Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-255371

PROSPECTUS

SUPPLEMENT

(To

prospectus dated April 26, 2021)

HealthLynked

Corp.

3,703,704

Shares of Common Stock

We

are offering 3,703,704 shares of our common stock, par value $0.0001 per share, to a certain institutional investor pursuant to this

prospectus supplement and the accompanying prospectus.

In

a concurrent private placement (the “Private Placement”), we are also selling to such investor unregistered warrants (the

“Warrants”) to purchase up to an aggregate of 1,851,852 shares of our common stock, at an exercise price of $0.65 per share.

The Warrants will be exercisable immediately upon issuance and will have a term of five years from the date of issuance. The Warrants

and the shares of our common stock issuable upon the exercise of the Warrants (the “Warrant Shares”) are being offered pursuant

to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”) and Regulation

D promulgated thereunder, and are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is

no established public trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to list

the Warrants for trading on any national securities exchange or any other nationally recognized trading system.

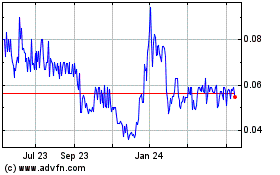

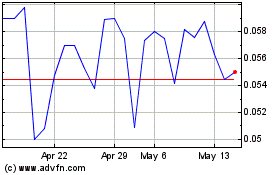

Our

Common Stock is currently quoted on the OTCQB under the symbol “HLYK.” The last reported sale price of our common stock on

the OTCQB on August 26, 2021 was $0.664 per share.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding shares of common stock held by non-affiliates,

or our public float, was $87,572,781 based on a total of 230,503,875 outstanding shares of common stock, of which 131,886,718 shares

of common stock were held by non-affiliates, and a price of $0.664 per share, which was the last reported sale price of our common stock

on the OTCQB on August 26, 2021.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement

and page 2 of the accompanying prospectus.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

0.54

|

|

|

$

|

2,000,000

|

|

|

Placement agent fees(1)

|

|

$

|

0.432

|

|

|

$

|

160,000

|

|

|

Proceeds, before expenses, to us(2)

|

|

$

|

0.4968

|

|

|

$

|

1,840,000

|

|

|

|

(1)

|

In

addition, we have agreed to reimburse the placement agent for certain offering-related expenses, including a management fee of 1.0% of

the gross proceeds raised in this offering, and to issue to the placement agent or its designees warrants to purchase up to 296,296 shares

of common stock (which represents 8.0% of the aggregate number of shares of common stock issued in this offering) with an exercise price

of $0.675 per share (representing 125% of the public offering price per share). See the section of this prospectus supplement entitled

“Plan of Distribution” on page S-10 for a description of the compensation payable to the placement agent.

|

|

|

(2)

|

The

amount of the offering proceeds to us presented in this table does not give effect to the sale or exercise, if any, of the Warrants being

issued in the concurrent Private Placement or the warrants being issued to the placement agent.

|

We

have retained H.C. Wainwright & Co., LLC (“Wainwright” or the “placement agent”) to act as our exclusive

placement agent in connection with this offering. The placement agent is not purchasing the shares of common stock offered by us in this

offering and is not required to sell any specific number or dollar amount of securities but will assist us in this offering on a reasonable

best-efforts basis.

Delivery

of the shares of common stock offered hereby is expected to take place on or about August 31, 2021, subject to satisfaction of certain

customary closing conditions.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is August 26, 2021.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of the registration statement that we filed with the SEC, using a “shelf” registration process and consists

of two parts. The first part is this prospectus supplement, including the documents incorporated by reference, which describes the specific

terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, gives more general

information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring

to both parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents

incorporated by reference into this prospectus supplement or the accompanying prospectus.

If

information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. This prospectus

supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us,

the securities being offered and other information you should know before investing in our securities. You should also read and consider

information in the documents we have referred you to in the section of this prospectus supplement and the accompanying prospectus entitled

“Where You Can Find More Information” and “Documents Incorporated by Reference.”

You

should rely only on this prospectus supplement, the accompanying prospectus, and the information incorporated or deemed to be incorporated

by reference in this prospectus supplement and the accompanying prospectus. We have not authorized, and the placement agent has not authorized,

anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus

supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on

it. We are not offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume

that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate

as of any date other than as of the date of this prospectus supplement or the accompanying prospectus, as the case may be, or in the

case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement

and the accompanying prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations and

prospects may have changed since those dates.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution

of this prospectus supplement, or the accompanying prospectus, in that jurisdiction. Persons who come into possession of this prospectus

supplement, or the accompanying prospectus, in jurisdictions outside the United States are required to inform themselves about and to

observe any restrictions as to this offering and the distribution of this prospectus supplement, or the accompanying prospectus, applicable

to that jurisdiction. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection

with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying

prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus supplement and

accompanying prospectus and does not contain all of the information you should consider before investing in our securities. You should

carefully read the prospectus supplement and the accompanying prospectus in their entirety before investing in our securities, including

the information discussed under “Risk Factors” in this prospectus supplement and the accompanying prospectus, as well as

the documents and financial statements and related notes that are incorporated by reference herein. Unless the context requires otherwise,

references in this prospectus to “HealthLynked,” “we,” “us” and “our” refer to HealthLynked

Corp. together with its consolidated subsidiaries.

Business

Overview

We

currently operate in four distinct divisions: the Health Services Division, the Digital Healthcare Division, the ACO/MSO (Accountable

Care Organization / Managed Service Organization) Division, and the Medical Distribution Division. Our Health Services division is comprised

of the operations of (i) Naples Women’s Center (“NWC”), a multi-specialty medical group including OB/GYN (both Obstetrics

and Gynecology) and General Practice, (ii) Naples Center for Functional Medicine (“NCFM”), a Functional Medical Practice

acquired in April 2019 that is engaged in improving the health of its patients through individualized and integrative health care, and

(iii) Bridging the Gap Physical Therapy (“BTG”), a physical therapy practice in Bonita Springs, FL opened in January 2020

that provides hands-on functional manual therapy techniques to speed patients’ recovery and manage pain without pain medication

or surgery. Our Digital Healthcare division develops and operates an online personal medical information and record archive system, the

“HealthLynked Network,” which enables patients and doctors to keep track of medical information via the Internet in a cloud-based

system. Our ACO/MSO Division is comprised of the business acquired of Cura Health Management LLC (“CHM”) and its subsidiary

ACO Health Partners LLC (“AHP”), which were acquired by the Company on May 18, 2020. CHM and AHP operate an Accountable Care

Organization (“ACO”) and Managed Service Organization (“MSO”) that assists physician practices in providing coordinated

and more efficient care to patients via the Medicare Shared Savings Program (“MSSP”) as administered by the Centers for Medicare

and Medicaid Services (the “CMS”), which rewards providers for efficiency in patient care. Our Medical Distribution Division

is comprised of the operations of MedOffice Direct LLC (“MOD”), a virtual distributor of discounted medical supplies selling

to both consumers and medical practices throughout the United States we acquired on October 19, 2020.

