Intrinsyc Software International, Inc. (TSX:ICS), a leading provider of software

solutions for mobile devices, today announced its financial results for the

second quarter ended June 30, 2010, reported in United States dollars and in

accordance with Canadian Generally Accepted Accounting Principles ("GAAP"). The

Company's results are presented in comparison to the three-month period ended

March 31, 2010 and the three-month period ended June 30, 2009.

Revenue for the quarter was approximately $3.0 million compared to approximately

$3.5 million in the previous quarter and compared to approximately $4.9 million

in the three months ended June 30, 2009. The overall gross margin was 50%

compared to 60% in the previous quarter and compared to 56% in the three months

ended June 30, 2009. While revenue for the quarter represents a sequential

decline of 14% from the previous quarter, revenue and margins were impacted by a

significant transaction in the period that deviated from the Company's historic

business model for service engagements in which revenue is recognized as

services are performed. Rather, the Company was compensated at a lower initial

margin for services and will receive royalty revenue as the customer sells the

product developed.

During the quarter, Intrinsyc assisted an original design manufacturer in the

development of an Android tablet device that is planned by the customer to be

launched in the third quarter of 2010. Much of the revenue from this project

should be recognized in the second half of 2010 in the form of a royalty payment

per device for licensed Intrinsyc intellectual property.

Total operating expenses, excluding amortization, stock-based compensation,

Technology Partnerships Canada ("TPC") funding investment, restructuring

charges, and loss/(gain) on disposal of equipment, for the three months ended

June 30, 2010 were approximately $1.5 million representing a decrease of 25

percent and 37 percent from approximately $2.0 million and $2.4 million in the

quarter ended March 31, 2010 and the quarter ended June 30, 2009, respectively.

Earnings before interest, amortization, stock-based compensation expense,

restructuring, loss/(gain) on disposal of equipment, foreign exchange

loss/(gain), TPC funding investment, and income tax ("EBITDA") for the three

months ended June 30, 2010 was $11,012 compared to EBITDA of $102,994 for the

three months ended March 31, 2010 and $310,242 for the three months ended June

30, 2009. Cash and cash equivalents were $10.3 million with net working capital

of $10.9 million as of June 30, 2010 compared to cash and cash equivalents of

$11.7 million with net working capital of $11.3 million as of December 31, 2009.

The Company reported revenue of approximately $6.5 million for the six-month

period ended June 30, 2010 as compared to approximately $9.3 million for the six

month period ended June 30, 2009. Total revenue attributable to the Company's

software solutions decreased to 39 percent of revenues, including software

licensing, maintenance/support and software-related services, as compared to 41

percent in the respective comparative period. Gross margin was 56 percent for

the six month period ended June 30, 2010, up from 52 percent in the six months

ended June 30, 2009.

Total operating expenses, excluding amortization, stock-based compensation, TPC

funding investment, restructuring charges, and loss/(gain) on disposal of

equipment, for the six months ended June 30, 2010 were approximately $3.5

million, compared to approximately $5.7 million for the six months ended June

30, 2009. EBITDA for the six months ended June 30, 2010 was $114,006 compared to

($880,160) for the six months ended June 30, 2009.

Technology Partnerships Canada ("TPC") Funding Agreement Termination

The Company, on August 10, 2010, entered into an agreement to terminate its TPC

funding agreement. This termination agreement requires an amount of CDN$350,000

to be paid by the Company over a three year period as full settlement of all

amounts owing under the TPC funding agreement, inclusive of current and future

royalty payments and future obligations as well as the elimination of the

disputed claim of CDN $929,183.

"Terminating the TPC funding agreement is beneficial for the Company as this

eliminates all current and future royalty payable and future obligations, as

well as the elimination of the disputed claim," stated Tracy Rees, President and

Chief Executive Officer.

Business Highlights

-- Signed four new Destinator(R) licensees: Nanovision, for an in-dash

navigation system in an electric automobile from Coda Automotive, SP by

Design, Rydeen Mobile Electronics, and Echomaster for use in personal

navigation devices.

