Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 20 2023 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of April 2023

Commission File Number: 001-14950

ULTRAPAR HOLDINGS INC.

(Translation of Registrant’s Name into English)

Brigadeiro Luis Antonio Avenue, 1343, 9th Floor

São Paulo, SP, Brazil 01317-910

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

ULTRAPAR PARTICIPAÇÕES S.A.

Signing of agreement for the acquisition of 50% stake in Opla by Ultracargo

São Paulo, April 19, 2023 – Ultrapar Participações S.A. (B3: UGPA3 / NYSE: UGP), in compliance with CVM Resolution 44/21, hereby informs the signing of an agreement for the acquisition of a 50% stake in Opla Logística Avançada (“Opla”), held by Copersucar S.A. (“Copersucar”), through its subsidiary Ultracargo Logística S.A. (“Ultracargo”). The value of the transaction is R$ 237.5 million, subject to customary working capital and net debt adjustments.

Opla, which was founded in 2017, is the largest independent terminal of ethanol in Brazil. Located in Paulínia (state of São Paulo), it has an installed tank capacity of 180 thousand m3 and offers integrated storage and logistics solutions through railways, pipelines and road transportation. It is jointly controlled by BP Biofuels Brazil Investments Ltd. (“BP”) and Copersucar, both with 50% stake. With the approval of the acquisition, Ultracargo and BP will be co-controllers of Opla.

The acquisition of this stake in Opla marks Ultracargo's entry into the inland liquid bulk storage and logistics segment, integrated with port terminals, in line with its growth plan. Opla is a strategic asset in the ethanol and derivatives distribution chain, with high growth potential and value creation by opening the terminal to third parties and relevant productivity gains in the use of the asset.

Ultracargo and Opla will maintain their regular course of business, on an independent manner, until the closing date of the transaction, subject to approval by the Administrative Council of Economic Defense (CADE).

Rodrigo de Almeida Pizzinatto

Chief Financial and Investor Relations Officer

Ultrapar Participações S.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 19, 2023

|

ULTRAPAR HOLDING INC. |

|

By: /s/ Rodrigo de Almeida Pizzinatto

|

|

Name: Rodrigo de Almeida Pizzinatto

|

|

Title: Chief Financial and Investor Relations Officer

|

(Market announcement)

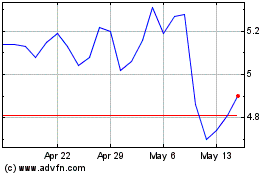

Ultrapar Participacoes (NYSE:UGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

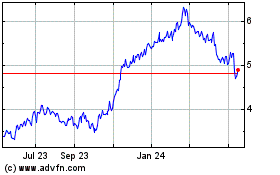

Ultrapar Participacoes (NYSE:UGP)

Historical Stock Chart

From Apr 2023 to Apr 2024