Recent

Developments

On

August 18, 2021, we sold 1,000,000 shares of common stock in a private placement transaction. We received $580,000 in proceeds from the

sale. In connection with the stock sale, we also issued 500,000 five-year warrants to purchase shares of common stock at an exercise

price of $0.75 per share. The shares were issued subsequent to the date of this prospectus.

Corporate

Information

HealthLynked

Corp. was incorporated in the State of Nevada on August 6, 2014. Our principal executive office is located at 1265 Creekside Parkway,

Suite 301, Naples, Florida 34108 and our telephone number is 239-513-1992. Our website address is www.HealthLynked.com, and the information

included in, or linked to our website is not part of this prospectus. We have included our website address in this prospectus solely

as a textual reference.

THE

OFFERING

|

Common

stock offered by us

|

|

3,703,704

shares.

|

|

|

|

|

|

Common

stock outstanding after this

offering(1)

|

|

234,207,579

shares (assuming that we sell the maximum number of shares of common stock offered in this offering and excluding the Warrant Shares

issuable upon the exercise of the Warrants to be issued in the concurrent Private Placement).

|

|

|

|

|

|

Concurrent

Private Placement of Warrants

|

|

In

the Private Placement, we are selling to the investor in this offering Warrants to purchase up to an aggregate of 1,851,852 shares

of our common stock, at an exercise price of $0.65 per share. The Warrants will be exercisable immediately upon issuance and will

have a term of five years from the date of issuance. The Warrants are being offered pursuant to the exemptions provided in Section

4(a)(2) under the Securities Act and Regulation D promulgated thereunder and, along with the Warrant Shares, have not been registered

under the Act, or applicable state securities laws. Accordingly, the Warrants and the Warrant Shares may not be offered or sold in

the U.S. except pursuant to an effective registration statement or an applicable exemption from the registration requirements of

the Securities Act and such applicable state securities laws.

|

|

Use

of proceeds

|

|

We

intend to use the net proceeds of this offering for general working capital purposes.

See

“Use of Proceeds” on page S-6.

|

|

|

|

|

|

Risk

factors

|

|

See

“Risk Factors” beginning on page S-3 of this prospectus supplement and page 2 of the accompanying prospectus and in the

documents incorporated by reference in this prospectus supplement for a discussion of factors you should consider carefully when

making an investment decision.

|

|

|

|

|

|

OTCQB

symbol

|

|

HLYK

|

|

|

(1)

|

The

number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 230,503,875 shares

of common stock outstanding as of August 26, 2021, and, unless otherwise indicated, excludes as of that date:

|

|

|

●

|

1,000,000

shares issued in a private placement for proceeds of $580,000 that was agreed and funded on August 18, 2021 but for which shares

were not issued as of the date of this prospectus;

|

|

|

|

|

|

|

●

|

3,013,750

shares of common stock issuable upon exercise of stock options;

|

|

|

|

|

|

|

●

|

up

to 58,301,344 shares of common stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $0.24

(other than with respect to the warrants below);

|

|

|

|

|

|

|

●

|

up

to 1,851,852 shares of common stock issuable upon exercise of the Warrants to be issued to the investor in the Private Placement

concurrent with this offering with an exercise price of $0.65 per share; and

|

|

|

|

|

|

|

●

|

up

to 296,296 shares of common stock issuable upon the exercise of warrants with an exercise price of $0.675 per share to be issued

to the placement agent or its designees as compensation in connection with this offering.

|

Except

as otherwise indicated, the information in this prospectus supplement assumes (i) no exercise of the warrants to be issued to the placement

agent or its designees in connection with this offering, and (ii) no exercise of options or exercise of warrants.

RISK

FACTORS

Before

deciding to invest in our common stock, you should consider carefully the following discussion of risks and uncertainties affecting us

and our securities, together with other information in this prospectus supplement, the accompanying prospectus and the other information

and documents incorporated by reference in this prospectus supplement, including the risks, uncertainties and assumptions discussed under

the heading “Risk Factors” in our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as

amended, or any updates in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. Our business, business prospects, financial

condition or results of operations could be seriously harmed as a result of these risks. This could cause the trading price of our common

stock to decline, resulting in a loss of all or part of your investment. Additional risks and uncertainties not presently known to us

or that we currently deem immaterial also may materially and adversely affect our business, financial condition and results of operations.

Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

Risks

Related to Our Business

The

ongoing COVID-19 pandemic has adversely affected our business and may continue to adversely affect our business until the pandemic is

resolved.

Coronavirus

could adversely impact our business.

In

December 2019, a novel strain of coronavirus, COVID-19, was reported to have surfaced in Wuhan, China. Since then, the COVID-19 coronavirus

has spread to multiple countries, including the United States. As the COVID-19 coronavirus continues to spread around the globe, we could

experience disruptions that could severely impact our business and our ability to raise capital to fund our operations. In addition,

the outbreak of COVID-19 could disrupt our operations due to absenteeism by infected or ill members of management or other employees,

or absenteeism by members of management and other employees who elect not to come to work due to the illness affecting others in our

offices. COVID-19 illness could also impact members of our Board of Directors resulting in absenteeism from meetings of the directors

or committees of directors, and making it more difficult to convene the quorums of the full Board of Directors or its committees needed

to conduct meetings for the management of our affairs.

The

global outbreak of the COVID-19 coronavirus continues to rapidly evolve. The extent to which the COVID-19 coronavirus may impact our

business and clinical trials will depend on future developments, which are highly uncertain and cannot be predicted with confidence,

such as the ultimate geographic spread of the disease, the duration of the outbreak, travel restrictions and social distancing in the

United States and other countries, business closures or business disruptions and the effectiveness of actions taken in the United States

and other countries to contain and treat the disease.

