UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2014

JAMMIN JAVA CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation)

|

000-52161

(Commission File Number)

|

264204714

(IRS Employer Identification No.)

|

4730 Tejon St., Denver, Colorado 80211

(Address of principal executive offices and Zip Code)

323-556-0746

Registrant's telephone number, including area code:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Effective March 31, 2014, the Board of Directors of Jammin Java Corp. (the “Company”, “we”, or “us”) adopted Amended and Restated Bylaws (“Restated Bylaws”) completely replacing the Company’s prior Bylaws. The Restated Bylaws affected certain changes to bring the Company’s organizational documents in line with Nevada law, to modernize and streamline the Bylaws and to clarify and expand certain provisions thereof. The material revisions to the Bylaws affected as a result of the adoption of the Restated Bylaws, aside from general updates and clarifications to such Bylaws, are described below:

|

|

1)

|

The Restated Bylaws updated the Company’s current name (the prior Bylaws had the Company’s old name Global Electronic Recovery Corp.);

|

|

|

2)

|

The Restated Bylaws remove the requirement from the prior Bylaws that the Company hold an annual meeting on the first week of December each year. As such, the Board of Directors has the right to determine when and how often (subject to applicable law) that the Company shall hold an annual meeting.

|

|

|

3)

|

The Restated Bylaws correct the vote required to remove directors under Nevada law from a majority of voting shareholders to 2/3rds of voting shareholders as required by Nevada law.

|

|

|

4)

|

The Restated Bylaws clarify that persons (other than the Board or Chairman) calling a special meeting must do so in a writing which must specify the general natural of the business proposed, and that upon receipt of such notice the Board has the right to determine the date, time and place of the meeting which must be scheduled within 90 days of the date of the notice (Section 3.2 of the Restated Bylaws). The prior Bylaws but did not specify how such meeting could be called or what was required to be supplied in connection therewith.

|

|

|

5)

|

The Restated Bylaws provide for the duties of the Chief Financial Officer and certain other named senior officers which are absent from the prior Bylaws (Section 7.9 of the Restated Bylaws).

|

|

|

6)

|

The Restated Bylaws allow for uncertificated shares (Section 9.1 of the Restated Bylaws) – the prior Bylaws were silent as to whether the Company had the ability to issue uncertificated/book entry shares.

|

|

|

7)

|

The Restated Bylaws remove language in the prior Bylaws providing the Company the right to loan money to officers and directors.

|

|

|

8)

|

The Restated Bylaws remove the requirement from the prior Bylaws that meetings be conducted pursuant to Robert’s Rules of Order.

|

|

|

9)

|

The Restated Bylaws clarify the time period during which shareholder proposals must be received by the Board (Section 3.5 of the Restated Bylaws), specifically that:

|

“[T]he Stockholders who intend to nominate persons to the Board of Directors or propose any other action at an annual meeting of Stockholders must timely notify the Secretary of the Company of such intent. To be timely, a Stockholder's notice must be delivered to or mailed and received at the principal executive offices of the Company not earlier than the close of business on the day which falls 120 days prior to the one year anniversary of the Company's last annual meeting of Stockholders and not later than the close of business on the day which falls 90 days prior to the one year anniversary of the Company's last annual meeting of Stockholders, together with written notice of the shareholder's intention to present a proposal for action at the meeting, unless the Company's annual meeting date occurs more than 30 days before or 30 days after the one year anniversary of the Company's last annual meeting of Stockholders. In that case, the Company must receive proposals not earlier than the close of business on the 120th day prior to the date of the annual meeting and not later than the close of business on the later of the 90th day prior to the date of the annual meeting or, if the first public announcement of the date of the annual meeting is less than 100 days prior to the date of the meeting, the 10th day following the day on which the Company first makes a public announcement of the date of the annual meeting. Such notice must be in writing and must include (a) the name and record address of the Stockholder who intends to propose the business and the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such Stockholder; (b) a representation that the Stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to introduce the business specified in the notice; (c) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting; (d) any material interest of the Stockholder in such business; and (e) any other information that is required to be provided by the Stockholder pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Notwithstanding the foregoing, in order to include information with respect to a Stockholder proposal in the proxy statement and form of proxy for a stockholder's meeting, Stockholders must provide notice as required by, and otherwise comply with the requirements of, the Exchange Act and the regulations promulgated thereunder. The Board of Directors reserves the right to refuse to submit any such proposal to Stockholders at an annual meeting if, in its judgment, the information provided in the notice is inaccurate or incomplete.”

