UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended

December 31, 2018

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______ to ______.

Commission

File Number:

333-199583

|

|

THE

COFFEESMITHS COLLECTIVE, INC.

|

|

|

|

(f/k/a

DOCASA, Inc.)

|

|

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

47-1405387

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(IRS

Employer

Identification

No.)

|

|

1901

North Roselle Road, Suite 800

Schaumburg,

Illinois

|

|

60195

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(630) 250-2709

Securities

registered under Section 12(b) of the Exchange Act:

None

Securities

registered under Section 12(g) of the Exchange Act:

Common

Stock, $0.001 Par Value

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ]

Yes [X] No

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [X] Yes [ ]

No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act

during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. [ ] Yes [X] No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [ ]

Yes [X] No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company filer. See definition of “large accelerated filer”, “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

Accelerated Filer

|

[ ]

|

Accelerated

Filer

|

[ ]

|

|

Non-Accelerated

Filer

|

[ ]

|

Smaller

Reporting Company

|

[X]

|

|

|

|

Emerging

Growth Company

|

[ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes [ ]

No [ ]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X]

No

On

June 30, 2018, the last business day of the registrant’s most recently completed second quarter, the aggregate market value

of the registrant’s common stock held by non-affiliates of the registrant was $40,010,300, based upon the closing price

on that date of the common stock of the registrant on the OTC Link system of $0.80/share. For purposes of this response, the registrant

has assumed that its directors, executive officers and beneficial owners of 5% or more of its common stock are deemed affiliates

of the registrant.

As

of April 12, 2019, the registrant had 160,012,875 shares of its common stock, $0.001 par value, outstanding. The Company

has 47,087,125 shares of its common stock conditionally issuable.

EXPLANATORY NOTE

The Coffeesmiths Collective, Inc.

(the “Company”) is filing this Current Report on Form 10-K/A (“Amendment No. 1”) to amend its Current

Report on Form 10-K filed with the Securities and Exchange Commission on April 17, 2019 (the “Initial Report”), which

had two administrative errors; one on the Statements of Operations and the other on the Statements of Cash Flow.

The information previously reported

in the Initial Report is hereby incorporated by reference into this Amendment No. 1. This Amendment No. 1 is being filed solely

to provide the information required by Item 8. Of Form 10-K and does not amend the Initial Report in any manner other than such

Item 8.

The updates in Amendment No. 1 were

already included elsewhere in the Initial Report but were not appropriately updated on these two pages, as follows:

Statements of Operations –

The foreign currency translation profit (loss) for 2018 was incorrectly reported as $393,465 whereas it should have been $(107,524).

As a consequence of this administrative error, total comprehensive loss was reported as $(2,284,758) whereas it should have been

$(2,785,746).

Statements of Cash Flow –

The non-cash investing and financing activities for the four months ended December 31, 2017 had reported acquisitions –

inventory, acquisitions – prepaid expenses, acquisitions – fixed assets, net, acquisitions – deposits, acquisitions

– accrued expenses, and acquisitions – loans as zero. Each balance has been corrected in Amendment No. 1.

THE

COFFEESMITHS COLLECTIVE, INC.

(f/k/a

DOCASA, Inc.)

and

Subsidiaries

Consolidated

Statements of Operations and Comprehensive Loss

|

|

|

For

the year

|

|

|

For

the four

|

|

|

For

the year

|

|

|

|

|

ended

|

|

|

months

ended

|

|

|

ended

|

|

|

|

|

December

31,

|

|

|

December

31,

|

|

|

August

31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue,

net

|

|

$

|

10,049,846

|

|

|

$

|

2,066,111

|

|

|

$

|

4,180,483

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct

costs of revenue

|

|

|

6,794,062

|

|

|

|

1,618,963

|

|

|

|

3,633,591

|

|

|

Professional

fees

|

|

|

270,416

|

|

|

|

102,533

|

|

|

|

171,181

|

|

|

Rent

|

|

|

1,488,265

|

|

|

|

252,528

|

|

|

|

463,655

|

|

|

Depreciation

and amortization

|

|

|

543,036

|

|

|

|

101,817

|

|

|

|

191,025

|

|

|

Property

taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

10,461

|

|

|

Other

general and administrative expenses

|

|

|

3,540,439

|

|

|

|

496,071

|

|

|

|

1,091,080

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

loss

|

|

|

(2,586,371

|

)

|

|

|

(505,801

|

)

|

|

|

(1,380,510

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

expense

|

|

|

(82,348

|

)

|

|

|

(10,293

|

)

|

|

|

-

|

|

|

Impairment

expense

|

|

|

(13,582

|

)

|

|

|

-

|

|

|

|

(46,566

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss

before provision for income taxes

|

|

|

(2,682,300

|

)

|

|

|

(516,094

|

)

|

|

|

(1,427,076

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision

for income tax

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Net

loss before non-controlling interest

|

|

|

(2,682,300

|

)

|

|

|

(516,094

|

)

|

|

|

(1,427,076

|

)