Risks

Related to Our Common Stock and this Offering

You

will experience immediate and substantial dilution if you purchase securities in this offering.

As

of June 30, 2021, our net tangible book value was approximately $(0.1) million, or $(0.000) per share. Since the offering price per share

of our common stock being offered in this offering is substantially higher than the net tangible book value per share of our common stock,

you will suffer substantial dilution with respect to the net tangible book value of the common stock you purchase in this offering. Based

on the offering price and our net tangible book value per share as of June 30, 2021, assuming no exercise of the warrants offered in

the concurrent Private Placement, if you purchase shares of common stock in this offering, you will suffer immediate and substantial

dilution of $0.533 per share with respect to the net tangible book value of the common stock. See the section entitled “Dilution”

for a more detailed discussion of the dilution you will incur if you purchase securities in this offering.

There

may be future sales of our securities or other dilution of our equity, which may adversely affect the market price of our common stock.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of

common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after

this offering or the perception that such sales could occur.

Future

sales of our common stock may cause the prevailing market price of our shares to decrease.

As

of August 26, 2021, we had 230,503,875 outstanding shares of common stock. In addition, as of that date, we had outstanding stock options

to acquire 3,013,750 shares of common stock. In addition, up to an aggregate of 58,301,344 shares of common stock were issuable upon

the exercise of warrants outstanding prior to this offering (other than the warrants below) at a weighted average exercise price of $0.24.

Up to an aggregate of 1,851,852 shares of common stock will be issuable upon the exercise of the Warrants that are being issued to the

investor in the Private Placement concurrent with this offering with an exercise price of $0.65 per share and up to 296,296 shares of

common stock will be issuable upon the exercise of the warrants with an exercise price of $0.675 per share that are being issued to the

placement agent or its designees as compensation in connection with this offering.

The

issuance of shares of common stock upon the exercise of warrants or options would dilute the percentage ownership interest of all stockholders,

might dilute the book value per share of our common stock and could increase the number of our publicly traded shares, which could depress

the market price of our common stock. The perceived risk of dilution as a result of the significant number of outstanding warrants and

options may cause our common stockholders to be more inclined to sell their shares, which would contribute to a downward movement in

the price of our common stock. Moreover, the perceived risk of dilution and the resulting downward pressure on our common stock price

could encourage investors to engage in short sales of our common stock, which could further contribute to price declines in our common

stock. The fact that our stockholders, warrant holders and option holders can sell substantial amounts of our common stock in the public

market, whether or not sales have occurred or are occurring, could make it more difficult for us to raise additional funds through the

sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate, or at all.

Even

if this offering is successful, we may need to raise additional capital in the future to finance our operations, which may not be available

on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product

development efforts or other operations.

We

have had recurring losses from operations, negative operating cash flow and have an accumulated deficit. We must raise additional funds

in order to continue financing our operations. If additional capital is not available to us when needed or on acceptable terms, we may

not be able to continue to operate our business pursuant to our business plan or we may have to discontinue our operations entirely.

Any additional capital raised through the sale of equity or equity-backed securities may dilute our stockholders’ ownership percentages

and could also result in a decrease in the market value of our equity securities. The terms of any securities issued by us in future

capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of

warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then outstanding.

If

we are unable to secure additional funds when needed or on acceptable terms, we may be required to defer, reduce or eliminate significant

planned expenditures, restructure, curtail or eliminate some or all of our operations, dispose of technology or assets, pursue an acquisition

of our company by a third party at a price that may result in a loss on investment for our stockholders, file for bankruptcy or cease

operations altogether. Any of these events could have a material adverse effect on our business, financial condition and results of operations.

Moreover, if we are unable to obtain additional funds on a timely basis, there will be substantial doubt about our ability to continue

as a going concern and increased risk of insolvency and up to a total loss of investment by our stockholders.

Special

note regarding FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the information incorporated by reference in this prospectus supplement contain “forward-looking statements,”

which include information relating to future events, future financial performance, strategies, expectations, competitive environment

and regulation. Our use of the words “may,” “will,” “would,” “could,” “should,”

“believes,” “estimates,” “projects,” “potential,” “expects,” “plans,”

“seeks,” “intends,” “evaluates,” “pursues,” “anticipates,” “continues,”

“designs,” “impacts,” “forecasts,” “target,” “outlook,” “initiative,”

“objective,” “designed,” “priorities,” “goal” or the negative of those words or other

similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events.

Forward-looking statements should not be read as a guarantee of future performance or results and will probably not be accurate indications

of when such performance or results will be achieved. All statements included or incorporated by reference in this prospectus supplement,

and in related comments by our management, other than statements of historical facts, including without limitation, statements about

future events or financial performance, are forward-looking statements that involve certain risks and uncertainties.

These

statements are based on certain assumptions and analyses made in light of our experience and perception of historical trends, current

conditions and expected future developments as well as other factors that we believe are appropriate in the circumstances. While these

statements represent our judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not

guarantees of any events or financial results. Whether actual future results and developments will conform with our expectations and

predictions is subject to a number of risks and uncertainties, including the risks and uncertainties discussed in this prospectus supplement,

the accompanying prospectus and the documents incorporated by reference under the captions “Risk Factors” and “Special

Note Regarding Forward-Looking Statements” and elsewhere in those documents.

Consequently,

all of the forward-looking statements made in this prospectus supplement and the accompanying prospectus, as well as all of the forward-looking

statements incorporated by reference to our filings under the Securities Exchange Act of 1934, as amended, are qualified by these cautionary

statements and there can be no assurance that the actual results or developments that we anticipate will be realized or, even if realized,

that they will have the expected consequences to or effects on us and our subsidiaries or our businesses or operations. We caution investors

not to place undue reliance on forward-looking statements. We undertake no obligation to update publicly or otherwise revise any forward-looking

statements, whether as a result of new information, future events, or other such factors that affect the subject of these statements,

except where we are expressly required to do so by law.

USE

OF PROCEEDS

We

estimate that we will receive net proceeds of approximately $1.7 million from the sale of the shares offered by us in this offering,

after deducting the placement agent fees and estimated offering expenses payable by us, excluding the proceeds we may receive from the

exercise of the Warrants issued in the concurrent private placement and the warrants to be issued to the placement agent as compensation.