-- Signed an engineering services and software license agreement (SLA) for

RapidRIL(TM) with Tattu Mobile to support the development of an Android

Tablet device.

-- Launched Destinator 9 application for the Apple iPhone(TM) in Western

Europe, Australia and New Zealand.

-- Launched Destinator 9 application for the Apple iPhone which will be

sold under the brand, Apontador Navegador(TM), by Apontador.

-- Announced a partnership to integrate GyPSii's award-winning social media

and contextual advertising/coupon functionality into the globally

acclaimed Destinator navigation application for smart phones. The

combination of the two heralds a first for the mobile navigation segment

with the full integration of social media features into a mobile turn-

by-turn navigation application.

-- Announced a partnership with MIPS technology to bring 3.5G functionality

to the MIPS architecture. The companies are porting Intrinsyc's RapidRIL

software to the MIPS architecture in order to accelerate mobile SoC

development for MIPS licensees around the globe.

-- Established user interface (UI) and Application Center of Excellence,

based in Beijing, China will support Original Equipment Manufacturer

(OEM) and Original Design Manufacturer (ODM) customers with development

of innovative UIs and applications with Microsoft(R) Silverlight 4.

"We are pleased to have sustained positive operations despite reduced revenue

during the quarter," stated Tracy Rees, President and Chief Executive Officer.

"Intrinsyc is also making progress in signing agreements with recurring revenue

models that should enhance future revenue and bottom line results."

Conference call

The Company will release its fiscal second quarter 2010 financial results on

Thursday, August 12, 2010 at 4:00 p.m. Eastern Time (1:00 p.m. Pacific Time).

The company will hold a conference call to discuss the financial results at 5:00

p.m. Eastern Time (2:00 p.m. Pacific Time) the same day. On the call, Tracy

Rees, President and Chief Executive Officer, and George Reznik, Chief Financial

Officer, will discuss the financial results announced. This conference call may

be accessed in North America, toll-free, by dialing 1-866-610-8602, and

internationally by dialing +1-212-401-8152 approximately 10 minutes prior to the

start of the call. This conference line is operator assisted and an access PIN

is not required. The conference call will also be broadcast live over the

Internet and available for replay on the company's Investor Relations Conference

Calls web page (www.intrinsyc.com/investors/conference_calls.aspx). Analysts and

investors are invited to participate on the call. Questions may be submitted to

invest@intrinsyc.com prior to the call.

The Audit Committee of the Company has reviewed the contents of this news release.

Forward-Looking Statements

This press release contains statements which, to the extent that they are not

recitations of historical fact, may constitute forward-looking information under

applicable Canadian securities legislation that involve risks and uncertainties.

Such forward-looking statements or information may include financial and other

projections as well as statements regarding the Company's future plans,

objectives, performance, revenues, growth, profits, operating expenses or the

company's underlying assumptions. The words "may", "would", "could", "will",

"likely", "expect", "anticipate", "intend", "plan", "forecast", "project",

"estimate" and "believe" or other similar words and phrases may identify

forward-looking statements or information. Persons reading this press release

are cautioned that such statements or information are only predictions, and that

the Company's actual future results or performance may be materially different.

Factors that could cause actual events or results to differ materially from

those suggested by these forward-looking statements include, but are not limited

to: the need to develop, integrate and deploy software solutions to meet the

Company's customer's requirements; the possibility of development or deployment

difficulties or delays; the dependence on the Company's customer's satisfaction;

the timing of entering into significant contracts; customers' continued

commitment to the deployment of the Company's solutions; the performance of the

global economy and growth in software industry sales; market acceptance of the

Company's products and services; the success of certain business combinations

engaged in by the Company or by its competitors; possible disruptive effects of

organizational or personnel changes; technological change, new products and

standards; risks related to international expansion; concentration of sales;

international operations and sales; dependence upon key personnel and hiring;

reliance on a limited number of suppliers; industry growth; competition;

intellectual property; product defects and product liability; currency exchange

rate risk; and other factors described in the Company's reports filed on SEDAR,

including its Annual Information Form and financial report for the year ended

December 31, 2008. This list is not exhaustive of the factors that may affect

the Company's forward-looking information. These and other factors should be

considered carefully and readers should not place undue reliance on such

forward-looking information. All forward-looking statements made in this press

release are qualified by this cautionary statement and there can be no assurance

that actual results or developments anticipated by the Company will be realized.

