CommerceWest Bank (OTCBB: CWBK) reported earnings for the three

months ended June 30, 2012 of $1,016,000 or $0.24 per basic common

share and $0.23 per diluted common share, compared with net income

of $343,000 or $0.08 per basic common share and $0.08 per diluted

common share for the three months ended June 30, 2011, an increase

of 200% and 188% respectively. The bank reported earnings for the

six months ended June 30, 2012 of $1,598,000 million or $0.37 per

basic common share and $0.36 per diluted common share, compared

with net income of $725,000 or $0.16 per basic common share and

$0.16 per diluted common share for the six months ended June 30,

2011, an increase of 131% and 125% respectively.

Financial performance highlights for the three months ended June

30, 2012 as compared to the three months ended June 30, 2011:

- Earnings growth of 195%

- Return on average assets of 1.30%, an

increase of 189%

- Non-interest income growth of 79%

- Non-interest expense reduction of

10%

- Cost of funds reduced 22%

- Loan growth of 19%

- Nonperforming assets reduced 75%, from

1.40% to 0.34% of total assets

- Non-interest bearing deposit growth of

30%

- A fortress balance sheet, with a tier 1

leverage ratio of 13.38% and total risk based capital ratio of

22.07%

- No TARP

Financial performance highlights for the three months ended June

30, 2012 as compared to the three months ended March 31, 2012:

- Earnings growth of 74%

- Non-interest income growth of 19%

- Non-interest expense reduction of

8%

- Nonperforming assets reduced 57%, from

0.83% to 0.34% of total assets

- Asset growth of 5%

- Loan growth of 8%

- Non-interest bearing deposit growth of

12%

- Total deposit growth of 7%

Mr. Ivo Tjan, Chairman and CEO stated, "The team has again

demonstrated the strength of our business model, core competency

and ability to grow with profitability. Our team members are

talented, passionate and will continue the mission to build the

best business banking franchise in California. Our proven business

model has allowed us to materially improve asset quality, while at

the same time growing core deposits and total loans. The Bank

continues to execute on our strategic approach of balancing between

offense and defense, which resulted in a 75% reduction in

non-performing assets, 19% growth in loans, a 30% increase in

non-interest bearing deposits and a 37% increase in non-interest

income year over year; while at the same time reducing non-interest

expense by 11%. Our results for the second quarter were highlighted

by strong earnings growth of 195% as compared to the same three

month period one year ago and 120% earnings growth for the six

months ended June 30, 2012, as compared to the same six month

period one year ago."

Mr. Tjan continued, "As we stated earlier in the year, the

runway is clear and we have begun to execute on delivering results

for our shareholders and clients. We are confident in our future

and our ability to grow the franchise value by managing growth with

profitability, which focuses on top line revenue, fee income

generation, quality loan growth, expanding the mixture in

non-interest bearing deposits and increasing core earnings."

Total assets increased $13.8 million as of June 30, 2012, an

increase of 4% as compared to the same period one year ago. Total

loans increased $26.1 million as of June 30, 2012, an increase of

19% over the prior year. Cash and due from banks decreased $10.7

million or 17% from the prior year. Total investment securities

decreased $7.5 million or 8% from the prior year.

Total deposits increased $11 million as of June 30, 2012, an

increase of 4% from June 30, 2011. Non-interest bearing deposits

grew $22.2 million as of June 30, 2012, an increase of 30% over the

prior year.

Stockholders’ equity on June 30, 2012 was $46.7 million, an

increase of 5% as compared to stockholders’ equity of $44.5 million

a year ago.

Total nonperforming assets decreased $3.3 million as of June 30,

2012, a decrease of 75% as compared to the same period one year

ago, from 1.40% to 0.34% of total assets. Provision for loan losses

for the three months ended June 30, 2012 was $75,000 compared to

$60,000 for the three months ended June 30, 2012, an increase of

25%. Provision for loan losses for the six months ended June 30,

2012 was $195,000 compared to $160,000 for the six months ended

June 30, 2012, an increase of 22%.

Non-interest income for the three months ended June 30, 2012 was

$945,000 compared to $529,000 for the same period last year, an

increase of 79%. Non-interest income for the six months ended June

30, 2012 was $1,737,000 compared to $1,267,000 for the same period

last year, an increase of 37%.

Non-interest expense for the three months ended June 30, 2012

was $2,332,000 compared to $2,579,000 for the same period last

year, a decrease of 10%. Non-interest expense for the six months

ended June 30, 2012 was $4,857,000 compared to $5,429,000 for the

same period last year, a decrease of 11%.

The Bank’s efficiency ratio for the three months ended June 30,

2012 was 59.01% compared to 83.78% in 2011, which represents a

decrease of 30%. The efficiency ratio illustrates, that for every

dollar the Bank made for the three month period ending June 30,

2012, the Bank spent $0.59 to make it, as compared to $0.84 one

year ago.