|

|

Loss

attributable to non-controlling interest

|

|

|

4,077

|

|

|

|

638

|

|

|

|

1,230

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss attributable to common shareholders

|

|

$

|

(2,678,222

|

)

|

|

$

|

(515,456

|

)

|

|

$

|

(1,425,846

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign

currency translation profit (loss)

|

|

|

(107,524

|

)

|

|

|

199,814

|

|

|

|

(33,723

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

comprehensive loss

|

|

$

|

(2,785,746

|

)

|

|

$

|

(315,642

|

)

|

|

$

|

(1,459,569

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss attributable to common shareholders per share

|

|

$

|

(0.01

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

average number of shares outstanding

|

|

|

208,288,685

|

|

|

|

207,100,000

|

|

|

|

207,025,000

|

|

See

accompanying notes to consolidated financial statements.

The

Coffeesmiths Collective, Inc.

and

Subsidiaries

Consolidated

Statements of Cash Flows

|

|

|

For

the Year

|

|

|

For

the Four

|

|

|

For

the Year

|

|

|

|

|

Ended

|

|

|

Months

Ended

|

|

|

Ended

|

|

|

|

|

December

31,

|

|

|

December

31,

|

|

|

August

31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2017

|

|

|

Cash

flows from operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss attributable to common shareholders

|

|

$

|

(2,682,302

|

)

|

|

$

|

(516,094

|

)

|

|

$

|

(1,425,846

|

)

|

|

Adjustments

to reconcile net loss before taxes and non-controlling interest to net cash provided by (used in) operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

and amortization expense

|

|

|

543,036

|

|

|

|

101,817

|

|

|

|

190,645

|

|

|

Other

comprehensive income

|

|

|

(107,524

|

)

|

|

|

199,814

|

|

|

|

(33,723

|

)

|

|

Impairment

expense

|

|

|

-

|

|

|

|

-

|

|

|

|

46,566

|

|

|

Bad

debt expense

|

|

|

-

|

|

|

|

-

|

|

|

|

423,680

|

|

|

Non-controlling

interest gain

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,230

|

)

|

|

Changes

in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts

receivable

|

|

|

(94,243

|

)

|

|

|

216,420

|

|

|

|

(551,695

|

)

|

|

Other

receivables

|

|

|

-

|

|

|

|

-

|

|

|

|

114,874

|

|

|

Prepaid

expenses

|

|

|

(21,410

|

)

|

|

|

(261,446

|

)

|

|

|

153,979

|

|

|

Inventory

|

|

|

(59,235

|

)

|

|

|

1,950

|

|

|

|

(7,154

|

)

|

|

Prepaid

expenses and other assets

|

|

|

-

|

|

|

|

-

|

|

|

|

(32,678

|

)

|

|

Other

non-current receivables

|

|

|

8,349

|

|

|

|

(1,840

|

)

|

|

|

-

|

|

|

Deposits

|

|

|

(235,652

|

)

|

|

|

(2,211

|

)

|

|

|

-

|

|

|

Accounts

payable

|

|

|

703,561

|

|

|

|

43,261

|

|

|

|

322,133

|

|

|

Accounts

payable to related parties

|

|

|

10,064

|

|

|

|

(40,867

|

)

|

|

|

-

|

|

|

Accrued

expenses

|

|

|

(1,621,887

|

)

|

|

|

282,167

|

|

|

|

(35,665

|

)

|

|

Taxes

payable

|

|

|

140,379

|

|

|

|

(32,079

|

)

|

|

|

78,585

|

|

|

Deferred

revenue

|

|

|

5,598

|

|

|

|

2,973

|

|

|

|

26,104

|

|

|

Net

cash used in operating activities

|

|

|

(3,411,266

|

)

|

|

|

(6,135

|

)

|

|

|

(731,424

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows used in investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition

of fixed assets

|

|

|

(1,936,809

|

)

|

|

|

(38,294

|

)

|

|

|

(831,296

|

)

|

|

Acquisition

of intangible assets

|

|

|

-

|

|

|

|

(4,779

|

)

|

|

|

-

|

|

|

Investments

|

|

|

-

|

|

|

|

-

|

|

|

|

29

|

|

|

Cash paid for acquisitions

|

|

|

(2,242,170

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Cash

acquired from acquisitions

|

|

|

256,550

|

|

|

|

200,582

|

|

|

|

-

|

|

|

Acquisition of Tapped, net

|

|

|

-

|

|

|

|

(243,937

|

)

|

|

|

-

|

|

|

Advance

to related party

|

|

|

(511,738

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Net

cash used in investing activities

|

|

|

(4,434,167

|

)

|

|

|

(86,428

|

)

|

|

|

(831,267

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

flows from (used in) financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds

from notes payable

|

|

|

-

|

|

|

|

-

|

|

|

|

3,229,558

|

|

|

Payments

on notes payable to related parties

|

|

|

-

|

|

|

|

(58,667

|

)

|

|

|

-

|

|

|

Payments

on capital leases

|

|

|

(108,425

|

)

|

|

|

(75,270

|

)

|

|

|

(57,986

|

)

