DMG Blockchain Solutions Inc. (TSX-V: DMGI) (OTCQB US: DMGGF)

(FRANKFURT: 6AX) (“DMG”), a vertically integrated blockchain and

data center technology company, today announces its fiscal second

quarter 2024 financial results. All financial references are in

Canadian Dollars unless specified otherwise.

Q2 2024 Financial Results

Highlights

- Q2 2024 revenue increased 31% over the prior year to $10M,

driven by self mining revenues increasing 39%

- Net Income was slightly positive, maintaining profitability for

the second consecutive quarter

- 153 bitcoin mined, down 22% from the prior quarter, with a

hashrate of 0.96 EH/s and fleet efficiency of 28.4 J/TH

- $4.5 million cash flow from operations, up 19% from the prior

quarter

- Deploying Bitmain T21 miners with goal to reach 1.7 EH/s by the

end of June, targeting 2 EH/s and beyond longer term

- Strong balance sheet with $43.6M in cash and digital currency,

$118M in total assets

Sheldon Bennett, DMG Blockchain Solutions’ Chief

Executive Officer, commented, “We are pleased with our robust

performance this quarter, achieving a 3% sequential revenue

increase to $10.0M and maintaining profitability for the second

consecutive quarter. Our strategic investments in both our Core and

Core+ strategies are delivering promising results. Systemic Trust

is paving the way for financial institutions to transact bitcoin in

a carbon-neutral manner, while the deployment of our Bitmain T21

miners positions us to achieve 1.7 EH/s by the end of June with

further expansion planned. Additionally, our strong cash flow from

operations of $4.5M and a solid balance sheet with $43.6M in cash

and digital currency underscore our execution.”

Second Quarter 2024 Financial Results

Review

Revenue for the second fiscal quarter ending

March 31, 2024 was $10.0 million versus $7.6 million in the prior

year period, an increase of 31%, primarily due to the increase in

digital currency mining revenues as a result of bitcoin price

increasing 133% over the year-ago period to an average of $71,851

in the March quarter. This increase was partially offset by a 93%

increase in Bitcoin network difficulty that lowered DMG’s bitcoin

generation per EH/s by 47% from the same period last year. In

addition, revenue was also partially offset by a loss in net pool

revenue of $1.3 million.

Income before other items for the three months

ended March 31, 2024 was -$1.8 million versus -$4.6 million in the

prior year period.

Operating and maintenance costs for the three

months ended March 31, 2024 were $5.3 million as compared to $4.6

million in the same quarter in the prior year. The increase is

attributed to utility expenses, driven by the expansion of digital

currency mining operations and the addition of new miners.

Net income for the three months ending March 31,

2024 was $2 thousand versus a loss of $3.8 million in the prior

year period. The improvement in net income was driven primarily by

an increase in revenue of $10.0 million versus $7.6 million in the

prior year period, unrealized revaluation gain on digital currency,

which was a gain of $1.0 million versus zero in the prior year

period as well as realized gain on sale of digital currency of $1.1

million versus $0.5 million in the year-ago period. It was also

driven by lower depreciation, which was $3.8 million versus $5.9

million in the prior year period. These were partially offset by

operating and maintenance costs, which increased by $0.7 million

and general and administrative expenses which increased by $1.1

million over the prior year.

Earnings per share for the second fiscal quarter

ending March 31, 2024 was $0.00 versus -$0.02 in the prior year

period.

As of March 31, 2024, the Company had cash of

$1.6 million, digital currency of $42.0 million and total assets of

$118.4 million. For more details, please refer to the Company’s

filings.

Readers are encouraged to review the Company’s

March 31, 2024 quarterly unaudited financial statements and

management’s discussion and analysis thereof for a fulsome

assessment of the Company’s performance and applicable risk

factors, available at www.sedarplus.ca.

