Petrolympic Completes Qualifying Transaction and Closes $3 Million Financing

December 27 2007 - 10:02AM

Marketwired Canada

Petrolympic Ltd. ("Petrolympic" or the "Company"; (TSX VENTURE:PCP.P), formerly

known as Pisces Capital Corp., a Capital Pool Company, is pleased to announce

that it has closed its previously announced Qualifying Transaction with

Petrolympia Inc. ("Petrolympia"), a Quebec-based junior oil and gas exploration

company. Concurrent with the completion of the Qualifying Transaction,

Petrolympic also closed its previously announced prospectus offering which

raised gross proceeds of $3,051,500 (the "Offering") via CTI Capital Inc. and

Research Capital Corp. (the "Agents"), with the assistance of Foundation Markets

("Foundation") which acted as financial advisor to Petrolympia and assisted in

coordinating the arms length financing. The TSX Venture Exchange has

conditionally approved listing of the common shares of Petrolympic, subject to

receipt from the Company of final submission documents, and it is expected that

trading of the common shares of Petrolympic under the new symbol "PCQ" will

commence on or about January 3, 2008.

The activities of Petrolympia, now a wholly-owned subsidiary of Petrolympic,

constitute the entirety of the operations of Petrolympic. As part of the

Qualifying Transaction, the former shareholders of Petrolympia received

48,147,111 common shares of Petrolympic at a price of $0.18 per share, of which

44,444,445 will be subject to an escrow period of 3 years with 10% of the shares

being released from escrow upon completion of the Qualifying Transaction and 15%

the balance of the shares being released every 6 months. The Company now has a

total of 70,754,849 common shares issued and outstanding. The new Board of

Directors of Petrolympic is comprised of Mendel Ekstein, Alain Fleury, Andreas

Jacob, Enrique Lopez de Mesa, Frank Ricciuti, Gerald U. Fong, and Miles Pittman.

For a more detailed description of the Qualifying Transaction, together with

complete biographies of each Board member, please consult Pisces' Final

Prospectus dated November 28, 2007, available on SEDAR.

At the closing of the Offering, Petrolympic issued 3,803 "A" Units, 800 "B"

Units, and 1,500 "C" Units. Each "A" unit consisted of 2,000 flow-through shares

at a price of $0.20 per share, 556 common shares at a price of $0.18 per share,

and 1,556 purchase warrants. Each "B" unit consisted of 2,500 flow-through

shares at a price of $0.20 per share and 1,250 purchase warrants. Each "C" unit

consisted of 2,778 common shares at a price of $0.18 per share and 2,778

purchase warrants. Each purchase warrant gives its holder the right to purchase

one common share at a price of $0.25 per share at any time until the second

anniversary of the closing of the Offering.

Petrolympic has agreed to renounce in favour of flow-through subscribers of the

Offering, Canadian Exploration Expenses incurred as a result of planned

exploration programs. Each flow-through share included in the "A" and "B" units

will allow its holder to claim income tax deductions of 100% at the federal

level and, in Quebec, of 150% at the provincial level. Subscribers residing

outside Quebec will, for provincial income tax purposes, have the right to the

same deductions as those allowed at the federal level.

In consideration of its services, the Agents received a corporate finance fee of

$27,500 (plus applicable taxes). The Agents also shared a cash commission of

$221,392.50 and 1,199,827 broker warrants with members of the selling group. The

broker warrants allow their holders to purchase, at any time until the second

anniversary of the closing of the Offering, 239,227 common shares at a price of

$0.18 per share (such broker warrants issued in respect of the sale of common

shares) and 960,600 common shares at a price of $0.20 per common share (such

broker warrants issued in respect of the sale of flow-through shares).

Petrolympic Ltd.

Petrolympic holds more than 113,906 hectares (281,468 acres) of exploration

permits in the Appalachian Basin of Quebec that include holdings in the Gaspe

Peninsula and The St. Lawrence Lowlands. The Gaspe block of exploration permits

total 40,885 hectares and are located between Rimouski and Matane in the

Province of Quebec immediately southwest of Lake Matapedia. The St. Lawrence

Block of exploration permits is located on the south shore of the St. Lawrence

directly south of Valleyfield less than 30 kilometres southwest of Montreal in

the Province of Quebec.

Petrolympic commenced a new phase of exploration in the fall of 2006 including

seismic testing and prior data reprocessing to identify high-value drilling

targets. Funds raised from the Offering will be used for the Phase II

exploration of the Gaspe and Phase I exploration of the St. Lawrence Lowlands.

CTI Capital Inc.

Founded in 1987, CTI capital Inc., is a full-service boutique securities dealer,

offering debt and equity trading, portfolio management, research, retail

brokerage, and investment banking services. The investment banking arm

specializes in initial public offerings and new issues, private placements,

reverse take-overs, Capital Pool Companies, mergers and acquisitions, and

exchange sponsorships for emerging growth-oriented companies.

Research Capital Corporation

Research Capital Corporation is a fully integrated Investment Dealer operating

on a national platform with offices in Vancouver, Calgary, Regina, Toronto, and

Montreal. Research has built its foundations around experiences and capable

professionals focused on serving Canadian growth companies and has been

delivering results since 1921.

Foundation Markets Inc.

Foundation Markets is a Toronto-based investment banking firm and Limited Market

Dealer committed to assisting small to medium-sized companies with rapid-growth

potential. The firm specializes in working with companies at a pre-public stage

to raise capital and prepare for a going-public transaction, assisting clients

to manage the entire process. The firm maintains an international perspective

and is able to assist companies in emerging markets as well as introduce

international opportunities to Canadian businesses.

This press release is not an offer of the securities described above for sale in

the United States (the "securities"). The securities offered have not been

registered under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or applicable exemption

from the registration requirements. Any public offering of the securities to be

made in the United States will be made by means of a prospectus that may be

obtained from Petrolympic and that will contain detailed information about the

Company and management, as well as financial statements. This press release

shall not constitute an offer to sell or the solicitation of an offer to buy nor

shall there be any sale of the securities in any State in which such offer,

solicitation or sale would be unlawful.

Pender Street Capital (TSXV:PCP.P)

Historical Stock Chart

From Apr 2024 to May 2024

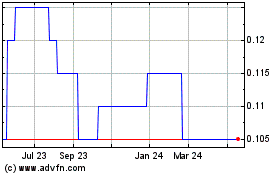

Pender Street Capital (TSXV:PCP.P)

Historical Stock Chart

From May 2023 to May 2024