|

|

10)

|

The Restated Bylaws clarify that “[v]otes cast shall include votes cast against any proposal and shall exclude abstentions and broker non-votes, provided that votes cast against any proposal, abstentions and broker non-votes shall be counted in determining a quorum at any meeting.” (Section 3.8 of the Restated Bylaws).

|

|

|

11)

|

The Restated Bylaws clarify the voting rights of shares (Section 3.13 of the Restated Bylaws):

|

“Except as otherwise required by Nevada Law, the Articles of Incorporation or the Bylaws, (i) at all meetings of Stockholders for the election of directors, a plurality of votes cast shall be sufficient to elect such directors; (ii) any other action taken by Stockholders voting a majority of the votes cast on such matter at a meeting at which a quorum is present shall be valid and binding upon the Company, except that adoption, amendment or repeal of the Bylaws by Stockholders will require the vote of a majority of the shares entitled to vote; and (iii) broker non-votes and abstentions are considered for purposes of establishing a quorum but not considered as votes cast for or against a proposal or director nominee. Each Stockholder shall have one vote for every share of stock having voting rights registered in his name on the record date for the meeting, except as otherwise provided in any preferred stock designation setting forth the right of preferred stock shareholders. The Company shall not have the right to vote treasury stock of the Company, nor shall another corporation have the right to vote its stock of the Company if the Company holds, directly or indirectly, a majority of the shares entitled to vote in the election of directors of such other corporation. Persons holding stock of the Company in a fiduciary capacity shall have the right to vote such stock. Persons who have pledged their stock of the Company shall have the right to vote such stock unless in the transfer on the books of the Company the pledgor expressly empowered the pledgee to vote such stock. In that event, only the pledgee, or his proxy, may represent such stock and vote thereon.

Where a separate vote by a class or classes is required, a majority of the outstanding shares of such class or classes, present in person or represented by proxy, shall constitute a quorum entitled to take action with respect to that vote on that matter and the affirmative vote of the majority of shares of such class or classes present in person or represented by proxy at the meeting shall be the act of such class.”

|

|

12)

|

The Restated Bylaws provide that two or more directors (as well as the Chairman, President or Vice President) can call a meeting of the Board of Directors (Section 5.4 of the Restated Bylaws).

|

|

|

13)

|

The Restated Bylaws provide for the Company to comply with applicable NASDAQ or NYSE rules and regulations in the event the Company trades on NASDAQ or NYSE, as applicable (Section 7.18 of the Restated Bylaws).

|

|

|

14)

|

The Restated Bylaws allow the Board of Directors to determine by resolution those persons that can sign and endorse checks (Section 8.2 of the Restated Bylaws).

|

|

|

15)

|

The Restated Bylaws allow for the Company’s Transfer Agent to refuse transfer of shares whenever there is any reasonable doubt as to their rightful ownership (Section 9.2 of the Restated Bylaws).

|

|

|

16)

|

The Restated Bylaws expand and clarify the indemnification rights of the Company as to officers and directors consistent with Nevada law (Article 10). Specifically, that we shall indemnify every (i) present or former director, advisory director or officer of us, (ii) any person who while serving in any of the capacities referred to in clause (i) served at our request as a director, officer, partner, venturer, proprietor, trustee, employee, agent or similar functionary of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, and (iii) any person nominated or designated by (or pursuant to authority granted by) the Board of Directors or any committee thereof to serve in any of the capacities referred to in clauses (i) or (ii) (each an “Indemnitee”).

|

The Restated Bylaws provide that we shall indemnify an Indemnitee against all judgments, penalties (including excise and similar taxes), fines, amounts paid in settlement and reasonable expenses actually incurred by the Indemnitee in connection with any proceeding in which he was, is or is threatened to be named as a defendant or respondent, or in which he was or is a witness without being named a defendant or respondent, by reason, in whole or in part, of his serving or having served, or having been nominated or designated to serve, if it is determined that the Indemnitee (a) conducted himself in good faith, (b) reasonably believed, in the case of conduct in his official capacity, that his conduct was in our best interests and, in all other cases, that his conduct was at least not opposed to our best interests, and (c) in the case of any criminal proceeding, had no reasonable cause to believe that his conduct was unlawful; provided, however, that in the event that an Indemnitee is found liable to us or is found liable on the basis that personal benefit was improperly received by the Indemnitee, the indemnification (i) is limited to reasonable expenses actually incurred by the Indemnitee in connection with the proceeding and (ii) shall not be made in respect of any proceeding in which the Indemnitee shall have been found liable for willful or intentional misconduct in the performance of his duty to us.

