|

)

|

|

–

|

|

|

Gain on

debt retirement

|

|

–

|

|

|

–

|

|

|

182,236

|

|

|

–

|

|

|

Interest income

|

|

–

|

|

|

–

|

|

|

|

|

|

–

|

|

|

Interest

expense

|

|

(104

|

)

|

|

–

|

|

|

(155

|

)

|

|

–

|

|

|

Other Income

|

|

120

|

|

|

–

|

|

|

120

|

|

|

7,252

|

|

|

Foreign exchange

|

|

533

|

|

|

–

|

|

|

527

|

|

|

–

|

|

|

|

|

(36,951

|

)

|

|

86,962

|

|

|

145,228

|

|

|

(10,984

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss for the period

|

$

|

(101,735

|

)

|

$

|

(24,433

|

)

|

$

|

(75,443

|

)

|

$

|

(268,428

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net Income (loss) per share

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.00

|

)

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of common shares outstanding–basic and diluted

|

|

34,837,625

|

|

|

37,860,500

|

|

|

34,837,625

|

|

|

37,860,500

|

|

See accompanying notes to consolidated financial

statements

F-17

LIVE

CURRENT

MEDIA

INC.

CONSOLIDATED

STATEMENTS

OF

CASH

FLOWS

Expressed

In

U.S.

Dollars

(Unaudited)

|

|

|

Nine Months Ended

|

|

|

Nine Months Ended

|

|

|

|

|

September 30, 2017

|

|

|

September 30, 2016

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss for the

period

|

$

|

(75,443

|

)

|

$

|

(268,428

|

)

|

|

Non–cash

items included in net loss:

|

|

|

|

|

|

|

|

Impairment of intangible assets

|

|

37,500

|

|

|

–

|

|

|

Gain from sale of domain names

|

|

–

|

|

|

(206,764

|

)

|

|

Accrued interest expense

|

|

155

|

|

|

–

|

|

|

Change in

operating assets and liabilities:

|

|

|

|

|

|

|

|

Accounts

payable and accrued liabilities

|

|

(250,488

|

)

|

|

(262,518

|

)

|

|

Cash flows used in operating activities

|

|

(288,276

|

)

|

|

(737,710

|

)

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

Proceeds from

sale of domain names

|

|

–

|

|

|

236,962

|

|

|

Cash flows from investing activities

|

|

–

|

|

|

236,962

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in

cash and cash equivalents

|

|

(288,276

|

)

|

|

(500,748

|

)

|

|

|

|

|

|

|

|

|

|

Cash, beginning of period

|

|

1,149,555

|

|

|

1,650,303

|

|

|

Cash, end of period

|

$

|

861,279

|

|

$

|

1,149,555

|

|

See accompanying notes to consolidated financial

statements

F-18

LIVE CURRENT MEDIA INC.

CONSOLIDATED STATEMENTS OF

STOCKHOLDERS' EQUITY

Expressed In U.S. Dollars

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

Additional Paid–

|

|

|

Accumulated

|

|

|

Stockholders'

|

|

|

|

|

Common stock

|

|

|

in Capital

|

|

|

Deficit

|

|

|

Equity

|

|

|

Balance, December 31, 2015

|

|

37,860,500

|

|

$

|

37,861

|

|

$

|

18,254,540

|

|

$

|

(16,865,819

|

)

|

$

|

1,426,582

|

|

|

Settlement Share Return

|

|

(3,022,875

|

)

|

|

(3,023

|

)

|

|

3,023

|

|

|

–

|

|

|

–

|

|

|

Net loss for the year

|

|

–

|

|

|

–

|

|

|

–

|

|

|

(419,774

|

)

|

|

(419,774

|

)

|

|

Balance, December31, 2016

|

|

34,837,625

|

|

|

34,838

|

|

|

18,257,563

|

|

|

(17,285,593

|

)

|

|

1,006,808

|

|

|

Net loss for the period

|

|

–

|

|

|

–

|

|

|

–

|

|

|

(75,443

|

)

|

|

(75,443

|

)

|

|

Balance, September 30, 2017

|

|

34,837,625

|

|

$

|

34,838

|

|

$

|

18,257,563

|

|

$

|

(17,361,036

|

)

|

$

|

931,365

|

|

See

accompanying

notes to

consolidated

financial

statements

F-19

|

LIVE

CURRENT

MEDIA

INC.

|

|

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

|

|

September

30,

2017

|

|

Expressed

in

U.S.