We

intend to use the net proceeds from this offering to for general working capital purposes.

DIVIDEND

POLICY

We

have never declared or paid dividends to our stockholders and we do not intend to pay dividends in the foreseeable future. We intend

to reinvest any earnings in developing and expanding our business. Any future determination relating to our dividend policy will be at

the discretion of our board of directors and will depend on a number of factors, including future earnings, our financial condition,

operating results, contractual restrictions, capital requirements, business prospects, our strategic goals and plans to expand our business,

applicable law and other factors that our board of directors may deem relevant.

DILUTION

If

you invest in our common stock in this offering, your interest will be diluted to the extent of the difference between the offering price

per share and the net tangible book value per share of our common stock after this offering, assuming no value is attributed to the Warrants

issued in the concurrent Private Placement.

Our

net tangible book value as of June 30, 2021, was approximately $(0.1) million, or $(0.000) per share of our common stock, based upon

228,776,097 shares of our common stock outstanding as of that date. Net tangible book value per share is determined by dividing our total

tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of June 30, 2021. Dilution in net

tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in

this offering and the net tangible book value per share of our common stock immediately after this offering.

After

giving further effect to the sale of 3,703,704 shares of our common stock in this offering at the offering price of $0.540 per

share and after deducting the placement agent fees and estimated offering expenses payable by us, our as adjusted net tangible book value

as of June 30, 2021 would have been approximately $1.7 million, or $0.006 per share of common stock. This represents an immediate increase

in net tangible book value of $0.007 per share to our existing stockholders, and an immediate dilution of $0.533 per share to new investors

purchasing our common stock in this offering at offering price.

The

following table illustrates this dilution on a per share basis:

|

Offering price per share

|

|

|

|

|

|

$

|

0.540

|

|

|

Net tangible book value per share as of June 30, 2021

|

|

$

|

(0.000

|

)

|

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

0.007

|

|

|

|

|

|

|

As-adjusted net tangible book value per share as of June 30, 2021 after giving effect to this offering

|

|

|

|

|

|

$

|

0.007

|

|

|

Dilution per share to investors participating in this offering

|

|

|

|

|

|

$

|

0.533

|

|

The

foregoing discussion and table does not take into account further dilution to investors in this offering that could occur upon the exercise

of outstanding options and warrants having a per share exercise price less than the offering price per share in this offering.

The

foregoing discussion and table are based on 228,776,097 shares of common stock outstanding as of June 30, 2021, and, unless otherwise

indicated, excludes as of that date:

|

|

●

|

1,727,778

shares issued upon exercise of warrants and to employees and consultants between July 1 and August 26, 2021;

|

|

|

|

|

|

|

●

|

1,000,000

shares issued in a private placement for proceeds of $580,000 that was agreed and funded on August 18, 2021 but for which shares

were not issued as of the date of this prospectus;

|

|

|

|

|

|

|

●

|

3,013,750

shares of common stock issuable upon exercise of stock options;

|

|

|

|

|

|

|

●

|

up

to 58,301,344 shares of common stock issuable upon the exercise of warrants outstanding at a weighted average exercise price of $0.24

(other than with respect to the warrants below);

|

|

|

|

|

|

|

●

|

up

to 1,851,852 shares of common stock issuable upon exercise of the Warrants to be issued to the investor in the Private Placement

concurrent with this offering with an exercise price of $0.65 per share; and

|

|

|

|

|

|

|

●

|

up

to 296,296 shares of common stock issuable upon the exercise of warrants with an exercise price of $0.675 per share to be issued

to the placement agent or its designees as compensation in connection with this offering.

|

To

the extent that options or warrants outstanding as of June 30, 2021 have been or may be exercised or we issue other shares, an investor

purchasing common stock in this offering may experience further dilution. In addition, we may seek to raise additional capital in the

future through the sale of equity or convertible debt securities. To the extent that we raise additional capital through the sale of

equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

PRIVATE

PLACEMENT OF WARRANTS

In

a concurrent Private Placement, we are selling to each of the investors in this offering Warrants to purchase up to an aggregate of 1,851,852

shares of common stock, representing 50% of the shares of our common stock that may be purchased in this offering. The Warrants are exercisable

at an exercise price of $0.65 per share, are exercisable immediately upon issuance and have a term of exercise equal to five years from

the date of issuance. A holder of Warrants will have the right to exercise the Warrants on a “cashless” basis if there is

no effective registration statement registering the resale of the Warrant Shares. Subject to limited exceptions, a holder of Warrants

will not have the right to exercise any portion of its Warrants if the holder, together with its affiliates, would beneficially own in

excess of 4.99% (or 9.99% at the election of the holder prior to the date of issuance) of the number of shares of our common stock outstanding

immediately after giving effect to such exercise, provided that the holder may increase or decrease the beneficial ownership limitation

up to 9.99%. Any increase in the beneficial ownership limitation shall not be effective until 61 days following notice of such change

to us.

Except

as otherwise provided in the Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the

Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their

Warrants.

The

Warrants and the Warrant Shares are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act and

Regulation D promulgated thereunder, and are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

There

is no established public trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to list

the Warrants on any national securities exchange or any other nationally recognized trading system.

PLAN

OF DISTRIBUTION

We

engaged H.C. Wainwright & Co., LLC to act as our exclusive placement agent to solicit offers to purchase the shares of our common

stock offered by this prospectus supplement and the accompanying base prospectus. Wainwright is not purchasing or selling any such shares,

nor is it required to arrange for the purchase and sale of any specific number or dollar amount of such shares, other than to use its

“reasonable best efforts” to arrange for the sale of such shares by us. Therefore, we may not sell all of the shares of our

common stock being offered. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and

prospective investors. Wainwright will have no authority to bind us. We have entered into a securities purchase agreement directly with

a certain institutional and accredited investor who has agreed to purchase shares of our common stock in this offering. We will only

sell to investors who have entered into securities purchase agreements.

Delivery

of the shares of common stock offered hereby is expected to take place on or about August 31, 2021, subject to satisfaction of certain

customary closing conditions.

