Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 12 2024 - 5:20PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant to Rule 433 under the Securities Act of 1933

Registration Statement on Form S-3: No. 333-255937

$600,000,000

SALLY HOLDINGS LLC (the “Company”)

SALLY CAPITAL INC.

6.75%

SENIOR NOTES DUE 2032

PRICING TERM SHEET

February 12, 2024

|

|

|

| Issuers: |

|

Sally Holdings LLC and Sally Capital Inc. |

|

|

| Title of Securities: |

|

6.75% Senior Notes due 2032 (the “notes”) |

|

|

| Principal Amount: |

|

$600,000,000 |

|

|

| Gross Proceeds to Issuers: |

|

$600,000,000 |

|

|

| Maturity Date: |

|

March 1, 2032 |

|

|

| Issue Price: |

|

100% |

|

|

| Coupon: |

|

6.75% |

|

|

| Yield to Maturity: |

|

6.75% |

|

|

| Interest Payment Dates: |

|

March 1 and September 1 |

|

|

| First Interest Payment Date: |

|

September 1, 2024 |

|

|

| Interest Record Dates: |

|

February 15 and August 15 |

|

|

| Interest Calculation: |

|

Interest on the notes will be computed on the basis of a 360-day year comprised of twelve 30-day months. |

|

|

| Optional Redemption: |

|

The notes will be redeemable, at the Company’s option, in whole or in part, at any time on or after March 1, 2027 at the redemption prices set forth below plus accrued and unpaid interest, if any, to, but not including,

the redemption date, if redeemed during the twelve-month period commencing on March 1 of the years set forth below: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| 2027 |

|

|

103.375 |

% |

| 2028 |

|

|

101.688 |

% |

| 2029 and thereafter |

|

|

100.000 |

% |

|

|

|

|

|

| |

|

In addition, at any time and from time to time prior to March 1, 2027, the Company at its option may redeem up to 40% of the original aggregate principal amount of the notes (including the principal amount of any additional

notes), with the net proceeds from certain equity offerings at a redemption price of 106.750%, plus accrued and unpaid interest, if any, to, but not including, the redemption date; provided, however, that if the notes are redeemed, an

aggregate principal amount of the notes equal to at least 50% of the original aggregate principal amount of notes (including the principal amount of any additional notes) must remain outstanding after each such redemption of notes. |

|

|

|

|

In addition, at any time prior to March 1, 2027, the notes may be redeemed or purchased (by the Company or any other person), in whole or in part, at the Company’s option, at a price equal to 100% of the principal amount

of the notes redeemed plus the applicable premium as of, and accrued and unpaid interest, if any, to, but not including, the date of redemption or purchase. |

|

|

|

|

|

Offer to Purchase upon

Change of Control: |

|

101% of the aggregate principal amount of notes, plus accrued and unpaid interest, if any, to, but not including, the date of purchase. |

|

|

| Use of Proceeds: |

|

The net proceeds from the issuance and sale of the notes, after deducting underwriting discounts and commissions and estimated offering expenses, together with borrowings under the ABL Facility and cash on hand, will be used to

redeem all of the issuers’ outstanding 5.625% senior notes due 2025. |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc. |

|

|

J.P. Morgan Securities LLC |

|

|

Truist Securities, Inc. |

|

|

| Co-Managers: |

|

Citizens JMP Securities, Inc. |

|

|

Regions Securities LLC |

|

|

U.S. Bancorp Investments, Inc. |

|

|

| Trade Date: |

|

February 12, 2024 |

|

|

| Settlement Date: |

|

February 27, 2024 (T+10) |

|

|

| Denominations: |

|

Minimum denomination of $2,000 and integral multiples of $1,000 in excess thereof |

|

|

| Distribution: |

|

SEC registered |

|

|

| CUSIP and ISIN Numbers: |

|

CUSIP: 79546V AQ9 ISIN:

US79546VAQ95 |

Other information (including financial information) is deemed to have changed to the extent affected by the changes

described above.

The issuers have filed a registration statement (including a prospectus and a prospectus supplement) with the Securities and

Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the issuers and Sally Beauty

Holdings, Inc. have filed with the SEC for more complete information about the issuers and this offering. You may obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the

issuers, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement if you request them by emailing BofA Securities, Inc. at: dg.prospectus_requests@bofa.com, or by

telephone: 1-800-294-1322 (toll free).

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES

WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

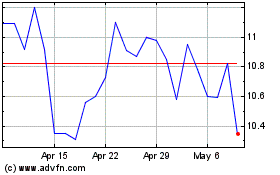

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

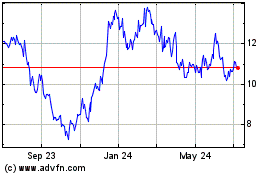

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024