Dollars

|

|

(unaudited)

|

|

1.

|

NATURE AND CONTINUANCE OF

OPERATIONS

|

Live Current Media Inc. (the “Company” or “Live Current”) was

incorporated under the laws of the State of Nevada on October 10, 1995. The

Company builds consumer Internet experiences around its portfolio of domain

names. DHI’s current business strategy is to develop, or to seek partners to

develop, its domain names to include content, commerce and community

applications.

The accompanying financial statements have been prepared

assuming the Company will continue as a going concern. As of September 30, 2017,

the Company has not achieved profitable operations, has incurred recurring

losses in developing its business, and further losses are anticipated. The

Company has an accumulated deficit of $17,361,036. The Company’s ability to

continue as a going concern is dependent upon its ability to obtain the

necessary financing to further develop its business. To date, the Company has

funded operations through the issuance of capital stock and debt. Management

plans to continue raising additional funds through equity or debt financings and

loans from directors. There is no certainty that further funding will be

available as needed. These factors raise substantial doubt about the ability of

the Company to continue operating as a going concern. The ability of the Company

to continue its operations as a going concern is dependent upon its ability to

raise sufficient new capital to fund its operating commitments and ongoing

losses and ultimately on generating profitable operations. The financial

statements do not include any adjustments to be recorded to assets or

liabilities that might be necessary should the Company be unable to continue as

a going concern.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

|

These consolidated financial statements and related notes are

presented in accordance with accounting principles generally accepted in the

United States (“US GAAP’), and are expressed in United States dollars.

Basis of Presentation

The accompanying unaudited interim consolidated balance sheets,

and the related consolidated statements of operations, stockholders’ equity and

cash flows reflect all adjustments, consisting of normal recurring adjustments,

that are, in the opinion of management, necessary for a fair presentation of the

financial position of the Company and its subsidiaries as at September 30, 2017

and the results of operations and cash flows for the interim periods ended

September 30, 2017 and 2016. The results of operations presented in these

consolidated financial statements are not necessarily indicative of the results

of operations that may be expected for future periods.

The accompanying unaudited interim consolidated financial

statements have been prepared in accordance with the rules and regulations of

the United States Securities and Exchange Commission (the “SEC”). Certain

information and footnote disclosures normally included in the Company's annual

audited consolidated financial statements and accompanying notes have been

condensed or omitted. These interim consolidated financial statements and

accompanying notes follow the same accounting policies and methods of

application used in the annual financial statements and should be read in

conjunction with the Company's audited consolidated financial statements and

notes thereto for the year ended December 31, 2016. There have been no material

changes to the significant accounting policies and estimates during the nine

months ended September 30, 2017 as compared to the significant accounting

policies and estimates described in the consolidated financial statements for

the fiscal year ended December 31, 2016.

F-20

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

|

Recent Accounting Pronouncements

In August 2014, the FASB issued ASU 2014-15,

Presentation of

Financial Statements - Going Concern (Subtopic 205-40): Disclosure of

Uncertainties about an Entity’s Ability to Continue as a Going Concern

,

which is intended to define management’s responsibility to evaluate whether

there is substantial doubt about an organization’s ability to continue as a

going concern within one year after the date that the financial statements are

issued (or within one year after the date that the financial statements are

available to be issued when applicable) and to provide related footnote

disclosures. The ASU provides guidance to an organization’s management, with

principles and definitions that are intended to reduce diversity in the timing

and content of disclosures that are commonly provided by organizations today in

the financial statement footnotes. The ASU is effective for annual periods

ending after December 15, 2016, and interim periods within annual periods

beginning after December 15, 2016, which for the Company is April 1, 2017. The

adoption of this standard did not have a material impact on the Company’s

financial position or results of operations.

In August 2016, the FASB issued ASU No. 2016-15,

Statement

of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash

Payments.

This ASU is effective for annual periods beginning after December

15, 2018 and interim periods within fiscal years beginning after December 15,

2019. ASU No 2016-15 addresses eight specific cash flow issues with the

objective of reducing the existing diversity in practice. The adoption of this

standard will not have a material impact on the Company’s financial position or

results of operations.