The Company disclaims any intention or obligation to update or revise

forward-looking information, whether as a result of new information, future

events or otherwise, except as required by law.

About Intrinsyc Software International, Inc.

Intrinsyc empowers device makers, mobile operators, and silicon vendors to

deliver compelling, next generation mobile devices faster with higher quality,

and differentiating innovation. We help our customers deliver compelling

products using our unmatched expertise with the leading OS platforms including

Android, Apple, Blackberry, Linux, Symbian, Windows CE and Windows Phone.

Intrinsyc delivers Destinator, the most feature rich navigation application with

the best integration for leading smart phones, including from OEMs like Motorola

and LG Electronics. Destinator is also available through leading application

stores and Intrinsyc's own navigation store www.destinatornavstore.com.

Intrinsyc is publicly traded (TSX:ICS) and headquartered in Vancouver, Canada,

with offices in China and the United States. www.intrinsyc.com

INTRINSYC SOFTWARE INTERNATIONAL, INC.

Consolidated Balance Sheets

---------------------------------------------------------------------------

As at June 30, 2010 December 31, 2009

---------------------------------------------------------------------------

(Unaudited)

ASSETS

Current assets

Cash and cash equivalents $ 10,250,513 $ 11,710,227

Accounts receivable 3,113,704 3,401,467

Inventory 25,775 14,269

Prepaid expenses - current 148,263 313,528

---------------------------------------------------------------------------

Total current assets 13,538,255 15,439,491

Restricted cash - 95,147

Prepaid expenses 42,685 47,063

Equipment 599,821 735,807

Intangible assets 3,394,315 3,880,481

---------------------------------------------------------------------------

Total assets $ 17,575,076 $ 20,197,989

---------------------------------------------------------------------------

---------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable and accrued

liabilities $ 2,065,982 $ 3,574,134

Current portion of long-term

payable to Technology

Partnerships Canada 70,449 -

Capital lease obligation - current 38,033 45,179

Deferred revenue 424,378 526,169

---------------------------------------------------------------------------

Total current liabilities 2,598,842 4,145,482

Long-term payable to Technology

Partnerships Canada 226,293 -

Long-term capital lease obligation - 7,388

---------------------------------------------------------------------------

Total liabilities 2,825,135 4,152,870

---------------------------------------------------------------------------

Shareholders' equity

Share capital 108,288,585 108,288,585

Warrants and underwriters' options 270,046 4,029,953

Contributed surplus 9,106,916 5,230,217

Accumulated other comprehensive

(loss) income 1,891,656 2,068,103

Deficit (104,807,262) (103,571,739)

---------------------------------------------------------------------------

Total shareholders' equity 14,749,941 16,045,119

---------------------------------------------------------------------------

Total liabilities and shareholders'

equity $ 17,575,076 $ 20,197,989

---------------------------------------------------------------------------

---------------------------------------------------------------------------

INTRINSYC SOFTWARE INTERNATIONAL, INC.

