Current Report Filing (8-k)

May 21 2019 - 10:58AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May

16, 2019

|

|

|

|

|

|

|

|

|

Commission

File Number

|

|

Name of Registrant, Address of Principal,

Executive Offices and Telephone Number

|

|

State of

Incorporation

|

|

I.R.S. Employer

Identification Number

|

|

1-16681

|

|

Spire Inc.

700 Market Street St. Louis, MO 63101

314-342-0500

|

|

Missouri

|

|

74-2976504

|

Check the appropriate box below if the

Form 8-K

filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act

(17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b) under

the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c) under

the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $1.00 per share

|

|

SR

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or

Rule 12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 3.03

Material Modification to Rights of Security Holders.

On May 21, 2019, Spire Inc. (the “Company”) consummated the public offering of 10,000,000 depositary shares (the

“Depositary Shares”), each representing a 1/1,000

th

interest in a share of the Company’s 5.90% Series A Cumulative Redeemable Perpetual Preferred Stock, par value $25.00

per share, with a liquidation preference of $25,000 per share (the “Series A Preferred Stock”). Under the terms of the Series A Preferred Stock, the Company’s ability to declare or pay dividends on, or purchase, redeem or

otherwise acquire for consideration by the Company, directly or indirectly, shares of its common stock or any class or series of capital stock of the Company that rank junior to the Series A Preferred Stock will be subject to certain

restrictions in the event that the Company does not declare and pay (or does not declare and set aside a sum sufficient for the payment thereof) the full cumulative dividends on the Series A Preferred Stock through the most recently completed

dividend period. The terms of the Series A Preferred Stock, including such restrictions, are more fully described in, and this description is qualified in its entirety by reference to, the Certificate of Designations (as defined in Item

5.03 below), a copy of which is filed as Exhibit 3.1 to this Current Report on

Form 8-K and

is incorporated herein by reference.

Item

5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 16, 2019, the Company filed a Certificate of Designations (the “Certificate of Designations”) with the Secretary of State

of the State of Missouri to establish the preferences, limitations and relative rights of the Series A Preferred Stock. The Certificate of Designations became effective upon filing, and a copy is filed as Exhibit 3.1 to this Current

Report on

Form 8-K

and is incorporated herein by reference.

Item 8.01

Other

Events.

On May 21, 2019, the Company consummated the issuance and sale of the Depositary Shares pursuant to an underwriting

agreement, dated May 14, 2019 (the “Underwriting Agreement”), with the several underwriters named therein (the “Underwriters”), for whom Morgan Stanley & Co. LLC, BofA Securities, Inc. and Wells Fargo Securities,

LLC acted as representatives, pursuant to which the Company agreed to issue and sell to the Underwriters the Depositary Shares. The public offering price for the Depositary Shares was $25.00. Pursuant to the Underwriting Agreement, the

Underwriters received an underwriting discount of $0.7875 per Depositary Share in respect of 6,442,000 shares sold to retail investors, and an underwriting discount of $0.500 per share in respect of 3,558,000 Depositary Shares sold to institutional

investors. The Depositary Shares were issued pursuant to a Deposit Agreement (the “Deposit Agreement”), dated as of May 21, 2019, among the Company, Computershare Inc. and Computershare Trust Company, N.A., acting jointly as

depositary, and the holders from time to time of the depositary receipts described therein. The Depositary Shares have been issued pursuant to the Company’s Registration Statement on Form

S-3

(Registration

No. 333-231443)

(the “Registration Statement”), which became effective upon filing with the Securities and Exchange Commission on May 14, 2019, and the related Prospectus

contained therein, as supplemented by the Prospectus Supplement dated May 14, 2019. A copy of the Underwriting Agreement and opinions related to the Depositary Shares and the Series A Preferred Stock are attached hereto as exhibits and are

expressly incorporated by reference herein and into the Registration Statement.

The foregoing descriptions of the terms of the

Underwriting Agreement and the Deposit Agreement are qualified in their entirety by reference to the actual terms of the Underwriting Agreement and Deposit Agreement, as applicable, copies of which are attached hereto as Exhibit 1.1 and

Exhibit 4.1, respectively.

Item 9.01

Financial Statements and Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated May 14, 2019, between the Company and the several underwriters named therein, for whom Morgan Stanley

& Co. LLC, BofA Securities, Inc. and Wells Fargo Securities, LLC are acting as representatives of.

|

|

|

|

|

3.1

|

|

Certificate of Designations with respect to the Series A Preferred Stock, dated May 16, 2019

|

|

|

|

|

4.1

|

|

Deposit Agreement, dated as of May

21, 2019, among the Company, Computershare Inc. and Computershare Trust Company, N.A., acting jointly as depositary, and the holders from time to time of the depositary receipts described therein.

|

|

|

|

|

4.2

|

|

Form of depositary receipt representing the Depositary Shares (included as Exhibit A to Exhibit 4.1).

|

|

|

|

|

4.3

|

|

Form of Certificate representing the Series A Preferred Stock (included as Exhibit A to Exhibit 3.1).

|

|

|

|

|

5.1

|

|

Opinion of Mark C. Darrell regarding the validity of the Series A Preferred Stock.

|

|

|

|

|

5.2

|

|

Opinion of Akin Gump Strauss Hauer & Feld LLP regarding the validity of the Depositary Shares.

|

|

|

|

|

23.1

|

|

Consent of Mark C. Darrell (included as part of Exhibit 5.1).

|

|

|

|

|

23.2

|

|

Consent of Akin Gump Strauss Hauer & Feld LLP (included as part of Exhibit 5.2).

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SPIRE INC.

|

|

|

|

|

|

Date: May 21, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Steven P. Rasche

|

|

|

|

|

|

|

|

Steven P. Rasche

|

|

|

|

|

|

|

|

Executive Vice President,

Chief Financial

Officer

|

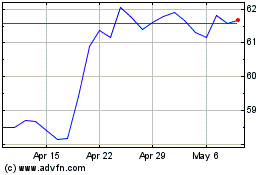

Spire (NYSE:SR)

Historical Stock Chart

From Mar 2024 to Apr 2024

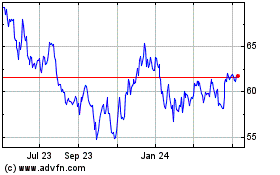

Spire (NYSE:SR)

Historical Stock Chart

From Apr 2023 to Apr 2024