Capital ratios for the Bank remain well above the levels

required for a “well capitalized” institution as designated by

regulatory agencies. As of June 30, 2012, the leverage ratio was

13.38%, the tier 1 capital ratio was 20.82%, and the total

risk-based capital ratio was 22.07%.

CommerceWest Bank is headquartered at 2111 Business Center Drive

in Irvine, CA, with Regional Offices in Orange County, Riverside

County, Los Angeles County and San Diego County. We are a full

service business bank and offer a wide range of commercial banking

services, including concierge services, remote deposit solution,

full-service internet banking, lines of credit, term loans,

commercial real estate lending, SBA lending, and full cash

management.

Mission Statement: CommerceWest Bank will create a complete

banking experience for each client, catering to businesses and

their specific banking needs, while accommodating our clients and

providing them high-quality, low stress and personally tailored

banking and financial services.

Please visit www.cwbk.com to learn more about the bank. “BANK ON

THE DIFFERENCE”

Statements concerning future performance, developments or

events, expectations for growth and income forecasts, and any other

guidance on future periods, constitute forward-looking statements

that are subject to a number of risks and uncertainties. Actual

results may differ materially from stated expectations. Specific

factors include, but are not limited to, loan production, balance

sheet management, expanded net interest margin, the ability to

control costs and expenses, interest rate changes, financial

policies of the United States government and general economic

conditions. The Company disclaims any obligation to update any such

factors or to publicly announce the results of any revisions to any

forward-looking statements contained in this release to reflect

future events or developments.

SECOND QUARTER REPORT - JUNE 30, 2012 (Unaudited)

BALANCE SHEET Increase (dollars

in thousands)

June 30, 2012 June 30, 2011

(Decrease) ASSETS Cash and due from banks

51,371 62,063 -17 % Securities 83,980 91,449 -8 % Loans 164,013

137,880 19 % Less allowance for loan losses (3,081 ) (3,967 ) -22 %

Loans, net 160,932 133,913 20 % Bank premises and equipment,

net 380 740 -49 % Other assets 30,969 25,670 21 %

Total assets 327,632 313,835 4 %

LIABILITIES AND STOCKHOLDERS' EQUITY Non-interesting bearing

deposits 95,872 73,698 30 % Interest bearing deposits 182,585

193,752 -6 % Total deposits 278,457 267,450 4 % Total

borrowings 500 500 0 % Other liabilities 1,911 1,415

35 % 280,868 269,365 4 % Stockholders' equity 46,764 44,470

5 % Total liabilities and stockholders' equity 327,632

313,835 4 %

CAPITAL

RATIOS:

Tier 1 leverage ratio 13.38 % 12.94 % 3 % Tier 1 risk-based capital

ratio 20.82 % 21.01 % -1 % Total risk-based capital ratio 22.07 %

22.27 % -1 %

STATEMENT OF

EARNINGS Three Months Ended

Increase Six Months Ended

Increase (dollars in thousands except share and per

share data)

June 30, 2012 June 30,

2011 (Decrease) June 30, 2012

June 30, 2011 (Decrease) Interest

income 3,071 3,192 -4 % 6,116 6,502 -6 % Interest expense

593 738 -20 % 1,203 1,455

-17 % Net interest income 2,478 2,454 1 % 4,913 5,047 -3 %

Provision for loan losses 75 60 25 % 195 160 22 % Non-interest

income 945 529 79 % 1,737 1,267 37 % Non-interest expense

2,332 2,579 -10 % 4,857

5,429 -11 % Earnings before income taxes 1,016 344 195 %

1,598 725 120 % Income taxes 0 0 0 %

0 0 0 % Net earnings 1,016

344 195 % 1,598 725

120 % Basic earnings per share $ 0.24 $ 0.08 200 % $

0.37 $ 0.16 131 % Diluted earnings per share $ 0.23 $ 0.08 188 % $

0.36 $ 0.16 125 % Return on Assets (annualized) 1.30 % 0.45 % 189 %

1.05 % 0.48 % 119 % Return on Equity (annualized) 8.76 % 3.10 % 183

% 6.89 % 3.33 % 107 % Efficiency Ratio 59.01 % 83.78 % -30 % 63.48

% 83.45 % -24 % Net Interest Margin 3.71 % 3.68 % 1 % 3.74 % 3.82 %

-2 %

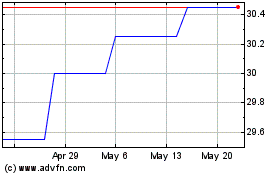

CW Bancorp (QX) (USOTC:CWBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

CW Bancorp (QX) (USOTC:CWBK)

Historical Stock Chart

From Apr 2023 to Apr 2024