Consolidated Statements of Operations and Deficit

(Unaudited and expressed in U.S. dollars)

---------------------------------------------------------------------------

Three Three Six Six

months months months months

ended June ended June ended June ended June

For the 30, 2010 30, 2009 30, 2010 30, 2009

---------------------------------------------------------------------------

Revenues $ 3,024,458 $ 4,874,621 $ 6,531,455 $ 9,275,428

Cost of sales 1,497,857 2,144,748 2,888,723 4,425,363

---------------------------------------------------------------------------

1,526,601 2,729,873 3,642,732 4,850,065

---------------------------------------------------------------------------

Expenses

Sales and

marketing 399,111 744,602 1,014,332 1,888,517

Research and

development 638,852 1,140,993 1,479,787 2,504,082

Administration 477,626 534,036 1,034,607 1,337,626

Amortization 290,889 339,417 579,745 658,746

Stock-based

compensation 58,747 108,871 116,792 193,379

Technology

Partnerships

Canada Funding

Investment 282,077 143,135 287,192 278,069

Restructuring - - 485,478 -

Loss (gain) on

disposal of

equipment - 199,793 (2,150) 220,345

---------------------------------------------------------------------------

2,147,302 3,210,847 4,995,783 7,080,764

---------------------------------------------------------------------------

Loss before

other expense

(earnings) and

income taxes 620,701 480,974 1,353,051 2,230,699

Other expense

(earnings)

Foreign exchange

(gain) loss (229,798) 310,261 (31,503) 197,078

Interest expense

(income) (10,194) 3,898 (16,796) (33,931)

---------------------------------------------------------------------------

Loss before income

taxes 380,709 795,133 1,304,752 2,393,846

Income tax recovery

Current (71,183) (86,463) (69,229) (60,714)

---------------------------------------------------------------------------

Net loss for the

period 309,526 708,670 1,235,523 2,333,132

Deficit, beginning

of period 104,497,736 102,266,096 103,571,739 100,641,634

---------------------------------------------------------------------------

Deficit, end of

period $104,807,262 $102,974,766 $104,807,262 $102,974,766

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Loss per share

(basic and

diluted) $ 0.00 $ 0.01 $ 0.01 $ 0.02

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Weighted average

number of shares

outstanding 163,259,070 163,254,903 163,259,070 163,254,903

---------------------------------------------------------------------------

---------------------------------------------------------------------------

INTRINSYC SOFTWARE INTERNATIONAL, INC.

Consolidated Statements of Comprehensive Loss

(Unaudited and expressed in U.S. dollars)

---------------------------------------------------------------------------

Three Three Six Six

months months months months

ended June ended June ended June ended June

For the 30, 2010 30, 2009 30, 2010 30, 2009

---------------------------------------------------------------------------

Net loss for the

period ($ 309,526) ($708,670) ($1,235,523) ($2,333,132)

Other comprehensive

gain (loss):

Unrealized gains

(losses) on

translating

financial

statements from

functional currency

to reporting

currency (711,683) 1,194,857 (176,447) 657,824

---------------------------------------------------------------------------

Comprehensive income

(loss) ($1,021,209) $486,187 ($1,411,970) ($1,675,308)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

INTRINSYC SOFTWARE INTERNATIONAL, INC.

Consolidated Statements of EBITDA and Loss

(Unaudited and expressed in U.S. dollars)

---------------------------------------------------------------------------

Three Three Six Six

months months months months

ended June ended June ended June ended June

For the 30, 2010 30, 2009 30, 2010 30, 2009

---------------------------------------------------------------------------

Revenues $3,024,458 $4,874,621 $6,531,455 $9,275,428

Cost of sales 1,497,857 2,144,748 2,888,723 4,425,363

---------------------------------------------------------------------------

1,526,601 2,729,873 3,642,732 4,850,065

---------------------------------------------------------------------------

Expenses

Sales and

marketing 399,111 744,602 1,014,332 1,888,517

Research and

development 638,852 1,140,993 1,479,787 2,504,082

Administration 477,626 534,036 1,034,607 1,337,626

---------------------------------------------------------------------------

1,515,589 2,419,631 3,528,726 5,730,225

---------------------------------------------------------------------------

EBITDA Income (Loss) 11,012 310,242 114,006 (880,160)