We

have agreed to pay the placement agent (i) a total cash fee equal to 8.0% of the aggregate gross proceeds of this offering, (ii) a management

fee equal to 1.0% of the aggregate gross proceeds of this offering, (iii) a non-accountable expense allowance of $25,000, (iv) $25,000 for fees and expenses of legal counsel and other out-of-pocket expenses and (iv) $5,650 for escrow agent fees in connection with

this offering.

We

estimate the total expenses of this offering paid or payable by us will be approximately $0.3 million. After deducting the fees due to the

placement agent and our estimated expenses in connection with this offering, we expect the net proceeds from this offering will be approximately

$1.7 million.

Placement

Agent Warrants

In

addition, we have agreed to issue to the placement agent or its designees as compensation warrants (the “Placement Agent Warrants”)

to purchase up to 269,269 shares of common stock (representing 8.0% of the aggregate number of shares of common stock sold in this offering),

at an exercise price of $0.675 per share (representing 125% of the offering price for a share of common stock to be sold in this offering).

The Placement Agent Warrants will be exercisable immediately and will expire five years from the commencement of sales under this offering.

Tail

Financing Payments

In

the event that any investors that had back and forth correspondence with the placement agent or were introduced to us by the placement

agent during the term of our engagement agreement with the placement agent provide any capital to us in a public or private offering

or capital-raising transaction within 15 months following the expiration or termination of the engagement of the placement agent, we

shall pay the placement agent the cash and warrant compensation provided above on the gross proceeds from such investors.

Right

of First Refusal

We

have granted the placement agent a right of first refusal for 18 months pursuant to which (i) it has the right to act as our exclusive

advisor if we or any of our subsidiaries dispose of or acquire business units or acquire any of our outstanding securities or make any

exchange or tender offer or enter into a merger, consolidation or other business combination or any recapitalization, reorganization,

restructuring or other similar transaction, including, without limitation, an extraordinary dividend or distributions or a spin-off or

split-off, if we decide to retain a financial advisor for such transaction, and (ii) it has the right to act as our sole book-runner,

sole manager, sole placement agent, sole agent, or sole underwriter, as applicable, if we or our subsidiaries finance or refinance any

indebtedness or raise funds in a public or private offering of equity or debt securities.

Indemnification

We

have agreed to indemnify the placement agent against certain liabilities, including civil liabilities under the Securities Act, or to

contribute to payments that the placement agent may be required to make in respect of those liabilities.

In

addition, we will indemnify the purchaser of shares of our common stock in this offering against liabilities arising out of or relating

to (i) any breach of any of the representations, warranties, covenants or agreements made by us in the securities purchase agreement

or related documents or (ii) any action instituted against a purchaser by a third party (other than a third party who is affiliated with

such purchaser) with respect to the securities purchase agreement or related documents and the transactions contemplated thereby, subject

to certain exceptions.

Other

Relationships

From

time to time, the placement agent and its affiliates may provide various advisory, investment and commercial banking and other services

to us in the ordinary course of business, for which they may receive customary fees and commissions.

Regulation

M Compliance

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the sale of our shares of common stock offered hereby by it while acting as principal might

be deemed to be underwriting discounts or commissions under the Securities Act. The placement agent will be required to comply with the

requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the Exchange

Act. These rules and regulations may limit the timing of purchases and sales of our securities by the placement agent. Under these rules

and regulations, the placement agent may not (i) engage in any stabilization activity in connection with our securities; and (ii) bid

for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under

the Exchange Act, until they have completed their participation in the distribution.

Transfer

Agent

The

transfer agent and registrar for our common stock is Worldwide Stock Transfer, LLC.

Listing

Our

shares of common stock are currently quoted on the OTCQB under the symbol “HLYK”.

LEGAL

MATTERS

The

validity of the securities offered by this prospectus supplement will be passed upon by Snell & Wilmer, L.L.P., Reno, Nevada.

EXPERTS

The

consolidated financial statements as of December 31, 2020 and 2019, and the related consolidated statements of operations, stockholders’

equity (deficit), and cash flows for each of the two years in the period ended December 31, 2020 and management’s assessment of

the effectiveness of internal control over financial reporting as of December 31, 2020 incorporated by reference in this Prospectus have

been so incorporated in reliance on the reports of RBSM LLP, an independent registered public accounting firm, incorporated herein by

reference, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the informational requirements of the Exchange Act and in accordance therewith file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements

and other information regarding registrants that file electronically with the SEC. The address of the SEC’s website is www.sec.gov.

We

make available free of charge on or through our website at www.HealthLynked.com, our Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange

Act as soon as reasonably practicable after we electronically file such material with or otherwise furnish it to the SEC.

This

prospectus supplement constitutes a part of a registration statement on Form S-3 that we have filed with the SEC under the Securities

Act. This prospectus supplement does not contain all of the information set forth in the registration statement. You can obtain a copy

of the registration statement for free at www.sec.gov. The registration statement and the documents referred to below under “Documents

Incorporated By Reference” are also available on our website, www.HealthLynked.com.

We

have not incorporated by reference into this prospectus the information on our website, and you should not consider it to be a part of

this prospectus.

DOCUMENTS

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus certain information that we file with the SEC, which means

that we can disclose important information to you by referring you to other documents separately filed by us with the SEC that contain

such information. The information we incorporate by reference is considered to be part of this prospectus and information we later file

with the SEC will automatically update and supersede the information in this prospectus. The following documents filed by us with the

SEC pursuant to Section 13(a) of the Exchange Act and any of our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange

Act, except for information furnished under Item 2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made before

the termination of the offering are incorporated by reference herein:

|

|

●

|

Our

Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 31, 2021, as amended by that Form 10-K/A

for the year ended December 31, 2020 filed with the SEC on April 20, 2021;

|

|

|

|

|

|

|

●

|

Our

Quarterly Report on Form 10-Q for the quarter ended March 30, 2021, filed with the SEC on May 17, 2021;

|

|

|

|

|

|

|

●

|

Our

Quarterly Report on form 10-Q for the quarter ended June 30, 2021, filed with the SEC on August 16, 2021;

|

|

|

|

|

|

|

●

|

The

description of our Common Stock contained in the Registration Statement on Form 8-A12G (File No. 000-55768) filed with the SEC on

April 14, 2017; and

|

|

|

|

|

|

|

●

|

Our

Current Reports on Form 8-K, filed with the SEC on January 15, 2021 and March 2, 2021.

|

Any

statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will

be deemed to be modified or superseded to the extent that a statement contained in this prospectus or any subsequently filed document

that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement.

