Richemont Could Review YNAP Deal With Farfetch Amid Delisting Reports -- Update

November 29 2023 - 5:34AM

Dow Jones News

By Andrea Figueras and Joshua Kirby

Luxury group Richemont said it has no plans to invest further in

Farfetch and could reconsider a deal with the e-commerce firm, amid

speculation Farfetch may be taken private by backers that include

China's Alibaba.

"Richemont would like to remind its shareholders that it has no

financial obligations towards Farfetch and notes that it does not

envisage lending or investing into [it,]" the Cartier-owner said

Wednesday.

Richemont said it could review its deal with British-Portuguese

Farfetch, reached last year, under which Richemont agreed to divest

nearly half of its e-commerce business Yoox Net-A-Porter in return

for a minority stake in NYSE-listed Farfetch, and access to the

latter's platforms. The deal has not yet closed, a spokesperson for

the company said.

"Neither Richemont Maisons nor YNAP have currently adopted

Farfetch Platform Solutions and they continue to operate on their

own platforms," Richemont said.

A spokeswoman for Farfetch declined to comment.

Richemont's comments come after Farfetch said late Tuesday that

it won't publish third-quarter results, which had been due

Wednesday. The company also won't provide forecasts at this time,

and any prior guidance should no longer be relied upon, Farfetch

said.

On Tuesday, British daily the Telegraph reported that Farfetch

founder Jose Neves was in talks with top shareholders to take the

company private, sending Farfetch shares surging more than 20%.

According to the newspaper, the move could have the support of

major backers including e-commerce giant Alibaba, as well as

Richemont. Alibaba didn't immediately respond to a request for

comment.

A delisting of Farfetch could affect the YNAP deal with

Richemont, analyst Piral Dadhania at RBC Capital Markets said.

Potential outcomes include Farfetch backing out of the deal or

renegotiating its terms, Dadhania wrote in a research note. The

deal could, however, also continue in its current form, he

added.

In the latter case, Richemont would be entrusting its brands'

platform technology to a privately-owned firm, Dadhania said. This

would be unusual and imply some operational risk, he said.

In a worst-case scenario in which the deal fell apart, Richemont

would likely look for other options to deconsolidate YNAP, Dadhania

said. Richemont had struggled to make the business profitable, and

it had weighed on the wider group before last August's deal, which

was widely welcomed by sector analysts and by investors.

Write to Andrea Figueras at andrea.figueras@wsj.com and to

Joshua Kirby at joshua.kirby@wsj.com; @joshualeokirby

(END) Dow Jones Newswires

November 29, 2023 05:19 ET (10:19 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

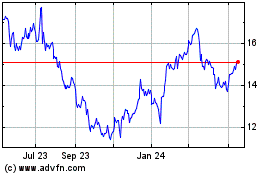

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

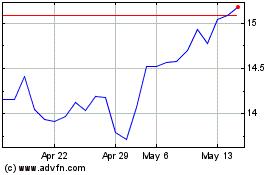

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Apr 2023 to Apr 2024