Except as provided above, the Restated Bylaws provide that no indemnification shall be made in respect to any proceeding in which such Indemnitee has been (a) found liable on the basis that personal benefit was improperly received by him, whether or not the benefit resulted from an action taken in the Indemnitee's official capacity, or (b) found liable to us. The termination of any proceeding by judgment, order, settlement or conviction, or on a plea of nolo contendere or its equivalent, is not of itself determinative that the Indemnitee did not meet the requirements set forth in clauses (a) or (b) above. An Indemnitee shall be deemed to have been found liable in respect of any claim, issue or matter only after the Indemnitee shall have been so adjudged by a court of competent jurisdiction after exhaustion of all appeals therefrom. Reasonable expenses shall include, without limitation, all court costs and all fees and disbursements of attorneys’ fees for the Indemnitee. The indemnification provided shall be applicable whether or not negligence or gross negligence of the Indemnitee is alleged or proven.

|

|

17)

|

The Restated Bylaws confirm the Board of Directors’ ability to declare dividends consistent with state law (Article 12 of the Restated Bylaws).

|

|

|

18)

|

The Restated Bylaws formally allow for electronic notices to be provided to shareholders (Section 13.3 of the Restated Bylaws) and what happens when notices are undeliverable (Section 13.4 of the Restated Bylaws).

|

|

|

19)

|

The Restated Bylaws exclude the Company from the Nevada Controlling Interest Statutes (Section 11.2 of the Restated Bylaws). Nevada’s “acquisition of controlling interest” statutes contain provisions governing the acquisition of a controlling interest in certain Nevada corporations. These “control share” laws provide generally that any person that acquires a “controlling interest” in certain Nevada corporations may be denied voting rights, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights. The Restated Bylaws provide that we are not subject to such statutes. If we did not opt out of such statutes, these laws would apply to us if we were to have 200 or more stockholders of record (at least 100 of whom have addresses in Nevada appearing on our stock ledger) and do business in the State of Nevada directly or through an affiliated corporation, unless our Articles of Incorporation or Bylaws in effect on the tenth day after the acquisition of a controlling interest provide otherwise. These laws provide that a person acquires a “controlling interest” whenever a person acquires shares of a subject corporation that, but for the application of these provisions of the Nevada Revised Statutes, would enable that person to exercise (1) one-fifth or more, but less than one-third, (2) one-third or more, but less than a majority or (3) a majority or more, of all of the voting power of the Company in the election of directors. Once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares” to which the voting restrictions described above apply.

|

The foregoing summary of the Restated Bylaws is qualified in its entirety by reference to the full text of the Restated Bylaws attached to this Current Report as Exhibit 3.2.

Also effective March 31, 2014, the Company filed Restated Articles of Incorporation with the Secretary of State of Nevada, restating (but not amending), its Articles of Incorporation as in effect as of such date, a copy of which is attached to this Current Report on Form 8-K as Exhibit 3.1.

Item 5.05 Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

Also effective March 31, 2014, we adopted a Code of Ethical Business Conduct, which replaced our prior Corporate Governance guidelines. The Code of Ethical Business Conduct modernizes the Corporate Governance guidelines and removes references to various committees of the Board of Directors which the Company does not have in place. The Code also includes more information on and issues regarding Securities Exchange Commission and public company reporting which the Company is subject to as a public company. The Code of Ethical Business Conduct applies to all of our directors, officers and employees.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit No.

|

Description

|

| |

|

|

3.1*

|

Restated Articles of Incorporation of Jammin Java Corp. (March 31, 2014)

|

|

3.2*

|

Amended and Restated Bylaws (March 31, 2014)

|

|

14.1*

|

Code of Ethical Business Conduct (March 31, 2014)

|

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Jammin Java Corp.

|

|

| |

|

|

|

|

Date: March 31, 2014

|

By:

|

/s/ Anh Tran

|

|

| |

|

Anh Tran

|

|

| |

|

President

|

|

| |

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

| |

|

|

3.1*

|

Restated Articles of Incorporation of Jammin Java Corp. (March 31, 2014)

|

|

3.2*

|

Amended and Restated Bylaws (March 31, 2014)

|

|

14.1*

|

Code of Ethical Business Conduct (March 31, 2014)

|

* Filed herewith.

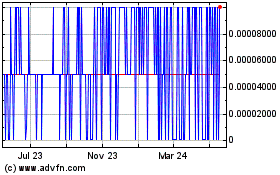

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

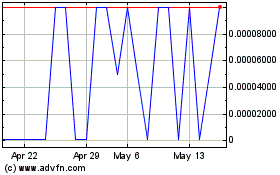

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Apr 2023 to Apr 2024