We

will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or

documents that have been incorporated by reference in the prospectus contained in the registration statement but not delivered with the

prospectus, other than an exhibit to these filings unless we have specifically incorporated that exhibit by reference into the filing,

upon written or oral request and at no cost to the requester. Requests should be made by writing or telephoning us at the following address:

HealthLynked

Corp.

1265 Creekside Parkway, Suite 301

Naples,

Florida 34108

239-513-1992

PROSPECTUS

HealthLynked

Corp.

$50,000,000

of Common Stock

HealthLynked

Corp., a Nevada corporation (“us”, “we”, “our”, “HealthLynked”

or the “Company”) may offer and sell from time to time, in one or more series or issuances and on terms that we will

determine at the time of the offering, shares of our common stock, par value $0.0001 per share (“Common Stock”) described

in this prospectus, up to an aggregate amount of $50,000,000.

This

prospectus provides you with a general description of the securities offered. Each time we offer and sell securities, we will file a

prospectus supplement to this prospectus that contains specific information about the offering and, if applicable, the amounts, prices

and terms of the securities. Such supplements may also add, update or change information contained in this prospectus. You should carefully

read this prospectus and the applicable prospectus supplement before you invest in any of our securities. This prospectus may not be

used to consummate sales of securities unless accompanied by a prospectus supplement.

We

may offer and sell the securities described in this prospectus and any prospectus supplement directly to our stockholders or to other

purchasers or through agents on our behalf or through underwriters or dealers as designated from time to time. If any agents or underwriters

are involved in the sale of any of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters

and any applicable fees, commission or discounts.

Our

Common Stock is currently quoted on the OTCQB under the symbol “HLYK”. On April 14, 2021 the last reported sale price of

our Common Stock on the OTCQB was $0.7347 per share, and the aggregate market value of the common stock held by non-affiliates as of

such date was $100,595,879, based on 226,939,373 shares of outstanding common stock, of which 136,921,028 shares are held by non-affiliates.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” on page 2 of this prospectus

and in the documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for

certain risks and uncertainties you should consider.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This

prospectus is dated April 26, 2021.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus of HealthLynked Corp., a Nevada corporation (collectively with all of its subsidiaries, the “Company”, “HealthLynked”,

or “we”, “us”, or “our”) is a part of a registration statement on Form S-3 that we filed with the

Securities and Exchange Commission (“SEC”) utilizing a “shelf” registration process. Under this shelf registration

process, we may, from time to time, sell the securities described in this prospectus in one or more offerings up to a total dollar amount

of $50,000,000 as described in this prospectus.

The

registration statement of which this prospectus is a part provides additional information about us and the securities offered under this

prospectus. The registration statement, including the exhibits and the documents incorporated herein by reference, can be read on the

SEC website or at the SEC offices mentioned under the heading “Where You Can Find More Information.”

We

will provide a prospectus supplement containing specific information about the amounts, prices and terms of the securities for a particular

offering. The prospectus supplement may add, update or change information in this prospectus. If the information in the prospectus is

inconsistent with a prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this

prospectus and, if applicable, any prospectus supplement. See “Prospectus Summary — Where You Can Find More Information”

for more information.

You

should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have

not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. We are not making offers to sell or solicitations to buy the securities in any jurisdiction in which an offer

or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to

whom it is unlawful to make an offer or solicitation. You should not assume that the information in this prospectus or any prospectus

supplement, as well as the information we file or previously filed with the SEC that we incorporate by reference in this prospectus or

any prospectus supplement, is accurate as of any date other than the date of such document. Our business, financial condition, results

of operations and prospects may have changed since those dates.

PROSPECTUS

SUMMARY

The

items in the following summary are described in more detail later in this prospectus. This summary does not contain all of the information

you should consider. Before investing in our securities, you should read the entire prospectus carefully, including the “Risk Factors”

beginning on page 2 and the financial statements incorporated by reference.

Our

Current Business

HealthLynked

Corp.) is a growth stage company incorporated in the state of Nevada on August 6, 2014. We currently operate in four distinct divisions:

the Health Services Division, the Digital Healthcare Division, the ACO/MSO (Accountable Care Organization/Managed Service Organization),

and the Medical Distribution Division.

Health

Services Division

The

Health Services Division is comprised of the operations of (i) Naples Women’s Center (“NWC”), a multi-specialty medical

group including OB/GYN (both Obstetrics and Gynecology) and General Practice, (ii) Naples Center for Functional Medicine (“NCFM”),

a Functional Medical Practice acquired in April 2019 that is engaged in improving the health of its patients through individualized and

integrative health care, and (iii) Bridging the Gap Physical Therapy (“BTG”), a physical therapy practice in Bonita Springs,

FL opened in January 2020 that provides hands-on functional manual therapy techniques to speed patients’ recovery and manage pain

without pain medication or surgery.

Digital

Healthcare Division

The

Digital Healthcare Division develops and operates an online personal medical information and record archive system, the “HealthLynked

Network,” which enables patients and doctors to keep track of medical information via the Internet in a cloud-based system.

ACO/MSO

Division

The

ACO/MSO Division is comprised of the business acquired of Cura Health Management LLC (“CHM”) and its subsidiary ACO Health

Partners LLC (“AHP”), which were acquired by the Company on May 18, 2020. CHM and AHP operate an Accountable Care Organization

(“ACO”) that assists physician practices in providing coordinated and more efficient care to patients via the Medicare Shared

Savings Program (“MSSP”) as administered by the Centers for Medicare and Medicaid Services (the “CMS”), which

rewards providers for efficiency in patient care. The ACO/MSO Division plans to operate a Managed Service Organization (“MSO”)

during the next twelve months either through a startup operation or another purchase. The ACO received an annual payment from MSSP in

the amount of $767,744 in September 2020.

Medical

Distribution Division

The

Medical Distribution Division is comprised of the operations of MedOfficeDirect LLC (“MOD”), a virtual distributor of discounted

medical supplies selling to both consumers and medical practices throughout the United States acquired by the Company on October 19,

2020.

Corporate

Information

Our

principal executive office is located at 1265 Creekside Parkway, Suite 301, Naples, Florida 34108 and our telephone number is 239-513-1992.