Amortization 290,889 339,417 579,745 658,746

Stock-based

compensation 58,747 108,871 116,792 193,379

Technology

Partnerships Canada

Funding Investment 282,077 143,135 287,192 278,069

Restructuring - - 485,478 -

Loss (gain) on

disposal of

equipment - 199,793 (2,150) 220,345

Foreign exchange

(gain) loss (229,798) 310,261 (31,503) 197,078

Interest expense

(income) (10,194) 3,898 (16,796) (33,931)

Income tax recovery

Current (71,183) (86,463) (69,229) (60,714)

---------------------------------------------------------------------------

320,538 1,018,912 1,349,529 1,452,972

---------------------------------------------------------------------------

Net loss for the

period under

Canadian GAAP ($ 309,526) ($ 708,670) ($1,235,523) ($2,333,132)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

INTRINSYC SOFTWARE INTERNATIONAL, INC.

Consolidated Statements of Cash Flows

(Unaudited and expressed in U.S. dollars)

---------------------------------------------------------------------------

Three Three Six Six

months months months months

ended June ended June ended June ended June

For the 30, 2010 30, 2009 30, 2010 30, 2009

---------------------------------------------------------------------------

OPERATING ACTIVITIES

Net loss for the

period ($ 309,526) ($ 708,670) ($ 1,235,523) ($ 2,333,132)

Items not involving

cash:

Amortization 290,889 339,417 579,745 658,746

Future income

taxes - (41,694) - (2,603)

Stock-based

compensation 58,747 108,871 116,792 193,379

Loss on disposal

of equipment - 199,793 - 220,345

Changes in non-cash

operating working

capital:

Accounts

receivable (842,175) 593,489 240,511 1,939,018

Inventory (18,958) - (12,178) 14,336

Prepaid expenses 117,153 48,000 170,253 227,909

Accounts payable

and accrued

liabilities (1,035,809) (1,457,154) (1,508,695) (3,116,015)

Current portion of

long-term payable

to Technology

Partnerships

Canada 72,936 - 72,936 -

Deferred revenue 1,555 (115,051) (97,291) (7,828)

---------------------------------------------------------------------------

Cash used in

operating

activities (1,665,188) (1,032,999) (1,673,450) (2,205,845)

---------------------------------------------------------------------------

INVESTING ACTIVITIES

Purchase of

equipment - (3,075) - (25,941)

---------------------------------------------------------------------------

Cash used in

investing

activities - (3,075) - (25,941)

---------------------------------------------------------------------------

FINANCING ACTIVITIES

Repayment of capital

lease obligation (7,233) (9,596) (14,272) (63,318)

Long-term payable to

Technology

Partnerships Canada 234,282 - 234,282 -

Restricted cash 97,248 1,035 97,248 12,104

---------------------------------------------------------------------------

Cash provided by

(used in) financing

activities 324,297 (8,561) 317,258 (51,214)

---------------------------------------------------------------------------

Effect of exchange

rate changes on

cash and cash

equivalents (508,944) 904,620 (103,522) 495,622

---------------------------------------------------------------------------

Increase (decrease)

in cash and cash

equivalents (1,849,835) (140,015) (1,459,714) (1,787,378)

Cash and cash

equivalents,

beginning of period 12,100,348 10,744,089 11,710,227 12,391,452

---------------------------------------------------------------------------

Cash and cash

equivalents, end of

period $10,250,513 $10,604,074 $10,250,513 $10,604,074

---------------------------------------------------------------------------

---------------------------------------------------------------------------

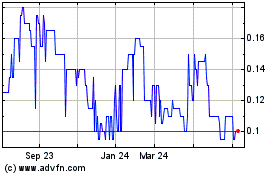

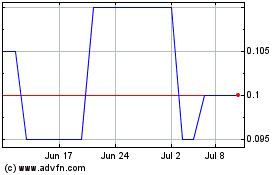

Tenth Avenue Petroleum (TSXV:TPC)

Historical Stock Chart

From Apr 2024 to May 2024

Tenth Avenue Petroleum (TSXV:TPC)

Historical Stock Chart

From May 2023 to May 2024