DMG Blockchain Solutions Inc. Second Quarter 2024

Financial Results Conference Call

The Company will host a conference call to

review second quarter 2024 financial results and provide a

corporate update on May 23, 2024 at 4:30 pm ET. Participants

are asked to pre-register for the call through this link.

Registered participants will receive a conference call weblink and

dial-in information in their confirmation email.

As there will be no live Q&A session,

management will address pre-submitted questions during the call.

Those wishing to submit a question may do so via

investors@dmgblockchain.com using the subject line ‘Conference Call

Question Submission’ through 2:00 pm ET on May 23, 2024.

About DMG Blockchain Solutions

Inc.

DMG is an environmentally friendly vertically

integrated blockchain and data center company that manages,

operates and develops end-to-end digital solutions to monetize the

blockchain ecosystem. DMG’s sustainable businesses are segmented

into two business lines under the Core and Core+ strategies and

unified through DMG’s vertical integration.

For more information on DMG Blockchain Solutions

visit: www.dmgblockchain.comFollow @dmgblockchain on X and

subscribe to DMG's YouTube channel.

For further information, please contact:

On behalf of the Board of Directors,

Sheldon Bennett, CEO & DirectorTel:

516-222-2560Email: investors@dmgblockchain.comWeb:

www.dmgblockchain.com

Investor Relations Contact:

Core IR 516-222-2560

For Media Inquiries:Jules

AbrahamCore IR 917-885-7378 julesa@coreir.com

Neither the TSX Venture Exchange nor its Regulation Service

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Information

This news release contains forward-looking

information or statements based on current expectations.

Forward-looking statements contained in this news release include

statements regarding DMG’s strategies and plans, the expected

increase in realized hashrate, deploying Bitmain T21 miners to

reach 1.7 EH/s by June 2024, targeting 2 EH/s and beyond, hosting

the conference call, the deployment of new capacity, the expected

arrival of new miners, the expected timelines, the opportunity and

plans to monetize bitcoin transactions, the continued investment in

Bitcoin network software infrastructure and applications,

developing and executing on the Company’s products and services,

increasing self-mining, efforts to improve the operation of its

mining fleet, the launch of products and services, events, courses

of action, and the potential of the Company’s technology and

operations, among others, are all forward-looking information.

Future changes in the Bitcoin network-wide

mining difficulty rate or Bitcoin hash rate may materially affect

the future performance of DMG’s production of bitcoin, and future

operating results could also be materially affected by the price of

bitcoin and an increase in hash rate mining difficulty.

Forward-looking statements consist of statements

that are not purely historical, including any statements regarding

beliefs, plans, expectations, or intentions regarding the future.