Our website address is www.HealthLynked.com. No information found on our website is part of this prospectus. This prospectus may

include the names of various government agencies or the trade names of other companies. Unless specifically stated otherwise, the use

or display by us of such other parties’ names and trade names in this prospectus is not intended to and does not imply a relationship

with, or endorsement or sponsorship of us by, any of these other parties.

RISK

FACTORS

An

investment in our Common Stock involves significant risks. You should carefully consider the risk factors contained in this prospectus

and in our filings with the SEC, as well as all of the information contained in any prospectus supplement, free writing prospectus and

amendments thereto, before you decide to invest in our Common Stock. Our business, prospects, financial condition and results of operations

may be materially and adversely affected as a result of any of such risks. The value of our Common Stock could decline as a result of

any of these risks. You could lose all or part of your investment in our Common Stock. Some of our statements in sections entitled “Risk

Factors” are forward-looking statements. You should also consider the risks, uncertainties and assumptions discussed under “Part I—Item 1A—Risk

Factors” of our most recent Annual Report on Form 10-K and in “Part II—Item 1A—Risk Factors”

in our most recent Quarterly Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as

may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our business, prospects, financial condition and results of operations.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. All statements other than statements of historical facts contained in this prospectus,

including statements regarding our anticipated future clinical and regulatory milestone events, future financial position, business strategy

and plans and objectives of management for future operations, are forward-looking statements. The words “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“should,” “forecast,” “could,” “suggest,” “plan,” “potentially,”

“likely,” and similar expressions, as they relate to us, are intended to identify forward-looking statements, but are not

the exclusive means of identifying such statements. Those statements appear in this prospectus, any accompanying prospectus supplement

and the documents incorporated herein and therein by reference, particularly in the sections captioned “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and include statements regarding

the intent, belief or current expectations of our management that are subject to known and unknown risks, uncertainties and assumptions.

You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties,

and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should

not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking

statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements.

Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we

do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus, whether

as a result of any new information, future events or otherwise.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These

statements are based upon information available to us as of the date of this prospectus, and although we believe such information forms

a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate

that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently

uncertain and investors are cautioned not to unduly rely upon these statements.

This

prospectus and the documents incorporated by reference in this prospectus may contain market data that we obtain from industry sources.

These sources do not guarantee the accuracy or completeness of the information. Although we believe that our industry sources are reliable,

we do not independently verify the information. The market data may include projections that are based on a number of other projections.

While we believe these assumptions to be reasonable and sound as of the date of this prospectus, actual results may differ from the projections.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds to us from the sale of our securities under this prospectus. Unless otherwise

provided in the applicable prospectus supplement, we currently expect to use the net proceeds that we receive from this offering

for working capital and other general corporate purposes. We may also use a portion of the net proceeds to acquire, license or invest

in complementary technologies or businesses; however, we currently have no agreements or commitments to complete any such transaction.

The expected use of net proceeds of this offering represents our current intentions based on our present plans and business conditions.

We cannot specify with certainty all of the particular uses for the net proceeds to be received upon the closing of this offering.

DESCRIPTION

OF OUR CAPITAL STOCK

We

are authorized to issue 500,000,000 shares of Common Stock, par value $0.0001 per share. As of April 14, 2021, there were 226,939,373

shares of Common Stock, par value $0.0001, issued and outstanding. Upon liquidation, dissolution or winding-up of the Company, our assets,

after the payment of debts and liabilities and any liquidation preferences of, and unpaid dividends on, any class of preferred stock

then outstanding, will be distributed pro-rata to the holders of our Common Stock. The holders of our Common Stock do not have preemptive

rights, meaning that the common stockholders’ ownership interest in the Company would be diluted if additional shares of Common

Stock are subsequently issued and the existing stockholders are not granted the right, at the discretion of the Company’s board

of directors (the “Board of Directors”), to maintain their ownership interest in our Company.

The

holders of Common Stock are entitled to share equally in dividends, if, as and when declared by our Board of Directors, out of funds

legally available therefore, subject to the priorities given to any class of preferred stock which may be issued. Any future dividends

will be subject to the discretion of our Board of Directors and will depend upon, among other things, future earnings, the operating

and financial condition of our Company, its capital requirements, general business conditions and other pertinent factors. It is not

anticipated that dividends will be paid in the foreseeable future.

Our

Common Stock is quoted on the OTCQB under the trading symbol “HLYK”. On April 14, 2021 the last reported sale price of our

Common Stock was $0.7347 per share.

Transfer

Agent

The

Company’s transfer agent is Worldwide Stock Transfer, LLC. The transfer agent’s telephone number is (201) 820-2008.

Anti-Takeover

Effects of Certain Provisions of Nevada Law and Our Charter Documents

The

following is a summary of certain provisions of Nevada law, our Certificate of Incorporation and our Bylaws. This summary does not purport

to be complete and is qualified in its entirety by reference to the corporate law of Nevada and our Articles of Incorporation and Bylaws.

Business

Combinations

The

“business combination” provisions of Sections 78.411 to 78.444, inclusive, of the Nevada Revised Statutes, or NRS, generally

prohibit a Nevada corporation with at least 200 stockholders from engaging in various “combination” transactions with any

interested stockholder for a period of two years after the date of the transaction in which the person became an interested stockholder,

unless the transaction is approved by the Board of Directors prior to the date the interested stockholder obtained such status or the

combination is approved by the Board of Directors and thereafter is approved at a meeting of the stockholders by the affirmative vote

of stockholders representing at least 60% of the outstanding voting power held by disinterested stockholders, and extends beyond the

expiration of the two-year period, unless:

|

|

●

|

the

combination was approved by the Board of Directors prior to the person becoming an interested

stockholder or the transaction by which the person first became an interested stockholder

was approved by the Board of Directors before the person became an interested stockholder

or the combination is later approved by a majority of the voting power held by disinterested

stockholders; or

|

|

|

●

|

if

the consideration to be paid by the interested stockholder is at least equal to the highest

of: (a) the highest price per share paid by the interested stockholder within the two years

immediately preceding the date of the announcement of the combination or in the transaction

in which it became an interested stockholder, whichever is higher, (b) the market value per

share of common stock on the date of announcement of the combination and the date the interested

stockholder acquired the shares, whichever is higher, or (c) for holders of preferred stock,

the highest liquidation value of the preferred stock, if it is higher.

|

A

“combination” is generally defined to include mergers or consolidations or any sale, lease exchange, mortgage, pledge, transfer,

or other disposition, in one transaction or a series of transactions, with an “interested stockholder” having: (a) an aggregate

market value equal to 5% or more of the aggregate market value of the assets of the corporation, (b) an aggregate market value equal

to 5% or more of the aggregate market value of all outstanding shares of the corporation, (c) 10% or more of the earning power or net

income of the corporation, and (d) certain other transactions with an interested stockholder or an affiliate or associate of an interested

stockholder.

