By William Boston and Sarah Nassauer

European and international companies are bracing for possible

rising costs and growing supply-chain complications as the blockage

of the Suez Canal heads into a fourth day amid signs of still

longer backlogs.

Retail and manufacturing importers are watching for delays in

their supply chains that already are strained by global

disruptions, and some are considering alternative routes, including

sending goods using pricier airfreight or on ships sailing around

Africa, which could stretch out deliveries by as long as two

weeks.

"We are keeping an eye on the situation," a spokesman for Dutch

brewing giant Heineken NV said, adding that a few of the company's

containers are delayed. "We feel comfortable for now with the

contingencies we have in place," the spokesman said.

The companies are tracking the growing backlog at the Suez Canal

as authorities there struggle to refloat the Ever Given, a

1,300-foot ship operated by Taiwan-based Evergreen Group that got

stuck in the canal.

The Suez Canal backup mostly won't affect big U.S. retailers

directly, but European companies will see a hit in an already tight

shipping market, said Chris Sultemeier, a former executive vice

president of logistics for Walmart Inc., the largest importer and

retailer in the U.S.

"The Suez is primarily used for Asia to Europe traffic, so from

a consumer goods, retailer standpoint it will have a dramatic

effect on Europe," he said.

High-end motorcycle maker Ducati Motor Holding SpA, which

manufactures its bikes in Bologna, Italy, and exports globally,

said finished products heading to Asia passing through the canal

aren't likely to reach customers on time.

So far, there hasn't been an impact on Ducati's production. But

Chief Executive Claudio Domenicali said supply disruptions from

transport difficulties in recent months are among the biggest

threats to the company's recovery since the second half of 2020.

"It's a bit worse than it was last year," Mr. Domenicali said.

A Ducati spokeswoman said that the company, owned by German car

maker Audi AG, would arrange alternative transportation, including

pricier airfreight, should delays at the Suez Canal threaten the

import of parts needed for production.

Executives at some businesses are weighing the costs of waiting

for the canal to reopen -- which could be days away or longer,

according to shipping experts -- against the costs and timing of

other transportation options.

Freight rates for shipping containers from Asia to Europe, which

have soared over the past year as retailers and manufacturers have

rushed to restock inventories depleted during the pandemic, have

remained steady during the Suez blockage, but that could change if

it drags on.

"If the delays continue though, that's another story," said

Eytan Buchman, chief marketing officer at Freightos, a Hong

Kong-based digital shipping rate provider. "If it gets bad enough

and carriers choose to reroute around Africa instead of waiting for

the canal to clear, importers will obviously experience delays due

to the longer transit time," Mr. Buchman said, "and likely

increased prices because of the additional costs associated with

the longer route."

The Warehouse Group Ltd., a North Shore, New Zealand-based

retailer, expects the blockage to exacerbate shipping delays the

company has been dealing with since late last year due to

pandemic-related restrictions. "The Suez Canal is likely to be

blocked for a couple of days, which isn't going to help," Chief

Executive Nick Grayston said on a Wednesday earnings call.

If the Ever Given can't be dislodged quickly, or if the vessel

isn't seaworthy because of hull damage or the weight of its cargo,

shipping lines will have to divert around Africa, extending transit

times and driving up fuel consumption, said Alan Murphy, chief

executive of Denmark-based maritime research firm Sea-Intelligence

ApS.

A prolonged blockage would exacerbate a continuing container

shortage and tie up more vessels and boxes in the Asia-Europe trade

lane, Mr. Murphy said. "That would force importers to fight for the

available containers," he said, and the problem would ripple out to

other trade lanes the longer the Suez is blocked.

Another alternate route would be shipping goods by rail on the

growing overland networks that have sprung up between China and

Europe. Johannes Schlingmeier, co-chief executive of Container

xChange, an online marketplace for buying and selling shipping

containers, said transportation companies have stepped up their

marketing of those services this week.

Some U.S. importers expecting shipments from India are bracing

for potential delays in coming months because of the Suez Canal

blockage, adding to what has already been a difficult shipping

year.

At Cheektowaga, N.Y.-based Christmas Central, a mostly online

seller of lights, seasonal décor and outdoor items, shipments from

India of items such as outdoor rugs and lanterns aren't yet

delayed, said President Nathan Gordon. But if ships head back to

India later than planned, that could affect shipments booked weeks

from now, he said.

"They haven't said there are any issues yet, but anything is

possible with the shipping disasters happening this year," said Mr.

Gordon.

Parmy Olson, Saabira Chaudhuri, Jennifer Smith, Paul Page and

Mark Maurer contributed to this article.

Write to William Boston at william.boston@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

March 25, 2021 13:46 ET (17:46 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

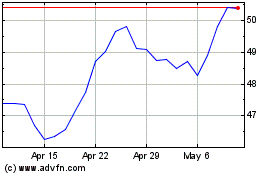

Heineken Nv (QX) (USOTC:HEINY)

Historical Stock Chart

From Mar 2024 to Apr 2024

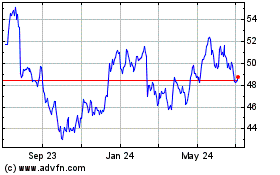

Heineken Nv (QX) (USOTC:HEINY)

Historical Stock Chart

From Apr 2023 to Apr 2024