|

|

Contributions

of capital

|

|

|

-

|

|

|

|

1,289

|

|

|

|

-

|

|

|

Sale

of preference shares

|

|

|

10,592,782

|

|

|

|

611,769

|

|

|

|

638,037

|

|

|

Payments

on notes payable

|

|

|

(213,811

|

)

|

|

|

(364,155

|

)

|

|

|

(2,244,654

|

)

|

|

Net

cash provided by (used in) financing activities

|

|

|

10,269,921

|

|

|

|

114,966

|

|

|

|

1,564,955

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

increase (decrease) in cash

|

|

|

2,428,488

|

|

|

|

22,403

|

|

|

|

2,263

|

|

|

Cash

at beginning of period

|

|

|

115,803

|

|

|

|

93,400

|

|

|

|

91,137

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

at end of period

|

|

$

|

2,540,291

|

|

|

$

|

115,803

|

|

|

$

|

93,400

|

|

The

Coffeesmiths Collective, Inc.

and

Subsidiaries

Consolidated

Statements of Cash Flows

|

|

|

For

the Year

|

|

|

For

the Four

|

|

|

For

the Year

|

|

|

|

|

Ended

|

|

|

Months

Ended

|

|

|

Ended

|

|

|

|

|

December

31,

|

|

|

December

31,

|

|

|

August

31,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

2017

|

|

|

Supplemental

disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

paid for interest

|

|

$

|

32,138

|

|

|

$

|

10,293

|

|

|

$

|

-

|

|

|

Cash

paid for taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

606

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash

investing and financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisitions

- Goodwill

|

|

$

|

9,372,020

|

|

|

$

|

2,013,119

|

|

|

$

|

-

|

|

|

Acquisitions

- Accounts receivable, net

|

|

$

|

225,520

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Acquisitions

- Inventory

|

|

$

|

235,651

|

|

|

$

|

(51,411

|

)

|

|

$

|

-

|

|

|

Acquisitions

- Loan receivable

|

|

$

|

6,130

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Acquisition

- Prepaid expenses

|

|

$

|

135,320

|

|

|

$

|

(95,052

|

)

|

|

$

|

-

|

|

|

Acquisitions

- Fixed assets, net

|

|

$

|

1,808,465

|

|

|

$

|

(73,3337

|

)

|

|

$

|

-

|

|

|

Acquisitions

- Intangible assets, net

|

|

$

|

126,209

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Acquisitions

- Deposits

|

|

$

|

79,737

|

|

|

$

|

(119,999

|

)

|

|

$

|

-

|

|

|

Acquisitions

- Accounts payable

|

|

$

|

539,347

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Acquisitions

- Accrued expenses

|

|

$

|

1,917,994

|

|

|

$

|

195,621

|

|

|

$

|

-

|

|

|

Acquisitions

- Loans

|

|

$

|

1,437,798

|

|

|

$

|

369,586

|

|

|

$

|

-

|

|

|

Assets

acquired with capital leases

|

|

$

|

-

|

|

|

$

|

191,761

|

|

|

$

|

-

|

|

|

Issuance

of common stock for acquisitions

|

|

$

|

1,673,081

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Issuance

of preference shares for acquisitions

|

|

$

|

3,506,434

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Issuance

of preference shares for capital lease

|

|

$

|

-

|

|

|

$

|

1,918,125

|

|

|

$

|

-

|

|

|

Assets

acquired from capital leases

|

|

$

|

158,645

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Contingent

consideration

|

|

$

|

928,965

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Fixed

asset additions by capital leases

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

357,967

|

|

|

Payment

of services by third party

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

82,592

|

|

|

Preference

shares issued for debt

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

605,511

|

|

See

accompanying notes to consolidated financial statements.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

|

April

22, 2019

|

By:

|

/s/

Ashley Lopez

|

|

|

|

Ashley

Lopez, Principal Executive Officer

|

|

|

|

|

|

April

22, 2019

|

By:

|

/s/

Phillip Maritz

|

|

|

|

Phillip

Maritz, Principal Financial Officer

|

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf

of the registrant and in the capacities and on the dates indicated.

|

April

22, 2019

|

By:

|

/s/

Stefan Allesch-Taylor

|

|

|

|

Stefan

Allesch-Taylor

|

|

|

|

CBE,

Chairman

|

|

|

|

|

|

April

22, 2019

|

By:

|

/s/

Matthew Gill

|

|

|

|

Matthew

Gill

|

|

|

|

Director

|

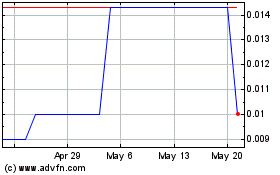

Coffee (PK) (USOTC:COFE)

Historical Stock Chart

From May 2024 to May 2024

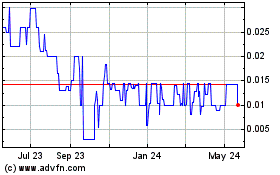

Coffee (PK) (USOTC:COFE)

Historical Stock Chart

From May 2023 to May 2024