In

general, an “interested stockholder” is a person who, together with affiliates and associates, owns (or within two years,

did own) 10% or more of a corporation’s voting stock. The statute could prohibit or delay mergers or other takeover or change in

control attempts and, accordingly, may discourage attempts to acquire our Company even though such a transaction may offer our stockholders

the opportunity to sell their stock at a price above the prevailing market price.

Control

Share Acquisitions

The

“control share” provisions of Sections 78.378 to 78.3793 of the NRS apply to “issuing corporations” that are

Nevada corporations with at least 200 stockholders, including at least 100 stockholders of record who are Nevada residents, and that

conduct business directly or indirectly in Nevada. The control share statute prohibits an acquirer, under certain circumstances, from

voting its shares of a target corporation’s stock after crossing certain ownership threshold percentages, unless the acquirer obtains

approval of the target corporation’s disinterested stockholders. The statute specifies three thresholds: one-fifth or more but

less than one-third, one-third but less than a majority, and a majority or more, of the outstanding voting power. Generally, once an

acquirer crosses one of the above thresholds, those shares in an offer or acquisition and acquired within 90 days thereof become “control

shares” and such control shares are deprived of the right to vote until disinterested stockholders restore the right. These provisions

also provide that if control shares are accorded full voting rights and the acquiring person has acquired a majority or more of all voting

power, all other stockholders who do not vote in favor of authorizing voting rights to the control shares are entitled to demand payment

for the fair value of their shares in accordance with statutory procedures established for dissenters’ rights.

A

corporation may elect to not be governed by, or “opt out” of, the control share provisions by making an election in its articles

of incorporation or bylaws, provided that the opt-out election must be in place on the 10th day following the date an acquiring person

has acquired a controlling interest, that is, crossing any of the three thresholds described above. We have not opted out of the control

share statutes, and will be subject to these statutes if we are an “issuing corporation” as defined in such statutes.

The

effect of the Nevada control share statutes is that the acquiring person, and those acting in association with the acquiring person,

will obtain only such voting rights in the control shares as are conferred by a resolution of the stockholders at an annual or

special meeting. The Nevada control share law, if applicable, could have the effect of

discouraging takeovers of our Company.

Our

Charter Documents

Our

charter documents include provisions that may have the effect of discouraging, delaying or preventing a change in control or an unsolicited

acquisition proposal that a stockholder might consider favorable, including a proposal that might result in the payment of a premium

over the market price for the shares held by our stockholders. Certain of these provisions are summarized in the following paragraphs.

Effects

of authorized but unissued common stock. One of the effects of the existence of authorized but unissued common stock may be to enable

our Board of Directors to make more difficult or to discourage an attempt to obtain control of our Company by means of a merger, tender

offer, proxy contest or otherwise, and thereby to protect the continuity of management. If, in the due exercise of its fiduciary obligations,

the Board of Directors were to determine that a takeover proposal was not in our best interest, such shares could be issued by the Board

of Directors without stockholder approval in one or more transactions that might prevent or render more difficult or costly the completion

of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder group, by putting

a substantial voting block in institutional or other hands that might undertake to support the position of the incumbent Board of Directors,

by effecting an acquisition that might complicate or preclude the takeover, or otherwise.

Cumulative

Voting. Our Articles of Incorporation do not provide for cumulative voting in the election of directors, which would allow holders

of less than a majority of the stock to elect some directors.

Vacancies.

Our Bylaws provide that all vacancies may be filled by the affirmative vote of a majority of directors then in office, even if less than

a quorum.

PLAN

OF DISTRIBUTION

We

may sell securities:

|

|

●

|

directly

to purchasers; or

|

|

|

●

|

through

a combination of any of these methods of sale.

|

In

addition, we may issue the securities as a dividend or distribution to our existing securityholders.

We

may directly solicit offers to purchase securities or agents may be designated to solicit such offers. We will, in the prospectus supplement

relating to such offering, name any agent that could be viewed as an underwriter under the Securities Act and describe any commissions

that we must pay. Any such agent will be acting on a best-efforts basis for the period of its appointment or, if indicated in the applicable

prospectus supplement, on a firm commitment basis. This prospectus may be used in connection with any offering of our securities through

any of these methods or other methods described in the applicable prospectus supplement.

The

distribution of the securities may be affected from time to time in one or more transactions:

|

|

●

|

at

a fixed price or prices that may be changed from time to time;

|

|

|

●

|

at

market prices prevailing at the time of sale;

|

|

|

●

|

at

prices related to such prevailing market prices; or

|

Each

prospectus supplement will describe the method of distribution of the securities and any applicable restrictions.

The

prospectus supplement with respect to the securities of a particular series will describe the terms of the offering of the securities,

including the following:

|

|

●

|

the

name of the agent or any underwriters;

|

|

|

●

|

the

public offering or purchase price;

|

|

|

●

|

any

discounts and commissions to be allowed or paid to the agent or underwriters;

|

|

|

●

|

all

other items constituting underwriting compensation;

|

|

|

●

|

any

discounts and commissions to be allowed or paid to dealers; and

|

|

|

●

|

any

exchanges on which the securities will be listed.

|

If

any underwriters or agents are utilized in the sale of the securities in respect of which this prospectus is delivered, we will enter

into an underwriting agreement or other agreement with them at the time of sale to them, and we will set forth in the prospectus supplement

relating to such offering the names of the underwriters or agents and the terms of the related agreement with them.

If

a dealer is utilized in the sale of the securities in respect of which the prospectus is delivered, we will sell such securities to the

dealer, as principal. The dealer may then resell such securities to the public at varying prices to be determined by such dealer at the

time of resale.

Agents,