Such information can generally be identified by the use of

forwarding-looking wording such as "may", "expect", "estimate",

"anticipate", "intend", "believe" and "continue" or the negative

thereof or similar variations. The reader is cautioned that

assumptions used in the preparation of any forward-looking

information may prove to be incorrect. Events or circumstances may

cause actual results to differ materially from those predicted, as

a result of numerous known and unknown risks, uncertainties, and

other factors, many of which are beyond the control of the Company,

including but not limited to, market and other conditions,

volatility in the trading price of the common shares of the

Company, business, economic and capital market conditions; the

ability to manage operating expenses, which may adversely affect

the Company's financial condition; the ability to remain

competitive as other better financed competitors develop and

release competitive products; regulatory uncertainties; access to

equipment; market conditions and the demand and pricing for

products; the demand and pricing of bitcoins; security threats,

including a loss/theft of DMG's bitcoins; DMG's relationships with

its customers, distributors and business partners; the inability to

add more power to DMG's facilities; DMG's ability to successfully

define, design and release new products in a timely manner that

meet customers' needs; the ability to attract, retain and motivate

qualified personnel; competition in the industry; the impact of

technology changes on the products and industry; failure to develop

new and innovative products; the ability to successfully maintain

and enforce our intellectual property rights and defend third-party

claims of infringement of their intellectual property rights; the

impact of intellectual property litigation that could materially

and adversely affect the business; the ability to manage working

capital; and the dependence on key personnel. DMG may not actually

achieve its plans, projections, or expectations. Such statements

and information are based on numerous assumptions regarding present

and future business strategies and the environment in which the

Company will operate in the future, including the demand for its

products, the ability to successfully develop software, that there

will be no regulation or law that will prevent the Company from

operating its business, anticipated costs, the ability to secure

sufficient capital to complete its business plans, the ability to

achieve goals and the price of bitcoin. Given these risks,

uncertainties, and assumptions, you should not place undue reliance

on these forward-looking statements. The securities of DMG are

considered highly speculative due to the nature of DMG's business.

For further information concerning these and other risks and

uncertainties, refer to the Company’s filings on www.sedarplus.ca.

In addition, DMG’s past financial performance may not be a reliable

indicator of future performance.

Factors that could cause actual results to

differ materially from those in forward-looking statements include,

failure to obtain regulatory approval, the continued availability

of capital and financing, equipment failures, lack of supply of

equipment, power and infrastructure, failure to obtain any permits

required to operate the business, the impact of technology changes

on the industry, the impact of viruses and diseases on the

Company's ability to operate, secure equipment, and hire personnel,

competition, security threats including stolen bitcoins from DMG or

its customers, consumer sentiment towards DMG's products, services

and blockchain technology generally, failure to develop new and

innovative products, litigation, adverse weather or climate events,

increase in operating costs, increase in equipment and labor costs,

equipment failures, decrease in the price of Bitcoin, failure of

counterparties to perform their contractual obligations, government

regulations, loss of key employees and consultants, and general

economic, market or business conditions. Forward-looking statements

contained in this news release are expressly qualified by this

cautionary statement. The reader is cautioned not to place undue

reliance on any forward-looking information. The forward-looking

statements contained in this news release are made as of the date

of this news release. Except as required by law, the Company

disclaims any intention and assumes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise. Additionally, the Company

undertakes no obligation to comment on the expectations of or

statements made by third parties in respect of the matters

discussed above.

DMG Blockchain Solutions Inc. Consolidated

Statements of Loss and Comprehensive Loss(Expressed in Canadian

Dollars)(Unaudited)

