State Street Corporation (“State Street”) (NYSE: STT) today

announced the commencement of a cash tender offer (the “Tender

Offer”) by its principal banking subsidiary, State Street Bank and

Trust Company (the “Bank”) for any and all of the outstanding

Floating Rate Junior Subordinated Debentures due 2047 listed in the

table below (the “2047 Debentures”), which were issued by State

Street.

The table below summarizes certain information regarding the

2047 Debentures and the Tender Offer, including the Tender Offer

Consideration and Early Tender Payment (each as defined below).

Title of Security

CUSIP Number

Issuer

Aggregate Principal

Amount

Outstanding

Interest Rate

Tender Offer

Consideration(1)

Early Tender

Payment(1)

Total

Consideration(1)(2)

Floating Rate Junior Subordinated

Debentures due 2047

857477AY9

State Street Corporation

$800,000,000

LIBOR plus 1.00%

$820

$30

$850

(1) Per $1,000 principal amount of 2047 Debentures validly

tendered (and not validly withdrawn) and accepted for purchase.

Excludes accrued and unpaid interest, which will be paid on 2047

Debentures accepted for purchase as described herein.

(2) Includes the Early Tender Payment for 2047 Debentures

validly tendered prior to the Early Tender Date (and not validly

withdrawn) and accepted for purchase.

The Tender Offer is being made pursuant to an Offer to Purchase,

dated October 21, 2019 (the “Offer to Purchase”), which sets forth

the terms and conditions of the Tender Offer. The Tender Offer will

expire at 5:00 pm, New York City time, on November 20, 2019, or any

other date and time to which the Bank extends the Tender Offer

(such date and time, as it may be extended, the “Expiration Date”),

unless the Tender Offer is earlier terminated. Holders of 2047

Debentures that are validly tendered and not validly withdrawn

prior to or at 5:00 p.m., New York City time, on November 1, 2019

(such date and time, as it may be extended, the “Early Tender

Date”), will be eligible to receive the Total Consideration (as

defined below), which is inclusive of the cash amount set forth in

the above table under the heading “Early Tender Payment” (the

“Early Tender Payment”). Holders of 2047 Debentures who validly

tender their 2047 Debentures after the Early Tender Date but prior

to the Expiration Date will only be eligible to receive the Tender

Offer Consideration (as defined below) and not the Early Tender

Payment.

All holders of 2047 Debentures accepted for purchase will also

receive accrued and unpaid interest on 2047 Debentures validly

tendered and accepted for purchase from the last interest payment

date up to, but not including, the settlement date for the 2047

Debentures purchased in the Tender Offer.

The consideration (the “Total Consideration”) offered per $1,000

principal amount of 2047 Debentures validly tendered and accepted

for purchase pursuant to the Tender Offer will be as specified in

the table above. The “Tender Offer Consideration” is equal to the

Total Consideration minus the Early Tender Payment.

The Tender Offer will expire on the Expiration Date. The

settlement date for the 2047 Debentures that are validly tendered

on or prior to the Expiration Date is expected to be November 22,

2019, the second business day following the Expiration Date,

assuming the conditions to the satisfaction of the Tender Offer are

satisfied.

2047 Debentures that are validly tendered may be validly

withdrawn at any time prior to or at 5:00 p.m., New York City time,

on November 1, 2019 (unless extended, the “Withdrawal Deadline”).

After such time 2047 Debentures may not be withdrawn unless the

Bank extends the Withdrawal Deadline.

The Bank’s obligation to accept for payment and to pay for

the 2047 Debentures validly tendered in the Tender Offer is not

subject to any minimum tender condition but is subject to the

satisfaction or waiver of the conditions described in the Offer to

Purchase, including termination of State Street’s Replacement

Capital Covenant dated April 30, 2007 and amended May 13, 2016,

which is expected to occur following the settlement of the

Redemption (as defined below). Following the Tender Offer, the Bank

reserves the right, subject to applicable law, to: (i) waive any

and all conditions to the Tender Offer; (ii) extend or terminate

the Tender Offer; or (iii) otherwise amend the Tender Offer in any

respect.

State Street also announced today that it will redeem (the

“Redemption”) $50,100,000 of its $150,000,000 aggregate principal

amount outstanding of Floating Rate Junior Subordinated Deferrable

Interest Debentures, Series A, due May 15, 2028 (the “2028

Debentures”), at a redemption price equal to the outstanding

principal amount of the 2028 Debentures to be redeemed, plus

accrued and unpaid interest to, but not including, the redemption

date. The redemption date for the 2028 Debentures will be November

20, 2019.

