Food Delivery's Big Coronavirus Test: Can It Deliver?

March 15 2020 - 1:29PM

Dow Jones News

By Heather Haddon and Preetika Rana

For food-delivery companies, the new coronavirus poses a complex

puzzle: It could boost customer demand but batter the restaurants

that supply the food and threaten the health of workers who deliver

it.

Initial signs from areas like Seattle that were hard-hit early

on by the U.S. outbreak show robust orders for food delivery, as

employees are urged to work from home and schools close. But

customers also are cutting back on actual visits that are important

to restaurants' profitability.

Grubhub Inc. said Friday it would defer the collection of

marketing commissions charged to independent restaurants it

delivers for, amounting to roughly 10% to 15% an order. The

Chicago-based company said it would defer those costs for now up to

$100 million, and the policy would last for an indefinite period

beginning Monday.

That followed Postmates Inc. saying this past Tuesday it would

temporarily waive all commissions for San Francisco-based

businesses that want to join its platform to take advantage of

consumers avoiding in-restaurant dining.

Restaurants who have struck deals with the delivery companies

are highlighting that alternative for customers. Chipotle Mexican

Grill Inc. said Thursday it was waiving delivery fees for the month

and shipping to-go orders in tamper-proof bags. The same day,

Starbucks Corp. sent a notice to U.S. customers about potential

disruptions to its stores and highlighting delivery through Uber

Technologies Inc.'s Eats division as a workaround.

The U.S. outbreak comes as food-delivery companies are in an

intense battle for customers and restaurant partnerships. Companies

shuttling food to customers' homes could benefit from coronavirus

if they shore up diner loyalty and restaurants remain open and

willing to deliver during the outbreak, according to Wall Street

analysts.

Food-delivery orders increased in China in January when the

pandemic first hit, according to industry research-firm NPD Group

Inc. But delivery companies experienced a drop of business a month

into the pandemic there as restaurants shut, consumers worried

about food contamination and the quarantining of drivers challenged

operations, according to a Credit Suisse report. Orders were down

30% in February from typical averages, then started to recover as

cities resumed business, restaurants reopened and service options

such as contactless delivery took hold, the Wall Street firm

found.

The U.S. companies are taking steps to reassure customers that

their services are safe. Several are permitting front-door

drop-offs to limit contact between drivers and consumers.

In Seattle, restaurant sales declined 10% in the week through

March 1 compared with a previous four-week average, according to

industry firm Black Box Intelligence. To-go sales at restaurants

grew by more than 10% during the same time period.

"I go out less than I normally would," said Oscar Avatare, a

23-year-old student at the University of Washington in Seattle.

"For certain meals that I would get with friends before, I now just

get on Uber Eats," he said. His university has suspended classes

for two weeks.

Nationwide spending on food delivery in the U.S. shows modest

week-over-week growth through Feb. 24, according to market-research

firm Edison Trends. Spending also grew year-over-year, though at a

slower pace compared with last year because DoorDash Inc., Eats and

Postmates rapidly grew on the back of aggressive sales and

marketing in the first half of 2019, according to Earnest Research.

Most restaurant chains didn't approach that level of growth, and

some experienced falling sales, the firm found. Meanwhile, other

discretionary spending fell sharply over the same period.

DoorDash, Grubhub, Uber Eats and Postmates declined to

comment.

It remains to be seen if customers shun food delivery out of

fear of any exposure to germs from the courier or meal.

"You can't control the supply chain with food delivery," said

Jonathan Padilla, a 31-year-old Stanford University researcher

focused on blockchain, who is avoiding getting food sent to him for

now.

Food-delivery companies are fighting to build customer loyalty

as the sector matures. Companies that pushed for growth at all

costs are now working to strengthen their finances. DoorDash

confidentially filed for an initial public offering last month.

Postmates is also considering a listing.

Food-delivery companies separately risk alienating their

gig-economy drivers at a time that they need them the most.

Companies are instructing drivers to avoid working if they feel

sick, but face a conundrum: Without them, they can't deliver

orders. Many drivers are demanding paid time off, so they can stay

at home if they feel sick without having to worry about paying the

bills.

"We are exposed to this virus way more than anyone, yet we are

denied any benefits," said Mostafa Maklad, a 36-year-old who

delivers for services in San Francisco. "Should I stay at home and

let the bills accumulate, or should I just risk it and work to

survive?"

Uber and DoorDash have said they would compensate drivers

infected or quarantined by a public-health agency with up to 14

days of missed pay. Uber, DoorDash, Grubhub and Postmates are

separately weighing banding together to set up a compensation fund

for drivers. DoorDash said it is handing out gloves and hand

sanitizers to its drivers. Postmates said it would also support

medical checkups for its drivers.

Write to Heather Haddon at heather.haddon@wsj.com and Preetika

Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

March 15, 2020 13:14 ET (17:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

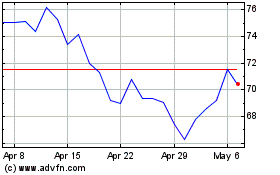

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024