Other recent accounting pronouncements issued by the FASB

(including its Emerging Issues Task Force), the American Institute of Certified

Public Accountants, and the SEC did not, or are not believed by management to,

have a material impact on the Company's present or future financial position,

results of operations or cash flows.

|

3.

|

DUE TO SHAREHOLDERS OF

AUCTOMATIC

|

The Company acquired Entity, Inc., commonly referred to as

“Auctomatic”, on May 22, 2008, through an agreement and plan of merger dated

March 25, 2008. The consideration for the acquisition was $2 million cash (minus

assumed liabilities of $152,305) and 1,000,007 shares of the Company’s common

stock at a deemed price of $3 per share, all payable pro rata to the eighteen

Auctomatic shareholders in stages:

|

|

•

|

$1,046,695 on closing (paid)

|

|

|

•

|

340,001 shares on closing (issued)

|

|

|

•

|

$800,000 on May 22, 2009

|

|

|

•

|

246,402 shares, issued at closing but distributable

one-third at a time on each of May 22, 2009, 2010 and 2011 (issued)

|

|

|

•

|

413,604 shares issuable pro rata to the three Auctomatic

founders one-third at a time on each of May 22, 2009, 2010 and 2011

subject to their being employed on the payment date

|

There were 91,912 shares issued pro rata to the two founders

who were employed on May 22, 2009. One of the Auctomatic founders resigned

during the first quarter of 2009 and forfeited his right to 137,868 founders’

shares. The remaining two founders terminated their employment by agreement in

August 2009 and forfeited their rights to the total of 183,824 shares of the

Company’s common stock that were due to be issued to them in each of May 2010

and 2011.

F-21

|

3.

|

DUE TO SHAREHOLDERS OF AUCTOMATIC

(continued)

|

The payment terms for the cash consideration payable on May 22,

2009, were renegotiated in 2009 and again in 2010 resulting in promissory notes

being issued to twelve of the eighteen Auctomatic shareholders: five of the

notes (Convertible Notes to Shareholders of Auctomatic) were convertible to

shares of the Company’s common stock and bore interest at the rate of 10% per

annum; seven of the notes (Non-Convertible Notes to Shareholders of Auctomatic)

were not convertible and bore interest at the rate of 8% per annum. The six

Auctomatic shareholders who opted not to participate in the Non-Convertible and

Convertible share offer continued to hold debt in the Company payable on May 22,

2009 with no interest accruing (see Due to Shareholders of Auctomatic below).

During the first quarter of 2013 the Company and most of the

Auctomatic note and debt holders agreed to settle the outstanding debt. The

Company paid $172,844 to settle debt of $508,006, which included principal and

interest, resulting in a gain on the settlement of debt in the amount of

$335,162.

The breakdown of the amounts due to the Shareholders of

Auctomatic at September 30, 2017 follows below:

|

Due to shareholders’

of Auctomatic, December 31, 2016 and 2015

|

$

|

13,193

|

|

|

Non-convertible notes payable to

shareholders of Auctomatic:

|

|

|

|

|

Balance, December 31, 2015

|

|

3,629

|

|

|

Accrued interest

|

|

207

|

|

|

Balance, December 31, 2016

|

|

3,836

|

|

|

Accrued interest

|

|

155

|

|

|

Balance, September 30, 2017

|

|

3,991

|

|

|

|

$

|

17,184

|

|

|

4.

|

GAIN ON RETIREMENT OF DEBT

|

On May 4, 2017, in conjunction with the termination of the

Company’s receivership, the Company realized a gain on debt retirement of

$182,236 related to the discharge of creditor obligations.

F-22

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities

Exchange Act of 1934, the registrant has duly caused this registration statement

to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

Live Current Media Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

February 6, 2018

|

|

By:

|

/s/

David M. Jeffs

|

|

|

|

|

|

DAVID M. JEFFS

|

|

|

|

|

|

Chief Executive Officer, President, Chief

Financial Officer

|

|

|

|

|

|

and Secretary

|

|

|

|

|

|

(Principal Executive Officer and Principal

Financial Officer)

|

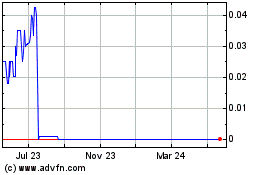

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Mar 2024 to Apr 2024

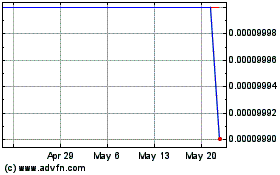

Live Current Media (CE) (USOTC:LIVC)

Historical Stock Chart

From Apr 2023 to Apr 2024