Information Relating to the Tender

Offer

Deutsche Bank Securities Inc. and J.P. Morgan Securities LLC are

acting as the dealer managers (the “Dealer Managers”) for the

Tender Offer. The information agent and tender agent is D.F. King

& Co. (“D.F. King”). Copies of the Offer to Purchase and

related offering materials are available by contacting D.F. King at

(800) 659-6590 (U.S. toll-free) or (212) 269-5550 (banks and

brokers). Questions regarding the Tender Offer should be directed

to Deutsche Bank Securities Inc., Liability Management Group, at

(212) 250-2955 (collect) or (866) 627-0391 (toll-free) or J.P.

Morgan Securities LLC, Liability Management Group, at (212)

834-8553 (collect) or (866) 834-4666 (toll free).

None of the Bank, State Street or their affiliates, their

respective boards of directors or managing members, the Dealer

Managers, D.F. King or the trustee of the 2047 Debentures is making

any recommendation as to whether holders of 2047 Debentures should

tender any 2047 Debentures in response to the Tender Offer, and

neither the Bank nor any such other person has authorized any

person to make any such recommendation. Holders of 2047 Debentures

must make their own decision as to whether to tender any of their

2047 Debentures, and, if so, the principal amount of 2047

Debentures to tender.

This press release shall not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities.

The Tender Offer is being made only pursuant to the Offer to

Purchase and only in such jurisdictions as is permitted under

applicable law.

The full details of the Tender Offer, including complete

instructions on how to tender 2047 Debentures, are included in the

Offer to Purchase. The Offer to Purchase contains important

information that should be read by holders of 2047 Debentures

before making a decision to tender any 2047 Debentures. The Offer

to Purchase may be downloaded from D.F. King’s website at

www.dfking.com/statestreet or obtained from D.F. King, free of

charge, by calling toll-free at (800) 249-7120 (bankers and brokers

can call collect at (212) 269-5550).

About State Street

Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors,

including investment servicing, investment management and

investment research and trading. With $32.90 trillion in assets

under custody and administration and $2.95 trillion* in assets

under management as of September 30, 2019, State Street operates

globally in more than 100 geographic markets and employs

approximately 40,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

* Assets under management include the assets of the SPDR® Gold

ETF and the SPDR® Long Dollar Gold Trust ETF (approximately $44

billion as of September 30, 2019), for which State Street Global

Advisors Funds Distributors, LLC (SSGA FD) serves as marketing

agent; SSGA FD and State Street Global Advisors are affiliated.

Forward Looking

Statements

This press release contains forward-looking statements that

are not historical in nature. Such forward-looking statements are

subject to risks and uncertainties, including the risks related to

the acceptance of any tendered 2047 Debentures, the expiration and

settlement of the Tender Offer, the satisfaction of conditions to

the Tender Offer, whether the Tender Offer will be consummated in

accordance with terms set forth in the Offer to Purchase or at all,

the completion of the Redemption of 2028 Debentures and the timing

of any of the foregoing, competitive factors, government regulation

and general economic conditions and other risks and uncertainties

described in State Street’s periodic reports on file with the U.S.

Securities and Exchange Commission including the most recent

Quarterly Report on Form 10-Q of State Street, as filed with the

U.S. Securities and Exchange Commission. In some cases, you can

identify these statements by forward-looking words, such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “looking ahead,” “may,” “plan,” “possible,” “potential,”

“project,” “should,” “will,” and similar words or expressions, the

negative or plural of such words or expressions and other

comparable terminology. Actual results may differ materially from

anticipated results. Neither State Street nor the Bank undertake to

update its forward-looking statements or any of the information

contained in this press release, including to reflect future events

or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191021005342/en/

Ilene Fiszel Bieler +1 617-664-3477

Marc Hazelton +1 617-513-9439

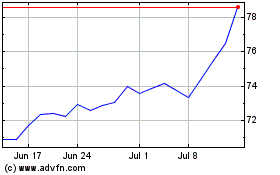

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

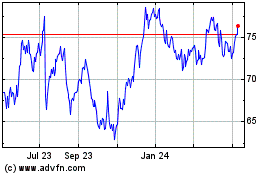

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024