|

|

|

For the Three MonthsEnded |

For the Six Months Ended |

|

|

Notes |

March 31, 2024 |

March 31, 2023 |

March 31, 2024 |

March 31, 2023 |

|

|

|

|

|

|

|

|

|

Revenue |

15 |

10,015,659 |

7,623,323 |

19,706,423 |

14,797,915 |

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

Operating and maintenance costs |

16(a) |

5,270,851 |

4,594,898 |

10,418,502 |

9,003,690 |

|

|

General and administrative |

16(b) |

1,846,398 |

776,942 |

2,732,459 |

1,724,878 |

|

|

Stock-based compensation |

|

398,010 |

423,079 |

766,502 |

938,209 |

|

|

Research and development |

|

486,216 |

499,165 |

924,395 |

931,104 |

|

|

Provision for doubtful accounts |

|

42 |

50,773 |

3,806 |

114,377 |

|

|

Depreciation |

10 |

3,805,988 |

5,854,704 |

8,147,770 |

11,945,549 |

|

|

Total expenses |

|

11,807,503 |

12,199,561 |

22,993,434 |

24,657,807 |

|

|

|

|

|

|

|

|

|

Loss before other items |

|

(1,791,844) |

(4,576,238) |

(3,287,011) |

(9,859,892) |

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

Interest and other income |

7 |

170,044 |

122,091 |

335,825 |

235,232 |

|

|

Provision of sales tax receivable |

|

(381,690) |

- |

(635,590) |

- |

|

|

Gain on disposition of assets |

|

4,809 |

- |

4,809 |

70,429 |

|

|

Foreign exchange loss |

|

(28,341) |

(26,014) |

(122,926) |

(106,991) |

|

|

Unrealized gain on revaluation of digital currency |

5 |

1,019,456 |

- |

9,182,316 |

- |

|

|

Realized gain on sale of digital currency |

|

1,143,489 |

506,054 |

1,995,359 |

328,892 |

|

|

Gain (loss) on change in fair value of marketable securities |

|

(133,708) |

134,698 |

111,043 |

(94,823) |

|

|

Loss on fair value of investments |

10 |

|

- |

(609,120 |

- |

|

|

Net income (loss) |

|

2,215 |

(3,839,409) |

6,974,705 |

(9,427,153) |

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

Items that may be reclassified subsequently to income or loss: |

|

|

|

|

|

|

Unrealized revaluation gain on digital currency |

5 |

15,472,215 |

6,245,331 |

15,472,215 |

4,820,027 |

|

|

Cumulative translation adjustment |

|

(11,278) |

48,347 |

(1,196) |

48,091 |

|

|

Comprehensive income (loss) |

|

15,463,152 |

2,454,269 |

22,445,724 |

(4,559,035) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted income (loss) per share |

13(d) |

0.00 |

(0.02) |

0.04 |

(0.06) |

|

|

Weighted average number of shares outstanding |

13(d) |

|

|

|

|

|

- basic |

|

169,029,065 |

167,681,377 |

168,585,910 |

167,599,591 |

|

|

- diluted |

|

172,516,428 |

167,681,377 |

173,248,160 |

167,599,591 |

|

|

|

|

|

|

|

|

|

DMG Blockchain Solutions Inc.Consolidated

Statements of Financial Position(Expressed in Canadian

Dollars)(Unaudited)

|

|

Notes |

As atMarch 31, 2024

(unaudited) |

As atSeptember 30,

2023(audited) |

|

|

ASSETS |

|

$ |

$ |

|

|

Current |

|

|

|

|

Cash and cash equivalents |

|

1,609,479 |

1,789,913 |

|

|

Amounts receivable |

6 |

2,102,769 |

2,476,679 |

|

|

Digital currency |

5 |

41,966,494 |

17,142,683 |

|

|

Prepaid expense and other current assets |

|

332,900 |

193,512 |

|

|

Marketable securities |

8 |

498,027 |

386,984 |

|

|

Assets held for sale |

11 |

3,702,466 |

3,451,024 |

|

|

Total current assets |

|

50,212,135 |

25,440,795 |

|

|

|

|

|

|

|

Long-term deposits |

9 |

18,687,623 |

3,256,324 |

|

|

Property and equipment |

12 |

42,632,378 |

47,398,585 |

|

|

Long-term investments |

13 |

45,000 |

45,000 |

|

|

Amount recoverable |

7 |

6,782,076 |

6,446,251 |

|

|

Total assets |

|

118,359,212 |

82,586,955 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

Current |

|

|

|

|

Trade and other payables |

14 |

5,408,373 |

4,178,104 |

|

|

Deferred revenue |

19 |

63,712 |

64,361 |

|

|

Current portion of lease liability |

15 |

57,014 |

50,555 |

|

|

Current portion of loans payable |

16 |

12,127,654 |

1,272,397 |

|

|

Total current liabilities |

|

17,656,753 |

5,565,417 |

|

|

|

|

|

|

|

Long-term lease liability |

15 |

71,873 |

41,202 |

|

|

Total liabilities |

|

17,728,626 |

5,606,619 |

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

Share capital |

17(a) |

111,820,687 |

110,820,540 |

|

|

Reserves |

17(b)(c) |

45,711,651 |

45,507,272 |

|

|

Accumulated other comprehensive income |

|

15,620,063 |

149,044 |

|

|

Accumulated deficit |

|

(72,521,815) |

(79,496,520) |

|

|

Total shareholders' equity |

|

100,630,586 |

76,980,336 |

|

|

Total liabilities and shareholders' equity |

|

118,359,212 |

82,586,955 |

|

|

|

|

|

|

|

Contingencies |

23 |

|

|

|

Subsequent events |

25 |

|

|

|

|

|

|

|

DMG Blockchain Solutions

Inc.Consolidated Statements of Cash Flows(Expressed in

Canadian Dollars)(Unaudited)

