Struggling Electric Vehicle Maker Workhorse Gets a Little Breathing Room

April 03 2019 - 6:05PM

Dow Jones News

By Andrew Scurria

Electric truck and drone developer Workhorse Group Inc. reached

a deal with lender Marathon Asset Management LP to relax financial

covenants on a $35 million financing package as the company tries

to meet demand for its vehicles.

Workhorse took out the loan from Marathon in January, saying it

would provide "meaningful, near-term funding" toward building and

delivering vehicles to United Parcel Service Inc., Deutsche Post

AG's DHL and other customers this year. The lender supplied a $10

million lump sum, plus a $25 million revolving line of credit to

meet purchase orders.

Marathon has now agreed to push back to April 30 from March 31 a

requirement for Workhorse to maintain $4 million in liquidity,

according to a Tuesday securities filing. As of Dec. 31, Workhorse

had $1.5 million in cash, cash equivalents and short-term

investments.

Deadlines for the company to achieve certain leverage ratios and

debt service coverage ratios were also delayed to Dec. 31 from

Sept. 30, according to the filing.

Workhorse, which develops and sells electric-powered delivery

trucks and vans for package-delivery companies and utilities,

reported a backlog of 1,100 orders for its NGEN-1000 electric vans

last month. The company started building prototypes in October.

Trucking delivery companies such as FedEx Corp., DHL and UPS are

eager to add electric delivery vans to their fleet as regulators

push to rein in pollution from commercial vehicles. All three have

ordered Workhorse electric trucks in recent years.

But capital constraints have prevented Workhorse from delivering

on the backlog, shrinking sales to $21,000 in the fourth quarter

last year, down from $5.2 million in the same period a year

earlier. Net loss was $17.7 million, up from $11.7 million a year

before, after the company absorbed additional warranty costs.

Chief Executive Duane Hughes acknowledged that last year was "a

challenging time for our business" but said the Marathon loan would

allow the company to reduce its dependence on equity financing and

focus on "the profitable manufacturing and delivery of the electric

vehicles we currently have in our significant backlog."

Write to Andrew Scurria at Andrew.Scurria@wsj.com

WSJ Pro Bankruptcy also covers distressed companies. Inclusion

of a company in this category is not intended to suggest that it

will file for bankruptcy protection, default on its debt or suffer

any other financial failure.

(END) Dow Jones Newswires

April 03, 2019 17:50 ET (21:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

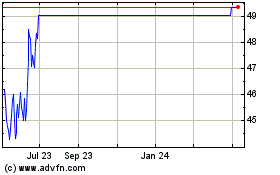

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Apr 2023 to Apr 2024