|

|

|

For the Six Months Ended |

|

|

|

March 31, 2024 |

March 31, 2023 |

|

|

|

$ |

$ |

|

|

OPERATING ACTIVITIES |

|

|

|

Net income (loss) for the period |

6,974,705 |

(9,427,153) |

|

|

Non-cash items: |

|

|

|

Accretion |

23,272 |

25,466 |

|

|

Depreciation |

8,147,770 |

11,945,549 |

|

|

Share-based payments |

766,502 |

938,209 |

|

|

Unrealized foreign exchange loss |

40,351 |

43,613 |

|

|

Gain on disposition of assets |

(4,809) |

(70,429) |

|

|

Gain (loss) on change in fair value of marketable securities |

(111,043) |

94,824 |

|

|

Loss on fair value of investment |

609,120 |

- |

|

|

Provision for sales tax receivable |

635,590 |

- |

|

|

Bad debt expense |

3,806 |

114,377 |

|

|

Digital currency related revenue |

(18,355,313) |

(13,773,874) |

|

|

Unrealized gain on digital currency |

(9,182,315) |

- |

|

|

Digital currency sold |

20,173,781 |

11,161,893 |

|

|

Realized gain on sale of digital currency |

(1,995,359) |

(328,892) |

|

|

Non-cash interest income |

(329,914) |

(229,349) |

|

|

Accrued interest |

- |

(129) |

|

|

|

|

|

|

Changes in non-cash operating working

capital: |

|

|

|

Prepaid expenses and other current assets |

(144,388) |

52,650 |

|

|

Amounts receivable |

(212,015) |

3,000,466 |

|

|

Amounts recoverable |

- |

(237,039) |

|

|

Deferred revenue |

11,277 |

(91,752) |

|

|

Trade and other payables |

1,144,920 |

1,895,676 |

|

|

Net cash provided by operating activities |

8,195,938 |

5,114,106 |

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

Purchase of property and equipment |

(830,859) |

(572,044) |

|

|

Deposits on mining equipment |

(18,102,867) |

(1,991,167) |

|

|

Proceeds on sale of equipment |

- |

4,829 |

|

|

Purchase of short-term investment |

(609,120) |

- |

|

|

Proceeds from sublease |

- |

37,012 |

|

|

Net cash used by investing activities |

(19,542,846) |

(2,521,370) |

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

Proceeds from option exercises |

438,024 |

63,750 |

|

|

Principal lease payments |

(61,187) |

(102,973) |

|

|

Proceeds from secured loan |

10,791,288 |

950,665 |

|

|

Repayment of loans payable |

(1,668) |

- |

|

|

Net cash provided by financing activities |

11,166,457 |

911,442 |

|

|

|

|

|

|

Impact of currency translation on cash |

17 |

(481) |

|

|

Change in cash |

(180,434) |

3,503,697 |

|

|

Cash, beginning |

1,789,913 |

1,247,513 |

|

|

Cash, end |

1,609,479 |

4,751,210 |

|

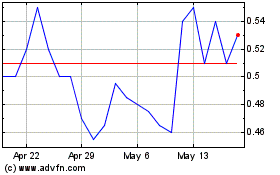

DMG Blockchain Solutions (TSXV:DMGI)

Historical Stock Chart

From May 2024 to Jun 2024

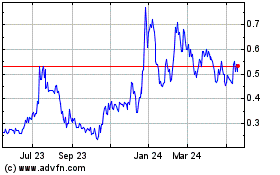

DMG Blockchain Solutions (TSXV:DMGI)

Historical Stock Chart

From Jun 2023 to Jun 2024